Knowledge. Shared Blog

September 2019

Catching Falling Angels: Finding Opportunities in Crossover Credit

Brent Olson

Brent Olson

Portfolio Manager | Credit Analyst Seth Meyer, CFA

Seth Meyer, CFA

Portfolio Manager

A growing segment of BBB rated securities are priced to fall into the high-yield market. In our view, this trend could create opportunities for investors who are willing to look across both the ratings spectrum and credit sectors, say Portfolio Managers Seth Meyer and Brent Olson.

Key Takeaways

- Many well-known BBB rated U.S. companies are trading at levels that imply a fall from BBB to BB is imminent, which would add them to the currently shrinking high-yield market.

- Many of these companies have numerous options available to help preserve balance sheet flexibility.

- In our view, high-yield investors may find attractive risk-adjusted return opportunities by looking across the rating spectrum.

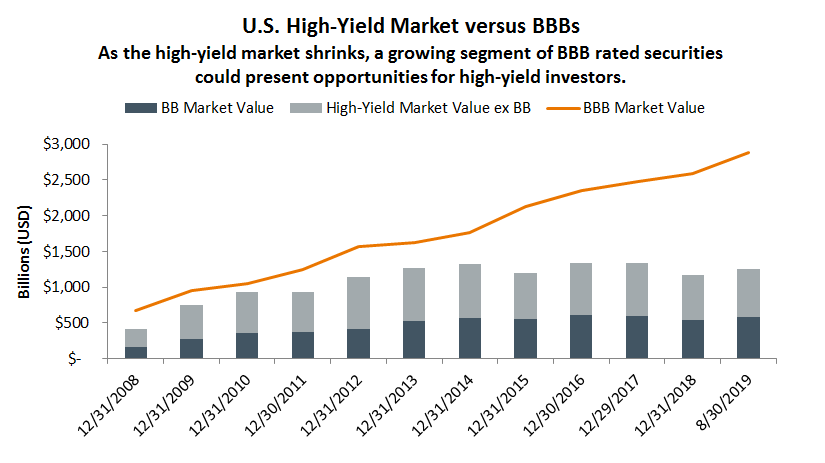

Between the investment-grade corporate bond market and the high-yield market lies the crossover market — a rapidly growing segment of BBB rated securities that is fertile ground for investors looking for attractive yields.

Source: Bloomberg Barclays

The U.S. investment-grade corporate market continues to increase in absolute size, driven largely by the BBB rated category of the market: More than half of the new issuers coming to the market are rated BBB. The weaker global economic outlook, together with increasing leverage and an onslaught of mergers and acquisitions in this rating segment, are weighing heavily on these investment-grade issuers, shifting the market consensus to expect many of the more “stressed” issuers to be downgraded.

Currently, a number of large and well-known BBB rated U.S. companies across a variety of sectors (from autos to technology) are trading at market levels that imply a fall from BBB to BB is imminent, which would remove them from the investment-grade market and add them to the high-yield market (thus their nickname, “falling angels”). Is this creating an opportunity? We think so.

In some cases, BBB companies at risk of being downgraded are priced below the aggregate level of BB bonds in their sector, implying not only the certainty of being downgraded, but also the potential to be downgraded even further. We believe these prices are the result of a supply/demand imbalance in the BBB segment in combination with a dearth of high-grade research resources within high-yield managers and a “forced-to-sell” mentality among high-grade managers who are loath to hold a security that may fall out of their index. Many of these BBB companies are very large companies with numerous options available to them to preserve balance sheet flexibility.

We believe many high-yield investors are ignoring attractive risk-adjusted total return opportunities at a time when the high-yield market is shrinking in absolute size. In our view, investors may be able to take advantage of these inefficiencies by looking at issuers in multiple sectors across the rating spectrum.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Bond ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox