Key takeaways:

- HINT has grown its dividend every year since inception, and despite the volatility and disparity in global dividends over the past 18-months, the dividend received by investors over the last 12-months has increased by 20% year-on-year.

- According to AJ Bell, just ten UK stocks are forecast to pay dividends worth £47.7 billion or 56% of the forecast total for 2022. Over the last five/ten years, the top ten payers have broadly been the same, and when stretched to the top 20 payers, the list is more or less static.

- Investing globally for dividends offers investors exposure to different sectors and trends they might not find in their home market, and more importantly, the benefit of diversification to their income in the event that things don’t go as planned.

In a volatile market environment, capital preservation is often the rallying battle cry of most investors. And when times are tough, it’s often tempting to stick to what you know, or believe that the best performing asset, sector, or region might be the best place to park your money. In this article, Ben Lofthouse, Portfolio Manager of Henderson International Income Trust, highlights why diversification is the key to navigating a volatile market environment.

To say the last few years have been volatile for investors would be an understatement. Global equity markets plunged as the world economy was brought to its knees by the Covid-19 pandemic. Alongside the share price declines, dividends payments also plunged with 2020 the worst year for payouts since 2011. 2021 was a welcome respite as economies reopened following the rollout of highly effective vaccines – though some regions continue to deal with recuring Covid-19 outbreaks today.

Unfortunately, that respite has been short-lived as 2022 has brought with it a different set of challenges. Stock markets have experienced their worst first half in 50 years and investor sentiment continues to be dampened by geopolitical tensions, elevated inflation, and rising interest rates amid a cost-of-living crisis. And that pain doesn’t look like it will abate anytime soon, with a recession now the base case for the global economy. As such, investors have been scrambling to find ways to insulate their portfolios from market volatility.

Though the impact has been felt across global equity markets, some regions, sectors, and businesses have been more resilient than others. The UK, in particular, has been quite resilient – though over the last few weeks it has come under pressure over monetary and fiscal policy concerns. When markets come under pressure, it’s natural to be concerned, and investors have reacted in different ways. Some have chosen to invest in the best performing asset whilst some have chosen to invest in what they know – also known as “home country bias”.

While these strategies might work for some in the short-term, for long term investors, history has time-and-time again shown them why focusing on a single asset or region in a period of volatility might not be the best approach. The UK, for instance – a market synonymous with dividends – was particularly hard hit by the pandemic. The market consists of services and old economy businesses that were severely impacted by lockdown restrictions. The regulator’s decision to stop banks from paying dividends was also a major headwind.

However, 2021 was a markedly different picture as UK dividends rose by 46.1% to a headline of £94.1 billion as sectors hard hit by lockdown restrictions rebounded strongly.1 The resumption of banking dividends to the punchbowl was also a strong tailwind. With 2022 well underway, dividends have continued to grow at a strong clip. However, when we look underneath the surface, all is not as it seems.

In 2021, UK dividends were largely driven by mining payouts, which were 3x larger than the normal average and accounted for almost a quarter of the UK total last year.2 Restored banking dividends also contributed strongly. Overall in 2021, 33% of UK dividends came from just 5 stocks – Rio Tinto, Tesco, British American Tobacco, Royal Dutch Shell, and BHP Group.3 Though dividends have continued their strong march upwards in 2022, payouts are being driven by the usual suspects: oil, mining, and financial companies. According to AJ Bell, just ten stocks are forecast to pay dividends worth £47.7 billion or 56% of the forecast total for 2022. This is not a recent phenomenon. When we look back over the last five/ten years, the top ten payers have broadly been the same, and when stretched to the top 20 payers, the list is more or less static.

After dotting the I’s and crossing the proverbial T’s – it’s not hard to figure out the risk that investors may be exposing themselves to. Because any investor looking to the UK for attractive dividends not only needs to be skilled at stock picking but also needs to have an in-depth of, and strong view on the largest paying stocks. Now that’s a lot easier said than done, given how unpredictable markets have been over the last few years.

