One of the ‘People and Planet’ themes we target within the Janus Henderson Sustainable Credit strategy is ‘Inclusion and social diversity’. Diversity in society, or indeed in a workplace, refers to the representation of people with different race, gender, age, ethnicity, sexual orientation, and disability. Inclusion is an extension of this, whereby people feel involved, valued, respected, treated fairly, and embedded in the culture of the business or community in which they live. Workplaces with high levels of diversity and inclusion are found to achieve greater productivity, innovation and performance whilst increasing the wellbeing of the workforce. In society, diversity helps reduce discrimination, creating equal opportunities and easing inequalities. This strengthens social cohesion and promotes positive relationships in our communities.

What can investors do to assist inclusion and social diversity?

The issuance of social bonds focused specifically on inequality, diversity and inclusion is still emerging in Australia, with a limited number of bonds that have direct use of proceeds available. However, corporates, financial institutions and government entities are integrating diversity and inclusion (D&I) objectives into their sustainable finance frameworks. These frameworks are then used to issue sustainable bonds in which capital is directed to projects that address these efforts. While gender diversity typically attracts a heavy focus when considering D&I, our view is that diversity extends well beyond gender.

Many companies have their own D&I policies. As an investor we seek out corporate issuers that demonstrate they are committed to education and training, maintaining a high percentage of women in management positions, workforce diversity, the reduction of gender pay gaps, a focus on employee satisfaction and managing controversies pertaining to workplace bullying . Other policies that support D&I may include elements such as paid parental leave and flexible working arrangements, including working from home. Government policies also play a part, through initiatives such as childcare subsidies and grass roots education.

In addition to looking for opportunities to support and invest in targeted debt offerings, Janus Henderson’s Australian Fixed Interest team has a role to play through active engagement with issuers. By having conversations with issuers about their diversity and inclusion programs during our sustainability focused meetings, our aim is to see companies develop and target best practice behaviours. Where an issuer is considering a social bond targeting diversity and inclusion, our view as a fixed interest team is that we will work with the issuer on structuring that bond, and offering support for them to come to market.

The following gives a sense of the types of diversity and inclusion investments available.

Financial institutions

Bank Australia

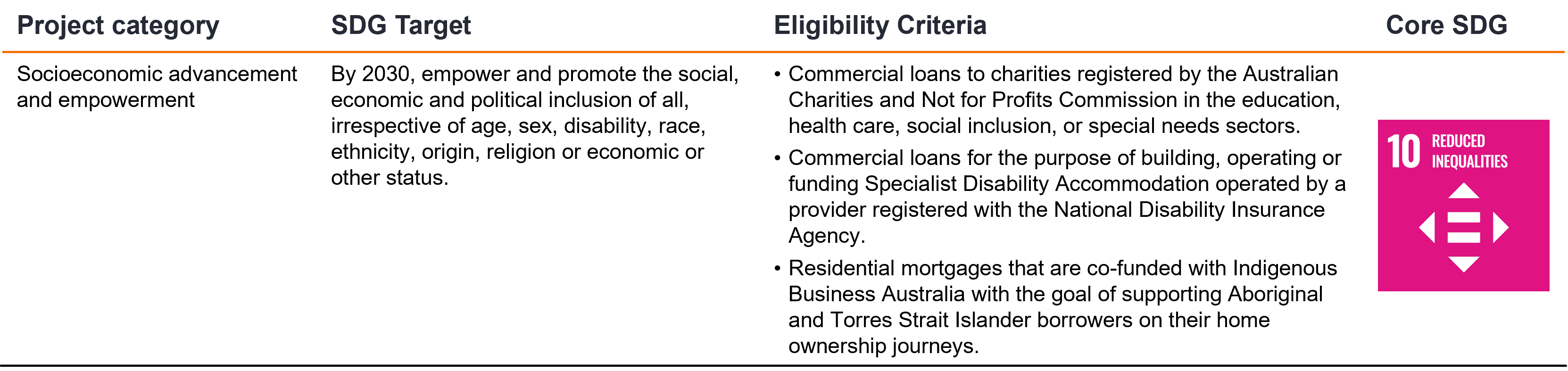

Bank Australia established a sustainability bond framework in 2018, targeting three of the UN Sustainable Development Goals (SDG’s). This included SDG10 ‘Reduced inequalities’. This is being addressed through:

1) Commercial loans to charities that target social inclusion, education, healthcare and other special needs

2) Commercial loans for the building, operating and funding of disability accommodation, and

3) Residential mortgages for indigenous people.

