Private education

Let’s look at private education first. To state the obvious, it doesn’t come cheap. Unless you are lucky enough to get a windfall, you’ll probably need to start planning and saving early to keep up with the rapidly rising cost of school fees. According to the Independent Schools Council (ISC), the average day school fee has increased 3.1% in the past year, with the majority of day schools now charging between £3,000 and £5,500 per term, or £9,000 to £16,500 a year.1 Of course, this doesn’t include the other school-related costs that parents can expect to pay such as uniforms, sports equipment, music lessons or school trips. Once, you know the private schools fee costs, not only can you get a savings strategy in place, but you can think sensibly about how you can go about making this a reality.

University costs

If you’re thinking about paying for your child to attend the university of their choice, it’s worth getting acquainted with how much their university place will set you back. Today, a three-year course costs an average of £9,250 per year in tuition fees alone, which works out at £27,750 over three years. That doesn’t include accommodation and living expenses, which could cost another £12,000 to £15,000 each year, depending on which university they attend.2 However, graduation can leave many students with a financial hangover that stays with them for years. Students can now expect to owe as much as £45,000 in student loans after graduation3, and could find themselves still repaying their student debts after several years.

Getting on the property ladder

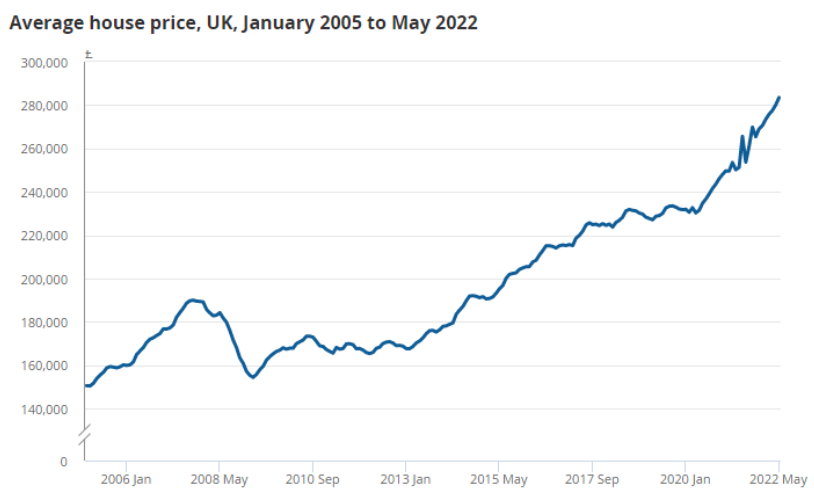

Over the last few years, the ‘bank of mum and dad’ has been one of the only options available to a generation hoping to get onto the housing ladder. According to the latest house price figures, the average house price reached £283,000 in May 2022 (see below).4 And while rising interest rates could see house prices fall back towards the end of 2022, the lack of housing supply is expected to continue to prop up house prices. Therefore, you should expect that helping your child onto the property ladder could involve a 10% deposit somewhere in the region of £30,000.5 Moreover, taking inflation into account, the lump sum amount needed by the time your child is ready for their first home is likely to be considerably more.

Source: HM Land Registry, Registers of Scotland, Land and Property Services Northern Ireland, Office for National Statistics – UK House Price Index

Source: HM Land Registry, Registers of Scotland, Land and Property Services Northern Ireland, Office for National Statistics – UK House Price IndexNotes: Not seasonally adjusted.

Where to begin?

Investing for those big financial outgoings that are still far off into the future might sound like a momentous task, but as with any journey, the first step is the most important. If you start early enough, and provided you take a consistent approach, even relatively small amounts can turn into significant lump sums. To get an idea of what’s possible, it’s worth understanding how regular savings can build up over time, by using the savings calculator on the Money Savings Expert website.

For starters, when it comes to saving over long periods, the numbers show that time is your greatest asset. If you paid £100 a month over a period of six years into a Cash ISA offering 3% interest, after six years your ISA would be worth a less-than-impressive £7,897.63.6 However, if you carried on paying into the ISA over an 18-year period, the ISA would be worth a much more meaningful amount of £28,665.56.7 That might well be enough for a deposit for your child’s first home, or help to pay their university tuition fees, with a bit left over to help with living expenses.

In other words, the sooner you begin, and the longer you keep saving, the closer you are likely to get to achieving your financial goals. However, if you’re looking to make your money work harder, and deliver better returns than cash over the long-term, investment trusts might be the smart option.

Why you should consider investment trusts

An investment trust is designed to be held over long time periods, usually more than ten years. This should help your investments to ride out any short-term market volatility or down periods. And when it comes to choosing the right investment trust, you don’t have to put all your eggs in one basket. You can choose to invest across lots of different assets and sectors, including growth or income trusts, or a blend of both. So, even if one of your investments disappoints, hopefully some of the other investments can make up for it.

The power of reinvesting dividends

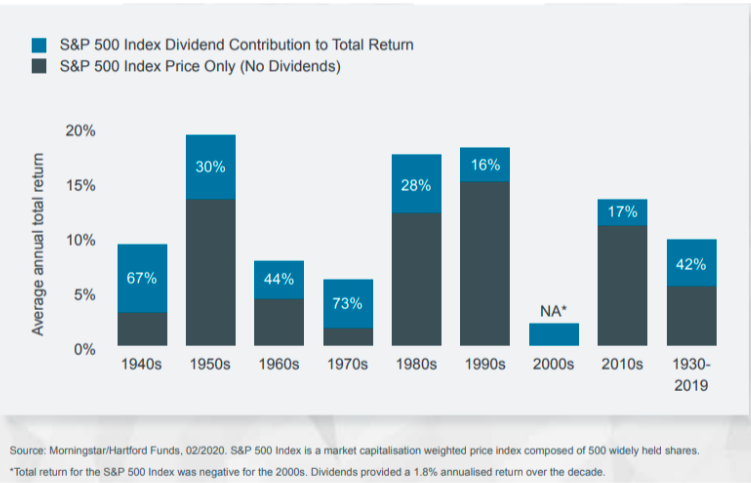

One of the big advantages of investment trusts is that they pay dividends to investors. You can choose to take these dividends as income – which some parents use to pay for school fees. Or you can reinvest your dividends, using them to buy additional shares in the investment trust, thereby increasing the number of shares you own, and the value of your investment. Dividends play a crucial role to total returns and can serve as a bulwark against economic problems and uncertainty that come from being invested in markets.

As a result, not only does an investment trust stand a better chance of potentially delivering inflation-beating returns over the long-term, but over a period such as 18 years, reinvesting those dividends is likely to boost the value of your investment by a far greater amount than if you had opted to take the income (see chart below – using S&P 500 as an example). However, it’s important to bear in mind that all investments come with an element of risk, so you need to make sure that you are comfortable with the amount of risk you are taking before you invest.

Investment trusts can be included in an Individual Savings Account (ISA) or a Junior ISA, which is opened on the child’s behalf and becomes theirs once they turn 18. There are a range of different investment options to choose from, including investments that focus on growth, income or a combination of the two. Even relatively small sums placed into an investment trust could outperform the returns from a Cash ISA over several years. This makes them well suited to parents who want to invest steadily over time, and want to build up a large lump sum, or to even occasionally make withdrawals from the investment when you need to pay for school or university fees.

It’s no surprise that more parents are keen to plan for those long-term costs by investing as soon as they can. The good news is, the sooner you start putting money aside to pay for those big life events, the greater the chance you have of achieving your long-term goals.

Find out more

For more information on investment options and the steps you can take to secure your family’s future, download our [latest guide]. There’s also a wealth of information for parents on our [Biggest Investment Hub].

Sources Expand1Source: https://www.isc.co.uk/media/8421/isc_census_2022_final-v2.pdf

2Source: https://www.ucas.com/finance/undergraduate-tuition-fees-and-student-loans

4Source: https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/may2022

5Source: Assuming a 10% deposit on a home costing on average £283,000 (not accounting for Stamp Duty or other associated costs).

6Source: https://www.moneysavingexpert.com/savings/savings-calculator/. This assumes an APR of 3% on £100 invested monthly into a fixed rate Cash ISA over a 6-year term.

7Source: https://www.moneysavingexpert.com/savings/savings-calculator/. This assumes an APR of 3% on £100 invested monthly into a fixed rate Cash ISA over an 18-year term.

Glossary ExpandVolatility – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.