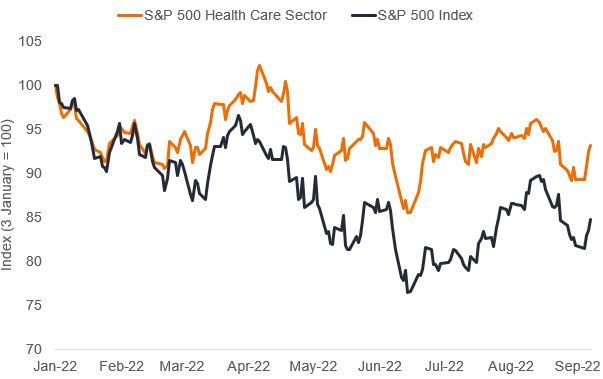

So far in 2022, the defensive nature of health care has been the sector’s dominant story, with the S&P 500® Health Care sector returning -5.7% for the year compared to -14.3% for the S&P 500® Index.1 With interest rates expected to keep rising and economic growth potentially slowing, the pricing power and non-cyclicality of areas such as pharmaceuticals and managed care could continue to stand out. But at the same time, health care’s innovation engine is humming along – and showing signs of attracting investor attention.

Ahead of expectations

Within health care, the year’s best-performing stocks fall into categories such as managed care, large-cap biopharmaceuticals, and distributors and pharmacy benefit managers. These industries are generally able to pass on price increases and benefit from steady demand. In managed care, for example, pricing for insurance policies resets annually, allowing companies to raise premiums in response to higher costs. In addition, proceeds invested in short-duration securities are rolled over as policies renew, making it possible to capitalize on rising rates. Meanwhile, consistent demand for medicines supports strong free cash flows and balance sheets among pharmaceuticals. The industry also has many levers to pull to reduce expenses and can lift drug prices. Drug price increases also support distributors and pharmacy benefit managers (which form the supply chain of drug distribution in the U.S.). The profit margins of these firms are tightly correlated with pharmaceutical pricing and volume trends.

Combined, these companies have generally delivered solid earnings growth this year and are the main reason why health care reported the second-largest positive differential between actual earnings and estimates in the second quarter, according to FactSet.2

Figure 1: Health care plays defense in 2022

Source: Bloomberg, data from 3 January 2022 to 9 September 2022. Indices rebased to 100 as of 3 January 2022.

Long-duration headwinds

On the other hand, long-duration companies within health care – firms whose cash flows tend to be realized further out in the future – have underperformed as interest rates tick up. Rising costs and COVID-19 disruptions have also been challenges for some areas of the sector. For example, health care providers, such as hospitals, have yet to see patient volumes return to pre-COVID levels due to nursing and labor shortages. Similarly, medical device companies have suffered from lower volumes, and with limited pricing power and supply disruptions, profit margins have come under pressure.

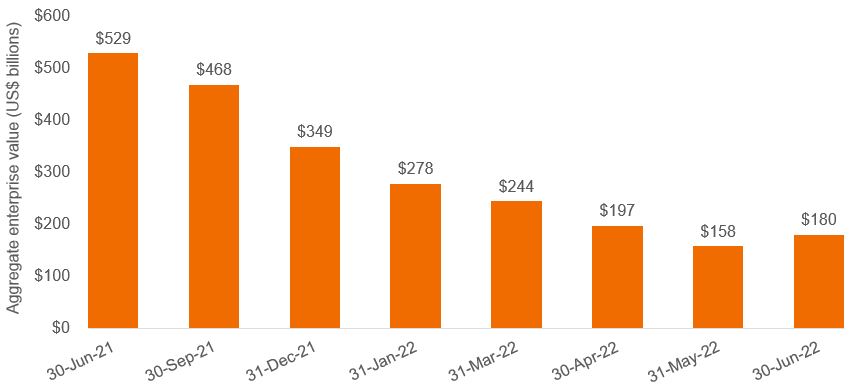

One of the largest underperformers has been biotechnology, with the group’s small- and mid-cap stocks mired in an unusually deep and protracted pullback. From February 2021 through a low in early May 2022, the S&P Biotechnology Select Industry Index, a benchmark for the subsector, fell 64%, underperforming the S&P 500 by 66% and the S&P 500 Health Care sector by 75% – the largest relative gap since the Biotechnology Select Industry Index’s inception in early 2006. In fact, at one point more than 200 companies were trading below the value of cash on their balance sheets. We also found many more companies trading at what we believed to be zero or negative pipeline value.

Figure 2: Total enterprise value* of development-stage biotech, 8 February 2021 to 30 June 2022

Biotech’s aggregate enterprise value has declined as much as 70% since 2021.

Source: Capital IQ, as of 30 June 2022. *Enterprise value is the sum of a company’s market capitalization, preferred stock and debt, minus cash and cash equivalents and is meant to be a measure of a company’s market value (what the cost would be to acquire a firm).

