ESG investing has shot to prominence in recent years – the assessment of environmental, social and governance (ESG) credentials when making investment decisions. Yet, for Henderson Diversified Income, ESG considerations are nothing new, with the managers realising early on that companies will only grow and do well if they genuinely look after the cross-section of stakeholders from across a business’ value chain. What is more, the recent hard-coding of certain exclusions into the investment process due to ESG risks does little to change the company’s investment approach, with it going hand-in-hand with its ‘sensible income’ investment philosophy.

A sea change

When the American Business Roundtable – a powerful lobby of the US’ top CEOs – switched its shareholder focused mantra towards encompassing all stakeholders in 2019, it thrust responsible investing into the limelight. In recent years, the rising number of extreme weather events have shone a light on climate change, and as social justice causes become much more widely reported, ESG investing has grown sharply to meet demand from increasingly socially conscious investors.

Large data providers such as MSCI and Sustainalytics have expanded their coverage in lockstep – and with new indices, data, and fresh tools available, investors are able to dig deeper for insights that may be financially material to their investments.

Hard-coded into HDIV’s DNA

Fund managers Jenna Barnard, John Pattullo and Nicholas Ware believe that as stewards of their clients’ capital, assessing ESG issues is a crucial component of investment analysis, helping mitigate tail risks, mitigate against long-term underperformance, and uncover opportunities. Moreover, they believe strong ESG credentials are vital as companies only grow if they consider all of their stakeholders, from employees, to customers, suppliers, bondholders, shareholders, and wider society, including the environment. This is the broadest definition of “sustainable” from their perspective.

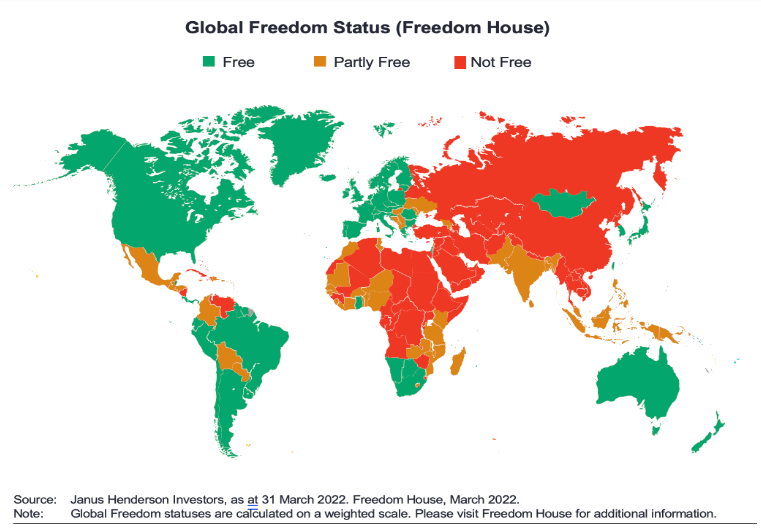

As a result, the managers believe ESG considerations should not be an overlay to the investment process, but rather an integral part given their impact on research effectiveness and quality. Recently, this approach has been formalised by shareholders, with the Company transitioning to Article 8 under SFDR. As a result, the company will not make any direct investments in corporate issuers who derive more than 10% of their revenue from oil and gas generation and production, oil sands extraction, and shale extraction, for example. In addition, they will not invest in issuers that derive any revenues from furs or controversial weapons, and they will not invest in countries deemed “Not Free” by the Freedom House Index (see map below).

In addition, where necessary, the managers will utilise the combined power of the wider Janus Henderson group to engage with management to ensure companies are travelling in the right direction on ESG issues. The managers embrace and welcome positive change. They believe that investing in better managed companies from an ESG perspective enables them to gain exposure to more resilient business models, more sustainable cash flows and places them in the best possible position to deliver strong risk adjusted returns for clients over the long-term.

A good portfolio example is Equinix, which builds digital infrastructure and data centres around the world. Companies operating in this area can score poorly for their environmental impact given potentially high levels of water and energy usage. However, after assessing the company’s ESG credentials and engaging with management, the managers have found these risks to be manageable due to the firms’ clear focus on sustainability. Equinix has placed significant resources into research and development projects that aim to decarbonise data centres, better manage water usage, and seek alternative, more renewable sources of fuel for the future.

While the Company has enhanced its ESG considerations – there has been no material change in the investment process or strategy. The Company’s ‘sensible income’ approach has always focused on larger, higher ‘quality’ companies, in non-cyclical and defensive parts of the economy. As such, the managers have always invested in businesses that are doing the right things, are in it for the long term (playing an infinite game) and look after all their stakeholders, including the environment. Such an approach is the reason why the Company has been able to pay a high, stable, and sustainable income to investors over the years.

3Source: Henderson Diversified Income Trust – Annual Report 2022