Source: Bank Australia, Sustainability Bond Framework August 2021

Commonwealth Bank of Australia

As part of their sustainable bond framework, from which they issue sustainable bonds, the Commonwealth Bank of Australia (CBA) has included financing initiatives related to diversity and inclusion. Specifically, this includes funding for:

• The construction and operation of public hospitals, not for profit hospitals, healthcare clinics and aged care facilities. The healthcare services will be accessible to all regardless of ability to pay and the private not-for-profit aged care services will be made affordable to all elderly individuals.

• Education (including construction of campuses and training facilities) that support financial education and is accessible for all regardless of ability to pay.

• Employment generation programs targeting migrants, undereducated, people with disabilities, those living below the poverty line, ageing and vulnerable youth.

Westpac

Westpac, via its sustainable bond program is also directing capital towards inclusive and sustainable community projects where they fund businesses which meet the Westpac NZ Diverse Supplier Group Definitions. Capital is used to educate these suppliers with training programs that support employment and skills development for vulnerable or at-risk groups. This includes businesses owned by indigenous groups, the LGBTQIA+ community and disability enterprises.

ANZ’s SDG bond

ANZ targets certain SDGs through this bond, specifically assisting with job creation and retention and education for marginalised or under-represented groups.

Source: ANZ SDG Bond Framework November 2024

Supranationals

The charter of supranationals is to pursue policy objectives on behalf of neighbouring sovereigns. Through their bond funding programs, supranationals are significant participants in the global social bond market. Many supranationals have issued social bonds targeting diversity and inclusion in their regions. For example, the World Bank issued a gender bond for projects that reduce gender disparities, promote economic empowerment and improve education, while the European Investment Bank (EIB) issued a social bond financing projects aimed at reducing inequality through access to affordable housing, education, healthcare and job opportunities for marginalised communities.

Within the APAC market, the Asian Development Bank issued the first Australian dollar gender bond. The eligible projects addressed included:

• Women’s economic empowerment

• Gender equality in human development

• Reduced time poverty of women

• Participation in decision-making and leadership, and

• Women’s resilience against risks and shocks including climate change and disaster impacts.

This is a style of bond that we specifically requested be issued into Australia and it is widely held across our portfolios.

State and Federal Government

Our states and sovereign are also active in directing funding towards marginalised and vulnerable groups. Sustainable bonds issued by NSW, VIC, SA, QLD and WA have included funding for people with disabilities, affordable housing, refugees, migrants and indigenous Australians.

Likewise, the Federal Government via Housing Australia (formerly known as the National Housing Finance and Investment Corporation), provides lending to registered commercial enterprises at discounted funding rates to deliver community housing projects to address housing affordability. 4,000 of the new affordable houses being built will be allocated to women and children impacted by family and domestic violence and older women at risk of homelessness.

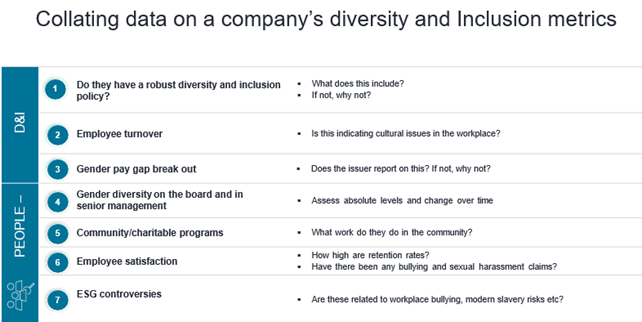

Corporate Australia

Australian businesses are increasingly committing to diversity and inclusion as a central part of their corporate strategy. Assessing how an issuer fares in this regard often forms part of our questioning during engagement meetings. In addition, many companies report on gender ratios, employee satisfaction and turnover, charitable programs etc which can be used as a starting point for our discussions. Below are some of the metrics that we collate.

Source: Janus Henderson Investors, December 2024

While many of the large corporates have gender targets, some others are pushing ahead on more encompassing action plans. While Qantas has been a public standout with their advocacy of diversity which included the issuance of a social bond targeting gender inclusion and supporting indigenous employment programs, companies such as Sydney Airport also advertise their 26 week paid parental leave, education on domestic violence, resources to support families, well-being support, employee engagement programs, job opportunities for ex-service people and their families and gender equality.

Conclusion

While diversity and inclusion policies within firms are gaining more traction, the issuance of use of proceeds bonds towards these initiatives is still limited. Some hurdles faced include:

– Defining and measuring targets and the ability to report on them

– Lack of prioritisation of D&I by some companies, and

– The infancy of the domestic social bond market.

Despite these hurdles, the Australian Fixed Interest team at Janus Henderson believe diversity and inclusion bonds to be an important investment opportunity, and will continue to engage with issuers to help develop the growth of financing targeted towards improving diversity and inclusion.