This then raises an important question. How can investors retain exposure to UK equities whilst ensuring that they reduce single stock/market risk? For us the answer is simple, through the Henderson International Income Trust (HINT).

HINT was launched in 2011 in response to the increase in concentration of UK dividends in a narrow selection of stocks and sectors. Though we expected this to improve over time as companies recovered from the financial crisis, the pandemic has been an unfortunate reminder that the concentration still remains.

HINT’s objective is to generate a high and growing dividend from a globally diversified portfolio of non-UK securities. The investment trust is specifically designed as a complementary fund for UK income-driven investors wishing to diversify their portfolios outside the UK. In fact, we are the only investment trust in the Global Equity Income sector to invest solely in companies listed or operating mainly in countries outside the UK. We invest across three regions/sleeves: Europe, Asia Pacific, and North America, to tap into a diversified spread of dividends across the globe.

This allows UK investors to truly diversify their income, whilst also taking advantage of the fact that global equity dividends are much less concentrated than dividends for the top-paying UK companies (see chart below). We are currently invested in circa 67 holdings across 20 countries and only 33% of income comes from our top ten largest payers.4 It’s a strategy that has served us well. HINT has a strong record of dividend growth: it has grown its dividend every year since inception and despite the volatility and disparity in global dividends over the past 18-months, the dividend received by investors over the last 12-months has increased by 20% year-on-year.5

Source: Janus Henderson Global Dividend Index (JHGDI), Link UK Dividend Monitor, as at 30 September 2021, Henderson International income Trust shows the Income received in the 12 months to 31 August 2021.

Many different economic factors—such as gross domestic product, interest rate differences, currency movements, political events, and even investor sentiment—can influence which region currently leads in performance. And because the landscape is consistently shifting, our active management approach enables us to tactically tilt the portfolio to gain exposure to whichever region (ex UK) is in favour at any given time. The ex-UK aspect of the portfolio should provide investors with true stock specific diversification as many global income funds are often overweight the top UK dividend-paying names.

