Much has been discussed about duration lately with a growing consensus that the time is right to add meaningful duration to portfolios. We’re not sure it’s that straightforward and would like to share:

- Defensive attributes of duration, whilst compromised for a period, have now been restored

- Timing duration is complex, markets give investors a second chance

- Turning points are highly volatile, even professional managers struggle or have given up on duration

- Cyclical and structural factors are both important, with the former likely to dominate and drive fixed interest returns should an economic downturn materialise, and

- A more nimble approach to duration may best serve investors as the march to higher ‘normal’ yields over the coming years continues.

Defensive attributes

The defensive attributes of duration in fixed interest allocations have been well articulated within the investment industry. Long duration, in particular, as being one of the few genuinely negatively correlated allocations investors benefit from during periods of economic downturns or recessions when growth assets fall in value. ‘Portfolio insurance’ is a term we’ve long used having managed short, mid, long and flexible duration portfolios for almost 30 years to simplify the benefits of duration.

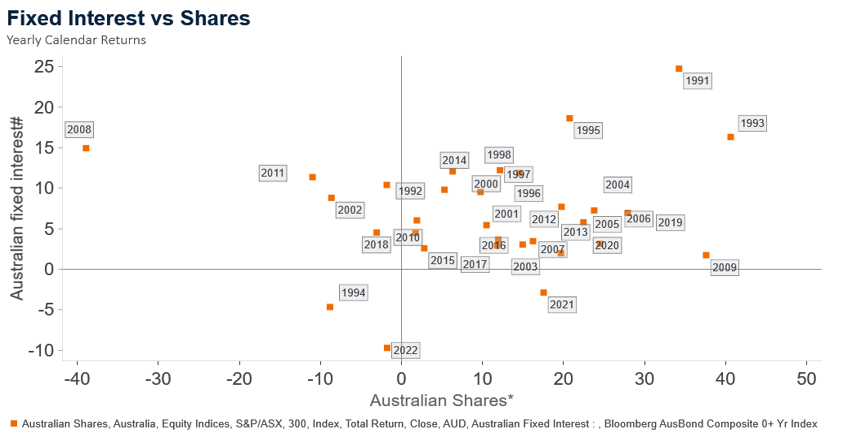

Duration had historically provided a robust ballast to growth assets in almost all recessions and significant equity market downturns. By way of example, during the Global Financial Crisis, fixed interest as measured by the Bloomberg Ausbond Composite 0+ Index delivered +13 to +15% against growth assets like Australian shares and A-REITs that were down -35 to -45% depending on the measurement period.

However, this role of providing a negatively correlated experience for investors began to be compromised during the period prior to the pandemic with central banks commencing zero, negative interest rate policies, forward guidance, yield curve control, Quantitative Easing (QE) measures in places like the US and Europe in order to support a lasting recovery from the Global Financial Crisis (GFC). In a bid to lift out of the lacklustre growth and inflation outcomes experienced with economies dragged down by very heavy debt burdens and slack in labour markets. And of course, this experiment took an even more dramatic twist once the pandemic arrived with most central banks, including Australia’s Reserve Bank of Australia (RBA) employing unconventional monetary policy stimulus. During this period, we assessed and communicated that the resulting 400 year low in global bond yields (100 year low in Australia’s case) was the anomaly rather than the norm, and that the defensive characteristics of duration had been compromised.

Chart 1: Unusual for bonds to lead equities lower

Policy pivot hurts shares and fixed interest in 2022

Source: Janus Henderson Investors, Bloomberg and Macrobond, as at 8 September 2023.

*Australian shares = S&P/ASX 300 Accumulation Index, #Australian fixed interest = Bloomberg AusBond Composite Bond Index (All Maturities). Note: Past performance is not a guide to future performance.

A more flexible, nimble approach to duration including at times zero or negative exposure was more suited to the environment. Subsequently, 2022 was a year not to be forgotten in fixed interest history with one of the worst drawdowns in long duration allocations, at a time when growth assets also fell, with correlations highly positive.

