Portfolio Manager Doug Rao discusses the phenomenon of concentrated market leadership and what that means for long-term investors.

Key Takeaways

- When market returns are driven by a handful of stocks, active investors face difficult decisions, especially when underweighting or not owning these stocks may significantly impact portfolio performance.

- The recent phenomenon of large-cap tech stocks driving a significant portion of stock market gains may be justified by the fact that these companies are strongly tied to themes related to digital disruption.

- Investors may benefit from focusing on competitively advantaged companies positioned to profit from these themes, which have only accelerated amid the COVID-19 pandemic and are likely to persist over the coming months and years.

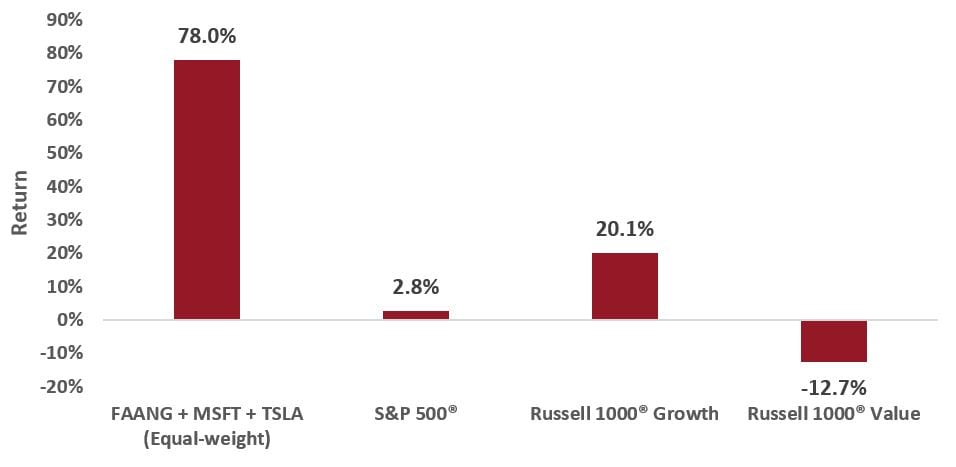

It’s no secret that a handful of large-cap tech stocks now dominates many indices and has driven a significant portion of recent stock market gains. Tech giants Facebook, Amazon, Apple, Netflix, Google (FAANG), Microsoft and Tesla together now make up over 40% of the Russell 1000® Growth Index.1 Year to date, an equal-weighted basket of these same companies would have returned 78.0% versus the Russell 1000 Growth Index return of 20.1%.2 This extreme concentration has forced active investors to face difficult decisions, especially when underweighting or not owning these stocks can significantly impact portfolio performance.

FAANG + MSFT + TSLA Comparative Performance (31/12/2019 – 31/10/2020)

Concentrated leadership is nothing new

It may come as a surprise that concentrated market leadership is hardly new. In fact, since 1926, in terms of dollar wealth creation, just 4% of companies drove 100% of gains.3 This concentration only appears to have been amplified in recent years, as the current crop of leaders are some of the most important components in the vast and growing digital economy. These are the tollbooth operators of the digital on-ramp, serving as the access point for businesses and individuals participating in the digital ecosystem. As a result, their free cash flow and earnings have grown at a much faster rate than the rest of the economy.

The advantages enjoyed by leading tech firms contrast with today’s value companies, many of which have struggled to grow as they face secular challenges such as the loss of market share or severe pricing pressure, have business models more closely linked to modest gross domestic product (GDP) growth, or are on the wrong side of technological progress. In contrast, as valuations for growth stocks have certainly risen, many have compounded cash flows at such a high rate that they continue to have attractive free-cash-flow yields. Some of these digital business models also benefit from powerful network effects and winner-take-most economics. Thus, their valuations may be justified and better understood within that context. Therefore, while there are certainly pockets where the market is overexuberant, we don’t necessarily believe that to be the case for the FAANG stocks.

