Following a 9-month hiatus in its rate-cutting cycle, the Federal Reserve (Fed) recently resumed monetary easing, with cuts in September and October 2025 in response to signs of a softening labor market.

While earlier hopes for more aggressive rate cuts have not fully materialized – in part, due to stickier inflation under Trump 2.0 – the Fed is still on course to cut rates through 2025 and 2026, albeit at a far slower pace than what was being predicted in 2024. Futures markets are now anticipating just 78 basis points (bps) of rate cuts over the next 12 months, bringing the effective federal funds rate to roughly 3.00%, from the current 3.87%.

With the prospect of lower interest rates, investors may be asking the following questions:

Should I rotate out of short duration into long-duration bonds? If I do maintain an allocation to short duration, which sectors might best suit my investment goals? Should high-quality, floating-rate bonds still command a strategic allocation in my fixed income portfolio?

Why maintain an allocation to short duration through a rate-cutting cycle?

Historically, most of the move down in long-term yields has taken place before the Fed starts cutting, not after (i.e., long-term yields generally move in anticipation of rate cuts). The current cycle is no exception, with the 10-year U.S. Treasury yield rallying to 3.62% in September 2024 before backing up to around 4.1% in November 2025.

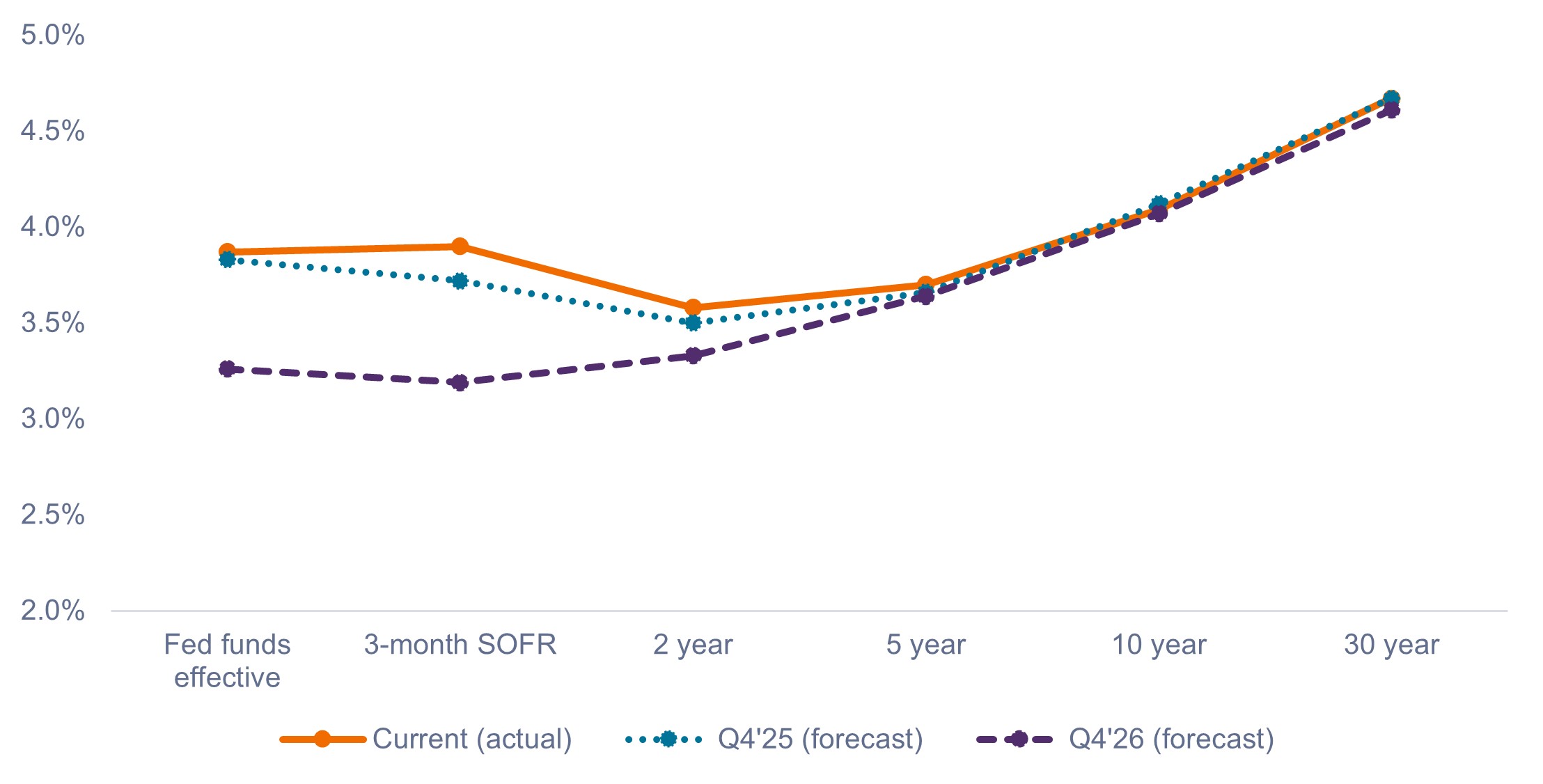

While long-term yields could rally further, the market is anticipating they will not do so unless we enter a recession or inflation falls much more than expected. As shown in Exhibit 1, short-term yields are projected to fall over the next year, with little change to 10-year and 30-year Treasury yields.

Exhibit 1: U.S. Treasury yield curves (actual vs. forecast)

Short-term yields are expected to come down, with little change to the long end.

Source: Bloomberg, as of 3 November 2025. Yield curve forecasts based on Bloomberg consensus forecasts.

What does this mean for investors?

1. We believe investors should not indiscriminately rotate from short- to long-duration bonds simply because the Fed is cutting. Investors who do so may be disappointed if long-term yields do not decline as much as they expect. Maintaining an allocation to short duration adds diversification, while also being better positioned in the event long-term yields rise or remain rangebound on the back of higher term premiums due to large fiscal deficits and higher inflation expectations.

2. We believe investors should continue to lean into the attractive yields at the front end of the yield curve. Absent a recession, rate cuts are expected to be slow and gradual over the next 12 months, underpinning a higher-for-longer rate environment that is supportive of short-duration fixed income.

3. Investors who are concerned about a recession might complement their short-duration holdings with a longer-duration asset that carries virtually no credit risk – such as agency mortgage-backed securities (MBS) – to provide some portfolio defense.

What options do investors have for filling their short-duration bucket?

As rates have moved higher in recent years, investors have flocked to short-duration corporate bonds or cash/money market funds to fill their short-duration bucket. But while the yields are enticing, we believe these sectors may not be the optimal choice.

According to our analysis, investors will likely be better served with an allocation to AAA rated collateralized loan obligations (CLOs), for the following reasons.

1. Spread return matters, especially when rates go lower

AAA CLOs have historically paid a higher credit spread – or additional income above the risk-free rate – than short-duration investment-grade (IG) corporates and cash. On average, between October 2015 and October 2025, AAA CLOs paid an additional 140 bps over the risk-free rate, compared to 56 bps for short-duration IG corporates and 0 bps for cash/money market funds.

