The healthcare sector went on a bumpy ride in 2023, with some areas like medical devices flipping from gains to losses and makers of new anti-obesity drugs seeing their stocks achieve high double-digit returns.

Looking ahead, we think the road could begin to smooth out. Attractive valuations, numerous medical advances, and positive long-term demographic trends have put the sector into a position of unusual strength in our view – with the potential to reward long-term investors.

Normalizing markets

For much of 2023, the healthcare sector had to nurse a COVID-19 hangover, as some companies saw their revenues decline sharply following the end of the public health emergency. Demand for diagnostics and the “picks and shovels” used to manufacture vaccines, for example, waned, weighing on tools and services companies, which also suffered from excess inventories at their clients. In biopharma, sales of COVID-19 vaccines and therapeutics topped $90 billion in 2022, roughly 20% of all blockbuster biotech drug sales that year. (A blockbuster drug has sales of $1 billion or more annually.) For 2023, some companies forecast their COVID revenues will drop by as much as 80%.

This deceleration was necessary and something we expected. It should also start to improve as we head into 2024, making for easier year-over-year sales comparisons. Encouragingly, excluding COVID products, many biopharma earnings have continued to grow. And tools companies estimate that the worst of the inventory destocking is behind us (or will bottom out in the coming months). Firms have also acted to right-size cost structures, which is expected to support profit margin expansion over the coming year. In short, after a rare year of earnings declines for the healthcare sector, we expect earnings to stage a recovery in 2024.

Clarity around GLP-1s

It was hard to miss the enthusiasm for a new class of weight-loss drugs known as GLP-1 agonists this year. These therapies work by mimicking gut hormones that regulate appetite and have achieved unprecedented levels of weight loss in patients – anywhere from 15% to more than 20%.

Data suggest the drugs could have other health benefits, too. In clinical trials, Wegovy – the first GLP-1 indicated for obesity – reduced the risk of heart attack, stroke, and death in people with cardiovascular disease and obesity by 20%. GLP-1s have been marketed for more than a decade for diabetes, and additional beneficial effects are still being uncovered, including in cardiovascular, liver, and kidney diseases.

We believe GLP-1s could be the biggest market opportunity yet in biopharma, with sales topping $100 billion before the end of the decade. But the drugs have also raised alarm bells about the future of medical device products and drugs that treat related diseases, anything from sleep apnea and heart disease to orthopedics.

We think the reality will be far more nuanced and that the knee-jerk reaction, which has driven down medical device and select biotech stocks, is overdone. For one, it could take decades for GLP-1s to bend demand curves. For an overweight 60-year-old with osteoarthritis, a GLP-1 prescribed today is unlikely to eliminate the need for a knee procedure since osteoarthritis may have built over decades and is largely irreversible. What’s more, GLP-1s might help drive demand if people live longer (as device usage is heavily related to age) or enable more people to qualify for procedures, thanks to weight loss.

Medicine is also rarely binary, with almost all conditions best managed with multiple therapeutic classes and rarely completely cured. Cholesterol-lowering drugs called statins, for instance, are extremely effective at reducing cardiovascular disease but have not knocked down demand for cardiac medical devices. For severe forms of fatty liver disease, GLP-1 trial data, in our view, do not compare to medicines more directly targeting the liver and fibrosis. Based on results from clinical studies and physician feedback, we believe other classes of medicines will play a key role in treating this large indication (prevalence of 10 million in the U.S. alone).

In short, we think GLP-1s represent a tremendous medical advancement, but we are not writing off the rest of the sector. On the contrary, we think many affected companies are still set up for long-term growth given the complexity of healthcare and the high unmet medical need.

Attractive valuations

Volatility has pushed down valuations of tools and device firms, as well as traditionally defensive areas of healthcare, such as managed care. These stocks hit bumps in 2023 as new regulation lowered reimbursement rates in Medicare Advantage (the private version of the federal health plan for the elderly) and reduced enrollment in Medicaid (which provides health coverage for low-income households). Rising utilization costs were another challenge, as people once again leaned on their insurance to catch up on routine medical care (yet another COVID hangover).

But these issues could find a resolution in 2024. Insurers, for instance, can raise premiums annually to offset costs (and have done so in recent months). An aging population makes Medicare Advantage still the fastest growth area of the industry, while former Medicaid members could qualify for federally subsidized private insurance.

In biotech, many stocks trade at even bigger discounts – by some measures, the biggest we have ever seen. After a record drawdown in 2021 and 2022, small- and mid-cap biotech stocks got caught up in the sell-off of long-duration growth assets as 10-year Treasury yields started to rise in 2023. This is not unusual, as we tend to see biotech underperform amid rising rates, with less focus on stock-specific developments. But some market moves seemed extreme as even positive news – such as one company’s announcement of approval for its new therapy for phosphate management in dialysis – would sometimes result in negative returns.

