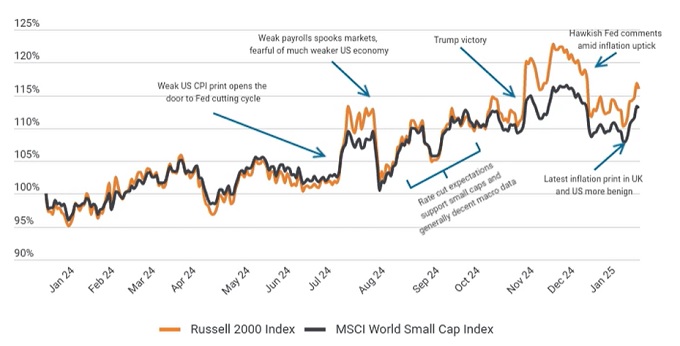

Source: Refinitiv Datastream, rebased to 100, Janus Henderson Investors Analysis, as at 30 December 2024. Indices used: Russell 2000 Index and MSCI World Small Cap Index.

Past performance does not predict future returns.

The second half of 2024 saw clients warming to the idea of allocating to small caps from an underweight (or zero) holding. But hotter inflation data in December, and the resulting yield spike, saw a pause in that shift in allocations. After that December bump, the latest Consumer Prices Index (CPI) prints in the US and UK once again came in weaker (lower) than expected in January.

While the pace and scale at which CPI has come down may not be large enough to declare victory over inflation, it is enough to change the market narrative somewhat. This was echoed by comments from US Federal Reserve (Fed) Governor Waller, who argued that the Fed could potentially make three or possibly even four cuts in 2025, if the data cooperated – starting as potentially early as March.

Falling interest rates tend to benefit small caps, for a variety of reasons:

- Cheaper debt financing costs

- Higher growth as sentiment improves towards the economy

- Greater risk appetite and a consequent shift in allocations towards small caps.

“When it comes to inflation and small caps, we believe that direction of travel is more important than scale. We expect to see higher volatility in inflation data this year, a characteristic of previous cycles when inflation has been at these levels. However, we believe we remain in a cutting cycle, with the case for small cap investing very much intact.”

– Nick Sheridan, Portfolio Manager

Consumer Price Index (CPI): A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate inflation.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures.

MSCI World Small Cap Index: An index of nearly 4000 stocks that captures the representation of smaller companies across 23 developed market countries.

Russell 2000 Index: An index that measures the performance of the 2000 smaller companies included in the Russell 3000 Index.

Small caps: Companies with a valuation (market capitalisation) within a certain scale, eg. $300 million to $2 billion in the US, although these measures are generally an estimate. Small cap stocks tend to offer the potential for faster growth than their larger peers, but with greater volatility.

Underweight: To hold a lower weighting of an individual security, asset class, sector, or geographical region than a portfolio’s benchmark.

Volatility: Measures risk using the dispersion of returns for a given investment.

Yield (yield spike): The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

IMPORTANT INFORMATION

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. The information in this article does not qualify as an investment recommendation. There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.