Tim Winstone, corporate credit portfolio manager, considers the outlook for European investment grade corporate bonds, explaining why an expected reduction in net bond supply, onging policy support and a recovering economy should help underpin investment grade bonds in 2021.

Key takeaways

- Vaccine rollouts should spur economic growth with earnings and cashflows expected to recover strongly, helping to reduce overall leverage (borrowing) ratios.

- The supply/demand backdrop should be favourable with net supply down sharply in 2021; bond issuance is likely to include monies raised to pay for capital expenditure in fast-growth areas and the green economy.

- Risks to the investment grade corporate bond market may come from too much of a good thing, namely a recovery that stokes inflation or aggressive merger and acquisition activity.

The initial enthusiasm in markets surrounding successful clinical trials may fade in the near term as the Northern hemisphere grapples with COVID-19 and the usual winter flu season and the challenging logistics of rolling out mass vaccinations. Stop-start social and economic restrictions are likely to persist throughout the winter months. Yet markets are forward looking and there is a growing expectation that restrictions will gradually ease and something closer to normality is likely to emerge by summer. Some form of health and safety practices, however, may be with us for some time until COVID-19 is less of a threat.

Deleveraging phase

Investment grade companies, by virtue of their investment grade credit rating, are in the privileged position of normally being able to access capital markets with ease. 2020 threw up the unusual challenge of cash flows at companies in some sectors collapsing due to lockdowns but swift action by central banks and governments to provide support meant most could access capital at reasonable cost to help them bridge the revenue shortfalls.

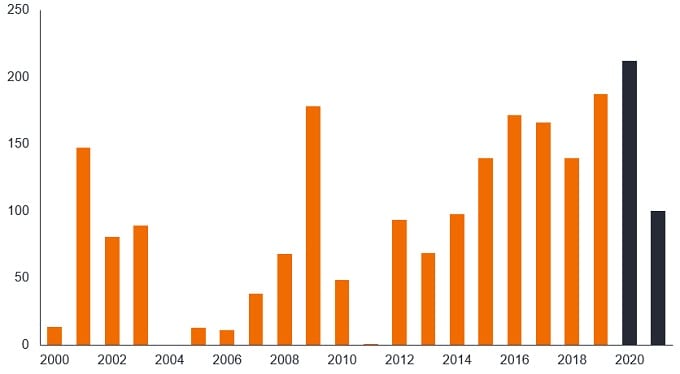

There was heavy investment grade bond supply in the second quarter of 2020 as companies moved to shore up balance sheets and liquidity but lots of that supply has sat as precautionary cash on balance sheets. With earnings expected to pick up substantially in 2021, many corporates will look to pay down debt (deleverage), rather than issue more bonds, which should have a knock-on positive impact on leverage metrics as both the numerator (debt level) and denominator (earnings) of that calculation improve. We can probably expect a high level of tender offers (buying back bonds early where cost effective to do so) as companies seek to rid themselves of surplus cash. Overall, the decline in net investment grade corporate issuance is expected to halve as shown in the chart below.

Euro investment grade non-financials net issuance €billion

Source: J.P.Morgan, Dealogic, 30 November 2020. 2020 is to end November. 2021 is a forecast. Forecasts are estimates and are not guaranteed.

Quality over quantity?

While supply is likely to be down substantially, the reasons for issuance in 2021 could be more attractive. In 2020, many companies slashed capital expenditure so 2021 could see bonds issued to pay for structurally important growth areas of the economy, including 5G telecom infrastructure. We can probably expect environmentally friendly initiatives to feature strongly as companies borrow to play a role in this growth area – the €750 billion recovery fund, the European Union’s flagship fiscal package, has a major emphasis on promoting a digital, sustainable and green recovery. More concerning would be if an economic recovery encourages aggressive merger and acquisition activity as company management, relieved to see an exit from COVID-19 uncertainty, look to borrow to finance acquisitions while rates are cheap.

Market technical conditions are determined by both demand as well as supply and we believe demand for European investment grade corporate bonds will remain robust. First, low and negative yields on government bonds and cash rates mean many investors will continue to seek out assets that offer a step up in yield without assuming the higher risk to capital of sub-investment grade bonds and equities. Second, the European Central Bank (ECB) in December 2020 signalled its ongoing support for asset purchase programmes and low rates to the end of 2021 and beyond. The ECB treats corporate bond yields as part of its policy toolkit and with the ECB remaining a ‘price insensitive’ buyer of investment grade credit this should help anchor yields at low levels.

Credit spreads

Credit spreads (the difference in yield of a corporate bond over a government bond of the same maturity) have narrowed (shrunk) from the very compelling levels of spring 2020. Credit spreads have the potential to narrow further in 2021 but this is expected to be limited and mostly in those areas that were heavily affected by COVID-19, including energy, leisure and real estate. In our view, greater opportunity is likely to be found among BBB rated bonds where wider credit spreads offer greater potential for narrowing. We think credit ratings agencies were quicker to downgrade companies in 2020 than in the Global Financial Crisis and have done a reasonable job of looking through near term challenges. Upgrades typically lag a downgrade rating episode so investors will need to do their homework as changes in credit spreads are likely to be more sentiment driven and reflect fundamentals rather than changes in credit ratings.

Risks on the horizon

While we are broadly positive on investment grade for 2021 we recognise the potential for volatility. At the time of writing, the UK and the EU had still not agreed a trade deal – failure to do so would likely be a negative for sterling bonds, although a deal should be a fillip. Inflation is a concern and the headline figure is expected to rise in 2021 as base effect comparisons with 2020 (when energy prices plummeted) could have an outsized effect. The ECB has demonstrated a willingness to prevent yields from rising too much but that does not mean that markets would not get spooked by high inflation, potentially putting upward pressure on yields. The economic recovery may also cause governments to begin to think about paybacks for their generosity towards companies during the crisis – increased corporate taxes and regulation may not be a major threat in 2021 as authorities shy away from derailing the recovery but they are likely to feature more as we approach 2022.

Notes:

Credit spread/spread: The difference in yield between securities with similar maturity but different credit quality; eg, the difference in yield between a high yield corporate bond and a government bond of the same maturity. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving creditworthiness.

High yield bond: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high yield bonds.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility.

Yield: The level of income on a security, typically expressed as a percentage rate.