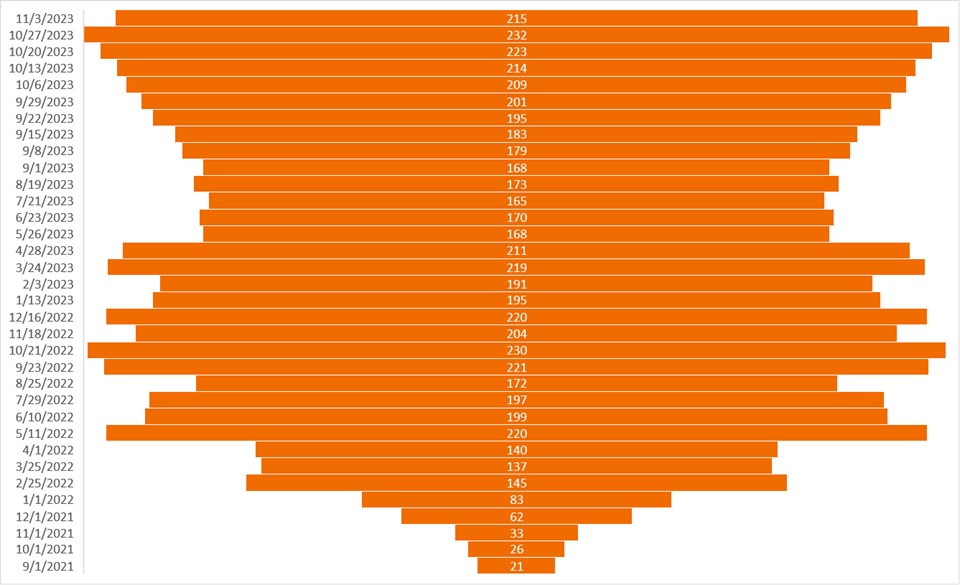

As such, the S&P Biotechnology Industry Index1, a benchmark of large-cap biotech stocks in the S&P 500® Index, trades at a nearly 25% discount to its 30-year average.2 And the number of development stage biotech firms trading below the value of cash on their balance sheets hit a record high in October (Figure 1).

Figure 1: Biotech at a discount

The number of biotech companies with negative enterprise value* hit a record high in October.

Source: CapitalIQ, as of 3 November 2023. *Enterprise value is defined as the current market capitalization less the net cash on the balance sheet. A negative enterprise value suggests a company trades for less than the value of its cash.

Once again, we think the selling is overdone. While the industry was due for some rationalization, many companies are making significant medical breakthroughs. In fact, in 2023, more than 55 novel therapies were approved by the Food and Drug Administration, with dozens more applications pending review as of mid-November.3 At that pace, it could be a record year for drug launches.

Furthermore, many of these new drugs address large disease categories where few treatment options existed before, including Alzheimer’s and Duchenne muscular dystrophy (an often fatal, muscle-wasting hereditary disease that afflicts children). These drugs are now beginning what could be a 10-year period of revenue growth, given patent protections. More breakthroughs are on the horizon, too, including the first oral therapy for fatty liver disease and a new type of treatment that inhibits KRAS mutations, which are widely found in pancreatic, colorectal, and lung cancer tumors.

