Turning the tide

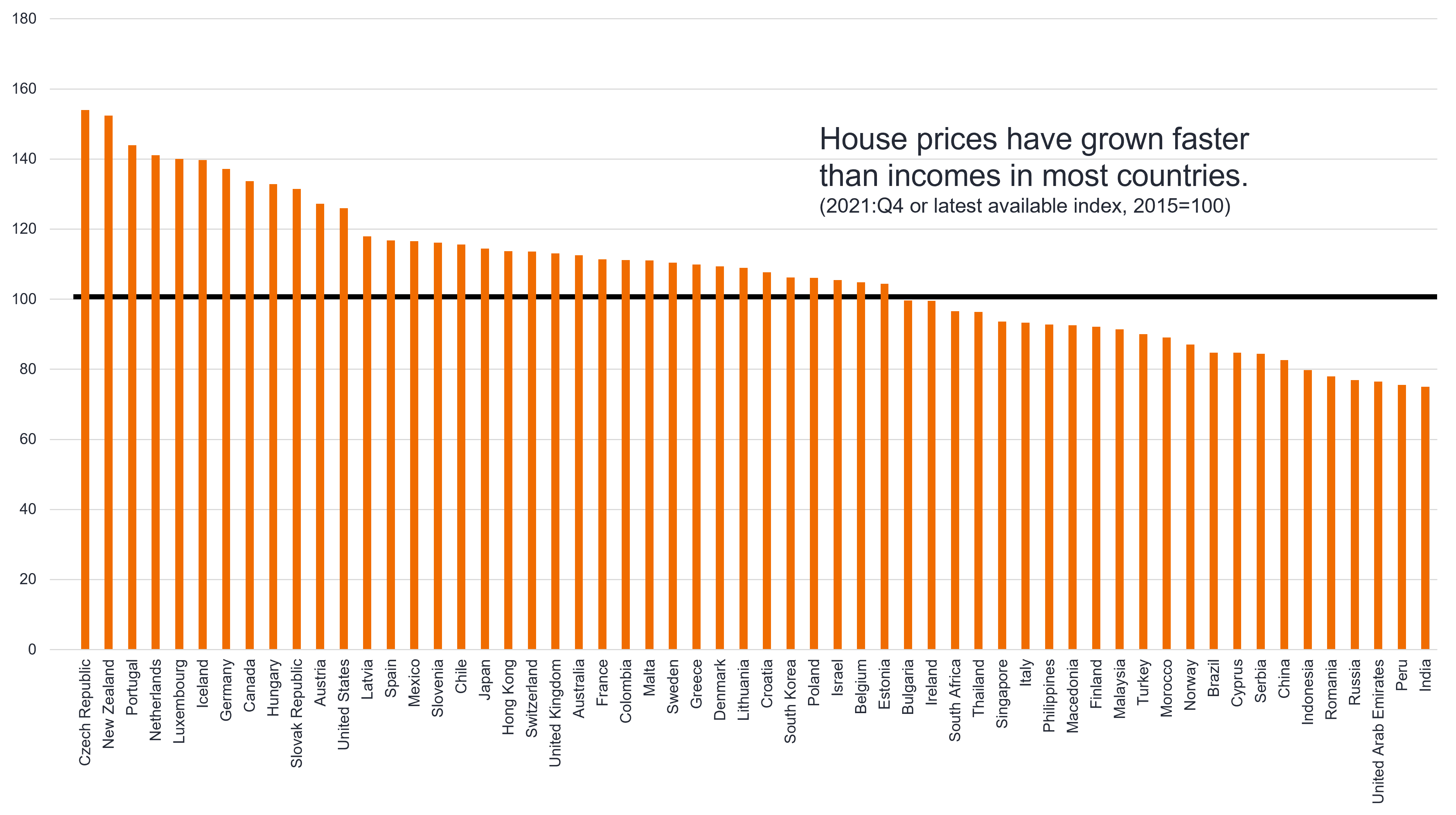

The urbanisation of cities across the globe has seen demand for housing far outstrip supply. It’s led to an explosion in property values and rents, as well as exacerbating shortages.

With modest wage growth in many countries simply unable to keep up, this has created an undesirable situation that stands to entrench inequality.

Chart 1: House price-to-income ratio around the world

Source: Bank for International Settlements and World Economic Outlook. As at 22 September 2022.

While tailored solutions for each location will be required, social, sustainability, and sustainability-linked bonds stand to play a pivotal role in alleviating some pressure.

Housing affordability: by the numbers

|

How bonds support Australia’s housing market

In Australia, housing affordability is felt acutely across the country, especially in capital cities like Sydney and Melbourne. This has prompted the Federal Government to recently announce a $10 billion Housing Affordability Fund to help address the issue.

If passed by Parliament, the Fund will bolster the Government’s existing support measures which already include funding for the National Housing Finance and Investment Corporation (NHFIC) and providing credit for loans issued by the Affordable Housing Bond Aggregator (AHBA).

These low-cost and long-term loans are provided to registered community housing providers with lower interest rates. Discounted rates can only be offered because the NHFIC issues bonds to raise the capital needed to fund the AHBA’s loans.

In 2021-22 alone, the NHFIC approved $509.3 million of new loans to community housing providers, saving them an estimated $96.2 million in lower interest and fees and enabling the construction of 3,296 social and affordable homes3.

