Well-known and investable commodity indices such as the Goldman Sachs Commodity Index1 (GSCI) and Bloomberg Commodity Index2 (BCOM) have evolved significantly over the years. First-generation indices (1970 for the GSCI, and 1998 for BCOM) have adapted in line with changes in market volume and liquidity, the inclusion of additional markets, changes in forward curve dynamics and increased focus upon mitigating the roll costs inherent in holding a total return commodity index.

The next evolution in commodity indices available to investors will likely incorporate environmental, social and governance (ESG) factors and carbon offsetting as part of the total index construct. In this article, we consider how investors can use carbon futures, both as an active tool to help mitigate carbon emissions, and as a potential additional source of returns.

Considering carbon emissions in a commodity index

Commodities are a crucial part of the electrification of the world’s power grid. They are also crucial inputs into sectors that will, over time, reduce global carbon emissions. As such, while estimates vary widely in terms of the actual quantum of raw materials needed to build out the new energy infrastructure, there is little doubt that demand is likely to increase materially over the next two to three decades.

The major commodity indices (GSCI and BCOM) in their current form do not directly incorporate the impact of carbon emissions that result from the extraction and end use of those commodities. There are, however, ways to solve for this to some degree. An investor that is not constrained to the major indices, and who is able to invest in a more bespoke index, can achieve the twin objectives of gaining broad-based exposure to commodity markets while at the same time neutralising some or all of the carbon emissions that result from this investment.

Mitigating the carbon footprint of a commodity index

The ICE Exchange offers a futures contract (EUA Futures) that allows for the purchase and sale of European Union (EU) based carbon emission allowances.3 Incorporating this futures contract as an additional constituent in a broader commodity index would synthetically reduce the carbon emissions of those commodities held.

This leads to two questions; is the carbon futures market large enough to be considered investable, and what potential impact would this have had on a theoretical commodity index that incorporates carbon futures?

Carbon futures: A maturing market

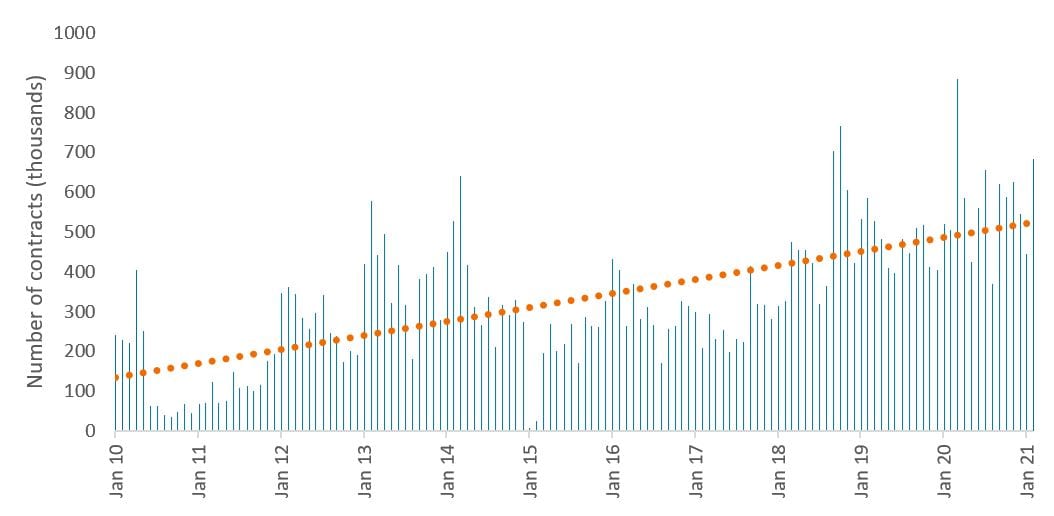

Over the past decade, the volume in the carbon futures contract has grown materially and is liquid enough to be included in a commodity index (exhibit 1). Volume is being increasingly supported by various participants and provides the potential for a greater degree of price discovery and risk transference.

Exhibit 1: Growing depth and liquidity of the EUR carbon futures market

Source: Bloomberg, Janus Henderson Investors, 1 January 2010 to 29 February 2021.

Source: Bloomberg, Janus Henderson Investors, 1 January 2010 to 29 February 2021.

