The human side of sustainable bonds

The sustainable bond market has evolved rapidly. What started with a narrower focus on connecting capital to better environmental outcomes has expanded into modern slavery, human rights, diversity and inclusion, business ethics and even executive pay.

While the first social bonds to achieve the official label came many years after the inaugural green bond in 2007, they have been quickly catching up. The number and size of social bond issuances has grown in leaps and bounds amid strong global investor demand.

What are social bonds?

|

Social bonds: a rising star

Once a specialised segment of the bond market, social bonds have gained global traction spurred on by the focus on public health and financial security during the pandemic. According to S&P, US $18 billion of social bond issuance was recorded in 2019, jumping to US $170 billion in 2020 and US $218 billion in 20211.

While the total size of the social bond market is relatively small (US $538.8 billion) compared to the green bond market (US $2.3 trillion2), it is growing rapidly. It currently accounts for 19 per cent of the total size of the green, social, sustainability and sustainability-linked (GSSS) bond market.

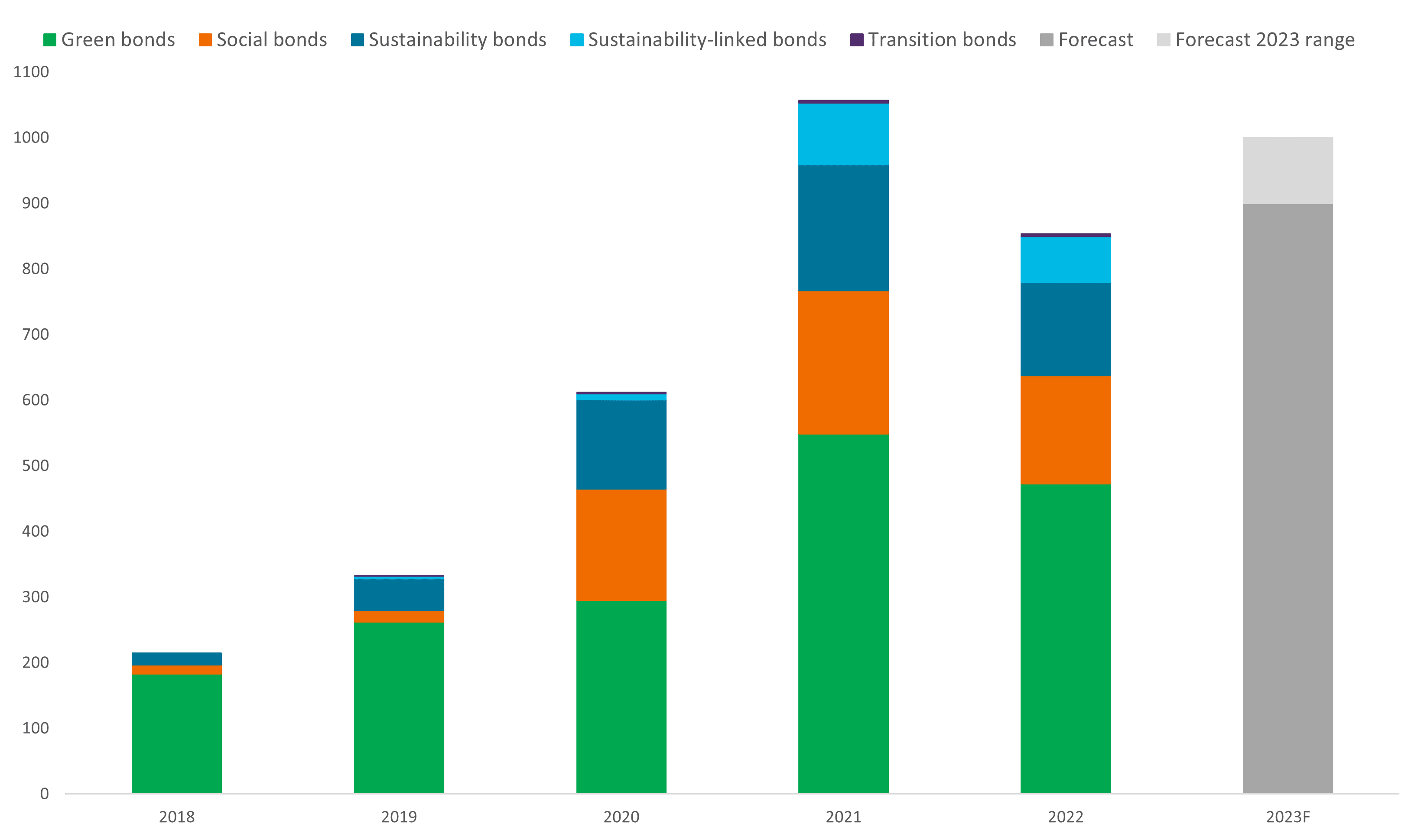

Chart 1: Annual GSSS bond issuance by instrument type (USD billions)

Source: S&P Global. As at 20 March 2023.

While 2022 saw global issuance of all GSSS bonds retreat from its 2021 peak, the market is set to resume growth in the years ahead.

This is supported by strong investor interest. In a recent Goldman Sachs survey of global investment professionals3, 65% had an active interest in investing in social bonds, of which only 29% had already invested.

A more diverse global market

While France remains the largest market overall, social bonds are popular with supranational organisations like the International Monetary Fund (IMF), the World Bank, and the Asian Development Bank (ADB).

Australia’s journey is comparatively in its infancy, with social bonds only coming into vogue in 2021. While issuance remains narrow, the trajectory for new issuance remains positive, while other developed country’s volumes have declined in the past year.

While social bond issuance is well established in developed economies that drive most of the activity, emerging markets are earlier in the journey. That emerging markets are becoming more vocal about their interest in green bonds suggests that social bonds may follow.

Investing in a fairer future

Whether it’s essential community infrastructure or improving healthcare for remote and underserved populations, social bonds can make a positive impact and reward investors that support these initiatives.

Introducing Sustainable CreditOur new active ETF, the Janus Henderson Sustainable Credit Active ETF (ASX:GOOD) is poised to capitalise on this growing segment of the fixed income market, which can deliver financial returns, while also seeking to do some good in the world. |

For important product information and disclosures such as PDS and TMD, please visit: https://www.janushenderson.com/en-au/investor/product/sustainable-credit-fund/

- Sustainable bond Issuance will Return to Growth in 2023: S&P Global

- Climate Bonds

- Investing for Inclusive Growth: Goldman Sachs