Strengthening tailwinds

The labelled bond market is pivotal in the fight against climate change. From developing renewable energy projects to eco-friendly buildings and critical infrastructure, bonds are funding a range of initiatives aiming to address key ‘people’ and ‘planet’ challenges.

The labelled bond universe

|

Dispelling sustainable investing myths

As these fixed income instruments have evolved to price in the risk and returns associated with sustainable projects more effectively, it is no surprise they have been increasingly snapped up by investors.

To date, over US$2.33 trillion has been issued via green bonds, with US$195.3 billion already issued in 20231.

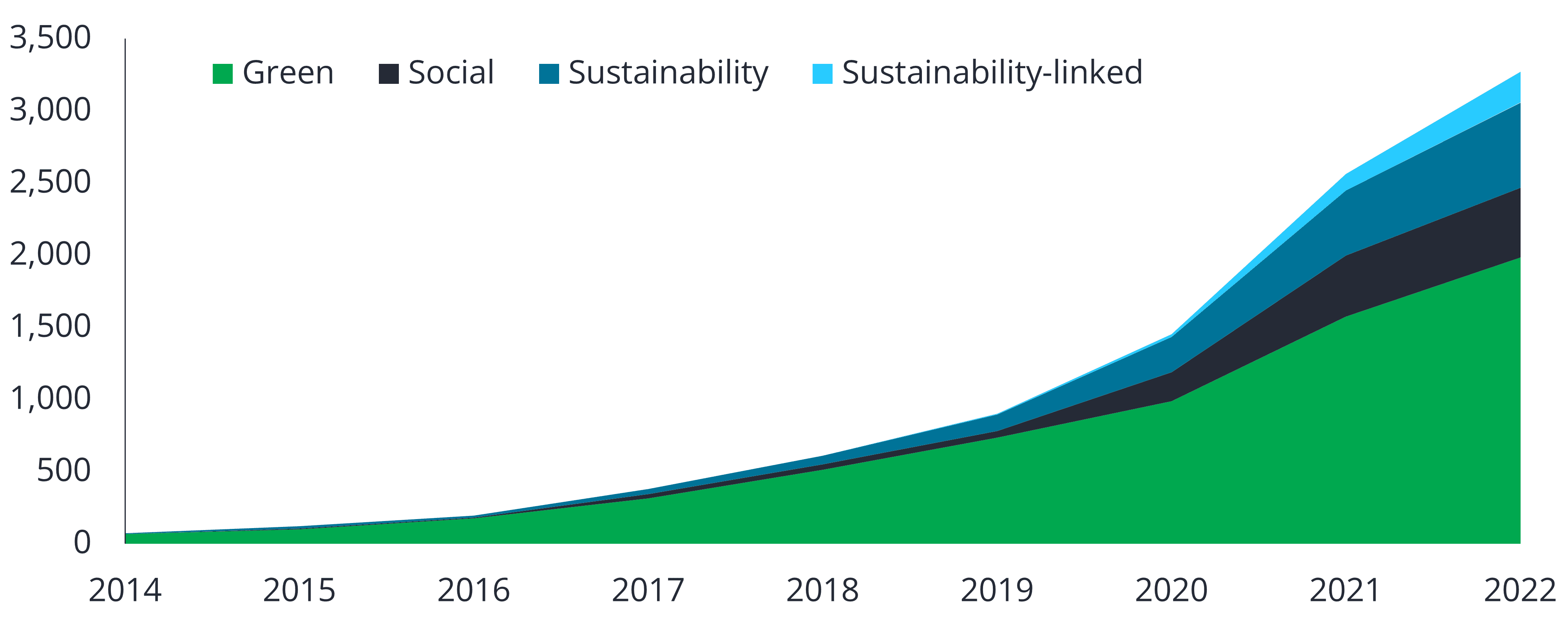

Chart 1: ESG Bonds Cumulative Issuance (USD billions)

Source: Bloomberg. As at 31 December 2022.

Funding the world’s decarbonisation

Decarbonisation efforts over the next decade will determine whether the world can limit global warming to 1.5 degrees. Financial modelling conducted in 2022 estimates that a global investment gap of approximately US$275 trillion must be bridged to meet net zero by 20502.

Green bonds are key to funding the transition to net zero, meaning trillions of dollars are expected to flood into the asset class to fund the necessary projects and initiatives.

Long-term structural tailwinds

While green bond issuance declined globally for the first time in 2022, the same tailwinds that have underpinned market growth for decades remain intact and are strengthening.

Just last year, US President Joe Biden announced the Inflation Reduction Act, which will spur green bond issuance and investment by providing tax credits and earmarking infrastructure funding for industries and projects to address climate change and energy security.

This legislation offers investors and issuers greater regulatory certainty and security, which will stimulate investment into sustainability-focused projects.

Additionally, the Chinese Government introduced new rules to strengthen its own domestic green bond market in a bid to eliminate greenwashing and align it more closely with international standards.

Finally, some regions are already well progressed down this path, with Europe having the most green bonds on issuance as well as having the largest number of dedicated investment mandates, led by activity in Germany and France.

These examples from some of the world’s largest green bond markets demonstrate that governments remain committed to reducing the risks of climate change and are embracing sustainability-focused initiatives, looking to the fixed income markets to help fund them. These offshore trends are expected to accelerate the growth in the Australian green bond market.

Introducing Sustainable CreditOur new active ETF, the Janus Henderson Sustainable Credit Active ETF (ASX:GOOD) is poised to capitalise on this growing segment of the fixed income market, which can deliver financial returns, while also seeking to do some good in the world. |

For important product information and disclosures such as PDS and TMD, please visit: https://www.janushenderson.com/en-au/investor/product/sustainable-credit-fund/