As defined contribution (DC) investors continue to search for suitable ways to allocate to alternative assets, including illiquids, it is clear that no perfect solution exists under the current operating infrastructure. New vehicle options, including Long Term Asset Funds, will help, but challenges remain when allocating to illiquid assets. Amidst the slow pace of change in this area, however, ongoing market volatility – and the resulting impact on member pension pots – has made the need to consider alternative investments and structures to be ever greater.

Over recent years, we at Janus Henderson have engaged with DC asset owners and advisors on the role of holding a diverse basket of investment trusts. This is considered a key tool to help provide access to underlying illiquid and alternative investments such as private equity, infrastructure, renewables and real estate, as well as more esoteric areas such as aircraft leasing, music royalties and timber. The investment trust wrapper has many benefits to investors, which we have covered previously: Closed-ended funds: an underexplored route to alternative assets for DC schemes. In this piece we look to extend the conversation and answer common questions that have arisen in our discussions with DC investors and advisors.

Are investment trusts new in DC?

While investment trusts may seem novel for DC trustees, it’s worth remembering that many DC plans are likely to have some investment trust exposure. This may be through passive UK index exposure – where trusts represent over a third of the FTSE 250 Index by market capitalisation – or indirectly through Multi-Asset funds, which are active investors in investment trusts and use these vehicles for access to alternative investments. There are well-known investment trusts in the FTSE 100, including Scottish Mortgage (a global equity trust) and 3i (a private equity trust).

Investment trusts play a significant role in UK capital markets, and there’s a good chance the average DC portfolio is already invested in them.

What role do they play in the real economy?

The growth in the UK’s investment trust sector has been driven for many years by the growth in the alternative asset space. As permanent pools of capital, the vehicles give managers the comfort of investing for the long term without the fear of calls on capital, as can be the case in open-ended funds. Trusts are also an important vehicle for the UK’s real economy, helping develop and deliver a more modern and green economy. For example, UK-listed investment trusts are already playing an active role in helping finance the UK’s switch to renewable energy, with around 15% of all UK wind and solar assets held through investment trusts, and 40% of all grid-scale battery storage.

Investment trusts have a central role in the UK’s green economy and can provide the long-term capital needed to fund future decarbonisation.

What is the liquidity profile of investment trusts?

By virtue of their listed nature, trusts – including those that invest in private assets – trade on exchanges, offering investors the option to access daily liquidity. Investors gain access to trusts by investing and owning an allocation of shares. Just like any other listed company, the price of a trust’s shares is affected by the value of the assets it owns, the level of supply and demand for its shares and overall market sentiment. The important point to note is that a price is always available to investors looking to buy or sell.

Overall, we see the liquidity profile of investment trusts as akin to UK mid-cap stocks, which are already owned by DC schemes through index portfolio allocations. This makes sense given the majority of the UK’s largest investment trusts reside within the FTSE 250 Index, where there are 92 trusts, including 48 that allocate to alternatives assets. Our analysis shows shares of trusts change hands about a quarter less than those of non-investment companies in the index. We think this reflects their low volatility profile somewhat, since trusts the experience around a third less volatility than non-investment companies.

The liquidity of investment trusts is also evident on the primary issuance side, with alternative investment trusts having raised over £55bn of new capital since the start of 2015. Though market volatility last year saw the sector record the first year without a new investment trust listing since 1975, it was still able to raise £3.8bn of fresh capital from investors.

The liquid nature of investment trusts allows managers the opportunity to trade in and out of positions and access asset classes efficiently through the economic cycle. This complements other alternative and illiquid fund structures that have much more rigid capital allocation processes.

What is the premium/discount-to-NAV feature and what does it mean for automatic DC contributions?

An investment trust has a net asset value (NAV) per share. This is the total value of the investments held by the trust, minus any money it owes (liabilities), which is then divided by the number of shares. While the NAV reflects the value of the assets, the share price is affected by supply and demand. As a result, there can be a difference between the NAV and the share price – shares either trade at a premium (higher than the NAV) or a discount (lower than the NAV).