An improving rate backdrop

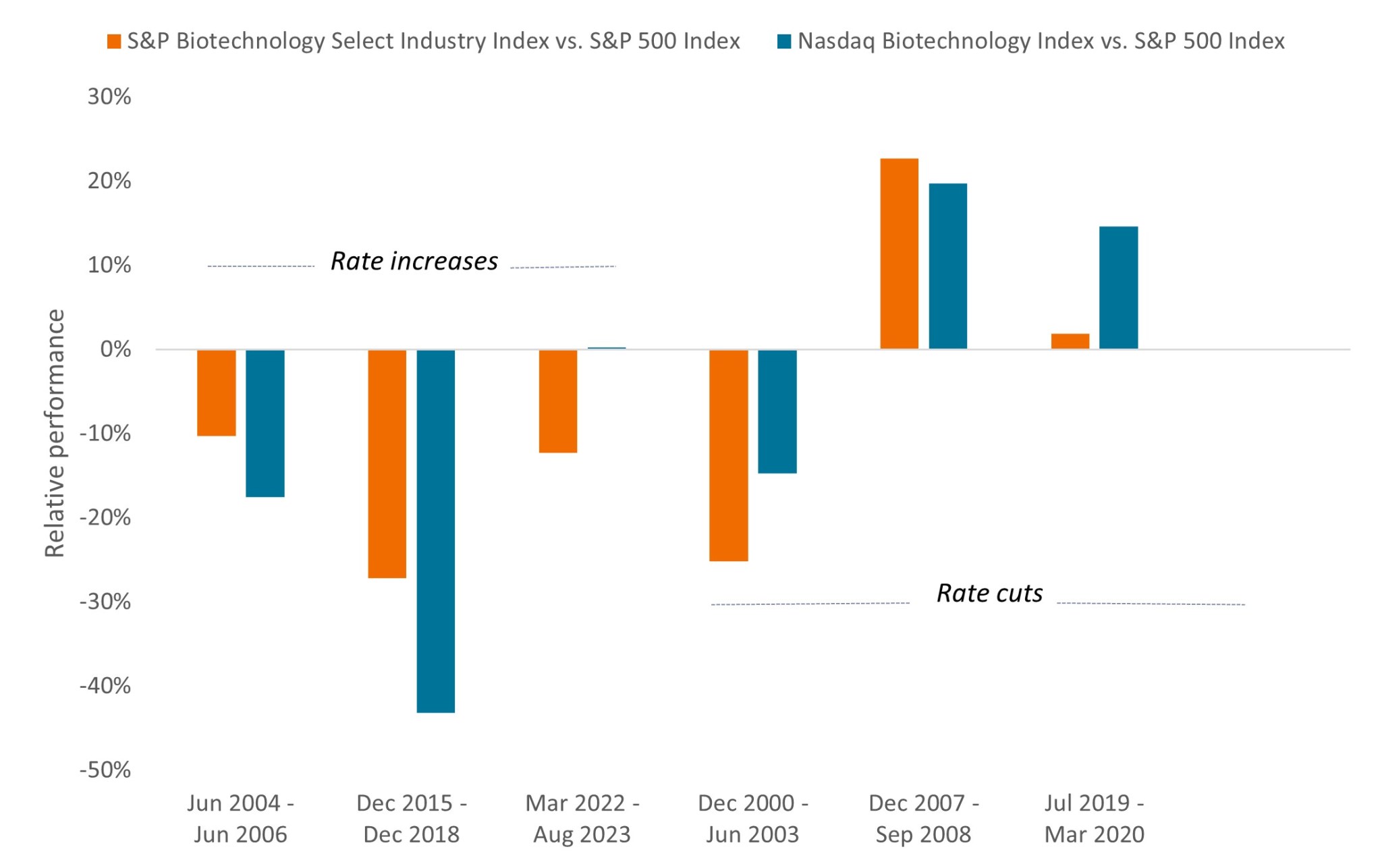

Meanwhile, an end to the Federal Reserve’s rate-tightening cycle could be a boon to biotech. Rate cuts could also be welcome even if they signal we are headed for an economic slowdown or recession. Historically, biotech has tended to outperform during such periods, benefiting from a lower discount rate and, most importantly, innovative drivers that are independent of economic growth (Figure 2).

Figure 2: An interest rate tailwind?

Relative performance of biotech stocks vs. the S&P 500 Index during interest rate hikes/cuts.

Source: Bloomberg. Rate increases/decreases are for changes in the Federal Funds Rate. Negative returns show the S&P Biotechnology’s or Nasdaq Biotechnology’s degree of underperformance relative to the S&P 500 Index. Positive returns show degree of outperformance. The S&P Biotechnology Select Industry Index represents the biotechnology sub-industry portion of the S&P Total Markets Index (S&P TMI). The S&P TMI tracks all the U.S. common stocks listed on the NYSE, AMEX, Nasdaq National Market and Nasdaq Small Cap exchanges. The Nasdaq Biotechnology Index is a stock market index made up of securities of Nasdaq-listed companies classified according to the Industry Classification Benchmark as either the Biotechnology or the Pharmaceutical industry. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results.

In fact, the healthcare sector overall has held up well during downturns. Since 2000, the MSCI World Health Care Index, on average, has captured just 47% of the downside when the MSCI World Index fell 15% or more.4 With valuations now generally attractive across the sector, we think healthcare could be well positioned to offer resilience should the economic outlook deteriorate.

That kind of defense can be rare to find in a sector that can also offer substantial growth opportunities. We think it all adds up to a potentially better ride for healthcare investors in 2024.

1 S&P 500 Biotechnology Industry Index is made up of the large-cap biotechnology companies in the S&P 500 Index. It is a level 3 Global Industry Classification Standard (GICS).

2 Bloomberg, as of 15 November 2023, based on forward, 12-month earnings estimates.

3 Food and Drug Administration, as of 15 November 2023.

4 Bloomberg. Based on returns for the MSCI World Health Care Index and the MSCI World Index. Return periods are April 2000 to September 2002; November 2007 to February 2009; May 2011 to September 2011; February 2020 to March 2020; and January 2022 to December 2022.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

MSCI World Index℠ reflects the equity market performance of global developed markets.

MSCI World Health Care Index℠ reflects the performance of health care stocks from global developed markets.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.