Today, with bond yields at much healthier levels, investors are rightly asking the question of whether the defensive characteristics of duration have been restored. In our assessment, yes! However, that is a very different question to another receiving significant airtime (and an almost consensus view) of whether now is a good time to strategically add meaningful duration to portfolios. On this second question, we feel the answer is not as straightforward.

Timing duration

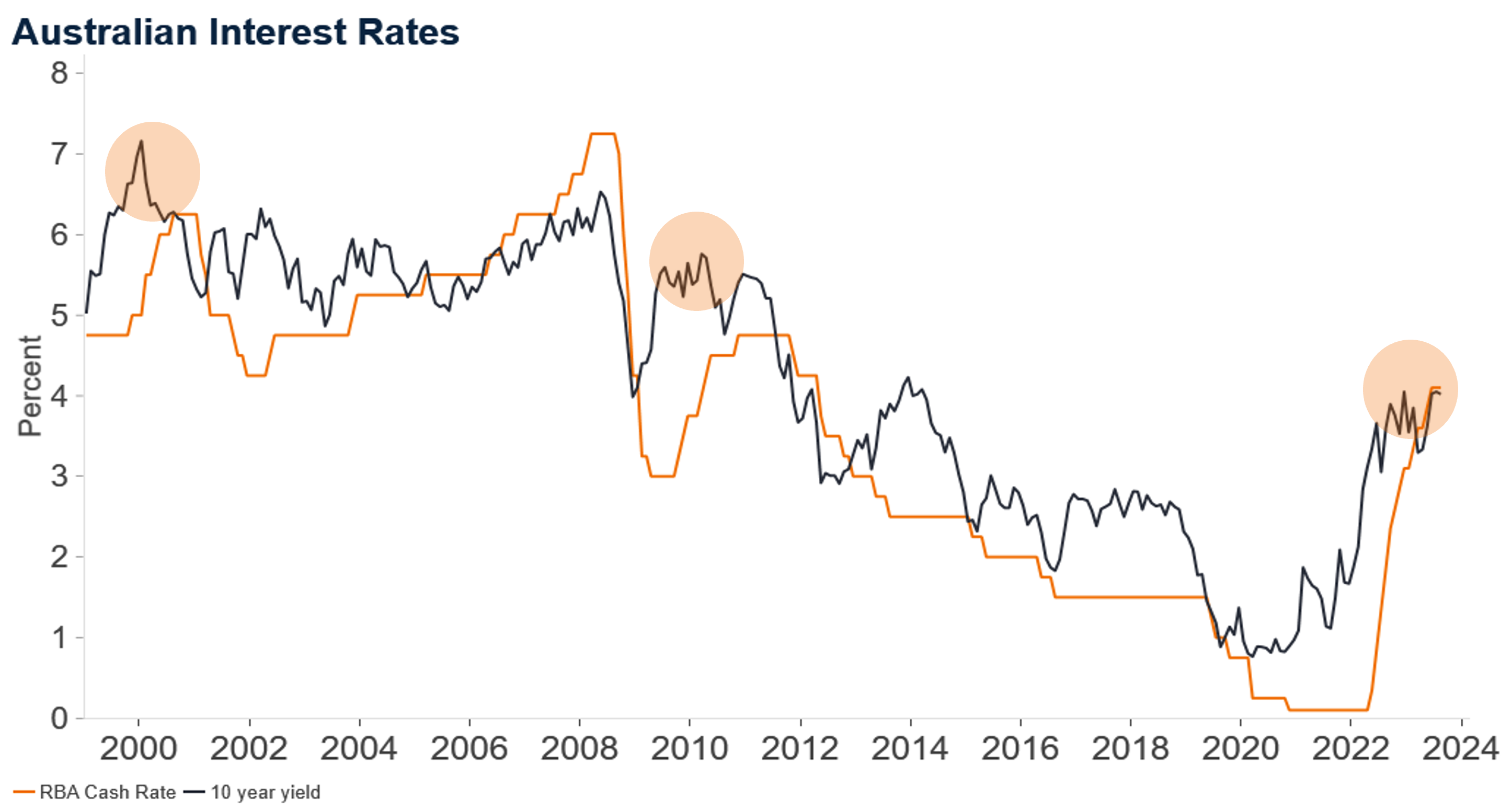

One of the common ways investors time when to add or reduce duration is to make an assessment of where official cash rates are going. Bond yields however drive fixed interest returns, not cash rates. And bond markets (yields) almost always lead cash rates. Sometimes bond markets get it right, sometimes it overshoots and self-corrects.

Chart 2: Cash and bond yields

Bond yields well ahead of cash rates

Source: Janus Henderson Investors and Macrobond, as at 11 September 2023.

There are usually two opportunities when adding duration from a timing perspective that can be quite valuable for return outcomes:

- Just prior to the commencement or very early in the tightening cycle: By this time, bond yields already reflect a full tightening cycle even if the central bank hasn’t commenced and are relatively safe with positive asymmetric return outcomes thereafter. Typically bond yields either go sideways, delivering fixed interest returns consistent with their yields, or if they have overshot, subsequently come back down driving even higher fixed interest returns (with some capital gains). The past year has been remarkably similar to prior episodes, with bond yields peaking in June 2022 and again at much the same levels today.

- Just prior to the final cash rate tightening or early in peak cash rates: Bond markets typically start factoring in the impact of tight policy, an expected slowing of economic growth and start pricing in the potential cash rate easing cycle. Bond yields fall, providing strong fixed interest returns. Sometimes this is sustained if validated by incoming economic data. At other times, yields reverse course if inflation remains elevated or growth resilient, with markets shifting to expecting more tightening.

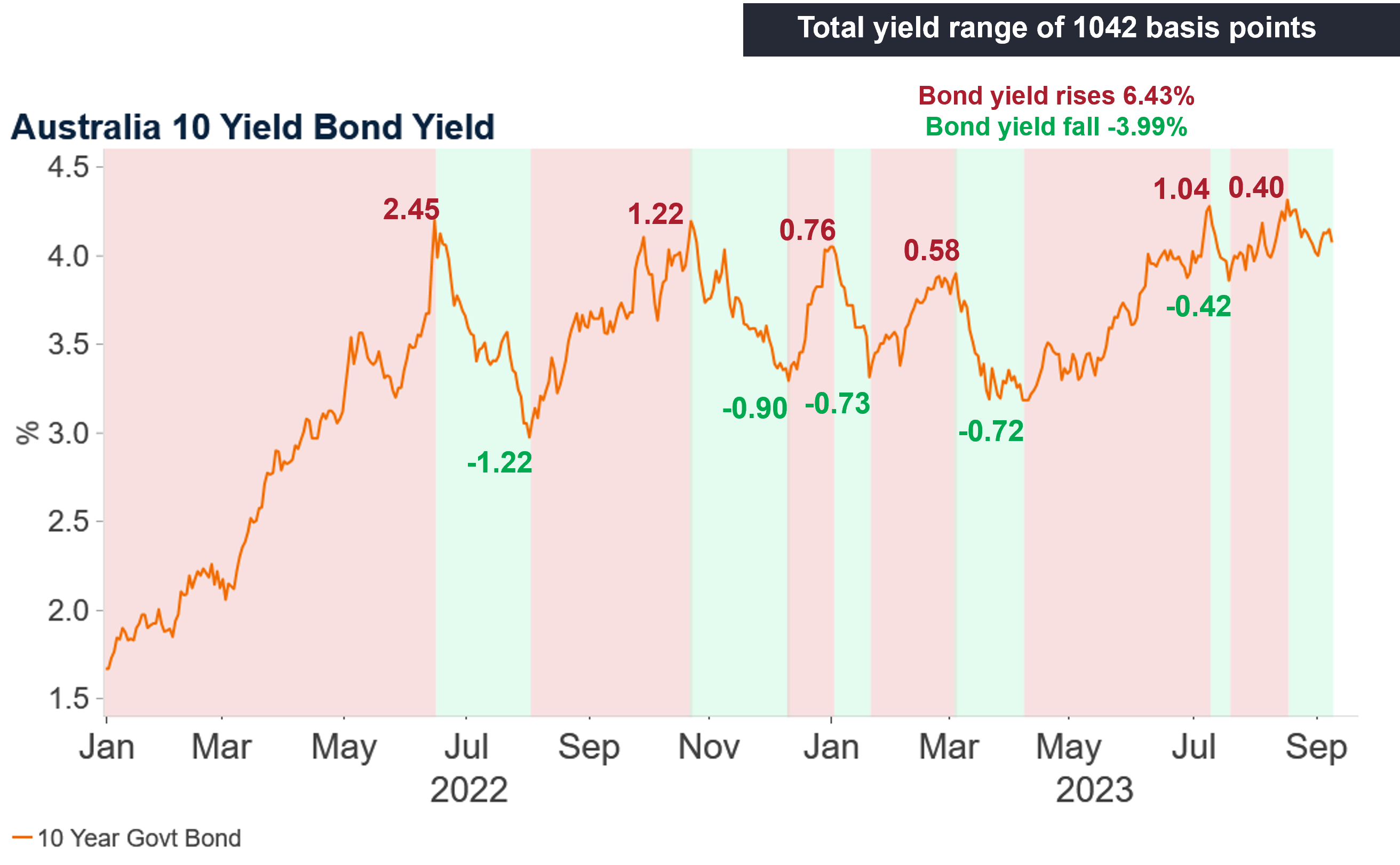

Volatile times

Turning points can be highly volatile in bond markets while investors re-assess again and again whether sufficient monetary policy had taken place to deal with inflation. This most recent period is again one for history books, with volatility in risk free yields not seen for a couple of decades. To put into context, every 100bps movement in yields up or down is circa + / – 5.5% return within Australian bond markets. In other words, a typical year’s fixed return was gained or lost eight times over the past year.

Chart 3: A very volatile period

10 year bond yield volatility

Source: Janus Henderson Investors and Macrobond, as at 11 September 2023. Note: Past performance is not a guide to future performance.

Active managers really can’t complain about a lack of investible opportunities and duration, done correctly, can be a powerful driver of performance. Yet, if one were to take a survey of manager positioning over the same period it is visibly noticeable the stark differences in active duration employed. This proves that duration management is complex and very few get it right consistently, and likely the very reason why most have given up and rely instead on spread sectors like credit for their primary source of alpha.

