The climate and energy transition presents a broad set of attractive, long-term growth opportunities as the world’s energy, industrial, transportation, production and consumption systems transition to a low-carbon economy. In the face of global climate change, investors are increasingly recognising and considering the climate-related negative and positive impacts of their investment decisions.

Many are choosing low carbon, climate-tilted exchange traded funds (ETFs) or Paris-aligned indices, which help investors to feel good about lowering the carbon intensity of their portfolios but we believe there is a way to do better for investors and the planet. An actively-managed, integrated approach to climate and energy transition investing should seek to go beyond simple carbon footprint measurement, alignment frameworks and clean-energy assessment. It should also aim to deliver the best risk adjusted returns, by investing in companies that are facilitating the real changes needed to achieve a net zero global economy.

Strong investor interest in climate transition

It should not be a shock to anyone that our planet is warming up quickly. Earth is made hospitable and habitable for humans and animals thanks to the regulation of atmospheric temperature by gasses such as carbon dioxide, methane, and nitrous oxide. Since we learnt that combustion of fossil fuels (wood, coal, oil and natural gas) releases vast amounts of energy, we have harnessed this knowledge to create heat, steam and then electricity for industrial development and human quality of life has improved by leaps and bounds. This same process also generates more of the gases that regulate atmospheric temperature. CO2 levels have risen from around 270 ppm (parts per million) in the pre-industrial era to around 420 ppm at the end of 2023.1 At the same time global temperatures have risen by around 1.1 degrees Celsius versus the pre-industrial average. There is now a global consensus and commitment on the need to act to limit the global temperature rise to 2 degrees, culminating in the goal of decarbonisation of the global energy supply by 2050.

An energy transition of this scale and speed is a huge undertaking and will require regulatory change to create the sticks (eg. carbon taxes), and the carrots (such as subsidies and grants) that will push and pull economic actors to reduce energy- related greenhouse gas emissions sufficiently. Huge investment is required and is already underway. Investors in companies that pivot into this activity stand to gain from the roughly US$140 trillion of cumulative investment required to adapt the global energy system, whilst those that cannot make the shift may find themselves with stranded assets leading to poor shareholder returns.

It is no wonder that interest from investors to integrate climate change factors in their portfolios is ramping up. According to Morningstar data, assets under management for EU exchange-traded funds (ETFs) tracking Paris-aligned and climate transition benchmarks increased by more than 70% from 2022 to EUR37 billion at the end of 2023.2 And a survey of institutional investors reported that 26% of European Pension Funds already employ a low carbon/climate-related index.3

Index investing alone is not the answer

While it is encouraging to see this step change in climate-aware index investing, a passive approach is unlikely to fully capture the regulatory and financial risks from the evolving climate change and sustainable investments landscape. Furthermore, without globally-accepted metrics to assess portfolio and company-level climate risk, index approaches are dependent on the creation of climate change benchmarks that can be subject to bias and opacity.

Our analysis of transition funds and ETFs in the market indicates that they are heavily tilted towards the big technology companies that dominate global markets, and tend to avoid the critical sectors such as energy and materials like steel, aluminium, copper, uranium and lithium that are essential to the delivery and facilitation of the transition. These funds also typically have little exposure to certain sectors which are key to the transition such as oil & gas, utilities or real estate, arguably sectors where making the transition is most important to society, and shareholders.

A key challenge with a pure index-tracking approach to the energy transition is that the benchmarks they employ may have data-driven exclusions or screens and suffer from being backward-looking, with potentially inaccurate or incomplete data. Forward-looking active investment informed by fundamental analysis with an element of engagement adds an important dimension that we believe increases the likelihood of optimal outcomes for both the transition and for investor returns. The inherently long-term nature and complexity of the energy transition is better suited to active management that includes all climate material sectors and considers qualitative factors like corporate culture and forward-looking transition planning alongside financial analysis.

Our transition axioms

In our view, there are key considerations that investors should recognise when thinking about climate and energy transition:

1. Low carbon footprint investing alone will not deliver the energy transition that the world needs to meet government and corporate targets for the decarbonisation required to limit global warming to 1.5 or 2 degrees above the pre-industrial revolution average.

2. There is a need for Investment in and engagement with transition companies. The energy transition will need investment in certain bridging fossil fuels. We need certain industries such as hydrocarbons for the next couple of decades to provide affordable energy and transport whilst the energy transition plays out. Forcing good companies to divest their fossil fuel assets may optically clean up those businesses in the medium term, but it does not necessarily lead to real change.

3. Active management and engagement in climate material sectors are crucial to achieving long-term value creation.

4. Trade-offs are endemic – we cannot transition without the materials provided by certain high carbon intensity industries like steel or aluminium, meaning that we may need to accept a higher level of carbon intensity today for lower carbon intensity tomorrow. From an investor perspective, one oft-perceived trade-off that is not required is a sacrifice in portfolio performance.

How to approach climate transition investing in practical terms?

