Bond markets had been relatively calm of late, but as time progresses, markets are increasingly skittish about slowing economic growth, the future path of cash rates, deteriorating labour markets and rising corporate defaults. For investors, key considerations include:

- Watching the labour market, not inflation, as this is what matters hereon. Forward indicators are weakening.

- Markets can, and do, re-price the future path of cash rates very quickly. The best fixed interest returns (duration) occur swiftly; equally, this can reverse if markets overshoot as they often do.

- Choosing duration carefully and being nimble enough to add and reduce promptly is critical. A tactical approach is best placed to navigate this cycle. Yield curve positioning matters most just before (and during) a rate cutting cycle, as different tenors perform differently.

- Credit default risks are nuanced in this cycle, as higher quality segments are fundamentally very strong. Lower down in credit quality, highly leveraged and cyclical consumer exposed companies are disproportionately vulnerable to defaults. Defensive instruments, such as credit default swap (CDS) protection and spare liquidity, can be valuable in times of uncertainty.

- Being prepared to add risk swiftly using a total return approach encompassing move, roll and carry (MoRoCa), even when the environment appears bleak, can be valuable. This will ultimately serve investors best in achieving strong returns.

The calm turning to the storm

It’s been over two years since investors witnessed one of the biggest lifts in bond yields in over four decades, and subsequently the largest repricing of fixed interest as an asset class. Since then, there’s been a lot of talk about fixed interest allocations: Whether investors are best served by being active or passive, whether duration is a valuable attribute, whether public or private markets provided the best risk adjusted returns for investors, and which segments of the credit markets were most attractive.

The reality is that for the most part, the last couple of years has been a benign environment for returns from the asset class, notwithstanding some elevated volatility along the way. And returns from each segment of the fixed interest market have been almost boringly as expected. Of course, there’s also been good market opportunities to enhance returns through active managers who were willing and able to utilise a full spectrum of active strategies including unconventional levers such as dislocated interest rate swap markets.

However, we believe things are going to get very interesting again for fixed interest investors. And it’s time to get focused, active and get portfolio positions in shape.

Central banks juggling multiple balls, but attention shifting quickly to one in particular

Most central banks have dual or triple objectives. In the Reserve Bank of Australia’s (RBA) case it is inflation and employment. In the most recent period, the almost sole focus has been on fighting inflation, which in itself was a biproduct of the disruptions caused by the pandemic, a range of contributing fiscal and other government policies such as migration. Whilst inflation had peaked and well on its way down, markets had remained unconvinced that monetary policy was tight enough for inflation to return to the target 2-3% band.

Monetary policy has long and variable lags. We have long argued that its impact can continue to work through the economy 12 to 24 months after the last phase of interest rate rises. And if the trend is heading in the right direction, it is a matter of when, not if, inflation gets back to target. Inflation will mathematically fall through the passage of time. Importantly though, the focus should rightly shift to the impact of the recent tight monetary policy on growth and labour markets in particular.

Unemployment is a lagging indicator, but many leading indicators of the labour market have already turned down, both here and abroad. Moreover, the central bank can and often does ease monetary policy before inflation itself is back within target bands, as weak demand will naturally address inflation. But at the detriment of labour markets. And the RBA will respond to this by commencing an easing cycle.

So, one single ball up in the air to watch is the labour market.

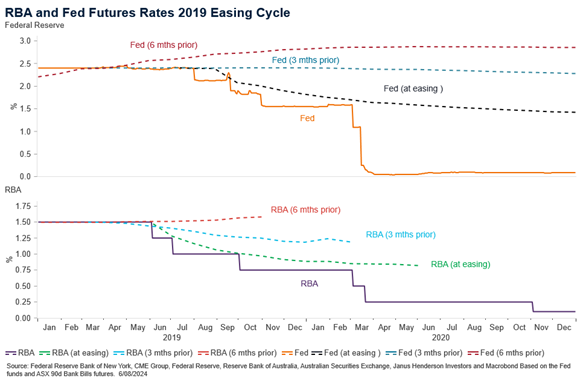

Markets rarely get it right, until they do

Bond markets will make many attempts to price in the future path of cash rates. Mostly incorrectly, but they do get it right eventually. It wasn’t long ago that markets lurched from pricing in some easing in monetary policy to reflect a need for some hiking and now back to an easing cycle reflecting the switch from a preoccupation on inflation to now labour markets. Today in Australia markets have priced in with certainty an easing cycle commencing November and a total 110 basis points (bps) of cuts by late 2025. In the US, markets have priced in a cut of 50bps next month and 225bps by end of 2025.

For investors, what matters ultimately is not the actual central bank policy changes but rather market expectations. It is this that drives bond yields and fixed interest returns. More often than not, markets will price in a full cycle before the central bank even gets started on policy changes. From an investment return perspective, much of this is delivered when expectations shift, and very little when the actual cutting cycle commences.

So, the million dollar question is whether the market has now priced in a full easing cycle? The answer depends on one’s assessment of the growth slowdown underway and how much deterioration of the labour market is likely to eventuate. We are of the view that the cycle, at least in Australia, priced in thus far is insufficient and we focus not just on the terminal rate but also neutral rates after this cycle.

