Knowledge. Shared Blog

October 2019

As Bond Volatility Rises, Mortgage-Backed Securities May Provide Defensive Diversification

Nick Childs, CFA

Nick Childs, CFA

Portfolio Manager | Securitised Products Analyst John Kerschner, CFA

John Kerschner, CFA

Head of US Securitised Products | Portfolio Manager

As corporate and government bond markets become increasingly volatile, mortgage-backed securities – whose risk premium or spread has historically been uncorrelated with corporate credit spreads – may provide diversity of returns.

Key Takeaways

- As the outlook for global economic growth remains uncertain, we believe corporate and government bond markets may become more volatile in the coming months.

- The spread between U.S. corporate bonds and MBS remains at historically tight levels, with MBS trading wide relative to their spreads over the past five years and corporate bonds trading tight.

- MBS have demonstrated their defensive capabilities across a variety of market conditions and may provide diversity of returns in the current environment, particularly as it relates to corporate bond exposure.

In August, the Institute for Supply Management’s (ISM) Manufacturing Index, which is an indicator of recent U.S. economic activity, unexpectedly fell below 50 – signaling contraction – for the first time in three years, then dropped again in September, accelerating concerns about the extent of the current U.S. slowdown. In the context of ongoing global trade disputes, continued economic weakness in Europe and Asia, and relatively tight spreads in corporate bond markets, we believe the coming months may see more volatile corporate and government bond markets.

One approach to navigating this challenging environment is to seek broader diversification, particularly as it relates to corporate bond exposure. In our view, U.S. agency mortgage-backed securities (MBS) – which have historically generated returns that are positively correlated with corporate spreads and have demonstrated their defensive capabilities across a variety of market conditions – may fit the bill.

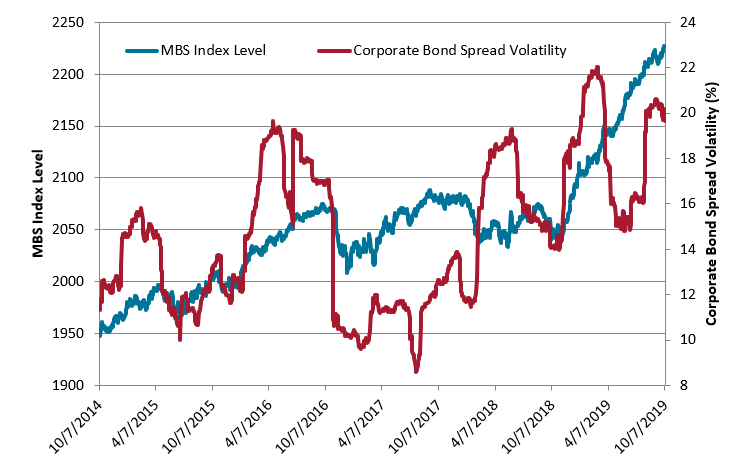

As corporate spreads widen in risk-averse markets, MBS spreads have tended to widen less. While the correlation is modest (0.44 for the past five years ), it is significantly higher than zero and has not been negative in the past five years. Furthermore, MBS has tended to perform well when corporate credit spread volatility has risen (see figure 1). Given the range of factors driving each market, the relationship is striking: MBS normally sees strong return gains during periods of high corporate bond volatility, with early 2018 being the only recent exception. Should economic uncertainty cause corporate bond volatility to rise, MBS may well provide diversity of returns.

Figure 1: MBS Index Relative to Corporate Bond Spread Volatility

Source: Bloomberg. The above chart compares the price level of the Bloomberg Barclays U.S. MBS Index with the volatility of the Option-Adjusted Spread (OAS) of the Bloomberg Barclays U.S. Corporate Bond Index.

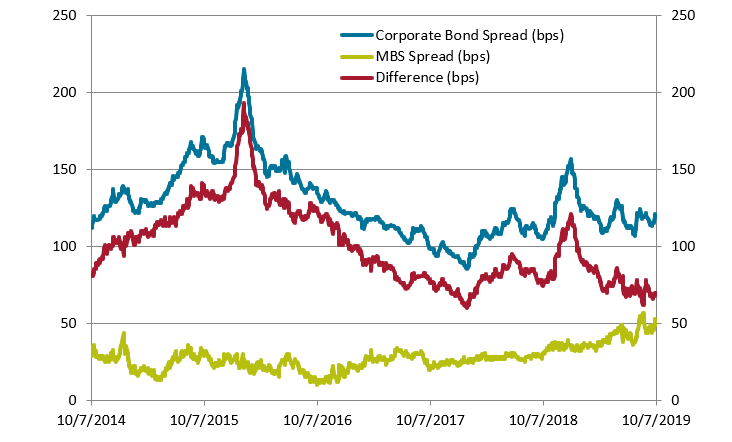

Meanwhile, the difference in spread between U.S. corporate bonds and MBS remains at historically tight levels. As can be seen in Figure 2, the difference between the higher-yielding corporate bond and MBS is near the lows set in early 2018 and well below the highs set in early 2016. The narrowing between the asset classes is largely due to widening in MBS spreads over treasuries, as corporate bond spreads have been relatively unchanged (though volatile) over the past few quarters. As such, MBS are trading wide relative to their spreads over the past five years, while corporate bonds are trading tight. Thus, in our view, on a relative risk/reward basis, MBS look attractive.

Figure 2: Corporate Bond Spreads Relative to MBS Spreads

Option-Adjusted Spread. Source: Bloomberg, as of 10/7/2019

MBS are also likely to be supported by improving technical factors in the months ahead. In August, MBS generated a positive absolute return but had their worst performance relative to U.S. Treasuries in over four years on the back of rising interest rate volatility and a surge in mortgage supply.

August also marked the fourth-largest month of mortgage supply and the strongest month of relative annual supply in 20 years. But supply is highly cyclical – the large volumes seen in August are largely digested, and we expect supply will taper off in the fall and winter months. And given the relative attractiveness of MBS to corporate bonds, we expect demand for MBS should increase over the same months, correcting the historically tight spreads between the two asset classes.

In the current economic and technical environment, MBS look well positioned to provide investors defensive diversity should volatility in the government and corporate bond markets rise.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Option-Adjusted Spread (OAS) measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option.

Bloomberg Barclays U.S. Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market.

Bloomberg Barclays U.S. Mortgage Backed Securities (MBS) Index tracks the performance of U.S. fixed-rate agency mortgage backed pass-through securities.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox