Look around you and so many things are the result of a combination. Where would we be if oxygen and hydrogen weren’t combined to make water? Who wants to return to a world where heavy luggage had no wheels?

In the financial world sometimes putting together different structures can provide investors with an appealing investment. Often this might involve a solution that mixes asset classes to offer a different risk/return profile but sometimes it is also about the structure of the vehicle itself.

Seeking predictability

Many investors crave predictability. It is partly why the bond market exists. In buying a bond an investor essentially lends money for a set period and – providing the bond does not default – receives a specific income over the term of the bond and their principal back when the term ends (the maturity date).

Investors value the predictability of steady income and the return of capital at a defined maturity date that a single bond offers. But this comes with a high degree of concentration risk – what if the bond defaults?

Of course, an investor could turn to a bond fund, which would reduce single issuer risk by diversifying across a portfolio of bonds and comes with the comfort that the portfolio is being managed by professionals. However, these tend to be open-ended so the yield on the fund can vary over time and the capital value when the investor comes to divest is less certain.

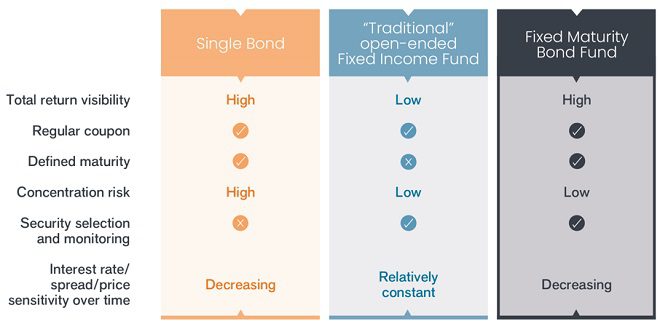

This is where a fixed maturity bond fund comes in. It combines the core features of a single bond (regular predictable coupon and fixed maturity date) with the key benefits offered by a fund (diversification across many bonds, together with security selection and monitoring from investment professionals).

Figure 1: Comparison of features of a single bond, a traditional open ended fund and a fixed maturity bond fund.

Source: Janus Henderson investors, 31 May 2023. For illustrative purposes only.

A fixed maturity bond fund has a finite life (typically in the three to five-year time frame), so investors know when to expect a return of capital. Moreover, with investments mostly made during the initial investment period, this helps to lock in yields, offering protection against potential falls in interest rates. This helps provide visibility around the fund’s potential return and means duration risk (interest rate sensitivity) is low and declines as the fund approaches maturity.

Fixed maturity products are designed to be held to maturity and investors should be prepared to remain invested for the term of the fund. Normally, to help protect remaining investors in the portfolio, there is a fee applied to any investor who redeems before the maturity date.

Key considerations

Ultimately, the most critical elements to assess a fixed maturity bond fund are the level of income generation and the sustainability of the coupon and capital.

Credit risk and reinvestment risk are two of the biggest threats to income on a fixed maturity bond fund. Credit losses could potentially endanger the level of income paid out and the final maturity payment, so it is important to employ a manager with deep credit expertise. Similarly, consideration needs to be given to reinvestment risk as coupons and maturities come due and need to be reinvested later in the fund’s life, potentially at lower yields. To help reduce reinvestment risk, a manager can keep callable bonds to a small proportion of the fund and invest in bonds with maturities that closely align to the term of the fund.

This is where a management team with experience in constructing and managing this type of portfolio is key. A global research footprint can help source the best opportunities, which may mean including some high yield alongside investment grade to exploit price inefficiencies and enhance yield.

A dynamic approach

Within Janus Henderson we advocate a more active investment process than a typical “buy and hold to maturity” approach, which can be termed “buy and actively manage”. It can be thought of as combining two elements:

- Buy component: This refers to establishing the portfolio, setting the base for a strategy and target yield. This is where access to suitable investments and fundamental credit analysis comes into play.

- Active component: This refers to on-going surveillance and risk monitoring to ensure the portfolio is robust and continues to deliver to expectations.

We believe this “buy and active” approach is a potential differentiator to typical fixed maturity bond funds. When managing these funds, we are essentially looking for the most efficient and reliable way to get a consistent yield for our clients over time. Building a robust bond portfolio upfront is hugely important but circumstances change and in our view the ability to be dynamic through our more active approach can be beneficial in avoiding problem credits and defending income.

Taken together, we believe fixed maturity bond funds can offer investors an appealing combination of income, diversification and a known maturity date.

Corporate bonds: A debt security issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Reinvestment risk: The risk that an investor will be unable to reinvest cash flows or proceeds from an investment at a rate comparable to the current rate of return. Callable bonds are seen as especially vulnerable to reinvestment risk because these bonds are typically called (redeemed) by the issuer when interest rates decline.

Yield: The level of income on a security, typically expressed as a percentage rate. For a bond, at its most simple, this is calculated as the annual coupon payment divided by the current bond price.