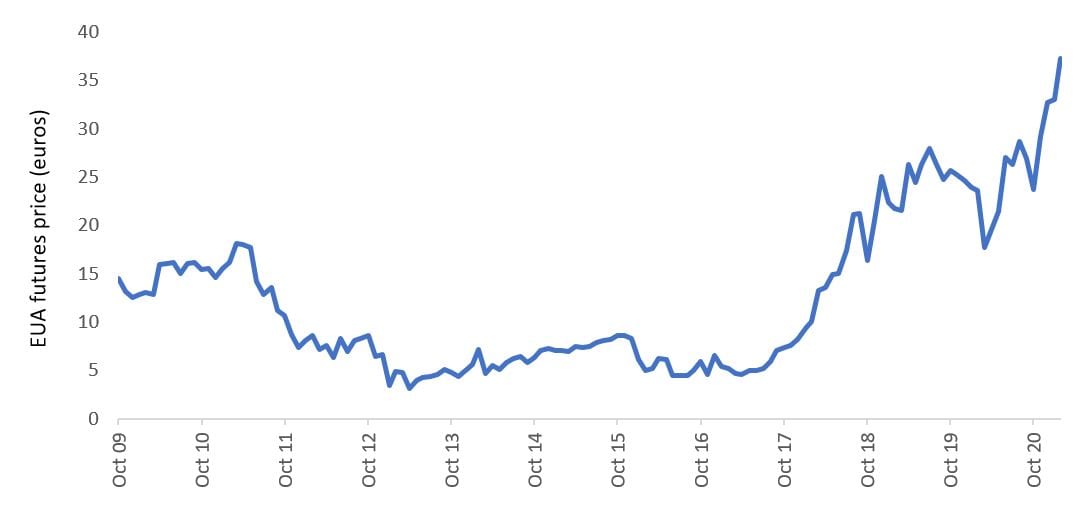

From a pricing perspective, while the initial rollout had pricing issues, more consistent regulation of supply and growing participation since 2010 has seen the market mature. More recent pricing (exhibit 2) is increasingly reflecting the growth in demand for carbon credits from various market participants, as well as the regulatory pressure from the EU to establish a soft floor price and encourage higher pricing for emissions over the next decade.

Exhibit 2: Carbon futures prices have risen sharply since 2017

Source: Bloomberg, Janus Henderson Investors, 30 October 2009 to 26 February 2021.

Source: Bloomberg, Janus Henderson Investors, 30 October 2009 to 26 February 2021.

Allocation considerations

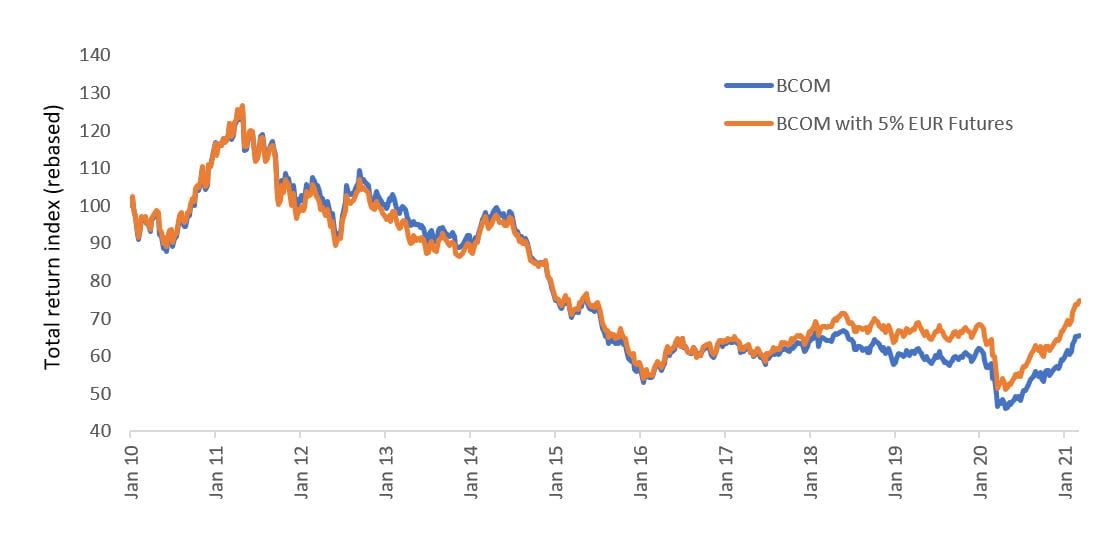

Adding carbon futures to a commodity index could help to mitigate the carbon footprint of the investment, dilute the weightings of each respective commodity, and provide an alternative and diversified driver of performance. While more detailed research is required to determine an appropriate weighting to achieve a desired outcome, and past results are no guarantee of future performance, exhibit 3 below simulates the impact of overlaying an initial 5% weighting of carbon futures (using EUR Futures) into the Bloomberg Commodity Index (BCOM) since 2010.

Exhibit 3: The impact of adding carbon futures into a commodity index

Source: Bloomberg, Janus Henderson Investors, 1 January 2010 to 5 March 2021 in euro terms. Calculated using the Bloomberg Commodity Index (BCOM) with a 5% allocation to EUA Futures. Note: This model is for illustrative purposes only. No accounts were managed using the portfolio composition and no representation is made that any hypothetical returns would be similar to actual performance.

Source: Bloomberg, Janus Henderson Investors, 1 January 2010 to 5 March 2021 in euro terms. Calculated using the Bloomberg Commodity Index (BCOM) with a 5% allocation to EUA Futures. Note: This model is for illustrative purposes only. No accounts were managed using the portfolio composition and no representation is made that any hypothetical returns would be similar to actual performance.

In recent years, this blend would have outperformed a 100% allocation to BCOM, while offering a synthetic reduction in the carbon footprint of the commodity allocation. It is our view that regulatory impetus, control of the supply of carbon credits and EU determination to set a floor in prices are all potentially supportive tailwinds for further price appreciation of carbon futures.

Conclusion

The carbon futures market is liquid and growing, and prices going forward seem supported by favourable regulatory tailwinds. We believe that commodities indices are likely to increasingly incorporate the impact and mitigation of carbon emissions as a natural part of their evolution, warranting a consideration to include carbon futures as part of a broader commodity index. Should the price of carbon futures appreciate over the medium term, this would provide a twofold benefit; a positive outcome from a carbon mitigation perspective, and an additional source of returns to the end investor.

1The S&P GSCI is a tradeable composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures, broadly diversified across the spectrum of commodities. The returns are calculated on a fully collateralised basis with full reinvestment. It serves as a benchmark for investment in commodities markets and as a commonly used measure of commodity performance over time.

2The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks the prices of futures contracts on physical commodities. The index is designed to minimise concentration in any one commodity or sector. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

3The ICE Exchange, Carbon Terminology and Product FAQ; EUA Futures Contract description.