Complex’ or ‘risky’?

Two of the myths surrounding the European securitised sector is that structures are ‘complex’ and ‘risky’. The first misconception isn’t helped by some of the acronyms used to describe the sector, but these reference the underlying collateral behind each sub-sector. The process of securitisation is the same and structures have commonalties such as floating rate characteristics and diversification benefits. However, there are differences in the underlying collateral of structures, ranging from commercial and residential mortgages, to corporate loans and other consumer debt, such as auto loans, student loans, credit card receivables and unsecured personal loans. We argue this diversity in the sector is a positive. There are distinct features within each sub-sector that offer potential benefits for investors, such as multi-sector credit investors who can take advantage of a full suite of fixed income opportunities.

Here in our Fact versus Fiction series, we explore the securitisation sub-sectors and these specific features. We also consider how these features refute the asset class as being ‘risky’ with the securitisation structure providing safety features compared to directly investing in such collateral assets or their debt, such as corporate debt or the property market.

Residential Mortgage-backed Securities (“RMBS”)

The most liquid component of the European securitised market, RMBS are collections of residential mortgages with similar characteristics that are packaged together. The cashflows (principal and interest payments) from the underlying mortgage loans are passed through to service investor debt tranches.

Ultimately, RMBS are important funding mechanisms for household mortgage lenders. In Europe, there are three main types:

- Prime: typically originated by high-street banks with high credit standards for the borrower.

- Non-conforming: typically non-bank or alternative lender funding to non-standard or ‘non-conforming’ borrowers. These might be individuals who are self-employed or have historical credit arrears.

- Buy-to-let: funding for professional landlords (five or more properties).

These mortgages are then pooled, typically by mortgage type, region or from a single originator. The mortgage pools then serve as the collateral for the RMBS.

RMBS structures generally include the typical loss protection features found in securitised assets. This begins with the household equity in the underlying properties and might also include excess spread and reserve funds. These forms of credit enhancement[1] are defined as:

- Excess spread is the net income earned on the loan portfolio after payment of securitised debt interest and operational expenses. This is often the first line of defence to offset any portfolio losses and can be redirected from the equity holders if needed.

- Reserve funds are often funded by the originator designed to cover interest and expense shortfalls and losses in the collateral pool.

Figure 1: Example RMBS structure

For illustrative purposes only.

The specifics of the overall structure of an RMBS varies deal-by-deal. For example, prime RMBS (with a higher quality mortgage pool), would typically have less excess spread and a lower reserve fund than non-conforming RMBS (with a lower quality mortgage pool). In the case of non-conforming RMBS, use of these credit enhancement features can result in improvements to overall credit risk profile of the bonds (and its credit rating), despite the lower quality of the underlying collateral.

It’s also worth noting some differences between European over US RMBS:

- Full recourse to borrowers: In the event of default, the lender can pursue the borrower for recovery beyond repossession of the property. In the US, sale of the underlying property is typically the only means of recovery following a default.

- High lending standards: European RMBS typically benefit from high lending standards in a well-regulated market.

- No prepayment risk: The US RMBS market is predominantly agency MBS, which tend to have no penalty for early repayments, despite being fixed rate mortgages. This exposes US RMBS to interest rate duration sensitivity, which does not typically exist in Europe.

Collateralised loan obligations (“CLO”)