We think basic premiums and discounts need to be treated with caution – particularly with alternative assets that have periodic (monthly/quarterly/semi-annual) valuations. In theory, the share price reflects where investors believe that the NAV is going. However, our experience is that trusts never trade at NAV: some trade at a structural discount and others at a premium. This reflects the market’s view about the appropriateness of the valuation methodology or supply/demand imbalances for certain underlying assets.

With DC investors making monthly contributions, questions have been raised as to whether it makes investment sense to invest in trusts that trade at a premium to their stated NAV. We think these decisions should rely on experienced investment professionals and an active fund management approach that gives managers discretion to invest only when they believe a premium or discount is justified based on their understanding of the NAV valuation.

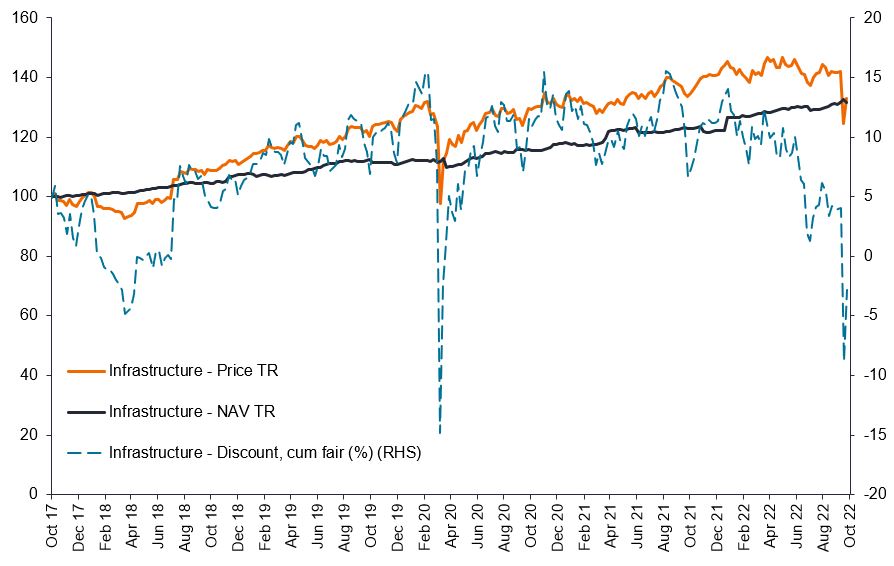

As an example, we have been long-term investors in infrastructure and renewable energy trusts, and have been happy to add more exposure even when these companies were trading at a premium to their most recently published NAVs for much of the last five years, as shown below in chart 1.

Chart 1: Infrastructure trusts – trading at a premium

Source: JP Morgan Cazenove, sector average, October 2022

Why pay ‘over the odds’ for anything? Well, primarily, our view has been that published NAVs in the sector have been too conservative.

Transactions observed in the market have backed our view, as illustrated in 2018 when the listed John Laing Infrastructure Fund was taken private at a 12.4% premium to the last NAV (or closer to 15% once the final dividend was included).

The premium/discount feature of Trusts offers a way for active fund managers to generate returns for investors. Understanding the dynamics of each trust and performing deep fundamental analysis can identify mis-pricings that managers can take advantage of, given the liquid nature of trusts. Furthermore, a well-diversified portfolio with allocations to multiple investment trusts (and other liquid vehicles such as exchange traded funds or mutual funds) has the discretion to allocate new contributions to investments that offer the best return potential at any given time.

Conclusion

The fundamental features of alternative and private asset investments means that no single solution addresses all the issues faced by DC stakeholders looking to diversify member pension pots away from conventional asset classes. We believe that liquid and illiquid structures can coexist to help tackle these challenges. With a growing alternative investment universe, a proven track record and existing role within the UK private asset landscape, holding a dedicated portfolio of investment trusts could offer an attractive tool to access the differentiation benefits these assets bring to a portfolio.