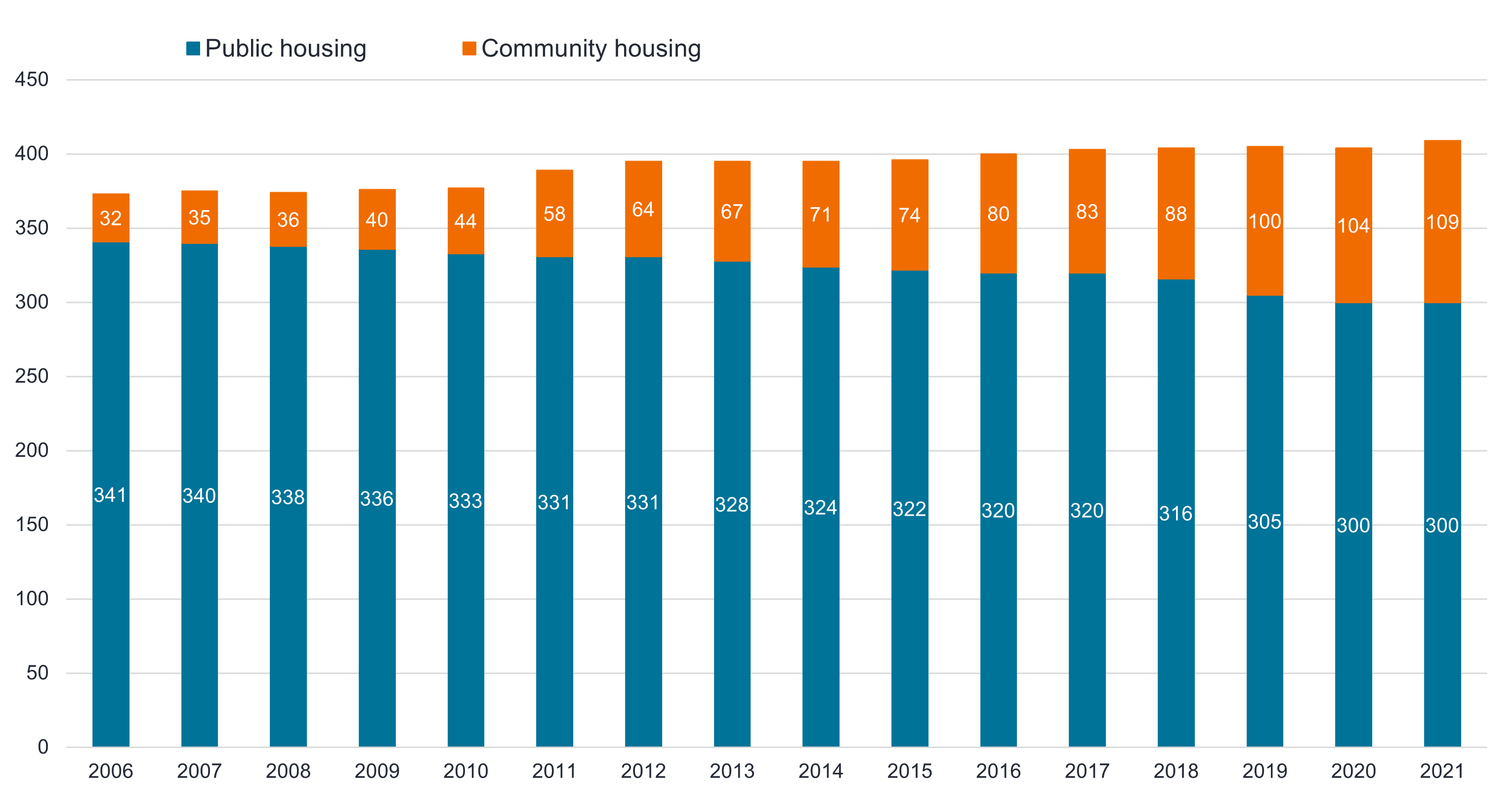

Chart 2: Australian community and public housing stock

Source: Australian Institute of Health and Welfare. As at October 2022.

Pacesetters reveal growth pathway

While the Australian subsidised housing sector is nascent, it is growing in line with other markets, including the UK and US, where large institutional investors are driving activity.

In the UK, approximately 70% of the capital to build affordable housing is currently sourced from private financing, up from 30-40% in the 2000s. In the US, annual transaction volumes are approximately $US36 billion in 2021, up from $US1.3 billion in 20114.

Building dreams: The case for social bonds

Affordable housing is a basic human need that has become increasingly difficult to access for many. While more investment is flowing into subsidised housing, substantially more is required to keep pace with demand. With issuers increasingly turning to sustainability bonds to create affordable housing supply, it presents an opportunity for investors of all kinds to participate in a growth area.

Introducing Sustainable CreditOur new active ETF, the Janus Henderson Sustainable Credit Active ETF (ASX:GOOD) is poised to capitalise on this growing segment of the fixed income market, which can deliver financial returns, while also seeking to do some good in the world. |

For important product information and disclosures such as PDS and TMD, please visit: https://www.janushenderson.com/en-au/investor/product/sustainable-credit-fund/

- What has caused the global housing crisis – and how can we fix it – WEF

- Demographia International Housing Affordability – Urban Reform Institute

- NHFIC Social Bond Report 2021-22 – NHFIC

- International Capital Flows Into Social and Affordable Housing – NHFIC