Today is the day! How many times have you said this when it comes to a goal in life? Today is the day I’ll start going to the gym. Today is the day I start eating healthy. Today is the day I’ll start saving for the future.

These statements require us to make a change and start a habit which can be difficult. Habits around saving and investing can be especially difficult since they deal with money. Along with that when we think about investing, we think “buy low, sell high.” However, questions arise such as is this the high? What if my timing is incorrect, and what if this leads to me losing money?

In fact, we feel the pain of loses two times the joy of gains and implementing savings and investing habits many times fail because of this aversion to loss. This makes starting hard!

To decrease that hesitancy, I think it’s important to start small and a PAC is a great way to do this. Not only does it help to alleviate some of the fear associated with starting to invest but it helps you automatically create a habit. That habit will then help you meet the goal of saving and investing for your future.

The beauty of a PAC is that you are able to create a disciplined investing strategy with small incremental investments. This strategy aims to help you plan or at least try to build assets that can used for future expenses. Those expenses could be associated with health care, education, and/or retirement.

Along with that a PAC helps you avoid having to decide the precise moment you should invest in the market. This helps us avoid the many behavioral and emotions problems that can get in the way us developing successful savings and investing plans.

Many people may think of an automatic investing program such as a PAC and think back to volatile periods in the market, and think why would I want to continue to invest during these periods?

First by utilizing a PAC it helps to anchor you to your disciplined approach when the swings of the market might attempt to drag you off course. Second over time this sort of disciplined investing approach makes financial sense.

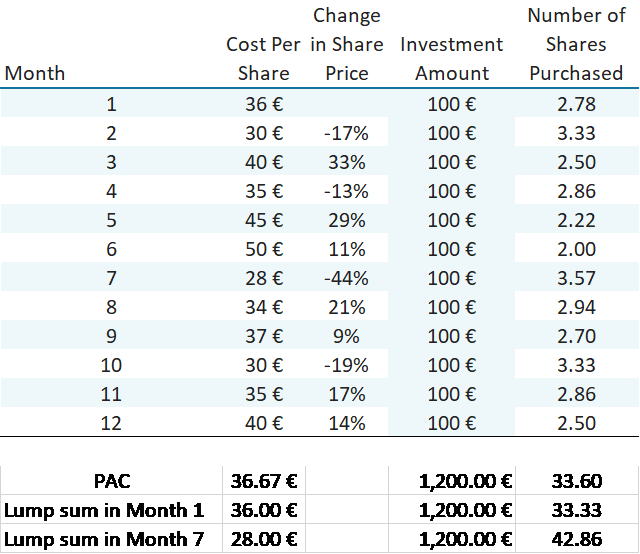

As you can see, at the end of the 12-month period where there was significant volatility, you end up with more shares and you would have paid a lower average share price for those shares. Furthermore, you’ve created a larger investment with lower tax ramifications just by systematically investing.

Smooth Out Volatility

We have seen a lot of market volatility over the past year and a half, and we will likely see more periods of market volatility in the future. Volatile markets can be stressful and lead investors to make untimely, emotional decisions. However, if you’re not saving for the future and providing yourself with growth potential by investing some of those savings, you may miss out on your future goals.

Now, you may be saying to yourself, “Yeah, but volatilely still stresses me out.” While there’s no way to completely eliminate the emotions associated with investing in choppy markets, a PAC may help allay those fears. Going back to our original example of the €100 lump sum investment in the table above, if you invested a lump sum of €100 in month one, you would own 33.33 shares with a cost basis of €36. However, if you had waited until month seven, you would own 42.14 shares with a cost basis of €28.

The key here, however, is that in month one, you didn’t know a downturn was coming. And when your investment decreased in value by 44% in month seven, you would likely have been afraid that the share price was going to continue to decline, which may have led you to decide to continue to wait it out in cash. The problem is, you probably wouldn’t have expected the share price to increase in value by 21% the next month.

A PAC helps smooth out the impact of price volatility, so you don’t fall into these kind of emotional traps. By systematically investing, you would end up with 33.60 shares with an average cost basis of €36.67 over the 12-month period. And most importantly, you didn’t have to try to figure out the best time to get into or out of the market, which requires an incredible amount of luck.

To put it simply a PAC aims to help you do three things:

- Reduce your overall risk

- Create a disciplined approach to accumulating capital

- Guard against behavioral traps that can get you off track

More generally it helps you start the important process of investing for your future. A process that creates discipline and allows you to better reach your goals. Remember…long term goals are not reached through short term emotions and utilizing a PAC helps you do this.