Cyclical and structural considerations

There seems to be a growing chorus that now is a good time to add duration to portfolios, however, this hinges on a consensus view of an upcoming recession. This may well end up being the case. There are in our assessment probable alternate scenarios including a very soft landing or even higher, stickier inflation for longer as labour markets remain strong. Whilst we agree from a cyclical perspective, we remain more cautious from a structural perspective and as such, temper our enthusiasm. We favour a more measured, nimble approach to adding duration when the return outcomes are more skewed towards investors and position more cautiously when markets under-price inflation and the path of monetary policy.

Cyclically, there are very good arguments to be made for duration after some 400 basis points of monetary policy tightening, the impact of indebted consumers and the likely economic slowdown late this year as higher lending rates take hold. Labour markets, while very strong, may very well be the most lagging indicator. The reasons for policy working, despite long and variable lags has been already well articulated amongst investment circles. Arguably, we have reached peak cash rates in Australia for this cycle and it is only a matter of when, not if, that markets price in a full easing cycle as leading economic data becomes apparent that policy is working. At that time, markets typically price in 150-250 basis points of easing, not just 25 or 50.

Structurally however, there are a few reasons why bond yields and in particular longer term bond yields remain more sticky even if markets were to price in an easing cycle, remaining elevated or even rise over the coming years for the following reasons:

- Labour markets are tight with full / above full employment that hasn’t been witnessed for over 50 years and may need further tightening in policy

- Easy gains of falling inflation behind us with base effects, supply disruptions resolved. The next leg down may take longer with wages still rising

- Structural reasons for higher inflation going forward including climate adaptation, energy transition, global trade reorganisation, etc.

