Firstly, what is sustainable investing?

|

Dispelling sustainable investing myths

1: Investors need to choose returns OR sustainability

According to a recent survey of institutional investors, the majority (60%) of respondents believed environmental, social and governance (ESG) investing delivered better financial performance than non-ESG equivalents.1

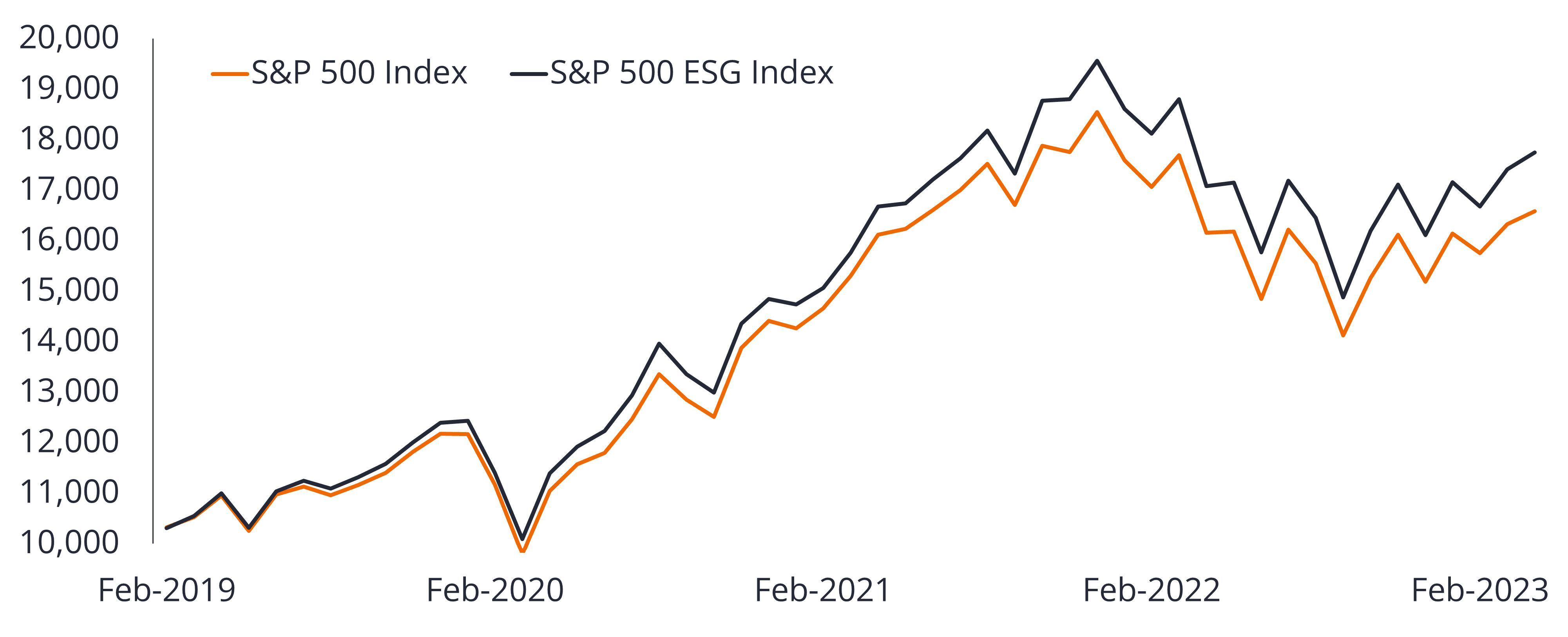

Additionally, even passive ESG funds broadly move in line with the S&P500 and since the S&P500 Global 500 ESG Index was established, have exhibited moderate outperformance as shown in the chart below.

Chart 1: S&P 500 ESG Index vs S&P 500 (%)

Source: Factset. As at 28 February 2023. Value change calculated from 28 February 2019.

This isn’t just limited to equity markets, as evidence also shows that bonds from entities with higher ESG ratings had relatively stronger financials, supporting higher credit quality and lower risks. Further, issuers with material ESG risks are more likely to have a ratings downgrade which may affect the price of the bond. Ultimately the combination of these aspects underpin the case for achieving moderately higher risk-adjusted returns when compared to bond issuers with lower ESG ratings.2

2: Sustainable investing is just about the environment

Another common misconception is that sustainable investments only scrutinise environmental issues. Whether it’s considering ethical business practices, board independence and diversity, or energy efficiency and local community impact, there are a wide range of areas for sustainable investing to focus on. Some investors even map their efforts against one or more of the 17 United Nations Sustainable Development Goals.

3: Only equity holders can influence ESG outcomes

Equity investing often takes the limelight when it comes to ESG issues, but debt capital arguably plays an even bigger role.

Unlike the stock market, companies often return to the bond market to refinance existing debt or to raise new funds. While ESG-focused equity investors vie for company ownership to influence desirable outcomes via proxy voting, debt capital providers have the unique ability to restrict or withhold funds if certain ESG standards are unmet.

Such companies will then need to look elsewhere for capital and may need to pay a higher price for it. This can apply financial pressure on a company’s ability to conduct operations and may influence management to take proactive steps to address their ESG business risks.

Withholding capital may also be an option of last resort, with good bond managers generally having undertaken company engagement and active stewardship prior to doing so. Engagement is the process by which the bond investor attempts to drive change and work with the company to improve their ESG practices. Ultimately, if not satisfied, the investor may opt to escalate the issues to the board and/or withhold capital from the company.

4: There are limited options to gain exposure to sustainable fixed income investments

Since the first green bond was issued in 2007 with little fanfare, the sustainable fixed income market has exploded in popularity and demand.

While the first issuance, conducted by the European Investment bank, was for just €600 million, today the cumulative issuance of green bonds stands at US$2.33 trillion, with US$195.3 billion already issued in 2023.3

As the sector has grown, so have the opportunities for investors to access this rapidly expanding market. Today, there are countless products and vehicles for investors to choose from including through managed funds and ETFs.

5: Sustainable investing is just a fad

While ESG investing has exploded in popularity more recently, it isn’t a flash in the pan. From the looming threat of global warming to pandemics, global food insecurity, and modern slavery issues, ESG investing seeks to address a raft of complex long-term issues.

You only need to look at the growth in ESG-related assets under management (AUM) to appreciate the magnitude of the trend. Recent research predicts asset managers will increase their ESG-related AUM to US$33.9 trillion by 2026, up from US$18.5 trillion in 2021. This growth rate is significantly outpacing that of non-ESG assets, setting it on course to represent 21.5% of total global AUM in less than five years.4

Investment capital has the potential and the power to drive positive environmental, social and governance changes, and investors, shareholders and stakeholders alike are now expecting it.

The best of both worlds?

Sustainable debt investing provides investors with a way to achieve financial returns while also making a positive impact on the environment and society.

With an increasingly large number of investors and issuers looking to participate, record issuance volumes, and supportive regulatory policies in place worldwide, the future of sustainable investing is undeniably bright.

Introducing Sustainable CreditOur new active ETF, the Janus Henderson Sustainable Credit Active ETF (ASX:GOOD) is poised to capitalise on this growing segment of the fixed income market, which can deliver financial returns, while also seeking to do some good in the world. |

For important product information and disclosures such as PDS and TMD, please visit: https://www.janushenderson.com/en-au/investor/product/sustainable-credit-fund/

- https://www.pwc.com/gx/en/news-room/press-releases/2022/awm-revolution-2022-report.html

- Rohit Mendiratta, Hitendra D. Varsani, and Guido Giese, “How ESG Affected Corporate Credit Risk and Performance”, The Journal of Impact & ESG Investing Special Issue on Climate: Part 2, Volume 2, Issue 2, Winter 2021

- Climate Bonds Initiative

- PWC – Asset and Wealth Management Revolution 2022: Exponential Expectations for ESG