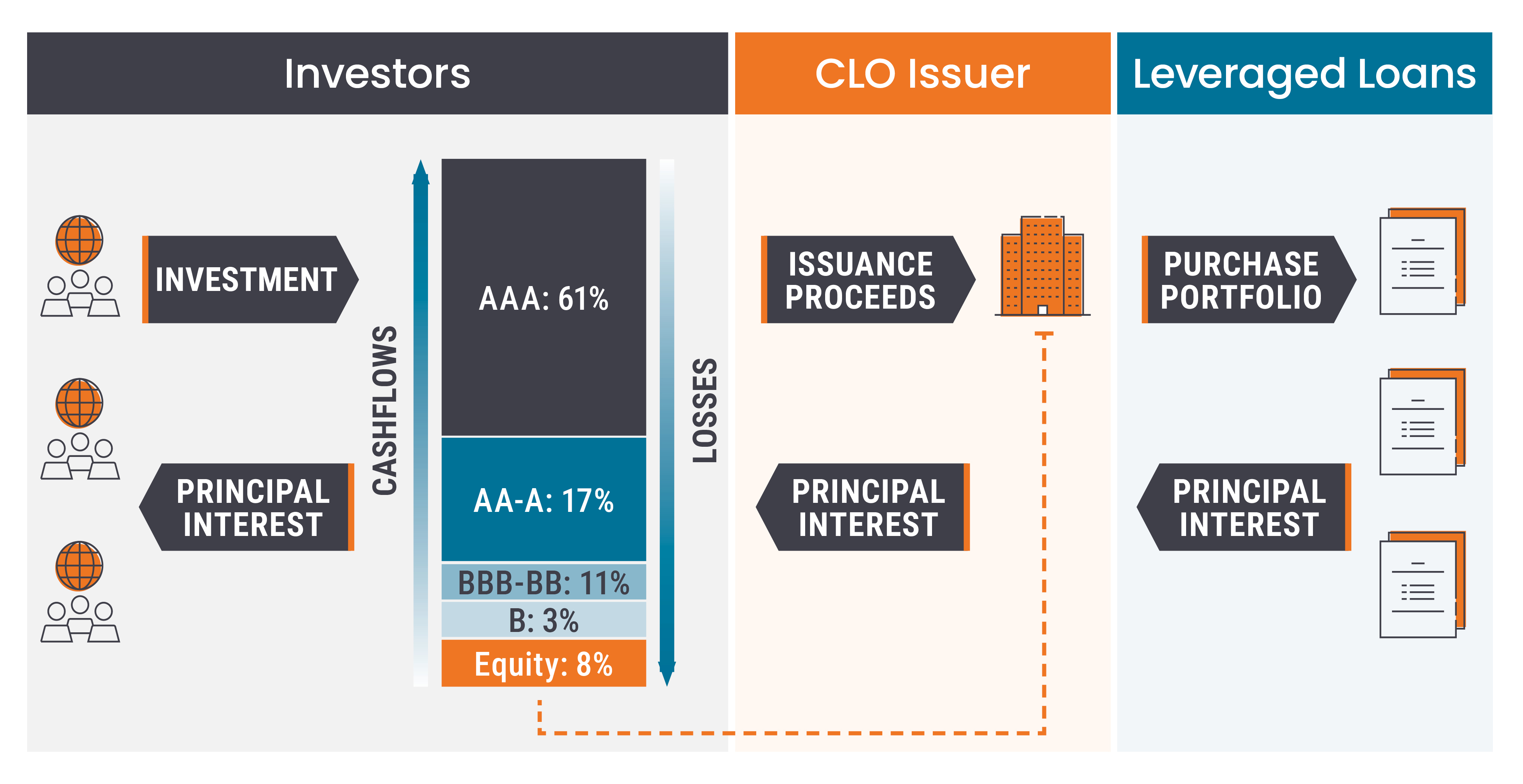

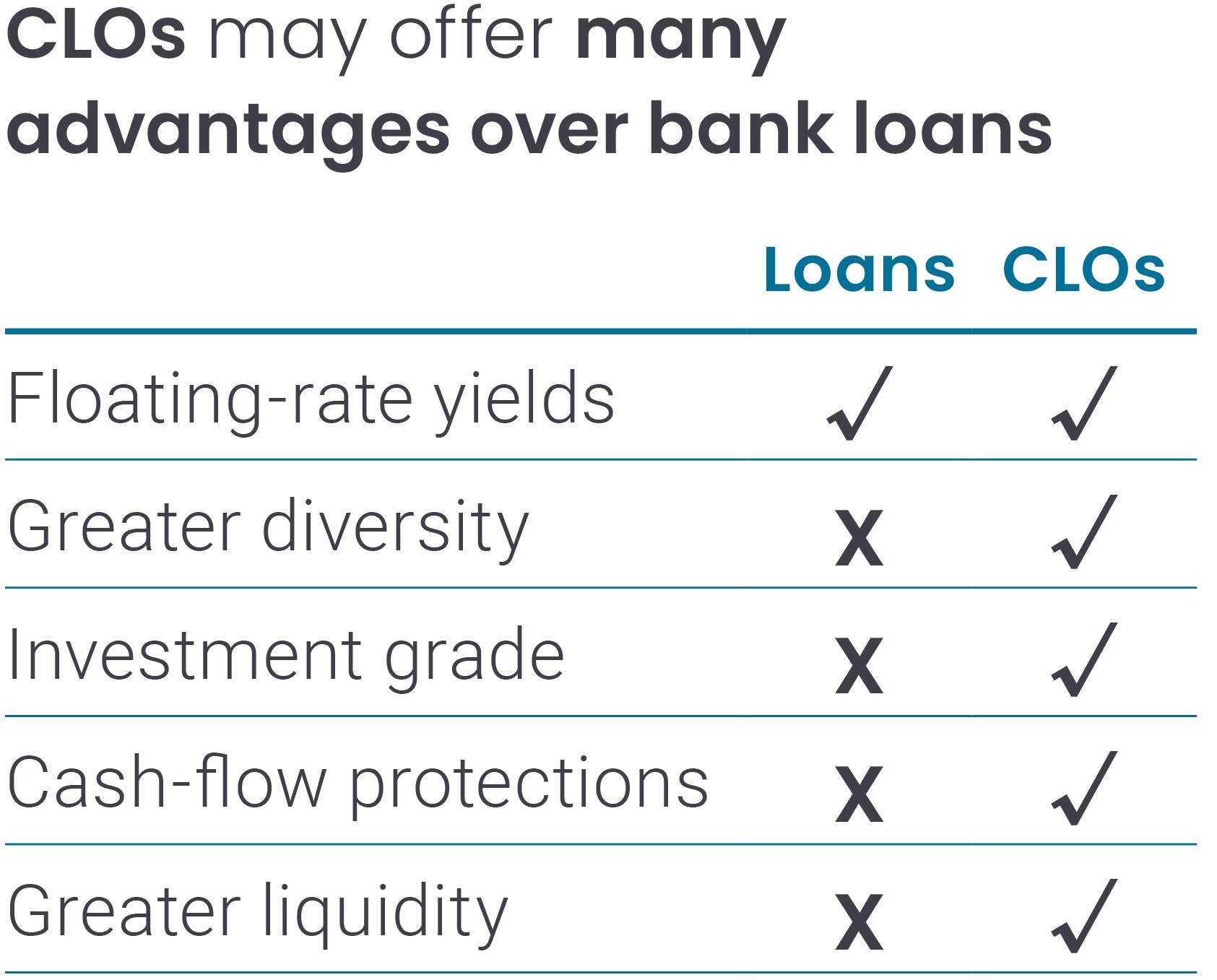

Collateralised loan obligations, or CLOs, are managed portfolios of loans issued to corporates. CLOs have increasingly become an important link between the financing needs of companies and investors seeking higher yields. CLOs are constructed by a CLO manager who selects loans to place in a portfolio, where such loans tend to be rated below investment grade (also referred to as leveraged loans). The advantages of accessing the European CLO market are:

- Enhanced quality – In a typical CLO structure, while the underlying loans are rated below IG, roughly 80% of the securities are rated AAA through A. The CLO manager can curate the loans to include and trade in and out of the portfolio during a reinvestment period, aiming to improve credit quality and risk-adjusted returns.

- High diversification – A typical CLO structure may contain 100-200 loans from 25-30 industries, as managers can take advantage of the diversity and liquidity of the European CLO sector. The CLO market is typically invested in the higher quality end of the leveraged loan universe.

- Compelling liquidity – High issuance in the CLO market has been fuelled by healthy demand, helping to increase liquidity and the number of managers participating in the CLO market, of which there are 67 in Europe[2].

Figure 2: Typical CLO structure

For illustrative purposes only.

Consumer ABS

Other types of securitised structures have underlying collateral linked to the consumer, such as auto loans, credit card receivables and personal loans. This category captures ‘real economy’ risk-return profiles that would respond differently to the various stages in the market cycle compared to corporate bonds.

One of the largest of these is the auto ABS sector, where issuers include the lending arms of car manufacturers. The sector is prized for its steady cash flows and stable prepayment characteristics with less incentive for car owners in addition to non-captive, third-party lenders – compared to say, homeowners – to refinance, as the speed of depreciation of a car means the cost of doing this outweighs the benefit. The other defining characteristics of the auto ABS sector are:

- Short weighted average life (WAL) of auto ABS is due to the shorter terms of the underlying loans. A lower WAL can enable investors to reduce portfolio sensitivity to moves in credit spreads.

- Rapid de-leveraging is enabled by these short terms and deal structures, which can lead to significantly increased credit enhancement and facilitate roll down of the often sequential notes.

- Diverse collateral from a broad range of issuers across a range of credit profiles, products and jurisdictions, with full capital structures from AAA to sub-IG.

Commercial Mortgage-backed Securities (CMBS)

Commercial mortgage-backed securities can comprise of packages of commercial property mortgages spanning a range of sectors, such as shopping centres and retail parks; offices; industrials such as logistics warehouses; and the hospitality sector, including hotels. Historically, European commercial real estate (CRE) lending was undertaken by banks who then issued CMBS, though alternative CRE lenders such as private equity and real estate debt funds also now participate in CMBS issuance.

