Investment Environment

The quarter started with a bear market rally due to the belief that the US Federal Reserve (Fed) was about to pivot. This was soon reversed following renewed inflationary pressures in Europe as well as Powell’s speech at Jackson Hole in late August where he made it clear that bringing inflation down was his priority. The equity markets then retested the lows coming into September following a worse-than-expected US August Consumer Price Index (CPI) report (8.3% actual versus 8.1% expected). Central banks continued to raise interest rates over the quarter -with 100 basis points (bps) from the Bank of England (BoE), 125bps from the European Central Bank (ECB), and 150bps from the Fed -which led to a spike in bond yields and a sell-off of equities.

The problem is that while US inflation seems to have peaked, it is taking time to roll over with the service component proving sticky, while in Europe and the UK, it is likely to remain elevated this winter due to large energy-related price increases. This has meant that inflation is well above the central banks’ targets in most countries, which is why the markets are pricing in further rate hikes. This has led to increased fears of a global recession given their coordinated nature.

The economic picture shows moderating global growth with recession calls from some of the major investment banks for Europe and UK becoming more common. Towards the end of September, the UK governments “mini budget” was poorly received by markets and led to a large sell-off in gilts, forcing the BoE to intervene by temporarily buying long-dated gilts. The underlying issue was the scale of the deficit leading to huge new issuance of gilts and the fact that the Office for Budget Responsibility (OBR) had not reviewed the new budget ahead of its release. The BoE was then forced into a bizarre policy mix of looking to increase rates at the front end of the yield curve while buying long-dated bonds -akin to having one foot on the brake and the other on the accelerator.

The central banks are succeeding in making financial conditions tight and what has spooked markets is that they are prepared to keep interest rates restrictive even as growth slows in their determination to bring down inflation. Inflation is a lagging indicator of growth and we have begun seeing this seep through into earnings expectations which for the S&P 500 Index started the quarter with an earnings growth forecast of 6.3% in the third quarter and ended the quarter decelerating to growth of 2.9%. We have seen a number of earning warnings saying that demand was very weak through August and September, particularly in Europe and China. It looks like prices are peaking, demand is slowing and yet costs are sticky, so it will be interesting to see what companies say about their guidance as we move into the fourth quarter.¹