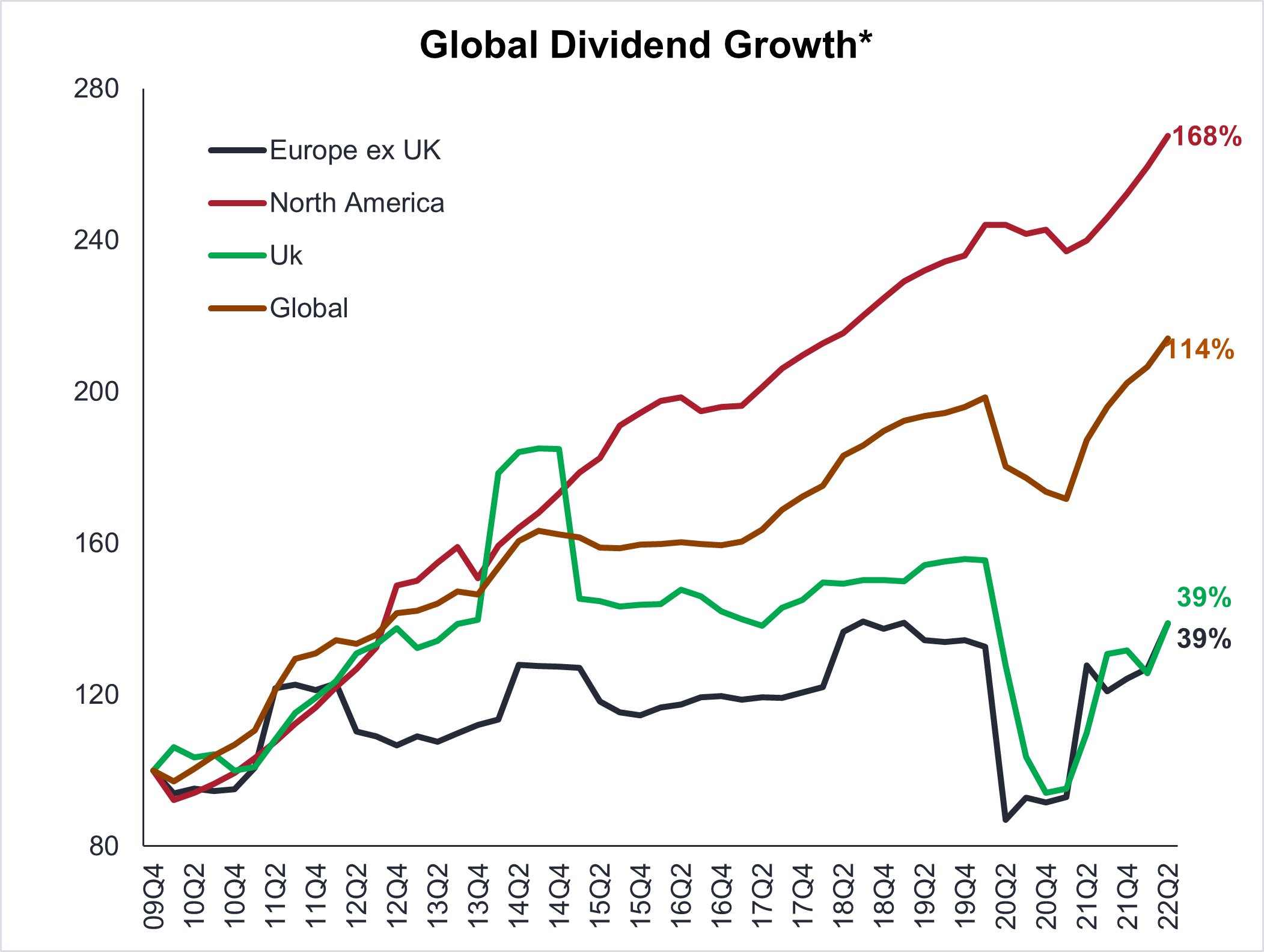

Source: Janus Henderson Global Dividend Index (JHGDI), as at 30 June 2022. (Cumulative dividend growth)

Note: Chart rebased to 100. Dividends paid by top 1,200 global companies by market capitalisation in USD. Rounded to the nearest whole number and based on dividend growth between Dec 2009 and December 2020. Yields may vary and are not guaranteed.

The diversification benefits can be clearly seen in the chart above. Whilst UK dividends have generally been on an upward trend since 2009, they have been more volatile compared to the global trend. The flexibility to invest in different regions across various sectors enables us to take advantage of the short to medium trends in various markets/sectors whilst remaining positioned to benefit from innovation unfolding over the long term. More importantly, being diversified dampens the overall volatility of the portfolio by reducing single country, sector, or stock risk, thus providing investors with a smoother return profile.

The events of the last 18-months have been a reminder that change is inevitable, and that different regions of the world, economies, business sectors, and companies can be impacted in different ways. Therefore, investing globally for dividends offers investors exposure to different sectors and trends they might not find in their home market, and more importantly, the benefit of diversification to their income in the event that things don’t go as planned.

Sources

2Source: Link Group UK Dividend Monitor, Q4 2021

3Source: AJ Bell Dividend Dashboard, Q2 2022. Past performance does not predict future returns.

4Source: Henderson International Income Trust, as at 30th September 2022

5Source: Henderson International Income Trust

Diversification – A way of spreading risk by mixing different types of assets/asset classes in a portfolio. It is based on the assumption that the prices of the different assets will behave differently in a given scenario. Assets with low correlation should provide the most diversification.

Fiscal policy – Connected with government taxes, debts and spending. Government policy relating to setting tax rates and spending levels. It is separate from monetary policy, which is typically set by a central bank. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Monetary policy – The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Volatility – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.