CMBS deals range from single-asset single-borrower (SASB) (ie. backed by a single, large loan and secured by a single property) to concentrated multi-borrower or ‘granular’ transactions with more diversified collateral pools, but often lower asset quality than SASB. There is also significant variation across CMBS structures. Post GFC, European issuance has tended to be of the single borrower type.

RMBS versus CMBS

While CMBS might optically be similar to RMBS (in that both securities grant investors exposure to real estate debt), there are some significant differences:

| RMBS | CMBS | |

| Collateral | Loans for residential properties, such as single-family homes and flats, primarily lent to the occupier, owner-occupier or on a lesser scale to landlords. | Loans for commercial properties, such as office buildings, shopping centres, warehouses, and hotels. |

| Collateral Diversity | High due to the large number of loans, enabling diversification of borrower risk. | Lower, with concentration in a few large loans, increasing sensitivity to the performance of specific properties or tenants. |

| Recourse | Full recourse to the individual borrower. | Effective recourse solely on property due to utilisation of Special Purpose Vehicle ownership. |

| Underlying interest rate types | Fixed and/or variable interest rates over differing periods, dependant on the prevailing market practices within different European regions. | Mostly floating rate, but some fixed. |

| Amortisation and Maturity | Full amortisation with some products being interest-only for an initial period or even life with terms up to 30 years. | Fully interest only with terms in the range of 5-10 years. |

| Regulatory and Legal Considerations | Influenced by consumer protection laws, which can affect foreclosure processes and times, as well as by broader mortgage market regulations. | Impacted by commercial property laws, tenant protections, and specific regulations governing commercial lending and leasing. |

| Sensitivity to Economic Factors | More sensitive to changes in household incomes, unemployment rates, and macroeconomic stability. | More directly tied to commercial real estate cycles, business confidence, and sector-specific trends (i.e. retail channel or office space demand), lease lengths, and occupancy rates. |

Source: Janus Henderson Investors. A special purpose vehicle is used to purchase a pool of assets from the originator and finances the acquisition of those assets by raising different tranches of debt and equity capital. The SPV then utilises the cashflows generated by the purchased assets to pay back investors and provide them with a return.

At the time of writing, sentiment around CRE remains negative, which poses a significant challenge to CMBS issuance. Anaemic underlying property values has been the central challenge, albeit inflation-linkage in some rents has helped offset some of the weakness. Lower interest rates could support the asset class and encourage borrowers to refinance their loans at better rates, whilst a recovery in the value of CRE properties would also be positive for deal making.

Some advantages of accessing the European CMBS sector are as follows:

- Liquid CRE market access: The sector grants access to the diverse CRE debt market without the high investment minimums, concentration risk, or liquidity constraints of direct investing.

- Enhanced yield opportunity: Investors are typically rewarded for the need to take more granular underwriting of individual property risks.

- Diversification: Investors can access more localised and sector-specific risk factors.

We summarise the sub-sectors of the diverse and liquid European securitised universe as follows:

European securitised at a glance

| Residential Mortgage-backed Securities (RMBS) | Collateralised Loan Obligations | Consumer ABS | Commercial Mortgage-backed Securities (CMBS) |

| Pools of household mortgage loans, created and issued by banks and other mortgage originators. | Diverse portfolios of corporate loans typically to leveraged companies that are rated below investment grade. | A large variety of consumer debt types, that have been securitised including auto loans, student loans, credit card receivables and unsecured personal loans. | Single loan or relatively few loans in a pool secured on commercial properties. |

|

|

|

|

When examined more closely, European securitised sub-sectors structures are actually fairly straightforward rather than ‘complex,’ each offering specific benefits for investors. Rather than investing in esoteric assets, we are familiar with the underlying collateral assets or debt, such as property, autos and corporates. The myth that securitisations are ‘risky’ as perpetuated by the GFC can be refuted when realising the benefits that a securitisation offers, such as structural protections, enhanced quality and yield, diversification and liquidity. The diversity in the underlying collateral and distinct features show how the different sub-sectors amalgamate into a fertile hunting ground for active fixed income investors looking to capture smooth stable returns.

Footnotes

[1] Credit enhancement is used in securitisation to improve the credit quality and ratings of the debt tranches.

[2] Source: Janus Henderson Investors, Bloomberg, Index Calc and JPMorgan Indices, as at 29 November 2024.