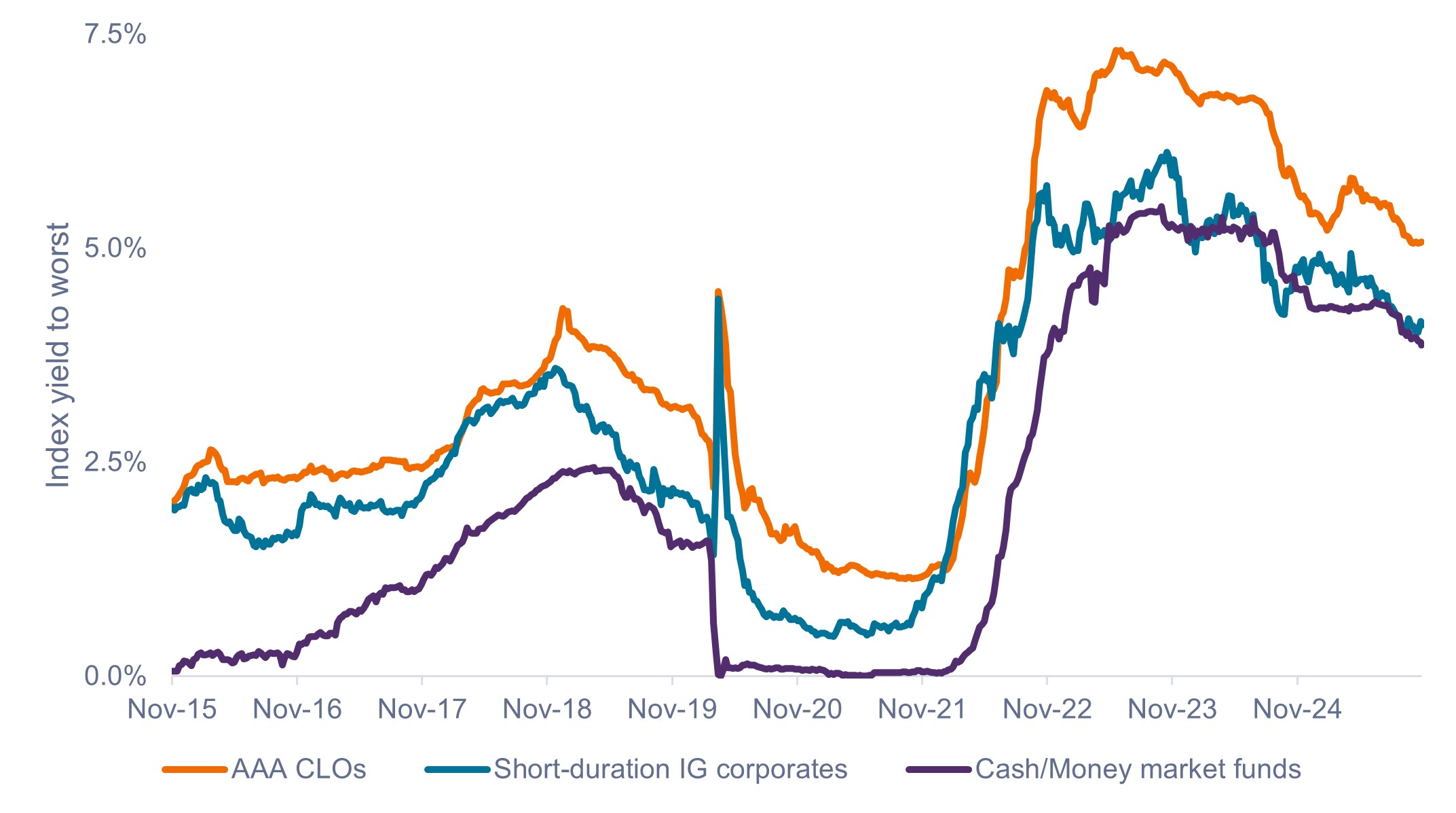

As shown in Exhibit 2, these spread differences might appear less significant when rates are hovering around their multi-decade highs. However, when rates start to decline, the additional income paid by AAA CLOs will become a greater proportion of the total yield and will also help investors to continue to receive an income stream even if rates hypothetically go to zero.

In contrast, cash and money market funds pay nothing when rates go to zero, leaving investors without an income stream from their short-duration holdings.

Exhibit 2: Yield to worst comparison (Oct 2015 – Oct 2025)

Higher spreads equate to higher yields over the long term.

Source: Bloomberg, as of 3 November 2025. Indices used to represent asset classes: AAA CLOs = J.P. Morgan CLO AAA Index, Short-duration IG corporates = Bloomberg U.S. Corporate 1-3 Year Index, Cash / Money market funds = Bloomberg U.S. Treasury Bills: 1-3 Months Index. Yield to worst on AAA CLOs calculated using 3-month LIBOR/SOFR plus J.P. Morgan CLO AAA Discount Margin. Past performance does not predict future returns.

