Portfolio Manager Jason England explains why the US Federal Reserve (Fed) had little choice but to “go big” at this week’s policy meeting and, despite the rate hike, the central bank has yet to reach peak hawkishness.

Key takeaways

- The Fed attempted to re-establish its credibility by acknowledging that the challenge posed by multi-decade high inflation requires a proportionate response.

- Despite the three-quarter point move, we doubt the Fed has reached peak hawkishness, owing to the complex nature of this bout of inflation.

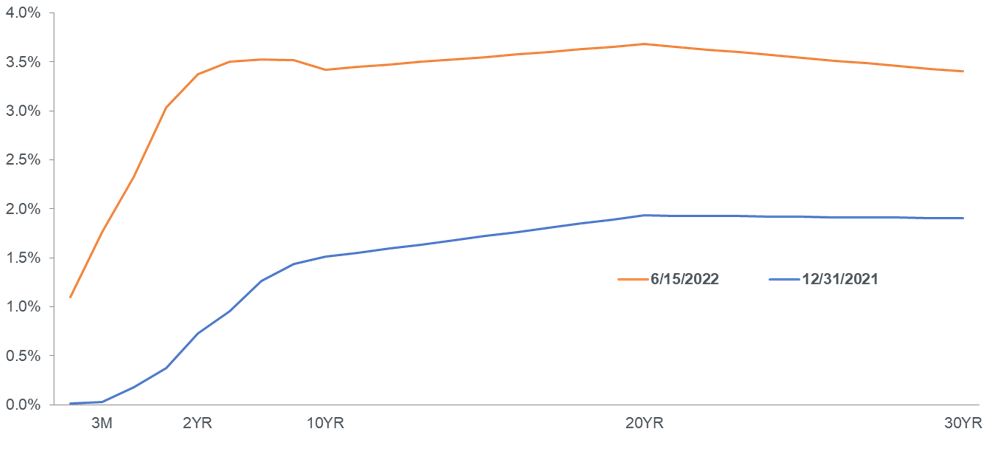

- The year’s bond sell-off has left the yield curve flatter and investors pondering what maturities offer the best risk-return profile in a still uncertain – and volatile – market.

Chairman Jerome Powell and other voting members of the Federal Reserve (Fed) had a singular objective during this week’s meeting of the Federal Open Market Committee: Regain control of the narrative that the central bank actually grasped the magnitude of the threat posed to the U.S. economy by the highest inflation in four decades and that it has the resolve to make the necessary policy adjustments to confront this challenge. Recently – and as evidenced by this year’s spectacular rise in yields across the Treasuries curve – the market has been making its own assessment of the Fed’s ability to manage inflation and guide the economy toward a soft landing.

In a bow to reality, the Fed raised its benchmark overnight rate by 75 basis points (bps) and made notable adjustments within its updated Summary of Economic Projections for policy rates, including raising its year-end 2022 forecast to 3.4% from 1.9% in March. We view these steps as necessary damage control, remedying problems of the Fed’s own doing. It botched its transitory inflation call and then inexplicably seemed to take a 75 bps move off the table at its last meeting. While we appreciate the power of forward guidance, in certain instances that tactic and being data dependent are mutually exclusive. We’d categorize 8.6% headline consumer price inflation as an outlier event, which should be met with an equally extraordinary policy response, including abandoning its heretofore methodical approach to rate increases.

A tall task made taller

The contributions to this year’s generational inflation are myriad: a post-pandemic demand surge, supply-chain dislocations, the war in Ukraine and record monetary and fiscal stimulus, including the Fed expanding its own asset base by as much as $4.8 trillion since the end of 2019. These ingredients include both supply and demand factors. Managing them through policy was always going to be a tough order – and they still are. The Fed’s call for peak inflation was premature. Consequently, we believe that even with today’s rate increase the Fed has yet to arrive at peak hawkishness. In contrast to the last meeting, Chairman Powell evaded boxing himself into a corner as he left the possibility of yet another 75 bps rate hike on the table. Possibly a lesson learned.

Source: Bloomberg, Janus Henderson, as of 15 June 2022.

Diverging views

At its March meeting, the Fed projected that the overnight rate would finish the year at 1.9%, only slightly below the 2.0% rate implied in futures prices at that time. Since then, traders have rung the inflation alarm. By Wednesday, year-end 2022 expectation in the futures market for the policy rate was 3.5%, just above the Fed’s new projection of 3.4%. Yet divergence between market views and that of the Fed remain. Of note, is the de minimis increase in the Fed’s projection for the neutral rate – the level that over the long term is neither inflationary nor weighs on employment. At 2.5%, it is still below the 3.6% projected by futures contracts with maturities of three years and longer. Much depends upon whether the Fed’s expectation for inflation, as measured by its preferred gauge, slides from 4.3% this year to 2.3% in 2024. Treasury Inflation-Protected Securities (TIPS) imply that inflation will average 4.1% over the two-year period.

Source: Bloomberg, as of 15 June 2022.

A missed opportunity

We have long stated that the bond market could absorb an orderly exit from the era of extraordinarily accommodative monetary policy as investors had the opportunity to reinvest maturing securities at modestly higher interest rates. The possibility of that scenario coming to fruition has passed, as evidenced by the Bloomberg U.S. Aggregate Bond Index’s -12.65% year-to-date return through June 14. Instead, rather than taking their cues from a circumspect Fed, Treasuries prices have paid much greater attention to surging inflation. The result is higher yields across the curve, especially along the front end, which are typically more tightly tethered to policy rates.

Source: Bloomberg, as of 15 June 2022.

Source: Bloomberg, as of 15 June 2022.

Inflation’s surge has pushed 2-year U.S. Treasury yields up by roughly 250 bps in 2022. The result has been a flattening yield curve as investors price in the likelihood of recession as the cost of capital increases. Such an outcome, however, is not our baseline scenario – at least for the near term. The economy, as reflected in Powell’s comments, remains on sound footing. Yet continued strength, especially the higher wages that accompany a tight labor market, is inflationary in its own right. When combined with supply-side factors such as lockdowns in China and commodities constraints, the inflationary outlook is far from settled. And even with today’s rate hike, the real yield – that is nominal yields minus inflation – on the 2-year Treasury is still negative. Policy is tightening but remains accommodative.

Given these factors, we believe bond market volatility will remain elevated, with the longer-dated maturities – given their conflicted view between persistent inflation and recession – likely exhibiting larger price swings than those along the front end of the curve. It is our view that this year’s fierce upward move in shorter-dated yields has left them potentially closer to what the market can expect for the trajectory of policy rates over the next 24 months. With yields between these two sets of maturities fairly close, we don’t believe the incremental yield of holding longer-dated securities is worth the elevated risks in a still uncertain macro environment.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.