We asked in February ‘are we nearly there yet?‘ regarding the increased opportunity we saw in the listed real estate market as we approached an inflection point in interest rates. Today, we have greater conviction in saying that the answer to that question, for most parts of the real estate market, is yes!

With peak interest rates now behind us and rate cuts from the European Central Bank, Bank of England and central banks in Sweden and Switzerland, the outlook has already begun to shift more positively. We believe today there are some compelling reasons advocating an investment in this under-owned asset class. Here, we highlight some of the ‘green shoots’ that are currently growing in European listed real estate:

Green shoot 1 – Property valuations are beginning to stabilise & fundamentals remain strong

One key observation that supports a more positive backdrop for the asset class is that underlying property valuations look to have passed the worst. While transaction volumes remain thin, there are increasingly positive signals in transaction markets across most subsectors as bid-ask spreads narrow, particularly in structurally-supported sectors. While an increased cost of capital is here to stay, falling inflation and greater visibility on funding costs are supportive of a stabilisation in asset values, which can help rebuild investor confidence. This was a consistent message conveyed in the H1 results season from management teams across many areas of the European real estate market:

“Property valuation turned positive, being up 2.0% like-for-like over six months”

– Klepierre (European shopping centres) H1 2024 results

“Valuations have stabilised with the UK seeing its first increase since the cycle turned in 2022”

– SEGRO (European industrial/logistics) H1 2024 results

“The devaluation cycle is coming to an end in the foreseeable future and we are seeing a revival on the transaction market.”

– LEG (German residential) H1 2024 results

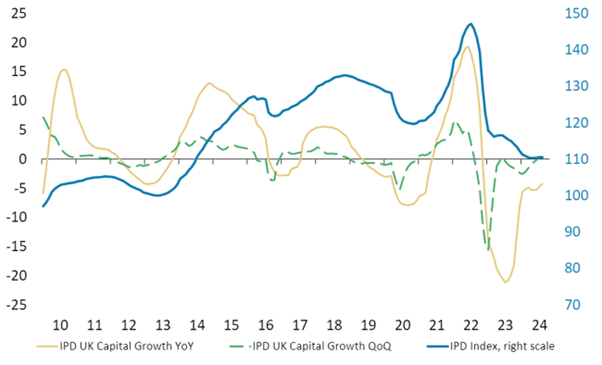

It’s also backed up by data from MSCI IPD looking at the UK commercial real estate sector, which shows that the first quarterly increase in property values since 2022 has now been recorded.

Chart 1: MSCI IPD All-UK Commercial Property Index, monthly index progression

Source: MSCI IPD, Morgan Stanley Research, as of 31 July 2024. YOY= year-on-year; QoQ= quarter-on-quarter. Past performance does not predict future returns.

Operational fundamentals in most property sectors also remain well underpinned with solid demand (high occupancy) meeting limited new supply, supporting the outlook for more sustained rental growth that can outpace the headwind of increasing funding costs and hence likely lead to earnings and dividend growth in the future.

Green shoot 2 – Increased opportunity for REITs to position for growth

We’ve spoken about this being a market of ‘winners & losers’ both in terms of real estate sectors and assets, as well as cost and access to capital. On the latter point, REITs have continued to demonstrate their ability to access debt markets, both through banks and bonds this year, with credit spreads continuing to tighten further. This has helped to alleviate many of the balance sheet concerns that hung over the sector in 2022 and 2023.

Chart 2: Real estate credit spreads normalising

Source: BofA Global Research, Bloomberg as of 19 August 2024. Bps= basis points; 1 bp = 0.01%. Past performance does not predict future returns.

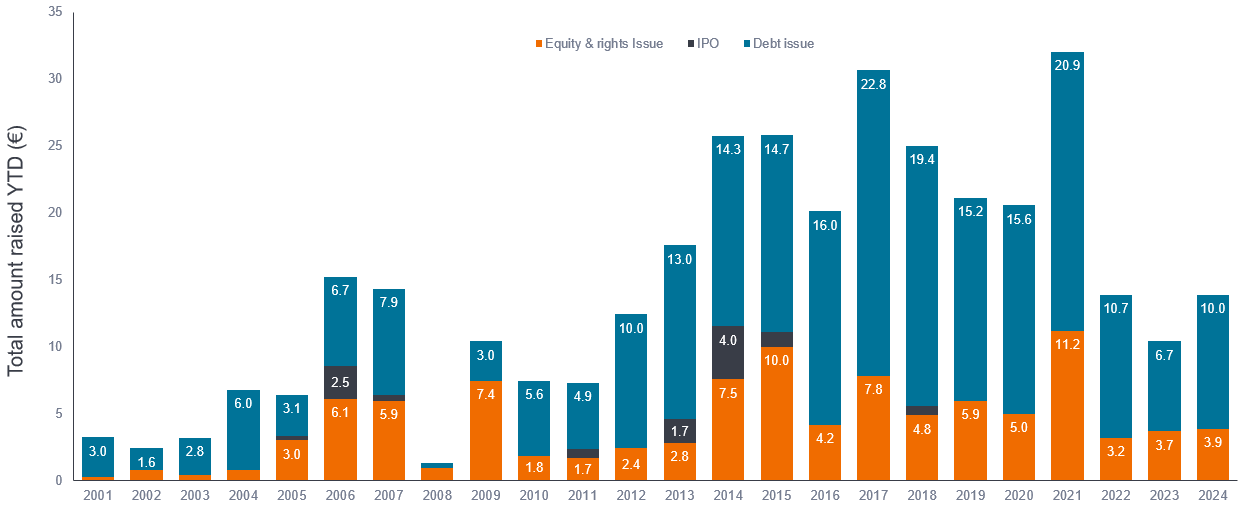

In addition, we are seeing more companies approaching shareholders to raise additional equity to help accelerate their growth. Notable activity so far this year includes SEGRO’s GBP 900m issuance, Unite Group’s (UK student accommodation) GBP450 million raise, Great Portland’s GBP 350m raise and Merlin Properties EUR 921m raise. Chart 3 shows that the listed sector has already surpassed 2022 and 2023 levels of capital raising in the first seven months of the year, providing fuel for growth. These raises have generally been well supported by a wide range of investors and have traded well from issue price.

We have supported many of these raises and are encouraging companies to emerge from this downturn on the front-foot, to leverage their operational platforms and to take advantage of accretive investment opportunities that may occur.

Chart 3: Capital raised in European real estate

Source: EPRA, S&P Capital IQ. Total amount raised year-to-date to 31 July 2024. Past performance does not predict future returns.

Green shoot 3 – REIT shares up but still remain attractive

Today, despite the strengthening outlook and robust company fundamentals, European property shares continue to trade at wide discounts relative to bottom-of-the-cycle asset values, presenting opportunities for a further repricing. As investor confidence picks up there is now an opportunity to invest in real estate at still attractive prices at a time when underlying property valuations are stabilising, transaction activity is picking up, and REITs enjoy a cost of capital advantage.

To summarise, our observations are leading us to be increasingly confident that underlying property valuations for REITs are bottoming and companies are positioning themselves on the front foot to take advantage of attractive opportunities that may appear. Investors who are seeking an asset class that can deliver consistent income, portfolio diversification and defensive growth may want to align with our thinking.

MSCI’s IPD UK Monthly Property Index tracks the performance of retail, office and industrial properties. The index includes data on actual property transactions from institutional investors and property companies. The IPD UK index is the standard benchmark for investors to analyse the performance of property in the UK market.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders.

Bid-ask spread: the amount by which the ask price exceeds the bid price for an asset in the market.

Credit spread: the difference in yield between securities with similar maturity but different credit quality, often used to describe the difference in yield between corporate bonds and government bonds. Widening spreads generally indicate a deteriorating creditworthiness of corporate borrowers, while narrowing/tightening indicates creditworthiness is improving.

Diversification: a way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Dividend: a variable discretionary payment, typically cash, taken from the company’s profits to reward shareholders for investing in the company.

IMPORTANT INFORMATION

There is no guarantee that past trends will continue, or forecasts will be realised.

REITs or Real Estate Investment Trusts: invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.