Tom Ross, corporate credit portfolio manager, discusses the outlook for high yield corporate bonds noting that an improving economic picture should help credit spreads to tighten further but may spark fresh concerns about monetary tightening.

Key takeaways

- The ongoing demand for yield is likely to lead to further tightening of credit spreads as investors seek out income producing assets and default fears diminish.

- The broad rally in high yield is likely to give way to more dispersion in 2021, with the best returns potentially coming from the competing forces of ongoing structural winners and selective opportunities among recovering cyclicals.

- The biggest risk to high yield markets may come from the opposing end of the credit spectrum should inflation concerns put upward pressure on government bond yields. We expect central banks to remain accommodative but economic data could drive volatility.

The availability of effective vaccines could turbo-charge the recovery in 2021. The lifting of restrictions in mid-2020 demonstrated the ability of economies to mount a rapid V-shaped recovery when allowed to do so. We are cognisant, however, that the logistics of vaccinating the broad population are easier said than done. We expect vaccination to have its biggest impact from the second quarter of 2021 as more vulnerable groups are protected and the northern hemisphere moves beyond winter.

Markets typically look ahead of current economic conditions and cyclically-sensitive credits are already responding, with credit spreads tightening (which can contribute to lower yields and higher bond prices) in anticipation of improving cash flows and declining default risk. While many companies were able to raise financing in capital markets in 2020 to tide them through the lockdowns not all will survive, so a keen eye on credit fundamentals will remain critical. We believe that selective opportunities exist in some of the more COVID-sensitive areas that have lagged the market, including leisure and real estate. There is also likely to be more opportunity lower down the credit spectrum and among smaller issuers as we embark on the repair phase of the credit cycle in which companies seek to improve their balance sheets. Investor appetite for risk and low interest rates should propel the grab for yield. This does not mean throwing caution to the wind. We expect credit spreads to tighten but in a more limited fashion given credit spreads have tightened significantly since March 2020.

The structural changes that have been taking place in the economy, such as digitalisation, will likely persist. Similarly, the factors that typically make for a good credit, including reliable cash flows, good management and an improving environmental, social and governance (ESG) trajectory, will remain important. Bonds from companies that demonstrate these qualities should help act as ballast against market volatility.

Welcome additions

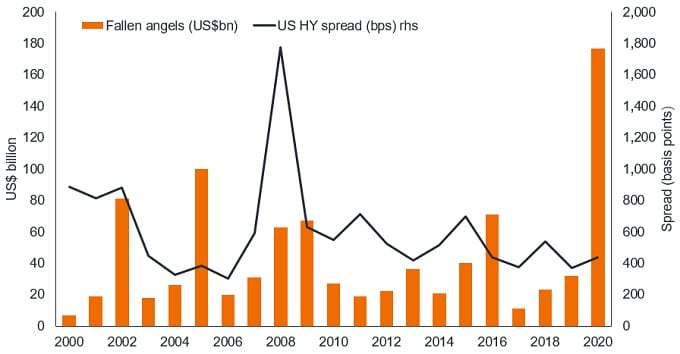

A notable feature of 2020 was the debunking of the notion that a wave of downgrades would destabilise the high yield market. While there was a big rise in fallen angels (bonds downgraded from investment grade to sub-investment grade) the high yield market proved adept at absorbing the increase in supply. In fact, high yield credit spreads are only mildly wider than at the start of 2020.

Fallen angels and US high yield credit spread at calendar year ends

Source: J.P. Morgan, USD fallen angels in US$ billion at calendar year ends, 2020 as at 30 November 2020; Bloomberg, spread to worst versus government on ICE BofA US High Yield Index at calendar year ends, 2020 as at 26 November 2020. Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

We welcome the increase in supply after a paucity of net new issuance within high yield markets in the years leading up to 2020, since it helps increase choice for high yield investors. What is more, for technical reasons the market is often poor at correctly pricing bonds when they transition between investment grade and high yield and vice versa, creating opportunities to profit from these pricing inefficiencies.

We expect further fallen angels in 2021 but down on 2020 levels and the default rate to peak well below the levels of the last crisis — quite a feat considering the scale of the economic disruption. Central bank support and government-led economic stimulus schemes have been instrumental in maintaining a functioning credit market and contributing to low financing costs. We think authorities will be keen not to derail the recovery, maintaining accommodative policies throughout 2021 by holding interest rates low and pursuing ongoing asset purchase schemes. With central banks still buying bonds (albeit primarily investment grade) and issuance likely lower, this should create a favourable demand/supply dynamic.

Too much of a good thing?

Markets, however, try to look ahead. A combination of the recovery building momentum and rising headline inflation may spook investors worried that interest rates may rise. The higher yields on high yield bonds traditionally act as a cushion against interest rate risk but we need to be mindful that government bond market volatility may spill over into other segments of fixed income. Our base case is that central banks will seek to dampen volatility in government bond markets but it is ironic that the biggest risk to high yield may come from what happens at the other end of the credit spectrum.

Notes

Credit spread/spread: The difference in yield between securities with similar maturity but different credit quality; eg, the difference in yield between a high yield corporate bond and a government bond of the same maturity. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving creditworthiness.Credit cycle: This cycle reflects the expansion and contraction of access to credit (borrowing) over time. It is related to changes in the economy and the monetary policy pursued by central banks.

Cyclical sectors/cyclicals: sectors comprising companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Default: When a bond issuer fails to meet their repayment obligations to bondholders. The default rate measures the percentage of defaulting bonds within the defined market over a set period.

Environmental, social and governance (ESG) are three key criteria used to evaluate a company’s ethical impact and sustainable practices. ESG or sustainable investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than, the broader market.

Fallen angel: A bond that has been downgraded from an investment grade rating to sub-investment-grade status, due to a deterioration in the financial condition of the issuer.

High yield bond: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high yield bonds.

Monetary policy/stimulus/tightening: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility.

Yield: The level of income on a security, typically expressed as a percentage rate.