Green shoots

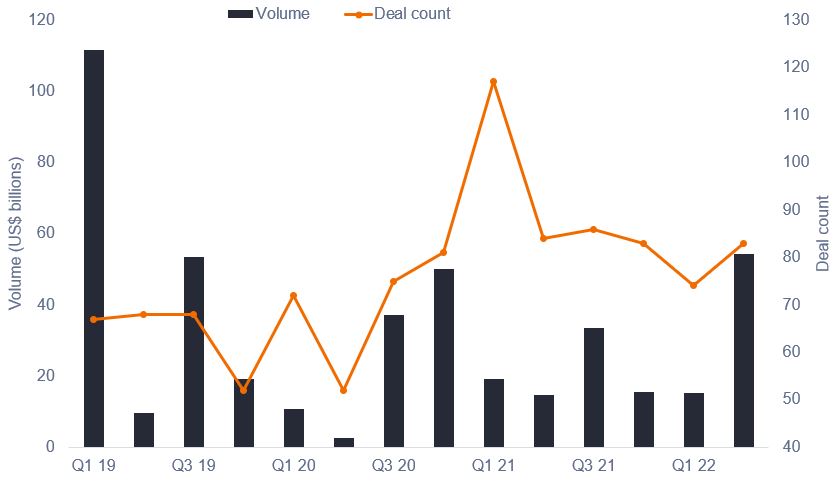

In our view, such pricing does not make sense, and we are seeing early signs of recovery. Merger and acquisition (M&A) activity, for one, has started to pick up, including several multibillion-dollar deals announced in the last few months. These include Pfizer’s recently announced acquisitions of Biohaven Pharmaceuticals (for nearly $12 billion, a roughly 80% premium) and Global Blood Therapeutics (for over $5 billion, a more than 100% premium). With many pharmaceutical companies facing patent expirations for blockbuster drugs3 over the next decade, we believe more deals are likely.

Figure 3: M&A activity picks up in biotech

Source: Bloomberg, as of 13 September 2022.

Investors are also starting to reward positive clinical trial data again. In August, Alnylam reported positive top-line results from its phase 3 study for an investigational RNAi treatment for transthyretin-mediated amyloidosis, a hereditary condition that can lead to organ failure, and in September, Akero Therapeutics delivered strong phase 2 data for its treatment for NASH, a serious form of fatty liver disease that affects over 10 million patients in the U.S. In both cases, the stocks rose significantly following the data releases. We expect more readouts in the coming months, including for Alzheimer’s disease, cancer, and obesity. Meanwhile, the first gene therapy for hemophilia was recently approved in Europe, and in the coming months, we expect a regulatory filing for the first gene therapy for Duchenne muscular disease, an often-fatal genetic disease that afflicts tens of thousands of children. We believe these represent potentially large end markets that could drive sustained revenue growth for the sector for years to come.

One less overhang

Already, the S&P Biotechnology Select Industry Index is up more than 30% since early May.4 Whether biotech can maintain that upward momentum remains to be seen. Rising interest rates, elevated inflation and other macroeconomic factors could continue to stir up volatility.

Still, more green shoots are emerging. In August, the Inflation Reduction Act of 2022 was signed into law in the U.S. The legislation, which introduces changes to drug pricing, removes what has been a source of uncertainty for health care for more than six years. In our view, the bill is better than feared, including positives such as reducing out-of-pocket costs for seniors and only allowing drug price negotiation to begin after an extended period on the market. The one major drawback, we feel, is the differential in treatment between oral medicines and biologics (injectable drugs). While drug price negotiation for biologics would not start until 13 to 15 years after commercial launch, the grace period for small molecule pills is only nine years. We believe this shorter window could discourage investment in much-needed areas such as oral cancer therapies.

Hopefully, this legislative flaw can be addressed before having an adverse impact. But overall, we believe the reform is manageable, with only a modest impact over the next decade on the industry (estimated by the Congressional Budget Office at roughly 2% of total biopharma revenues5). Most importantly, it eliminates what had been a significant overhang for the sector – and is hopefully a sign of more positive things to come for health care.

[jh_content_filter spoke=”apac-social, arpa, auii, aupi, axii, bepa, brpa, clpa, cnpi-en, copa, deii, dkii, dkpa, dkpi, fiii, fipa, hkpi-en, iepa, iepi, lupa, lupi, media, mxpa, nlii, noii, nopa, nopi, pepa, ptpa, seii, sepa, sepi, sgpi, social, ukii, ukpa, ukpi, uopa, usii, uspa, uspi, uypa, zapa”]

[/jh_content_filter]

1 Bloomberg, data from 3 January 2022 to 9 September 2022. The S&P 500 Health Care sector comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector.

2 FactSet, data as of 5 August 2022.

3 A blockbuster drug is a medicine with annual sales of US $1 billion or more.

4 Bloomberg. Data from 11 May 2022 to 13 September 2022.

5 Congressional Budget Office Cost Estimate, as of 15 July 2022.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

S&P 500® Biotechnology Select Index reflects the performance of companies primarily engaged in the research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.