Portfolio Review

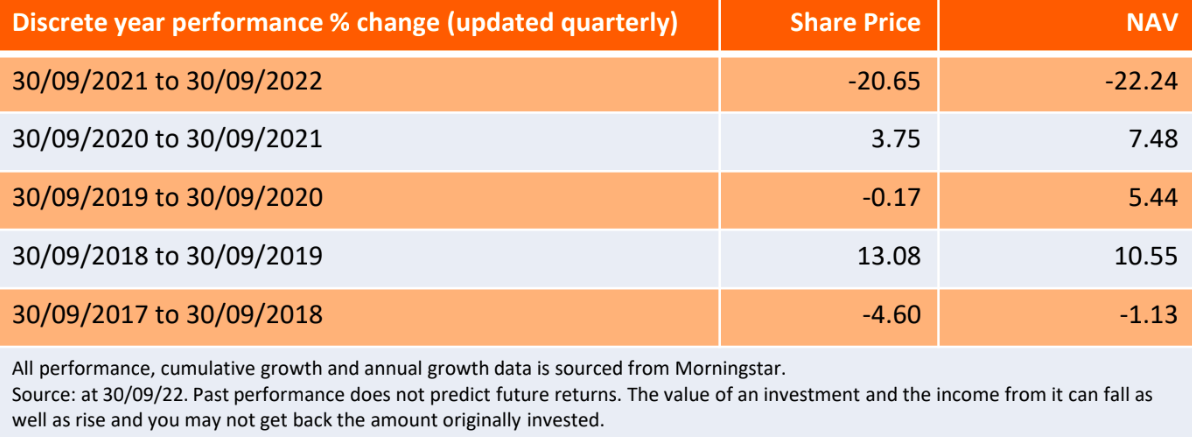

The Company’s net asset value (NAV) fell by -5.1% during the quarter.¹

We were given permission by the board to reduce gearing in the quarter and if needed to use the reserves to pay dividends. We have used this flexibility to reduce gearing as a short term/tactical opportunity to re-load at wider spreads. We continued buying back shares and will look to continue to do so in the market if we consider it be accretive for our shareholders.During the quarter, European investment grade bonds widened by 9 basis points (bps) and delivered -3.3% while US investment grade widened by 3bps and delivered -5.1%. Both these negative returns were driven by the rates sell-off. European high yield bonds tightened by 16bps to deliver -0.4% and US high yield tightened by 44ps and delivered -0.7%, outperforming the rest of the fixed income universe.In terms of primary activity during the quarter, we have seen muted primary issuance in both the European and US investment grade markets as well as very little issuance in either the European or US high yield market, driven by a typically quieter summer season, secondary market volatility and elevated pricing levels. In terms of distress, we have seen a pick-up in the US with a total of $23.4 billion this quarter -the highest quarter since the Covid-19 crisis. The US high yield default rate stood at around 1.6% and European markets at around 0.4% at the end of the quarter. The overall level of distress in the market has begun picking up from a low base.

Manager outlook

The themes from the first two quarters remain the same. The market is concerned about high inflation, further interest rate hikes and slowing growth likely heading into a recession. We have positioned the portfolio defensively and, while a little early, we find that data points are corroborating our positioning.

We have been buying more investment grade bonds during the quarter as we have been getting more defensive, selling down some of the sub-financial exposure as we see recessionary fears present a weaker backdrop for global risk assets. We remain fully invested in “reason to exist” large cap credit around what we see as the B-rated (19.7% of the fund), BB-rated (28.7%) and BBB-rated (45.6%)sweet spot.

The focus on providing a relatively consistent and attractive income stream to investors means that the investments are naturally skewed to lower-rated and riskier corporate bonds.

1Source: Bloomberg as at 30 September 2022.

Bear market – A bear market is when a market experiences prolonged price declines. It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.

Bond yield – The level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. Lower bond yields means higher bond prices.

Credit spread – The difference in the yield of corporate bonds over equivalent government bonds.

Default rate – The default rate is the percentage of all outstanding loans that a lender has written off as unpaid after a prolonged period of missed payments. The term default rate – also called penalty rate – may also refer to the higher interest rate imposed on a borrower who has missed regular payments on a loan.

Defensive stocks – A defensive stock is a stock that provides consistent dividends and stable earnings regardless of the state of the overall stock market. There is a constant demand for their products, so defensive stocks tend to be more stable during the various phases of the business cycle.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Investment grade bonds – A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

Front-end yield curve – The “front end of the yield curve” is financial jargon for short term debt securities. That means bonds issued for around a year or less.

Gearing – Gearing is the measure of a companies debt level. It is also the relationship between a companies leverage, showing how far its operations are funded by lenders versus shareholders. Within investment trusts it refers to how much money the trust borrows for investment purposes.

Gilts – Government bonds in the U.K., India, and several other Commonwealth countries are known as gilts. Gilts are the equivalent of U.S. Treasury securities in their respective countries. The term gilt is often used informally to describe any bond that has a very low risk of default and a correspondingly low rate of return.

High yield bond – A bond which has a lower credit rating below an investment grade bond. It is sometimes known as a sub-investment grade bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Large cap credit – Large-cap (sometimes called “big cap”) refers to a company with a market capitalization value of more than $10 billion. Large cap is a shortened version of the term “large market capitalization.”

Long-dated bonds – A long-dated asset is a type of income-generating asset, such as residential mortgages and 30-year bonds, where the revenue streams occur until that asset’s maturity date (which is well into the future).

Monetary policy – The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Net Asset Value (NAV) – The total value of a fund’s assets less its liabilities.

Recession – A recession is a macroeconomic term that refers to a significant decline in general economic activity in a designated region.It had been typically recognized as two consecutive quarters of economic decline, as reflected by GDP in conjunction with monthly indicators such as a rise in unemployment.

Yield curve – A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. A yield curve can signal market expectations about a country’s economic direction.