So, you’ve decided to buy an investment trust because you’ve been attracted by a number of their distinguishing features: such as the fact that they can borrow money to increase their investment capital (known as ‘gearing’) or their ability to hold back some of their income returns in good years to make up for any shortfalls in leaner times (known as ‘income reserving’).

You’ve also researched investment trust managers and trusts – using both the Association of Investment Companies (AIC) website and the managers’ own websites – and arrived at a shortlist of trusts in which you want to invest.

Now… how do you actually get started? This article tells you what you need to know.

Investment trusts are ‘closed-ended’ funds which are structured as companies. Unlike ‘open-ended’ funds, they are traded on the stock market just like other company shares, and so buying and selling them is no different from trading in any other shares (roughly 350 investment trusts are currently traded on the London Stock Exchange). You could engage a professional investment adviser to transact for you but, if you’re happy investing without financial advice, you can buy them yourself which will be less costly. If you decide to go it alone, the option best suited to you is likely to depend on a number of factors, such as whether you intend to invest a lump sum or monthly, whether you want all your investments on one platform or not, and how frequently you’re likely to transact.

There are three key ways in which you can buy an investment trust:

- through a stockbroker

- by using an online trading platform or ‘fund supermarket’

- in some cases, directly from the manager.

What does it cost?

Trading in investment trust shares will incur a number of costs and so, before deciding on the route you take, be sure to shop around as the differences can be significant. Cost is not the sole determining factor of course; you should also take into account other aspects, such as the user-friendliness of the platform and the feedback that the provider has received regarding its customer service. Unsurprisingly, the lowest-cost providers don’t always rank at the top of the table for customer satisfaction and it might not make sense to pay a premium for what is essentially a fairly simple transaction.

The first cost is Stamp Duty Reserve Tax (‘Stamp Duty’ for short) which is chargeable on all share transactions at a rate of 0.5% of the transaction value.

Second, there is a trading or dealing fee. This can differ significantly between providers – from as little as £5 to about £12 per trade – and can also vary depending on how frequently you trade. It’s worth noting that, if you want to invest regularly in the same trusts, it can often be cheaper to go directly to the manager (although this limits your choice) since a number of well-known managers don’t charge trading fees if you are investing in their own trusts. Regular investing is a good way to ‘drip-feed’ money into the market, thereby avoiding the difficulty of trying to time your investments – a notoriously tricky task.

Third, if you have yet to take advantage of the £20,000 Individual Savings Account (ISA) allowance for the 2020/21 tax year, you can buy investment trusts within a tax-free ISA wrapper. This shelters your dividend returns from income tax, and any capital appreciation from capital gains tax. However, most platform providers will levy an administration fee for running your ISA. You can only open one Stocks & Shares ISA each tax year, although you can choose a different ISA provider each year.

Finally, you are likely to experience a ‘holding’ or ‘platform management’ charge, levied monthly or annually. This can be expressed as a percentage of your investments, or as a fixed monetary amount, and may or may not be capped at a certain level. It will be subject to VAT.

How to compare?

Despite the additional cost, there has been sustained growth in the proportion of investors choosing to hold investment trusts within a platform. Research published in May by the AIC revealed that the greatest growth in investment trust use has been on direct-to-consumer platforms, with many individual investors who previously bought investment trust shares directly now switching their holdings to one of these platforms.[1] Nevertheless, given its impact on long-term returns, cost is always a factor that’s difficult to ignore but, given the four potential cost elements described above, it’s far from easy to calculate.