It’s important to note, however, that the specter of antitrust lawsuits and increased regulation have recently become more of a risk to tech companies’ winner-take-most business models. However, we believe an increased level of scrutiny and some measure of policy could eventually stimulate competition and spur innovation throughout a broader share of the digital economy. This could be particularly beneficial for companies whose businesses are well-positioned but that sit directly below the largest firms in the tech hierarchy.

Overall, we believe concentrated leadership is emblematic of fundamental economic change and has highlighted the rift between companies on the right and wrong sides of digital disruption. In light of that, we believe it is important for investors to consider companies positioned to profit from accelerating investment themes.

Focus on accelerating investment themes

A number of existing technological trends have picked up speed as a result of the pandemic and are likely to only get stronger over the coming months and years. E-commerce, for instance, has gained ground as a percentage of total consumer spending and continues to outperform expectations. Consumers who adopt online shopping rarely return fully to brick-and-mortar retailers, which should help drive longer-term growth in e-commerce. New demographic groups such as the older population and laggard industries like grocery shopping and online learning are also helping to support the sector’s growth trajectory.

Over-the-top (OTT) video consumption has also picked up substantially. Investments made now – in original content, for example – may enable pricing power in the future, increasing the value of streaming platforms. Furthermore, platforms like Netflix and Disney+ don’t rely on advertising revenue, in contrast to their linear television competitors. The net effect has been to put Netflix and Disney+ at an advantage as advertising budgets tighten and has also sped up the switch to digital advertising platforms like Facebook and Google. Broader digitization across the economy creates further tailwinds for online advertising. For instance, e-commerce companies generally spend a greater portion of their marketing expenses on online advertising than brick-and-mortar stores. So, as e-commerce grows, online advertising will likely continue to flourish as well.

Aided in part by cloud computing and Software as a Service solutions, employees have been able to work from home in a disrupted environment. As productivity has remained high, corporations are beginning to analyze the potential benefits of a permanent shift to a work-from-home environment. Companies not only face a level of business continuity and legal risk by returning to offices too quickly, but there are also potential productivity benefits from reduced commute times and cost benefits from needing less office space. Tangentially, permanent work-from-home situations could have significant impacts on the housing and commercial real estate markets as individuals and enterprises choose to live and operate outside of high-cost urban centers.

Public cloud platforms are the infrastructure for innovation

In many ways, these and other technological trends couldn’t exist without the massive public cloud infrastructure being built by some of the largest tech companies, including Amazon (Amazon Web Services), Microsoft (Azure Cloud) and Google (Google Cloud Platform). The cloud offers cheaper, more agile and more secure enterprise IT than on-premises alternatives. But while these platforms have grown tremendously in the last five years, the buildout of the cloud is still only 4% penetrated into the $1.3 trillion Infrastructure as a Service (IaaS)/Platform as a Service (PaaS) market.3 Consequently, we believe investment in cloud infrastructure has a long runway of growth and that some of this demand could consolidate around existing platform leaders.4 For one, the current environment has brought technology budgets under pressure, making cost even more important. There are also high barriers to entry, such as the enormous amounts of capital and sophisticated software developers needed to compete.

The importance of competitive advantage

The themes discussed above are playing a vital role in the transformation of the economy. However, while being on the right side of technological trends is important, it is also essential to identify companies with business model advantages that are able to maintain durable growth and generate high returns on capital over the long term. We think it is important to own companies that have solid business models with deeply rooted competitive advantages, including strong balance sheets. Such qualities should allow these companies to allocate capital into growth opportunities as the economy continues to evolve from the old to the new.

1Source: FactSet, as of 31 October 2020.

2Source: Bloomberg, as of 31 October 2020.

3Bessembinder, Hendrik (Hank), Wealth Creation in the U.S. Public Stock Markets 1926 to 2019 (February 13, 2020). Available at SSRN: https://ssrn.com/abstract=3537838 or http://dx.doi.org/10.2139/ssrn.3537838

4Source: Janus Henderson research.