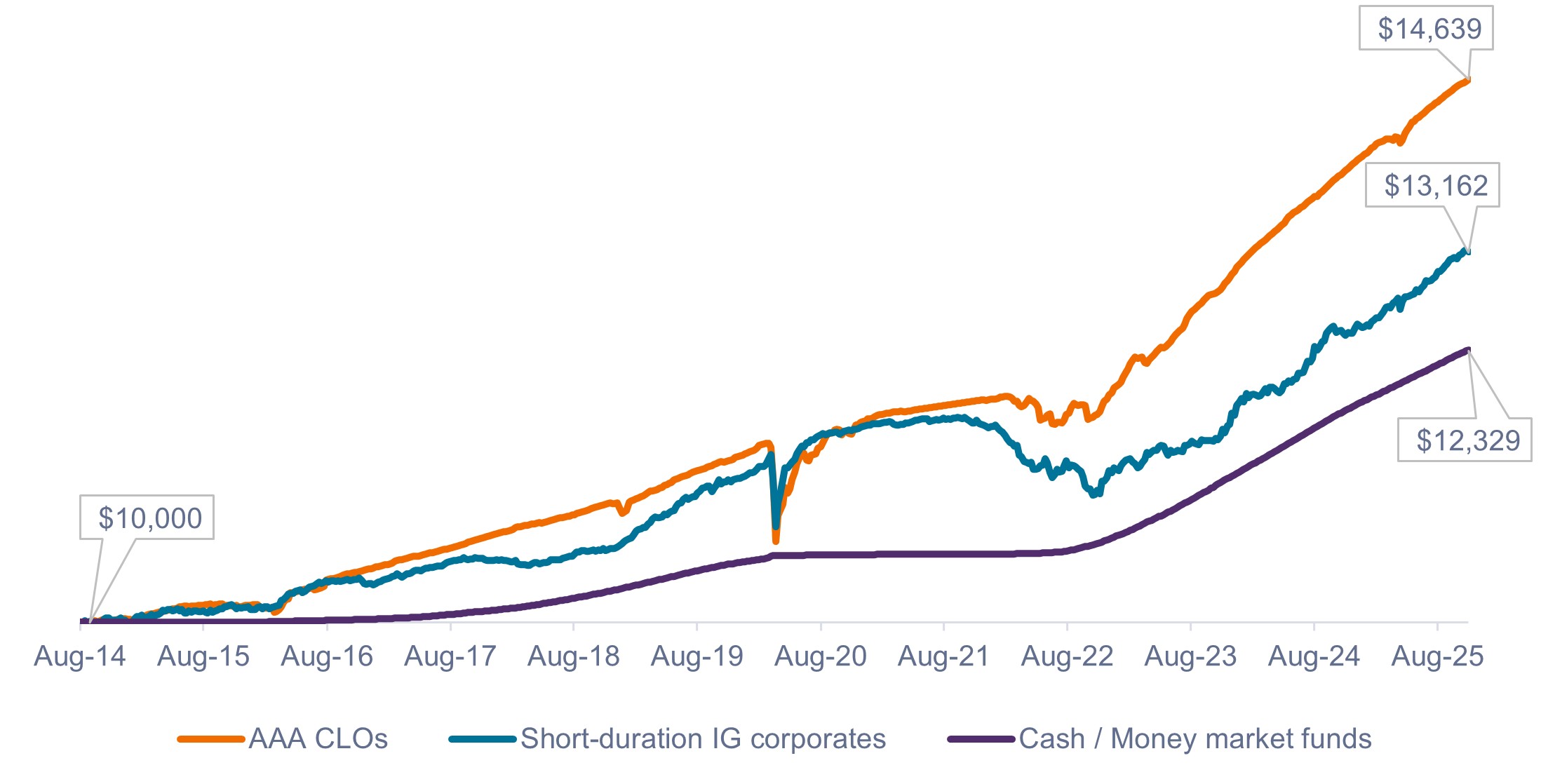

As shown in Exhibit 3, the additional credit spread paid by AAA CLOs has translated into higher cumulative total returns versus short-duration IG corporates and cash.

Exhibit 3: Cumulative growth of an initial $10,000 investment (Aug 2014 – Oct 2025)

Excess returns from credit spread add up over time.

Source: Bloomberg, as of 31 October 2025. Indices used to represent asset classes as per Exhibit 2. Past performance does not predict future results.

