The year 2021 was a rollercoaster ride for investors, with plenty of highs but also some lows. European markets closed the year with double-digit returns as widespread vaccine rollouts and massive government stimulus measures helped lift the eurozone economy out from the pandemic-induced downturn. As a result, growth was revised upwards, whilst the release of pent-up consumer demand served as a breath of fresh air to company earnings.

However, as we look ahead, it is clear that this recovery has been accompanied by several factors which will cause volatility in 2022. First, the Russia and Ukraine conflict has led to a sell-off in global equity markets and sparked a global energy supply shock which has sent energy prices soaring. Second, the combination of persistent bottlenecks in the global supply chain and booming energy prices have driven inflation around the globe to record highs, leading markets to price in more interest rate hikes by the Federal Reserve and central banks globally. Combine all these factors together, and it becomes clear that 2022 will be a tricky year for investors to navigate – with some calling this uncertainty the “new normal”.

At European Smaller Companies Trust, our job is to navigate this uncertainty whilst seeking to generate sustainable and long-term returns for our shareholders by investing in good quality small-to-medium-sized European businesses. While the last two years haven’t been plain sailing for investors, they have highlighted one key thing – the resiliency of smaller businesses. To us, this is not a new revelation as time and time again, small-cap stocks have bounced back stronger than their large-cap counterparts following periods of uncertainty or large equity market drawdowns. The global financial crisis was a prime example of this, and looking even further back, so was the dot-com bubble.

| Global financial crisis* | Post GFC +3yrs | Post GFC +5yrs | Post GFC +10yrs | |

| MSCI Europe Large Cap | -29.33% | +20.84% | +69.65% | +101.30% |

| MSCI Europe Small Cap | -37.59% | +50.14% | +154.34% | +237.89% |

Source: Bloomberg as at 01/03/2022

*Global Financial Crisis – 31/12/2006 to 31/12/2008

Of course, previous performance doesn’t guarantee future returns, and many would say that the issues investors face today are vastly different from those during the financial crisis. While that is true, two underlying components remain the same – uncertainty and volatility – and the last two years have been no exception. During the pandemic, small-cap stocks bore the brunt of the sell-off, but in true fashion, they bounced back stronger than expected.

Resilience that’s built-in

This poses the question – do investors underestimate the resiliency of smaller businesses in the face of uncertainty? While history provides a reference point, clear answers can be found in how these companies have dealt with and are dealing with headwinds currently dominating the market environment.

- Higher inflation – In the face of higher inflation, quality small-cap stocks have adapted quickly. Many small companies operate in niche industries and often have a competitive advantage by virtue of their intangible assets, which competitors generally have difficulty re-creating or duplicating. These dominant and durable intangible assets, which tend to be driven by innovation, customer loyalty, copyrights and distribution networks, lead to strong pricing power. Because of this, small businesses have been able to pass on raw material price increases, including higher transportation and labour costs, in a way that has been favourable to their bottom line. It is also important to point out that small-cap stocks have outpaced inflation in every decade going back to the 1930s – and are the only major asset class to do so.

- Supply chain disruptions – With China the de facto “world’s factory”, the Covid-19 pandemic exposed vulnerabilities in the supply chains of many organizations, especially those with a high dependence on China to fulfil their need for raw materials and finished products. It even emphasized how outdated some supply chain models were in some cases. Though many companies were affected, smaller businesses were better placed to mitigate these disruptions. As they have decentralized, agile operating models with flexible supplier contracts and relationships, small businesses were able to react quickly to secure supplies. More importantly, they tend to have domestic supply chains, meaning disruptions were less frequent and less severe compared to larger businesses.

- Accelerating structural growth trends – The world is changing fast, and the pandemic accelerated many trends and consumption patterns. Among them was the push towards a more sustainable economy with eco-friendly consumers increasingly holding companies to account for their environmental impact. European small-cap stocks, in particular, are already at the forefront of the sustainability drive. Due to their innovative and disruptive nature, these smaller companies have highlighted that they can adapt and grow faster than their large-cap counterparts. And as a result, they dominate sectors that will help the global economy transition to cleaner energy sources, including the renewable energy and electric vehicle industries. With net-zero carbon targets now firmly in place across the globe and as the energy transition conversation intensifies, it’s clear that smaller companies will have a significant role to play.

Looking at how small European companies have dealt with a dynamic and volatile environment and positioned themselves, it’s clear that they are more resilient than some investors think. While their innovation and flexibility has been key in navigating the market environment, another key underlying factor is the strength of their balance sheets. In Continental Europe, smaller companies are less geared; meaning they have less debt than their larger counterparts. Therefore, they are not as risky as some might think if the economy deteriorates or interest rates rise.

| Western Europe ex UK – strong balance sheets | ||

| Net Debt/EBIDTA (x) | % of companies that re net cash | |

| Large cap | 1.7 | 20.6 |

| Small and Mid-Cap | 1.5 | 39.4 |

Source: JPMorgan research, Janus Henderson Investors Analysis, as at 30 December 2021.

Net debt is calculated by subtracting a company’s total cash and cash equivalents from its total short-term and long-term debt.Net cash is when total cash and cash equivalents is greater than total debt

Earnings before interest, tax, depreciation, and amortisation (EBITDA) is a metric used to measure a company’s operating performance that excludes how the company’s capital is structured (in terms of debt financing, depreciation, and taxes).

An active approach

The challenge lies in finding the right businesses. At European Smaller Companies Trust, we employ an active bottom-up approach to portfolio management. This process involves screening potential investment opportunities, meeting with management teams to understand their businesses, and supplementing this with internal and external research. Understanding the business, the threats to its success, its competitive position, and the quality of the management team in the context of the company’s valuation are crucial in determining whether an investment should be made and the size of that investment.

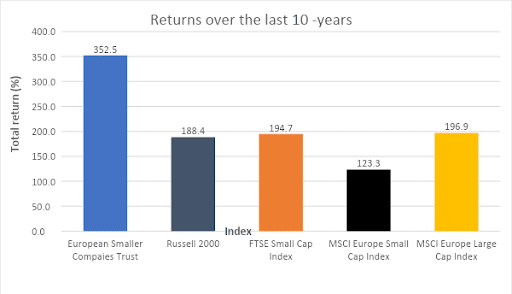

For businesses in each phase of the company life cycle – early stage, quality growth phase, mature and turnaround – we have explicit attributes and valuation metrics for measuring success and seeking out mispriced securities. The Trust’s long-term outperformance validates our quest to seek out and invest in growing companies across all of these life-cycle segments. The Trust has significantly outperformed its benchmark, small-cap indices in other developed markets, and its large-cap counterparts over the last 10 years.

Source: Bloomberg, data on a total return basis for the ten years to 28/02/2022

Note – Total return in local currency

Despite recent events, we believe the outlook for European smaller companies looks bright as they continue to demonstrate resilience in the ‘new normal’ and as the transition towards a more sustainable global economy gains momentum. Moreover, their ability to innovate and adapt quickly should enable them to take advantage of structural and consumer-led trends that will dominate the years to come. As active managers, we will continue to look for high-quality businesses that we believe are undervalued and where the market perception is wrong but have the potential to generate stable and consistent returns for our shareholders.

Glossary Terms ExpandInflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Geared – A measure of a company’s leverage that shows how far its operations are funded by lenders versus shareholders. It is a measure of the debt level of a company.

Volatility – The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment