Over the past few months, there has been a lot of talk about “vibes.” Good vibes, bad vibes, brat vibes, crypto vibes … the vibes have taken over our collective psyches.

In fact, we’ve seen “nervous vibes” from investors of all stripes over the past two years through our Investor Survey. In both the 2023 and 2024 surveys, 78% of respondents cited the 2024 presidential election as their top concern as it relates to the impact on their finances. That concern – which topped worries about inflation or a potential recession – led to pessimism about the markets and shifts toward more conservative allocations.

Now that the election is decided, it may be time for a vibe check with clients.

Bad vibes and uncertainty linger

Even though the election has been decided, that doesn’t mean the emotions investors have grappled with over the past couple years will disappear. Given how tight the race was, there are inevitably many Americans who were disappointed with the outcome, and many uncertainties about the economy remain. This uncertainty could lead to emotional, short-term decision making, which as we know usually leads to less-than-optimal long-term investment results.

Now more than ever, advisors need to help clients focus on their long-term goals and not let their emotions lead them to make significant allocation changes. Here are a few ideas that I’ve found can help put the election and its impact – or lack thereof – on markets in proper perspective:

- Research has shown that investors who let their political preferences dictate their investment decisions underperformed the broader market by 2.7% per year on average through over-trading, taking less risk, and having increased international allocations.1

- In the one-year period following the last five elections (three Democrat wins, two Republican) the S&P 500® Index has returned on average +19%.2

- From 1945 to 2024, the average return of the S&P 500 in the first year of a presidential administration has been +7.7%.

Finally, it may be helpful to remind these investors that everyone, no matter their candidate of choice, woke up the day after the election and went to work. And that (among other things) is ultimately what makes stock prices – and our long-term investments – increase in value.

Good vibes in markets – for now

Immediately following Trump’s win, equity markets shot upward, with the S&P 500 reaching an all-time high of 5,995 on November 8, 2024. Along with that, the VIX index of implied equity market volatility decreased significantly. Between November 1 and November 8, the VIX decreased by 31.7% to a level of 14.94.

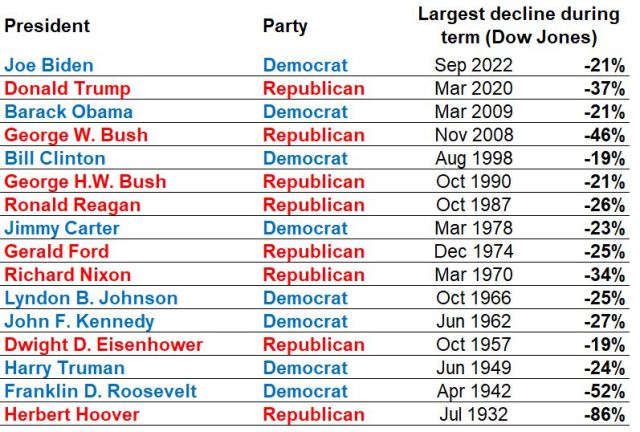

The good vibes initially felt in markets may have some investors convinced the surge will continue for the next four years. And while markets do tend to go up during most presidencies (both Democrat and Republican), it’s important to remember that equity performance has historically been indifferent to election outcomes over the long term. In fact, every U.S. president going back to Herbert Hoover has seen a bear market during their administration.

Source: “All That Matters: Elections and Your Money.” Baird Research, March 2024.

Along with that, the Shiller CAPE Ratio, a stock valuation measure that uses real earnings per share over a 10-year period versus just a one-year period, was at 38.08 on November 7, 2024. (Its all-time high 44.19 in December 1999.) Research has shown that CAPE values are strongly negatively correlated with future returns (correlation coefficient = -0.7).3 The current elevated level may mean that stocks are overvalued and that markets could be headed for a period of lower returns.

Of course, while the VIX and the CAPE can help provide historical context, none of these measures can predict with certainty where stocks are headed, especially when so many unknown factors have the potential to change the trajectory of the markets and economy.

Long-term vibes matter most

So, what are investors to do? There are always reasons to be optimistic and pessimistic, but the market is going to do what it is going to do – and we can’t control that. The only thing we can control is the long-term plan we have created. And that should be a plan that is created with your goals in mind, not who the president is or isn’t.

In the end, my own vibes tell me that keeping a goals-driven, long-term focus is the best we can do, and history supports the effectiveness of that strategy.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

1 Bonaparte, Y., Kumar, A., and Page, J. “Political Climate, Optimism, and Investment Decisions.” February 2012.

2 “The stock market’s performance after the past 5 elections.” TheStreet.com. November 5, 2024.

3 “CAPE Is High: Should You Care?” CFA Institute, April 17, 2024.