Credit risks a nuanced consideration this time

As the economic and business cycle nears the latter stages, any slowdown in economic growth, softening of labour markets, will inevitably impact corporate earnings adversely. This cycle will be no different. However, the starting point is worthy for assessing different segments of the corporate debt market. To put some context, corporates in Australia and abroad were healthy, making adequate profits prior to the pandemic. During the pandemic, these very companies shifted upward to making abnormally high profits, aided by both arms of policy (monetary and fiscal) and a resumption of demand. Inflation on nominal revenues also assisted the bigger, stronger companies, from a credit standpoint, in gaining market share and achieving margin expansion.

Today, investment grade companies for the most part remain well funded with debt termed out, highly profitable but slowing, and relatively resilient from a fundamentals perspective to an economic growth slowdown. We see profits as moderating rather than falling precipitously. The same is not precisely true for the small, medium enterprise (SME) segment. Nor is it true for highly leveraged and / or cyclical, consumer centric businesses. It is fitting then that a default cycle has commenced in Loans, High Yield and pockets of private credit across the globe. Domestically this was most visible in SME delinquencies. It was initially centred around the property construction sector, but is now widening to hospitality, domestic tourism and other consumer segments.

Not all default cycles end in a crisis for credit markets. This cycle would suggest that the actual defaults in investment grade companies should remain quite low but elevated in higher yielding segments. But rather than spike uniformly we are more likely to see a rotation of defaults from industry to industry within lower quality credit keeping the defaults rolling over multiple years. And recovery rates in these lower quality segments are being realised at lower levels than the past, for the reasons well telegraphed. Of course, market dislocations can occur with concerns around defaults lower down in credit markets, and cause mark to market underperformance in higher quality credit. We would assess these events as opportunities to add without fear to investment grade credit.

Overall, higher quality credit in the investment grade space remains the sweet spot for investors delivering healthy additional yields. However, for the sticker yields of lower credit quality, higher yielding segments need to be adjusted down for defaults, and loss given defaults, to make an accurate assessment from a relative value perspective. The relative value of higher beta segments of the credit market currently remains less compelling from a relative value perspective in our assessment, but a widening of credit spreads in this area would be valuable entry points for investors. We remain ready to allocate swiftly.

Time to get active and portfolios into shape

Tail ends of economic and market cycles have always been volatile, with investors seeking duration, flight to quality of risk free assets and high compensation for default risk. Liquidity can also become fleeting in an environment of uncertainly.

In order to preserve capital and also extract good returns in this environment, one must not passively sit on the sidelines. This is the wrong part of the cycle to be driven by the blind construction of benchmarks. Firstly, to safeguard portfolios and lift the desired defensive attributes, levers such as active management of duration, yield curve positioning and credit protection through the CDS market can be invaluable. Secondly, we are confident dislocations will occur and opportunities will be thrown up. Again, actively utilising a full spectrum of levers in inflation linked bonds, bond/swap & bond/semi-government spreads, corporate and asset backed betas including global loans, high yield, emerging market debt can further drive prospective return outcomes. Individual industry positioning will become important if markets dislocate more meaningfully.

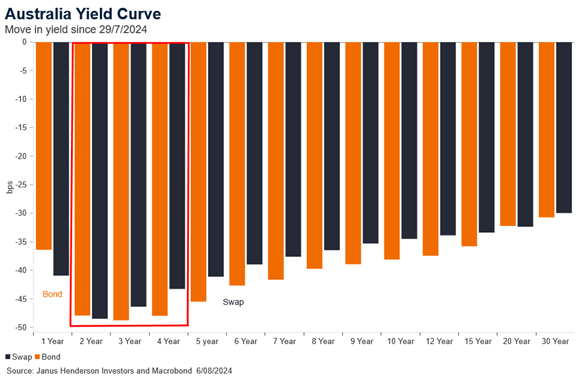

To provide a simple example of the need for actively selecting a portfolio’s exposure in a targeted way, one needs to look no further than the events of the past month. Bond yields in selected tenors have rallied much more than others which happens every time in this part of the cycle. A portfolio with even two years of duration in the right parts of the yield curve outperformed a portfolio with four years of duration.

Managing duration is more complex than most think. Not only is getting the direction of yield movements important, but the selection of tenors can also drive the success or failure of the position. Further, should bond markets overshoot to the downside in yields, which is very possible during the tail end of cycles, it is equally important to cut duration briskly and potentially move underweight. The timing, sizing, and choice of duration across the yield curve all matter for investor return outcomes. So does the choice of expressing duration through government bonds or interest rate swaps as the chart above illustrates.

Key consideration for investors include:

- Choosing duration carefully and being nimble enough to add and reduce promptly,

- Yield curve positioning matters most just before a rate cutting cycle,

- Defensive instruments such as CDS protection and spare liquidity can be invaluable during times of uncertainty, and

- Being prepared to add risk using a total return approach utilising move, roll and carry (MoRoCa) even when the environment appears bleak can add the best value.

It is time to get truly active and shuffle defensive portfolios into shape, if they’re not already in shape, in order to navigate the coming volatile period in bond markets. Early and decisive action will ensure the best outcomes for investors through to the other side.