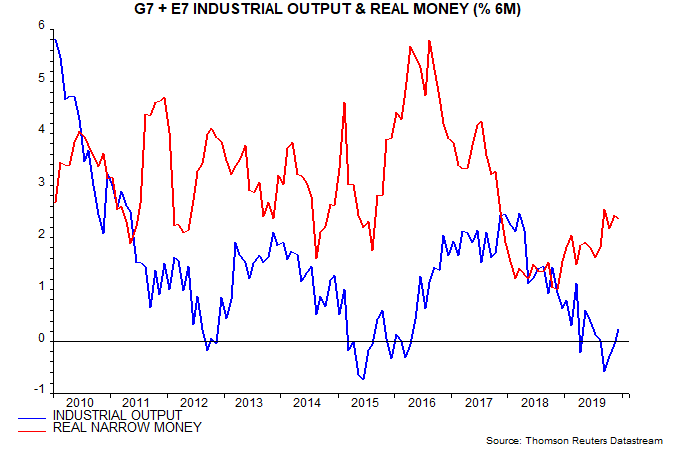

Six-month growth of global (i.e. G7 plus E7) real narrow money is estimated to have been unchanged at 2.4% (not annualised) in December, based on monetary data covering 70% of the aggregate and near-complete CPI inflation data – see first chart.

Real money growth remains well below a post-GFC average of 3.2%, suggesting that six-month industrial output momentum will show limited recovery through Q3 2020, allowing for an average nine-month lead.

Real money growth bottomed at 1.0% in November 2018 while industrial output momentum appears to have reached a low 10 months later in September 2019.

The recent high for real money growth was 2.6% in September 2019. A rise through this level, ideally to 3-4%, in early 2020 would signal economic acceleration during H2 and into 2021. This is the scenario suggested by cycle analysis – the stockbuilding and business investment cycles are expected to have entered recovery phases by H2.

A relapse in real money growth without a prior breach of the September high, however, would signal a “double dip” starting around mid-2020.

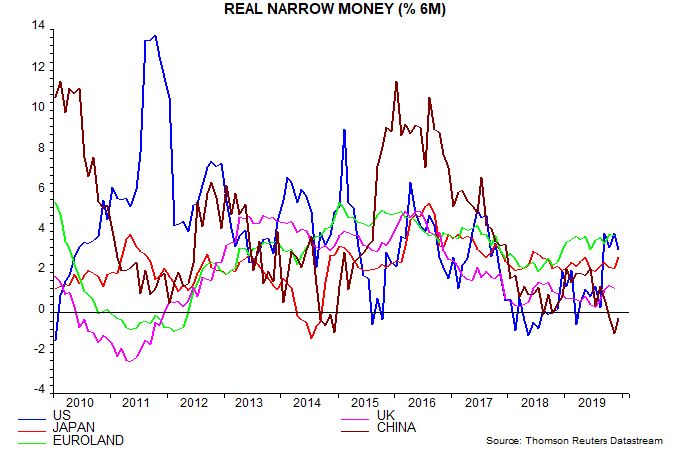

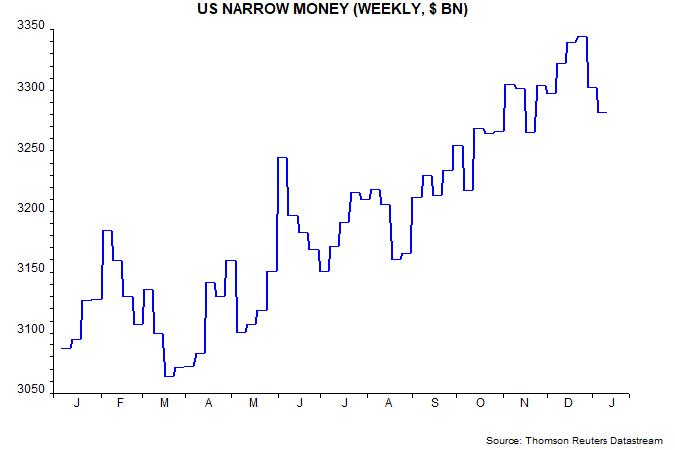

US trends could drive a relapse. Six-month narrow money growth surged higher in September as the Fed cut rates for the second time in two months and restarted balance sheet expansion – second chart. Rates have been stable since end-October and the balance sheet boost could be ending. Narrow money contracted in the first two weeks of January – third chart.

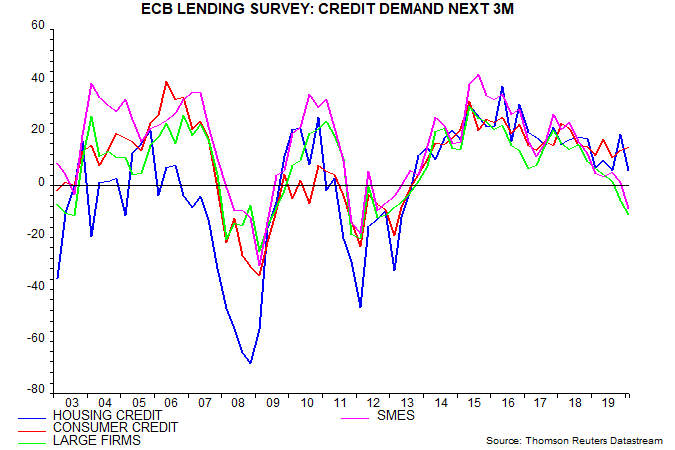

A fading impact of the ECB’s September policy easing could similarly result in a moderation of Euroland money growth. The Q4 bank lending survey released today signalled a further weakening of business credit demand – fourth chart. (December money numbers will be released on 29 January.)

An alternative positive scenario is that US / Euroland money trends remain solid while a reversal of recent Chinese real money contraction pushes the global six-month growth measure through 3%. A sharp fall in CPI inflation as pork prices normalise will give a significant boost to Chinese real money but the timing is uncertain, while – as previously discussed – a recovery in nominal money growth probably depends on an unwind of bank credit tightening during 2019, of which there is little sign yet.