Mathew Kaleel, Portfolio Manager in the Janus Henderson Diversified Alternatives Team, discusses how a lack of oil storage capacity and low demand saw the oil price fall steeply into negative territory.

20 April 2020 marked another historic market move that has never been seen in our lifetimes – a major global oil benchmark trading negatively.

While lesser known oil benchmark prices have traded below zero in the past, the fact that the May 2020 WTI Crude Oil Futures Contract settled at -$37.63 per barrel on the close marks another unique market dislocation in the current environment.

What actually happened?

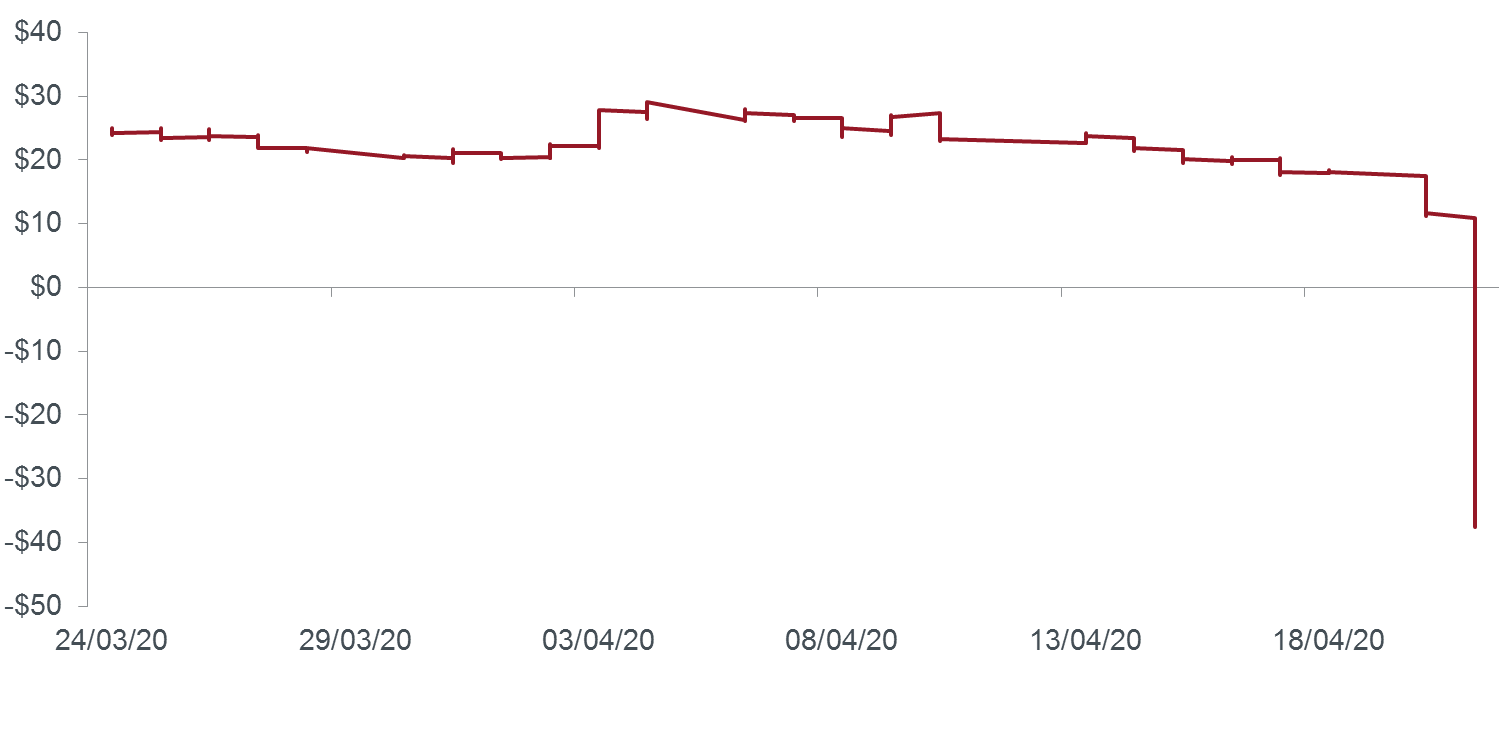

The front month West Texas Intermediate Crude Oil contract, May 2020 WTI Crude, was nearing the last days to trade the contract prior to going into the delivery phase. The day saw a complete collapse in prices, with no bids at certain times of the day. For context, the previous day’s close was $18.27 per barrel, meaning there was a one day fall of $55.90. The following is a one month time series for this contract.

