Dayton’s Full Width Article Test – Template

-

Peter Harrington-Howes

Peter Harrington-Howes

-

Matthew Bullock

Matthew Bullock

Head EMEA Portfolio Construction and Strategy -

Mario Aguilar De Irmay, CFA

Mario Aguilar De Irmay, CFA

Senior Portfolio Strategist -

Tom Lemaigre

Tom Lemaigre

Portfolio Manager -

Switzerland

IRF Communications -

Spain

Grupo Albion -

Latin America

Sherlock Communications -

Italy

Verini & Associati -

France

Shan -

Germany & Austria

Dolphinvest

Dayton’s Full Width Article Test – Template

-

Peter Harrington-Howes

Peter Harrington-Howes

-

Matthew Bullock

Matthew Bullock

Head EMEA Portfolio Construction and Strategy -

Mario Aguilar De Irmay, CFA

Mario Aguilar De Irmay, CFA

Senior Portfolio Strategist -

Tom Lemaigre

Tom Lemaigre

Portfolio Manager -

Switzerland

IRF Communications -

Spain

Grupo Albion -

Latin America

Sherlock Communications -

Italy

Verini & Associati -

France

Shan -

Germany & Austria

Dolphinvest

Jim Cielinski, Global Head of Fixed Income, argues that the easy returns from corporate bonds since the COVID recovery are largely over but opportunities can still be unearthed through a selective approach.

Key Takeaways

- Valuations are expensive but reflect the fact that the economic and policy environments are supportive for credit.

- Vaccination programmes and re-opened economies mean COVID no longer dominates every news bulletin; other factors are beginning to influence markets and idiosyncratic risks are likely to grow.

- Higher inflation need not be bad for credit – but the gradual removal of monetary accommodation is likely to see more policy divergence and create higher volatility.

Autumn in the Northern Hemisphere brings a supportive environment for mushrooms to sprout. Yet the most coveted of all fungi – the white truffle revered for its flavour – remains stubbornly underground. Its aromatic marvel is only revealed to those prepared to undertake a serious search effort. This may involve a combination of years of experience, a canine companion’s strong sense of smell, as well as an understanding of topography and biology.

Where we see commonalities with the truffle hunters is the increasing effort required to unearth opportunities in the credit markets. Partly, this is a consequence of full valuations and partly a recognition that some of the economic tailwinds are receding. Volatility may rise and idiosyncratic risks are ubiquitous. Value is present but is often lurking beneath the surface.

Debt levels and valuations

Most of 2021 has been characterised by broadening vaccination efforts, albeit led by richer, developed countries. The prospect and reality of economies re-opening has provided fertile conditions for earnings to soar and cash flows to recover. As expected of forward-looking markets, risk assets have rallied as investors foresaw this improvement. In early September, US equities, as represented by the S&P 500® Index, reached an all-time high. Spreads on US high yield bonds, while still above their historical lows, have retraced all the COVID-induced widening. Similar stories have played out in Europe, although Asia Pacific and emerging markets have faced a rockier 2021.

Debt has soared in the pandemic but is being supported by well-behaved debt servicing costs. Coupled with easy money, liquidity has further fuelled the appetite for risk assets. The debate about whether easy financing conditions is a positive backdrop or a recipe for excess will be with us throughout the next year. The stock of debt – from both sovereign and corporate borrowers – is at record highs as depicted in Figure 1a. On the other hand, Figure 1b shows that debt as a proportion of equity is near all-time lows. This may say more about the high valuations of equity markets than it necessarily does about corporate debt levels.

Figure 1a: Total stock of debt at record highs

Figure 1b: US corporate debt to equity at record low

How much debt is too much? Both indicators tell us little about the answer. High levels of debt mean little without understanding the ability to service that debt or the likelihood of losing access to fresh capital. Equally, debt-to-equity ratios may suggest an environment where a high degree of equity capital offers a buffer against capital losses for bondholders. In reality, it often portends excessive equity valuations and a harbinger of a cyclical turn. Previous lows have taken place ahead of the 1973 oil crisis, the 2000 dot-com crash and the 2007-09 Global Financial Crisis, where deep corrections in equity markets caused debt levels as a percentage of equity to spike higher.

Credit spreads typically exhibit a positive correlation to equity markets, and stretched valuations in either or both markets suggests caution. Economic fundamentals remain strong, however, and with the last crisis so recent, we would anticipate any sell-off in equities to be shallow and short-lived and likewise any spread widening episode in credit to be modest. Liquidity trends are likely to be the principal driver of these markets in the absence of faltering fundamentals.

Default rates are low and falling. Moody’s European and US speculative 12-month trailing default rates having tumbled from highs of 5.1% and 8.9% respectively in the past year to 3.7% and 3.1% by the end of July 2021.1 Leverage ratios (measured by gross debt divided by earnings before interest, tax, depreciation and amortisation) have reduced. Morgan Stanley noted that average gross leverage (debt to earnings) among US investment grade corporate bonds has fallen to 2.4 times earnings from closer to 3 times earnings back in 2020, while in US high yield gross leverage has fallen from 4.8 times earnings in 2020 to below 3.9 times earnings by end of Q2 2021.2 We believe momentum is likely to have persisted through Q3.