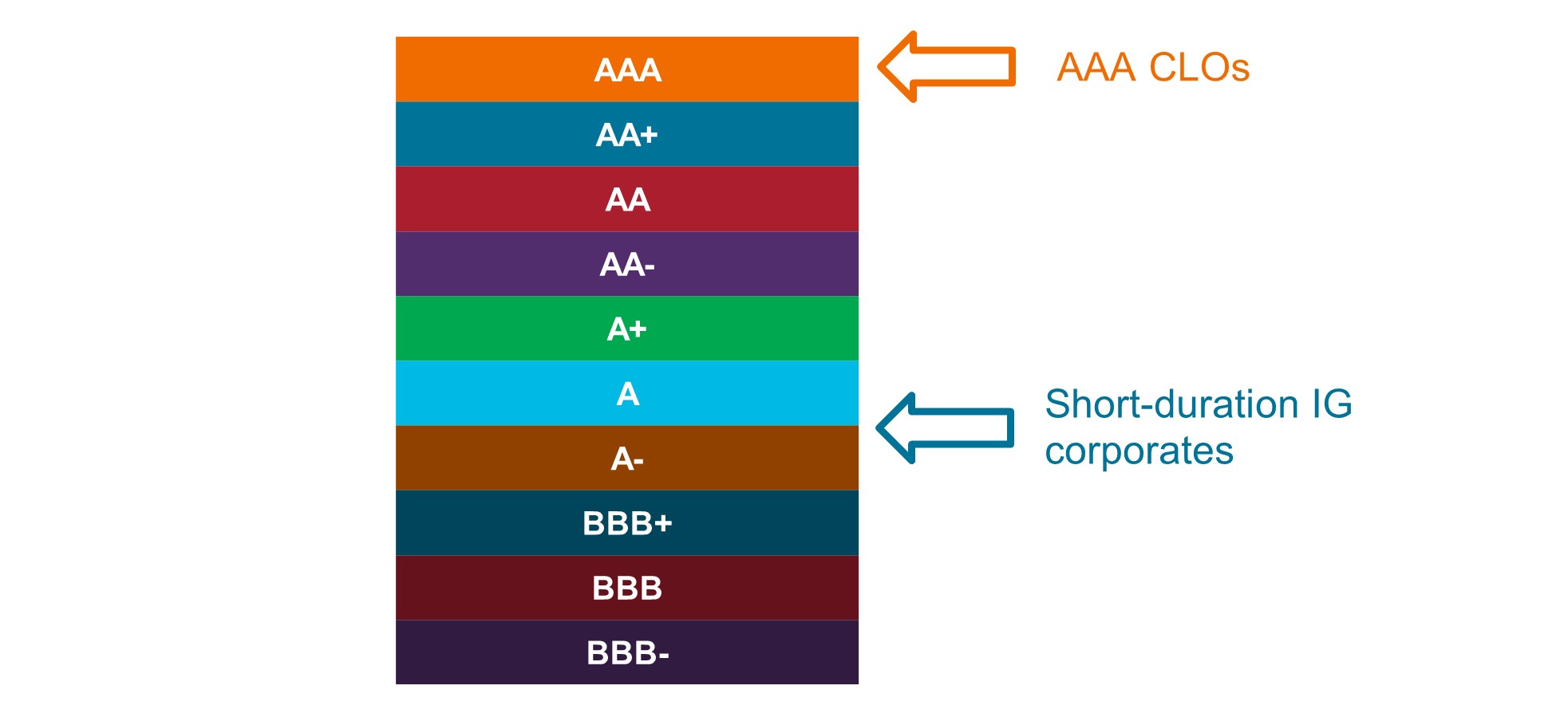

2. Higher yields need not come at the cost of lower credit quality

At an index level, AAA CLOs exhibit higher credit quality than short-duration IG corporates. Investors may increase yield while also improving the overall credit quality of their portfolios by incorporating an allocation to AAA CLOs.

Exhibit 4: Index-level average credit ratings

Source: Bloomberg, S&P Ratings as of 31 October 2025.