Chart 1: May 2020 WTI Crude Oil, price per barrel (USD), 30 minute price series over 1 month

Source: Bloomberg. As at 21 April 2020.

Why did this happen?

In its most simple terms, this price collapse was a function of a number of events occurring at the same time:

- A significant oversupply of oil based upon a collapse in demand in the US for energy as a result of lockdowns throughout the country.

- This particular type of oil (West Texas Intermediate) is based inland, with the main delivery point being in Cushing, Oklahoma. This oil benchmark relies on there being sufficient spare capacity at Cushing to take delivery, but this has been falling recently due to oversupply.

- The May 2020 oil contract was approaching expiry, so liquidity was drying up and most commodity traders and major indices had already rolled contracts into June 2020 and beyond.

- WTI futures contracts are physically deliverable, i.e. if you are holding a long position on expiry, you will be delivered 1,000 barrels of WTI Crude per contract held. As such, if you are unable to store this oil, you should not be holding this contract this close to expiry.

- Financial participants held a long position in this contract going into expiry and were trying to sell May futures and roll into further dated contracts (most likely June and July 2020 futures) on Monday 20 April.

- With a lack of storage, lack of liquidity and significant long volume on one side of a physically deliverable market, prices collapsed to a point that incentivised buyers, who could physically take delivery and store it, to step into the market.

Are oil prices more generally trading at these levels?

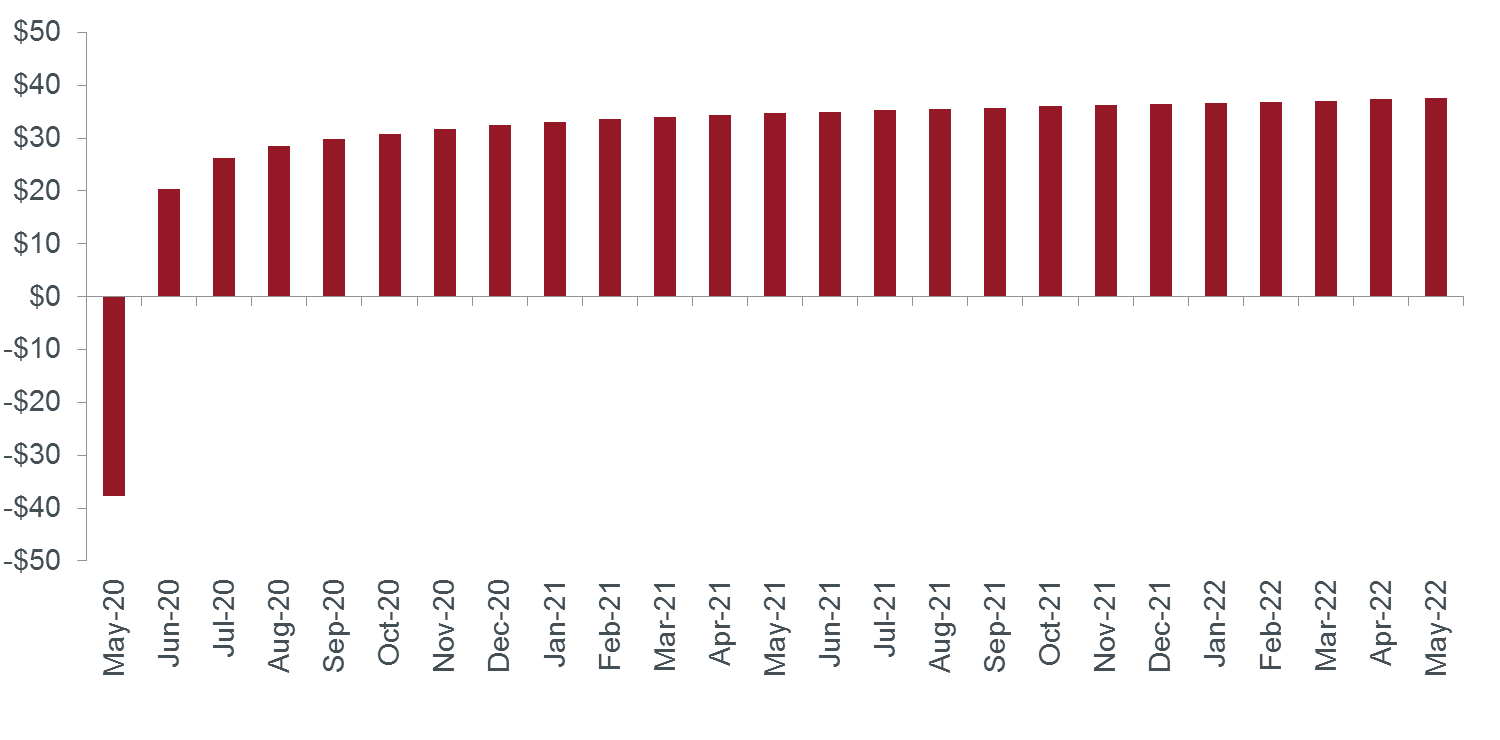

No. This situation is a short-term, idiosyncratic dislocation in one particular oil market in which a lack of available storage converged with a long holder of oil needing to offload this position at any price. The chart below compares the prices over the last year for both May 2020 and June 2020 WTI Crude Oil futures contracts. Another critical point to note is that physical delivery of oil relates to WTI Crude, whereas Brent Crude Oil is a cash settled instrument, so has not seen dislocation at the front end of the curve, and has not been trading negatively at any point.

Until recently, the spread (difference) between these two contracts was immaterial. The imposition of lockdowns throughout the US saw the prices gradually diverge at the beginning of March as traders priced in firstly a short-term supply shock, then a much more significant collapse in demand as lockdowns were imposed globally. Additionally, as storage has filled up in Cushing, the May contract repriced to incentivise buyers who are able to take physical delivery and store this oil.

Chart 2: May 2020 and June 2020 WTI Crude Oil futures contracts (USD)

Source: Bloomberg, as at 21 April 2020.

The issue with the markets on Monday was a confluence of long financial positioning in a physically deliverable market without any ability to store that oil. The uniqueness of this particular contract trading negatively is shown below in the term structure of WTI Crude on 20 April. Apart from the front month (May 2020), WTI Crude over the next three years has an expected price range of at least $20 (at the time of writing).

Chart 3: WTI Crude Oil Term Structure as at 20 April 2020 (USD)

Source: Bloomberg, as at 21 April 2020.

What broader meaning can be attached to this event?

While this event was quite idiosyncratic in terms of a buyer holding a physically deliverable contract far too close to expiry, it reflects the broader dislocation in markets, and more importantly, the extent of the demand destruction that is occurring as a result of the global lockdowns in most countries.

It should also be noted that without a material change in market fundamentals, there is a possibility that negative prices could be seen again in the next month if the supply issues at Cushing are not dealt with in time. It is also possible that negative prices could materialise in more than just the front month, and may, in a worsening fundamental environment, show negative pricing across a number of futures contracts. Whilst unlikely, it is in no way beyond the realms of possibility.

Where this has particular relevance in terms of knock-on effects are in the following broad areas:

- US onshore oil producers: in general, smaller, higher cost producers will likely shut in (close) wells. This is a function of each well’s cash and variable costs. The longer prices remain around current levels (around US$20/barrel), the more supply will be taken out of the market; it is not economic to produce oil that potentially requires paying a buyer to take it.

- Producers whose wells are further inland are at larger risk as they deliver to a point, such as Cushing, which, as mentioned above, has limited capacity.

- There is a significant fall in rig activity, capex and new activity. The chart below shows the clear relationship between oil prices and rig activity.

Chart 4: Spot WTI Crude prices (USD) versus active onshore rigs over the last ten years

Source: Bloomberg, as at 21 April 2020.

Rig activity is a purely economic response to oil prices. As oil prices have traded lower and are now at a level that renders few, if any, onshore oil wells profitable on an all-in cost basis, rigs in use have collapsed. Commodity markets are effective as a clearing mechanism, and prices will remain at a point that will assist in rebalancing markets.

The most likely path of rebalancing, based upon unprecedented demand destruction and muted demand going forward, is a significant curtailment in supply either via voluntary production cuts or shut ins. This implies there is potential for a large number of energy companies to cease operations completely, particularly those focused at the smaller, higher cost point of the industry.

What should we watch out for to see if it can happen again?

There are a number of markers to watch out for in markets over the next few weeks:

- Changes in Cushing inventory levels: there should be time for oil at Cushing to be diverted to other storage facilities.

- Changes in rig counts and commentary from oil companies in the US: this will have the most meaningful impact in rebalancing the market. Significant supply cuts in the order of 2-3 million barrels per day are needed to offset some of the demand destruction.

- Changes in Oil ETFs: including net changes in positioning, changes to ETF structures and the potential closure of some ETFs, which is starting to occur.

Note: All prices in US dollars (USD) unless specified otherwise.