A great deal of this improvement is already reflected in spreads, which are trading towards the tighter end of their long-term ranges. For example, in early September 2021, global high yield spreads, as measured by the ICE BofA Global High Yield Index, were around 50 basis points (bps) above the five-year low of 311 bps recorded in 2018 and around 130 bps above the 233 bps historical low recorded in 2007.3 While this still offers some room for further tightening, the risk-to-reward ratio is becoming more finely balanced.

Such an environment demands a more concerted effort in terms of credit analysis. An area of focus for us is seeking to identify rising stars (issuers that are likely to see their credit rating upgraded from high yield to investment grade). The passage to a higher rating is usually accompanied by a tightening of spreads over time. Currently, a healthy spread differential exists between BB rated high yield bonds and BBB rated investment grade bonds, as illustrated in Figure 2. In fact, the ratio of credit spreads on BB high yield bonds compared with BBB investment grade bonds is towards the top of the 10-year range.

Figure 2: US BB-BBB relative valuation remains wide

Return of multiplicity

Absent a new variant, COVID is becoming less of an obstacle to the economy. So, what can intrude on the reasonably peaceful credit markets?

Politics is always an unknown quantity. There has been a notable shift in tone in China as the Communist Party cracks down on what it sees as anti-competitive areas and seeks to improve social equality. This has reverberated through sectors as investors seek to recalibrate the earnings potential of companies.

Tax increases are moving into mainstream political thinking, whether to finance structural demographic change – witness the 1.25% social care levy announced in the UK to help pay for social care for an ageing population – or the Organisation for Economic Co-operation and Development (OECD) shift on digital taxes. Arguments around raising the US debt ceiling limit, a regular event, are likely to animate the US Congress and bring a sharp focus onto debt levels more generally. These issues will likely fade, but risks exist.

The UN Climate Change Conference of the Parties (COP 26) taking place in Glasgow, Scotland, in November also highlights the growing importance of climate change and broader sustainability issues. From carbon pricing to potential methane taxes there is plenty to both raise costs for companies as externalities are priced and to create opportunities for companies that are embracing change. We see winners and losers from this and other environmental, social and governance factors.

The area most likely to challenge markets in coming months, however, is how they respond to inflation data and central bank policy. Ongoing disruption in supply chains is complicating central bank assessments of the inflation outlook. We have already seen central banks in Eastern Europe and Latin America raise interest rates this year as policy globally begins to diverge. With yields at low levels, interest rate risk becomes a greater concern within credit, even among areas where it has traditionally been less important. Deutsche Bank noted in early September that 85% of US high yield bonds had a yield below the rate of US CPI inflation.4 Markets are betting big that inflation is transitory.

Inflation – the concern that will not go away

The lazy assumption is that inflation is bad for bonds. It is certainly true that those bonds with a fixed coupon will see the real value of that coupon decline. Whether that translates to positive or negative total returns for the investor depends on other factors. What is the current yield? What is the duration of the bond? What income returns are other investment substitutes offering? Most importantly, inflation becomes a concern when it forces central bankers to become overly concerned. Tighter policy will be the most likely factor behind the cycle’s demise.

Higher inflation and higher real yields need not necessarily be bad for credit since they typically indicate a growing economy. An improving credit environment that helps to lower spreads can act as a counter to upward pressure on yields. In fact, research from Morgan Stanley compared excess returns on US investment grade and US high yield under different conditions (Figure 3) and found that rising inflation was typically positive for performance, with more mixed results from rising real yields.

Figure 3: Credit performance across different regimes

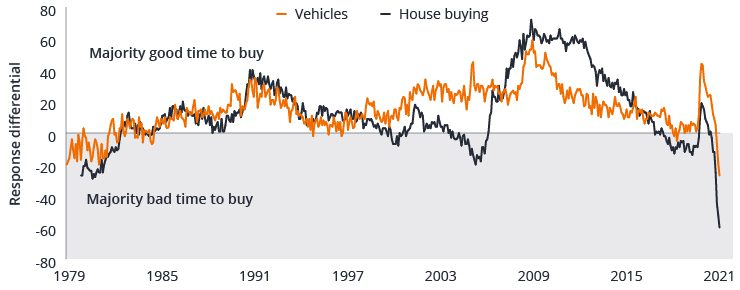

We also need to be cognisant of the impact that inflation can have on economic participants. Already, higher prices are beginning to affect consumers, as evidenced in Figure 4. Consumers are beginning to consider price rises in a negative light in terms of purchasing intentions.

Figure 4: Good or bad time to buy due to prices

Good time to buy (prices are low) minus bad time to buy (prices are high)

Inflation can be damaging if it hurts demand or policy makers react aggressively to contain it. Markets are perceiving higher inflation as transitory and appear to be judging gradual efforts by central bankers to take the foot off the accelerator (PEPP reductions by the European Central Bank, tapering by the Federal Bank of Australia and the shift in language by the US Federal Reserve) as sensible responses to an improving economy. It is an abrupt change in the narrative that typically upsets markets.

We agree that much of the shift in inflation is transitory. Should markets get spooked, we would consider it a buying opportunity. The world is awash with excess savings that typically rush back in to capture yield. A correction would certainly help us to sniff out a larger number of opportunities.

1Source: Moody’s, 10 August 2021.

2Morgan Stanley, 27 September 2021. Gross leverage is debt/ earnings before interest, tax, depreciation and amortisation.

3Source: Bloomberg, ICE BofA Global High Yield Index, 9 September 2021.

4Source: Deutsche Bank, Chart of the Day, 7 September 2021.