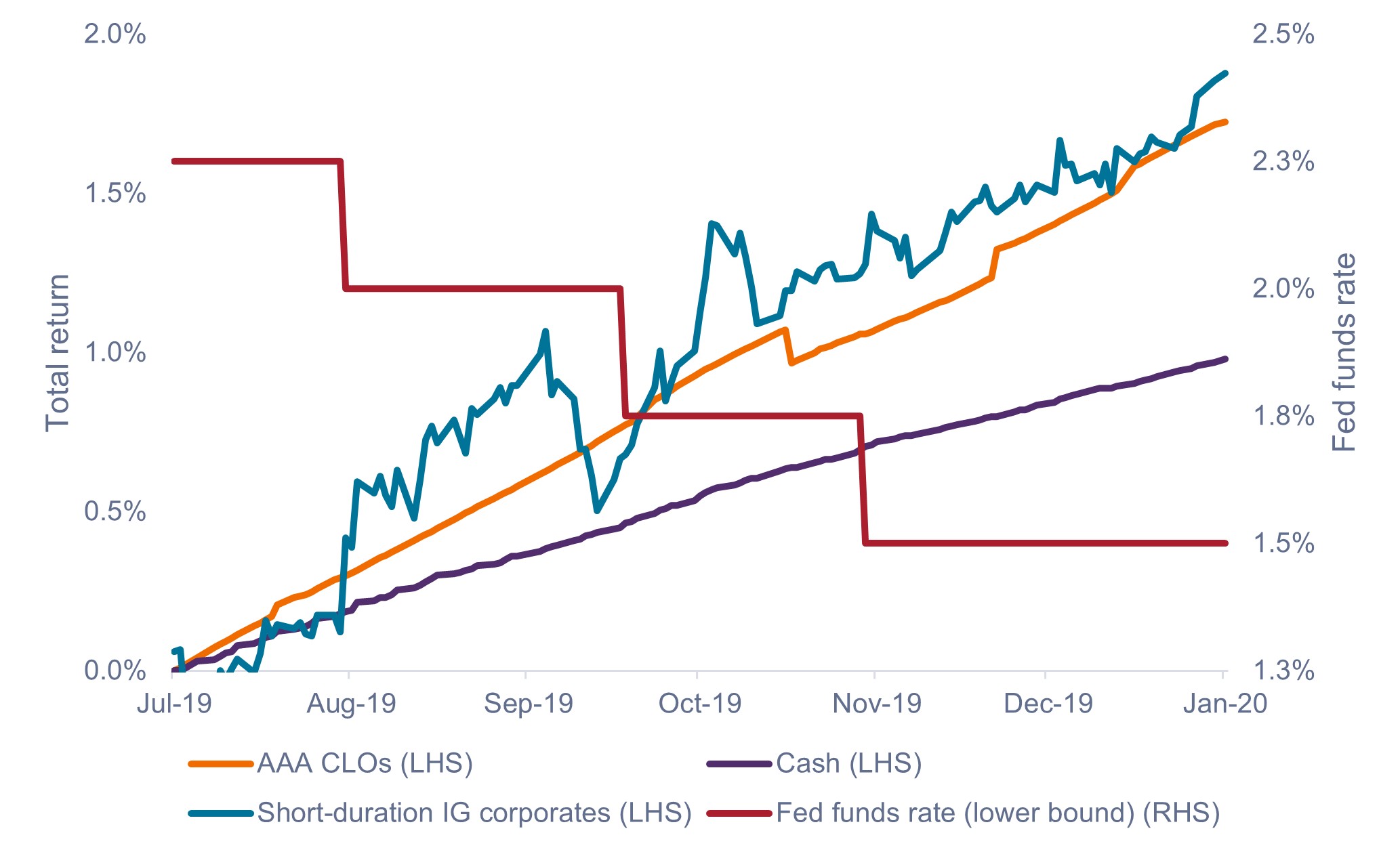

3. The precedent of 2019’s rate-cutting cycle

In our view, investors who remain concerned about short duration in a declining rate environment may find it helpful to compare today’s environment to the second half of 2019 – the most recent rate-cutting environment.

The Fed made three rate cuts of 25 bps each during the second half of 2019, taking its benchmark rate from 2.5% to 1.75% by year end. (The Fed subsequently cut rates to zero in March 2020 with the onset of COVID-19).

At that time, the yield curve was slightly inverted (3-month versus 10-year inversion peaked at -51 bps), and Fed rate cuts resulted in the curve flattening out. Today, we also anticipate the yield curve to steepen from its relatively flat position as the Fed moves forward with rate cuts.

