Artificial intelligence (AI) is a topic that tends to be as polarizing as it is ubiquitous. As the technology makes its way into the workplace, some employees have embraced AI’s capabilities and consider it a boon to productivity and efficiency. Others question its usefulness or worry it could render their positions obsolete.

Regardless of how you may feel about AI personally, there’s little doubt that it is a powerful force that is having a transformative impact on businesses, consumers, and the economy – and that impact is only likely to grow in the years ahead. Our investment teams have written extensively about the history of AI and why it has the potential to be the greatest productivity enhancer since the Industrial Revolution.

AI tools are facilitating financial exploitation

Like many advanced technologies, AI holds the potential for misuse when it falls into the wrong hands. Notably, the evolution of AI has enabled fraudsters to develop increasingly sophisticated financial exploitation scams, leading to over $3 billion in losses in 2023.1

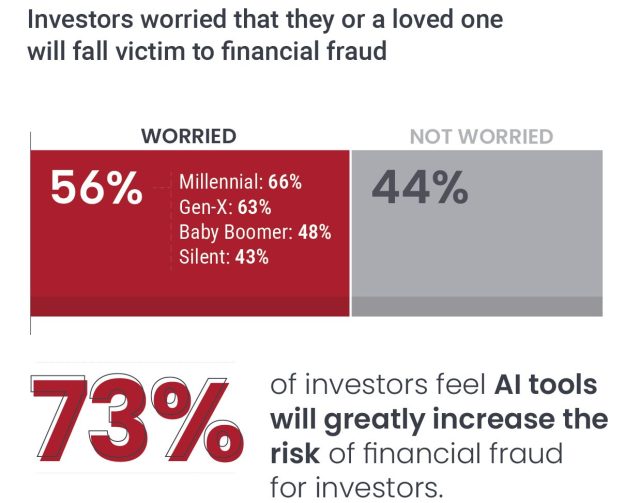

[jh_content_filter spoke=”uspa”]These risks are hardly a secret: Our latest Investor Survey found that 73% of investors believe AI will greatly increase the risk of financial fraud. [/jh_content_filter][jh_content_filter spoke=”itpa”]These risks are hardly a secret: Our latest Investor Survey found that 73% of investors believe AI will greatly increase the risk of financial fraud. [/jh_content_filter]

Financial exploitation in general is a key area of concern among investors. More than half (56%) of our survey respondents said they are very or somewhat worried that they or a loved one could fall victim to a financial exploitation scam.

While financial scams disproportionately impact those over age 60, all of us, regardless of age, are at risk of exploitative attempts on our assets. What’s more, it appears that younger generations may be more concerned than older cohorts.

Among our survey respondents, 66% of Millennials and 63% of Gen X investors said they were worried about financial fraud, compared to 48% of Baby Boomers and 43% of Silent Generation investors. This could be due to younger investors being more tech-savvy and hence more aware of how AI can be used to commit financial scams. It could also stem from younger individuals being worried about their parents’ and/or grandparents’ vulnerability to fraudsters.

A useful tool in advisor practices – within limits

While investors are clearly wary of AI’s role in facilitating financial exploitation, they don’t have an entirely negative view of the technology. Our survey sought to gauge how investors feel about their financial advisors using AI for various areas of their practice, and the feedback was largely positive – but varied significantly based on how AI was being used.

Among investors who use a financial advisor or would consider hiring one in the next two years, a large percentage (83%) said they feel either good or neutral about their advisor using AI for administrative tasks or to create educational content (85%). However, more than a third would object to their advisor using AI to make investment recommendations, and 44% would be upset if their advisor used AI to respond to texts or emails. These findings are a clear indication that clients still strongly value the human element for these key aspects of their advisory relationship.

How advisors can help clients avoid financial fraud

Financial advisors are in a unique position to educate clients about the risk of financial fraud, and many forward-thinking advisors have already taken steps to reduce their clients’ vulnerability.

Among advised investors responding to our survey, 45% said they have received resources from their advisor on avoiding financial exploitation scams, and another 29% reported they have not yet received resources but would like to.

A critical first step to raising awareness around how to identify and avoid scams is communication. Investors may be feeling vulnerable and uncertain about how to protect themselves, and having proactive, candid discussions can help destigmatize the issue while providing valuable education.

[jh_content_filter spoke=”uspa”]

For advisors who want to address financial exploitation in their practices but are unsure where to start, Janus Henderson offers dedicated resources through an exclusive partnership with Wayne State University. Through this program, we hope to help protect more investors by providing tools and resources advisors can use to educate clients and assess their vulnerability.

[/jh_content_filter]

1 2023 IC3 Elder Fraud Annual Report. Federal Bureau of Investigation. Justice.gov.