Investment Environment

The third quarter was a weak period for UK equities. Sustained high rates of inflation continued to pressure the finances of UK households, while political uncertainty (particularly towards the end of the quarter) led to a sharp rise in government bond yields (falling prices) and a fall in sterling. While a fall in the value of sterling can translate to earnings benefits for much of the FTSE 100 Index -where many companies generate the majority of earnings overseas -it is likely to be an earnings headwind for many of the more domestic-focused smaller companies which import some of their inputs in US dollars. This difference in currency impact, combined with weaker investor sentiment more broadly towards the UK economy, meant that the more domestically exposed FTSE 250 and FTSE Small Cap indices underperformed the FTSE 100. During the quarter, the FTSE 250 index fell 7.3% while the FTSE Small Cap (ex investment trusts) Index fell 9.1%. This compares to the FTSE 100 Index which fell 2.8% (all figures are total return in sterling terms).¹

Portfolio Review

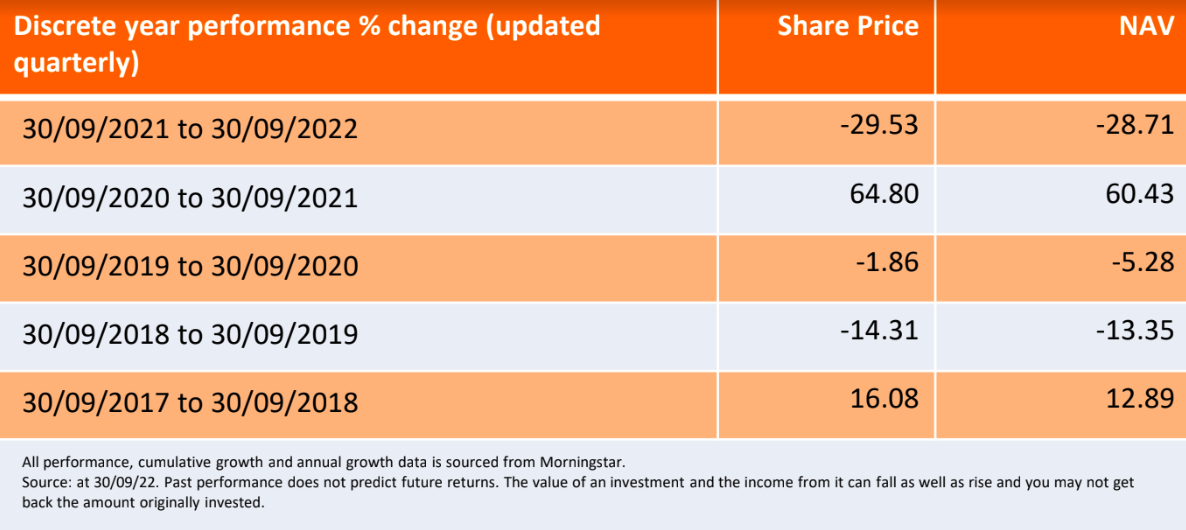

The Company underperformed its FTSE All-Share Index benchmark during the quarter as its net asset value fell 9.3% relative to a 3.4% fall in the All-Share Index. Over the same time period, the company’s AIC UK All Companies peer group fell 6.9%.¹

As at the end of the third quarter, we held 28% of the portfolio in the FTSE 100, with the majority of the portfolio (53%) listed on AIM. This overweight position in smaller companies reflects where we see the greatest potential for earnings growth over the long term. However, in the short term, our significant smaller company weighting has been a headwind to performance.

At the stock level, the best performers during the quarter included oil and gas companies SericaEnergy and Jersey Oil & Gas, which have been benefiting from the rise in commodity prices this year. Zoo Digital, which provides subtitling and dubbing services to content producers, also performed well. As platforms such as Disney+ are rolled out globally, there is increasing demand to localise content and Zoo Digital has been benefiting from this trend.

The worst performers during the quarter tended to be companies exposed to consumer spending, such as Scottish housebuilder Springfield Properties, car retailer Vertu Motors or low-cost gym operator Gym Group. In all cases, the shares performed poorly given concerns that the current pressures on household disposable income will impact consumer spending.

The portfolio always holds a blend of what we call ‘tomorrows leaders’, or companies which in our view have the capacity to grow significantly over the long-term, and ‘stabilisers’ -larger companies and natural resource companies that aim to add diversification to the portfolio and that might perform well at different points in the economic cycle. This year has seen the ‘stabilisers’ outperform and we have been taking profits in this area, particularly in natural resources where we recently sold the position in Shell and reduced the position in SericaEnergy. We have been rotating the proceeds of these sales into ‘tomorrows leaders’ which have recently underperformed. Examples include SME services provider K3 Capital, media agency Next Fifteen Communications and flexible office rental provider Workspace.

Manager outlook

Sentiment towards UK equities has been poor for a number of years, as illustrated by net flow data, the widening valuation differential versus overseas peers and sentiment indicators (such as fund manager surveys). This weak sentiment has, if anything, been exacerbated in recent months because of additional political uncertainty and therefore a greater ‘risk premium’ associated with UK assets. While it is frustrating to see much of the portfolio de-rate, the scale of the valuation falls we have seen could be viewed as an opportunity to add to positions at significantly below their long-run average valuations. In many cases the companies we are adding to are market leading businesses, with strong balance sheets and experienced management teams.

¹Source: Bloomberg as at 30 September 2022

Balance sheet – a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure.

Bond yield – The level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. Lower bond yields means higher bond prices.

De/re-rate – A stock rerating is when a company’s valuation changes, therefore investors will be willing to pay a higher or lower price for the stock.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Leverage – The use of borrowing to increase exposure to an asset/market. This can be done by borrowing cash and using it to buy an asset, or by using financial instruments such as derivatives to simulate the effect of borrowing for further investment in assets.

Net asset value (NAV) – The total value of a fund’s assets less its liabilities.

Valuation metrics – Metrics used to gauge a company’s performance, financial health, and expectations for future earnings e.g. price to earnings (P/E) ratio and return on equity (ROE).