As shown in Exhibit 5, AAA CLOs continued to generate consistent positive returns amid these rate cuts. Once again, the credit spread within AAA CLOs supported ongoing income returns. While short-duration IG corporates marginally outperformed AAA CLOs during that period, they did so with far higher volatility.

Exhibit 5: Total returns during the last Fed rate-cutting cycle (Jun 2019 – Dec 2019)

Credit spread income underpinned continued positive returns despite rate cuts.

Source: Bloomberg, J.P. Morgan, as of 3 November 2025. Indices used to represent asset classes as per Exhibit 2. Past performance does not predict future returns.

4. Lower-correlation volatility and improved risk-adjusted returns

Some investors – not wanting to put their short-term cash reserves at risk – may feel uneasy with any volatility within their short-duration bucket. (As represented by average rolling 1-year standard deviation in Exhibit 6, AAA CLOs and short-duration IG corporates do exhibit some volatility in contrast to cash, which is essentially a zero-volatility asset.)

However, we believe many investors are too cautious in this regard and could handle more volatility in their short-duration bucket in exchange for higher potential returns. Historically, despite occasional drawdowns, AAA CLOs have still ended up comfortably ahead of cash over the long term.

Further, while drawdowns do occur in AAA CLOs, they are relatively small compared to other risk assets, have not been common historically, and the asset class has typically recovered within one or two quarters. In our view, aside from maintaining a modest cash allocation for immediate needs (0-3 months), we believe investors would be better served over the long term by taking on a small amount of volatility to improve their portfolio’s income-earning potential.

Exhibit 6: Key short duration metrics (Jan 2012 – Dec 2024)

| AAA CLOs | Short-duration IG corporates | Cash / Money market funds | |

| Largest quarterly gain* | 4.32% | 4.07% | 1.38% |

| Largest quarterly drawdown** | −4.38% | −2.47% | 0.00% |

| Total negative quarters | 5 | 11 | 0 |

| Annualized total return | 3.25% | 2.30% | 1.36% |

| Average rolling 1-year standard deviation | 1.3% | 1.4% | 0.1% |

Source: Bloomberg, J.P. Morgan, as of calendar year ended 31 December 2024. Data based on sequential (not rolling) calendar quarters. Indices used to represent asset classes as per Exhibit 2. *Largest quarterly gains: AAA CLOs and short-duration IG corporates: Q2:2020, Cash: Q4:2023. **Largest quarterly drawdowns: AAA CLOs: Q1:2020, Short-duration IG corporates: Q1:2022. Past performance does not predict future returns.

As shown in Exhibit 7, adding CLOs to the Bloomberg U.S. Aggregate Bond Index (U.S. Agg) may have improved long-term risk-adjusted returns by increasing total return while also reducing standard deviation.

Exhibit 7: Historical hypothetical allocation scenarios (Dec 2014 – Dec 2024)

Impact of adding 10%, 20%, and 30% allocation of AAA CLOs to the U.S. Agg.

Source: Bloomberg, Janus Henderson Investors, as of calendar year ended 31 December 2024. Our analysis adds AAA CLO exposure on a pro rata basis to the Bloomberg U.S. Aggregate Bond Index to determine the historical effect of having 10%, 20%, and 30% AAA CLO exposure. Scenarios are hypothetical and performance is based on historical index returns. Investors should not assume they will have a similar investment experience. Hypothetical examples are for illustrative purposes only and do not represent the returns of any particular investment.

Conclusion

We believe investors should maintain diversification within their fixed income portfolios throughout the interest rate cycle. Therefore, in our view, an allocation to short duration remains highly relevant in the current environment.

Further, optimizing total return for one’s entire portfolio is vital to improving long-term risk-adjusted returns. We believe a strategic allocation to AAA CLOs, with their attractive floating-rate yields, high credit quality, and low correlation to other fixed income sectors, remains a key component of a strategic fixed income allocation.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded.

Bloomberg U.S. Corporate 1-3 year Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market with maturity between 1-3 years.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

J.P. Morgan CLO AAA Index is designed to track the AAA-rated components of the USD-denominated, broadly syndicated CLO market.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Volatility measures risk using the dispersion of returns for a given investment.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

An inverted yield curve occurs when short-term yields are higher than long-term yields.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.