- Long bond yields still below long-term levels, and

- Natural buyers of longer dated bonds dissipating.

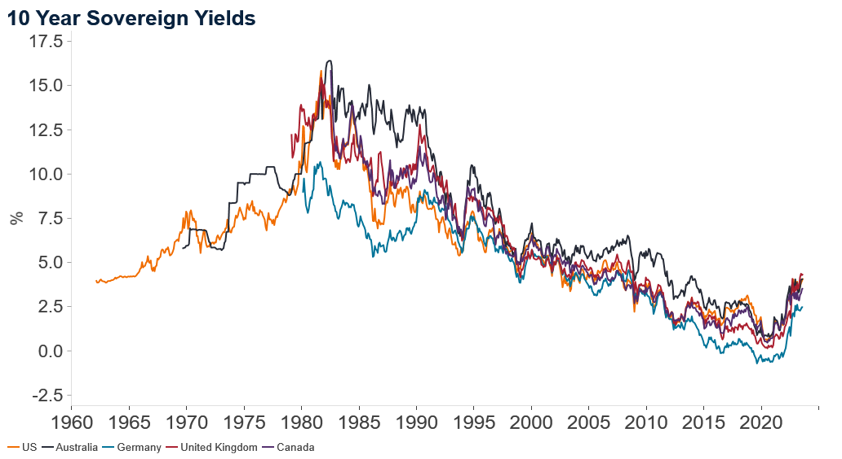

Chart 4: 10 year sovereign yields

Source: Janus Henderson Investors and Macrobond, as at 11 September 2023.

Longer term bond yields, despite their recent steep climb, still remain low by historical standards. Whilst the risks of fixed interest returns being wildly negative like 2022 is behind us, the risk of a -1% to -3% capital loss on average over the next 3 to 5 years eating away from the yield or income return remains a possibility in our assessment. The march to higher ‘normal’ yields, whatever normal is, will continue over the coming years in our assessment, pausing for any cyclical downturn.