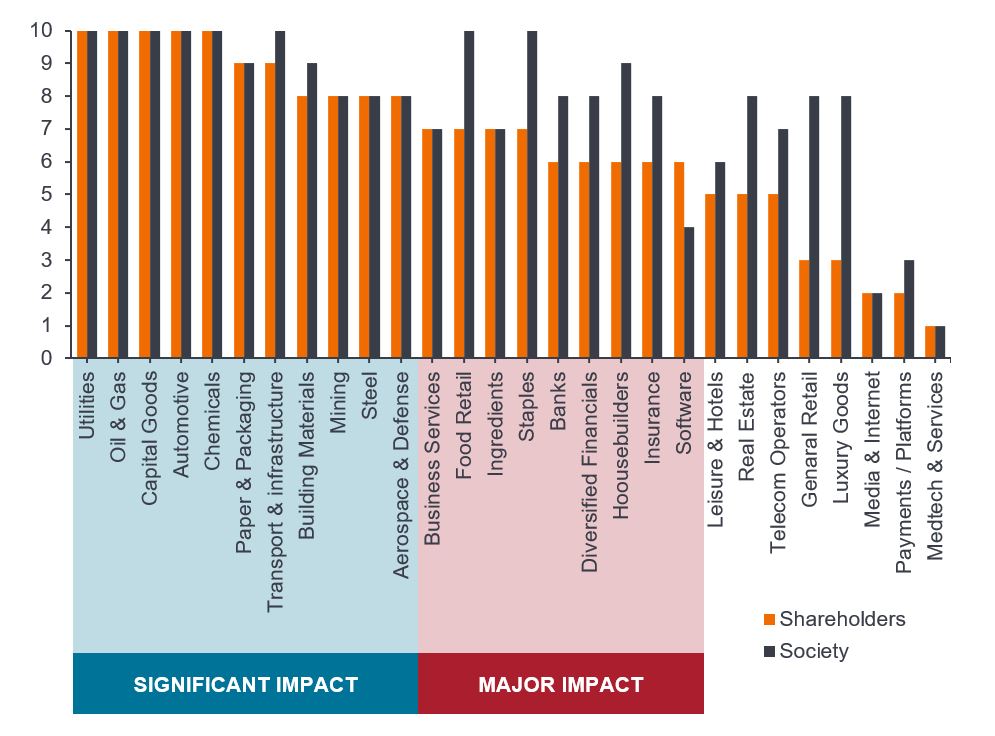

Identify the key sectors: Climate material sectors should be the bedrock of climate transition investing. For these sectors, adapting to climate change is a material factor for shareholders either because it opens up new markets and avenues for creation of shareholder value, or because it avoids punitive carbon taxes and asset stranding, which diminish shareholder value. Another dimension of a climate-material sector is where making the transition is important for society at large. Some of these are unfortunately excluded from certain low-carbon approaches to climate investing.

Exhibit 1: Both shareholders and society can benefit from climate investing

Source: BNP Exane, ‘How to be a Net Zero hero’, 30 August 2022. Scores are assigned out of 10 for the material impact and relevance of climate-material issues on shareholders and society. Used here to illustrate some of the key sectors that should form the bedrock of climate transition investing.

Within these sectors one should focus on identifying companies that are providing key inputs to the transition value chain (ie. materials, transport, chemicals, financing, technology), and companies that are in the process of transitioning towards lower carbon operations (ie. utilities, steel, materials).

Understand companies in depth and build forward-looking goals: Additionally, a good understanding informed by in-house analysis of companies’ transition readiness along short, medium, and long-term horizons to identify forward-looking opportunities, rather than focusing solely on companies with the greenest credentials today, is imperative.

There are three types of companies that play key roles in making the climate transition happen:

1 Green Solutions

Companies with revenue exposure to clean energy deployment or low emission operations eg. wind turbines, solar panels, semiconductors used in clean tech or electric vehicles, RFID (Radio Frequency Identification) tags that reduce waste, providers of renewable or efficiency technology.

Companies with revenue exposure to clean energy deployment or low emission operations eg. wind turbines, solar panels, semiconductors used in clean tech or electric vehicles, RFID (Radio Frequency Identification) tags that reduce waste, providers of renewable or efficiency technology.

2 Enablers

Providers of low-carbon critical commodities like copper or lithium, financers of low carbon or clean energy deployment, CAD software or engineering services to design industrial plant, semiconductors, providers of precision farming equipment or plant-based proteins for reducing the environmental footprint of feeding the growing world population.

3 Improvers

‘Brown to beige’ – or ‘brown to green’ – companies that provide essential goods and services like auto makers, aviation companies, electricity utilities, oil and gas producers, steel producers, or cement makers but are trying to do so with a lower carbon impact.

This approach to climate transition investing facilitates the identification of investment opportunities across the full climate and energy transition value chain.

Conclusion

The climate and energy transition presents material risks for some companies and enormous opportunities for others. An active, pragmatic approach, which accepts a somewhat higher carbon intensity profile, focused on investment, rather than solely on divestment, across climate material sectors, is an approach that improves the prospects for achieving the climate and energy transition.

Investing in companies that provide the solutions, enable those solutions and apply them to improve their own operations can achieve diversification and exposure to a range of sectors in the quest for generating the best risk-adjusted returns for investors. Crucially, adoption of this approach means investors can both do good and feel good, as we strive towards a brighter future for all.

1 NOAA Global Monitoring Lab: No sign of greenhouse gases increases slowing in 2023, 24 April 2024.

2 https://www.responsible-investor.com/assets-of-eu-climate-benchmark-etfs-nearly-double-in-2023/

Brown industries: the highest carbon-emitting sectors such as miners, oil & gas companies, construction.

Carbon tax: a fee imposed on the burning of carbon-based fuels (coal, oil, gas) that aims to reduce and eventually eliminate the use of fossil fuels.

Paris-aligned portfolio: a portfolio that aligns with the goal of achieving net–zero emissions by 2050. The Paris Agreement’s main goal is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees.

Index funds/approach: an investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold, The opposite of active investing.

Stranded assets: assets that suffer unanticipated or premature write-downs, devaluations, or conversions to liabilities due to climate change-related impacts.

There is no guarantee that past trends will continue, or forecasts will be realised.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.