If you’ve recently found yourself drawn to the many attractive benefits of investment trusts, you’re certainly not alone. At the end of 2011, the total assets under management across the investment company industry (including investment trusts, venture capital trusts and other closed-ended funds) amounted to a little over £90 billion. Now, as at the end of June 2020, that figure has more than doubled to almost £200 billion … and that’s after the damaging effects on world markets of the current COVID-19 pandemic.1

Having established that investment trusts might prove to be a valuable addition to one’s portfolio, an investor faces the obvious challenge of then having to select one or more specific trusts – and, with over 400 trusts currently trading on the UK stock market, there’s no lack of choice. Fortunately however, help is at hand, and much of the ‘heavy lifting’ has already been done for you. The Association of Investment Companies (AIC), the trade body founded in 1932 to further the interests of the investment trust industry, regularly publishes detailed information regarding all the investment trusts listed on the UK stock market within its website – https://www.theaic.co.uk.

In order to make life easier, the AIC has segmented the industry into sectors: this classification framework provides a way of grouping companies with common characteristics in order to narrow the choices down to ones that are most likely to suit a particular need, thereby speeding up the process of search, comparison and selection. You can find information on the specific sectors here: https://www.theaic.co.uk/aic/statistics/aic-sectors This section of the AIC website sets out the sectors, defines them, and lists the individual investment trusts that are categorised within each sector.

Trusts reclassified

In May of last year, the AIC undertook a wide-ranging revamp of its classification framework and made a number of key changes:

- some sectors were new (about half of these came from breaking down the property and debt sectors into greater detail)

- some were renamed (although most of these were fairly cosmetic like ‘Sector Specialist: Infrastructure’ becoming just ‘Infrastructure’)

- some disappeared altogether

- a number of investment trusts were reclassified within different sectors.

In order to be categorised within a sector, 80% or more of the trust’s assets must be invested in line with the sector definition. According to Ian Sayers, the Chief Executive of the AIC: “We undertook this review to ensure that investment company sectors accurately reflect the shape of the industry today. Recent years have seen significant growth in investment companies investing in alternative assets, such as property, debt and infrastructure and the emergence of new asset classes such as leasing and royalties. Our new sectors allow investors to find and compare companies with similar characteristics easily. I’m confident the new sectors will play a useful role in helping inform investors’ decisions.“

Why is sector classification important?

The AIC sector classification system is used throughout the industry by investors, asset managers, the media, advisers, investment platforms and data vendors. It provides meaningful and relevant categories for numerous types of analysis, including performance rankings and data tables, peer group comparisons, and awards. The AIC’s sectors are not an indicator of the relative risks or potential rewards of any investment trust, but are used by investors to help them identify potential investment areas, sectors or regions of interest.

Typically, investors will embark upon an investment decision journey by determining which sectors exhibit the characteristics which align most closely with their needs. For example, if you’re a retiree, you may well want to consider sectors that specialise in delivering a high, and ideally growing, income. A younger individual with no specific or immediate needs to fulfil might be seeking a good broadly-focused investment trust that invests globally and which aims to deliver both income and capital growth. Similarly, someone who already has a reasonably well-balanced portfolio might be looking to explore something more specialist.

The AIC operates six core investment trust sectors (a seventh relates to venture capital trusts), and these six are then further segmented according to country/region, asset type or specialism – as you can see from the table below – giving 48 investment trust sectors in all.

| UK | Overseas | Flexible | Specialist | Property | Debt |

| All Companies | Asia Pacific | Flexible Investment | Biotechnology & Healthcare | Debt | Direct Lending |

| Equity & Bond Income | Asia Pacific Income | Commodities & Natural Resources | Europe | Loans & Bonds | |

| Equity Income | Asia Pacific Smaller Companies | Environmental | Rest of World | Structured Finance | |

| Smaller Companies | Asia Pacific – ex Japan | Financials | UK Commercial | ||

| Europe – ex UK | Growth Capital | UK Healthcare | |||

| Latin America | Hedge Funds | UK Residential | |||

| European Emerging Markets | Infrastructure | Property Securities | |||

| European Smaller Companies | Infrastructure Securities | ||||

| Global | Insurance & Reinsurance Strategies | ||||

| Global Emerging Markets | Leasing | ||||

| Global Equity Income | Liquidity | ||||

| Global High Income | Private Equity | ||||

| Global Smaller Companies | Renewable Energy Infrastructure | ||||

| Japan | Royalties | ||||

| Japanese Smaller Companies | Technology & Media | ||||

| Latin America | |||||

| North America | |||||

| North American Smaller Companies |

Bear in mind that, whilst these classifications are based on a combination of regional or industry focus and the trust’s investment objective, they aren’t exact, in that no two investment companies are ever the same.

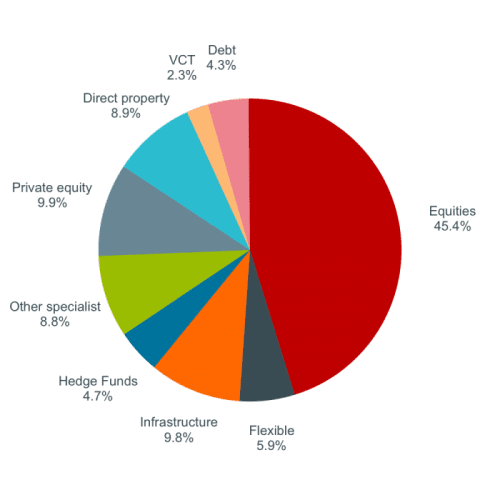

It’s also interesting to see the breakdown of asset types across the investment trust industry. As the chart below reveals, of the total assets under management of £197 billion as at the end of June 2020, over 45% was invested in equities. Beyond that, the asset mix is relatively broad with no other asset type representing more than 10% of the industry total.1

1Source: AIC, 28/07/20

The Janus Henderson range

The table below shows the sector classification for the current range of 13 Janus Henderson investment trusts:

| TRUST | AIC SECTOR |

Henderson Diversified Income Trust plc |

Debt – Loans & Bonds |

Henderson European Focus Trust plc |

Europe |

Henderson EuroTrust plc |

Europe |

Henderson Far East Income Limited |

Asia Pacific Income |

Henderson High Income Trust plc |

UK Equity & Bond Income |

Henderson International Income Trust plc |

Global Equity Income |

Henderson Opportunities Trust plc |

UK All Companies |

Lowland Investment Company plc |

UK Equity Income |

The Bankers Investment Trust PLC |

Global |

The City of London Investment Trust plc |

UK Equity Income |

The Henderson Smaller Companies Investment Trust plc |

UK Smaller Companies |

TR European Growth Trust PLC |

European Smaller Companies |

Making your final selection

By using the AIC’s sector information you should now have a good feel for the type of trust which best suits your needs, and therefore the relevant sector(s) to consider. The next stage is to identify the best performers within those sectors. You can do this by, again, reviewing the wealth of past performance data within the AIC’s website and/or by visiting the websites of the trusts themselves (whilst remembering that past performance isn’t an indicator of future performance) and undertaking as much research as you can: study the factsheet, listen to any investment commentaries from the fund manager, analyse the trust’s major holdings and download the latest annual and half-year reports.

You’ll then be ready to take the plunge … but if you’re still uncertain, consult a professional financial adviser.