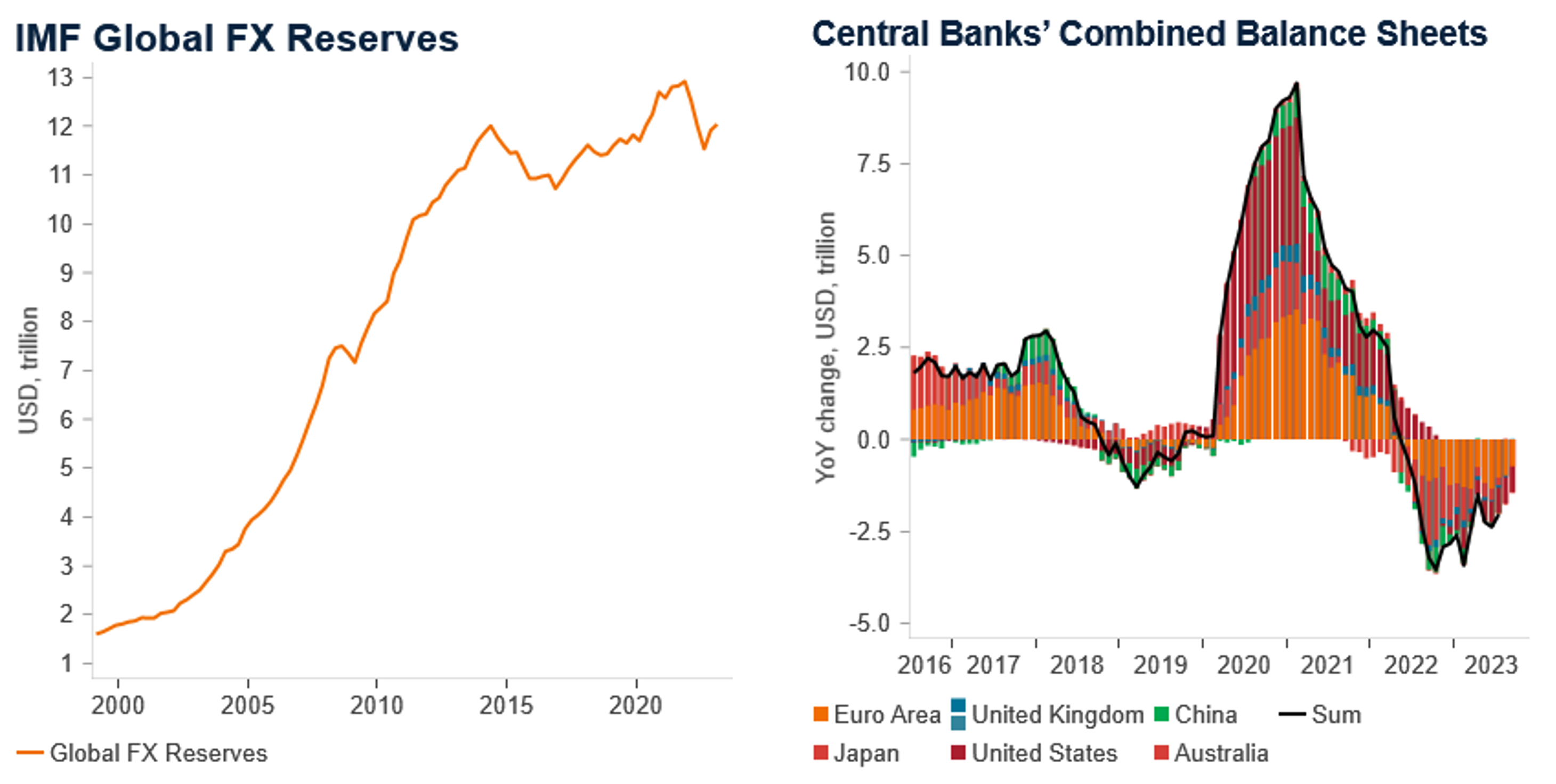

Chart 5: Demand for bonds

Price insensitive buyers disappearing

Source: Janus Henderson Investors and Macrobond, Source: Janus Henderson Investors and Macrobond,

as at 11 September 2023. as at 11 September 2023.

During the period of the ‘great moderation’ in bond yields, one of the less price sensitive natural buyers of US treasuries were central banks and their rising FX reserves. China is a case in point over the period from 2000 to 2015. Then came along another price insensitive buyer, in the form of central banks through their QE programs expanding their balance sheets. Both of these were multi-trillion dollar buyers. Now both of these channels are in outflow with quantitative tightening (QT) and China spending some of their reserves to boost domestic growth measures. Globally, pension funds, insurers and other investors can of course fill the void now that yields are more attractive but they are likely to be more demanding on price (yields). As such, the natural price insensitive buyer in our assessment has gone and all things being equal, this is likely to have some upward pressure on long term bond yields.

Is now the time to add duration?

We remain a strong advocate for the defensive characteristics of duration, one of the few true portfolio insurance policies available for investors. The days of this attribute being heavily compromised is behind us and fixed interest should play a pivotal role in diversified portfolios at the next downturn.

However, our conviction to add meaningful structural active or outright duration remains modest today, well below our highest conviction levels in mid-2022 when bond markets back then had moved ahead and priced in a full tightening cycle. Today, we feel it is appropriate to take a more measured position in duration incorporating both the cyclical and structural aspects of inflation, monetary policy and bond yields.

What would cause a reassessment and higher conviction in long duration? Either:

- The forward economic indicators turn more sharply down, with markets not fully factoring them in and/or

- Bond yields rise further, well above economic fundamentals, all else being equal.

In both of these scenarios, the cyclical factors will likely dominate structural factors for a period of time, driving bond yields lower and delivering strong fixed interest returns for investors.

As such, whilst we like duration today we temper our enthusiasm in favour of a more measured, nimble approach to adding duration when the return outcomes are more skewed towards investors and position more cautiously when markets under-price inflation and the path of monetary policy.

Active duration positioning, whilst complex, done correctly can drive strong outcomes for investors.