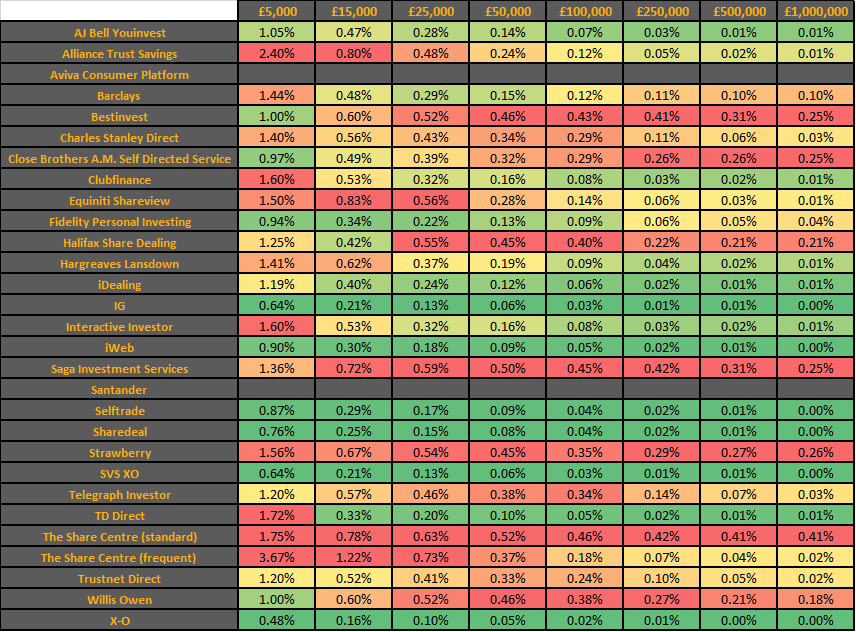

Happily, a solution is at hand. Conscious of the problem confronting so many potential investors, the AIC in February of last year commissioned ‘the lang cat’, a specialist investment consultancy, to identify the platforms which were most cost-effective for holding and trading investment trust shares. The table below shows the annual cost of investing various amounts in investment trusts (expressed as a percentage of the amount invested) via a wide selection of platform providers. It assumes the investment is within an ISA and four transactions are made in that year. The costs include platform fees, trading fees and any additional charges for the tax-free ISA wrapper. Within this selection of platforms, the cheapest appear in green and the most expensive are highlighted in red.

Source: Money Observer, Cheapest and most expensive online brokers for investment trusts, 09/10/17

What have we learned?

Looking at the data a little more forensically, what do they tell us? In our view, the key points to bear in mind are:

- Platforms charging fixed fees (eg Alliance Trust Savings or Interactive Investor) tend to be more costly for those with modest portfolios, but become progressively more cost-effective as the portfolio size increases. If a percentage-based approach were adopted, the charges would simply grow in line with the portfolio value.

- Providers charging percentage fees (eg Bestinvest or Charles Stanley) are relatively cost-effective at the lower end of the portfolio spectrum, but become less so as the investment amount climbs. Some (eg Hargreaves Lansdown) cap their ongoing fees: it charges 0.45% pa but, for investment trusts, this is capped at £45. For example, a £100,000 portfolio of open-ended funds would incur an annual cost of £450 a year, whereas an equivalent portfolio of investment trusts would only be charged £45.

- Some platforms are universally cheap (eg X-O or iWeb), generally reflecting the absence of ongoing charges. However, they cater purely for share traders, with no open-ended funds, bonds or other assets available, and can be fairly basic in terms of the service and functionality they have to offer.

- Investment trusts – in common with most stock market assets – are best held for the longer term. Those who do so can generally maintain their trading costs at an acceptable level but, if not, they can become onerous with a knock-on effect on investment returns. Low-cost services charge circa £5 per trade, but others (eg Halifax Share Dealing) can be more than double that.

- A number of platforms (eg AJ Bell or Alliance Trust Savings) lower their trading costs for regular investors: the former normally charges £9.99 per trade but only £1.50 if there is a regular investment plan in place; similarly, for AJ Bell, the costs are £9.95 and £1.50 respectively.

- Most platforms will impose the usual transaction costs when you are reinvesting dividends, but a number (eg Selftrade or Willis Owen) let you do so for a lower fee.

- Some investors may want to vote at investment trust shareholder meetings but not all platforms provide for shareholder voting, whilst a number impose an additional charge.

Price is only one facet of platform selection and potential investors should undoubtedly take a number of other elements into consideration before selecting a provider. The degree of guidance they may need in selecting their investments, the level of functionality offered by the platform, and the importance they attach to a well-known brand should all be considered. However, as the data show, by choosing the platform best suited to their specific needs and circumstances, the canny DIY investor could pay a great deal less to manage their investment trust holdings.

[1] Source: The Association of Investment Companies, 19/05/2020