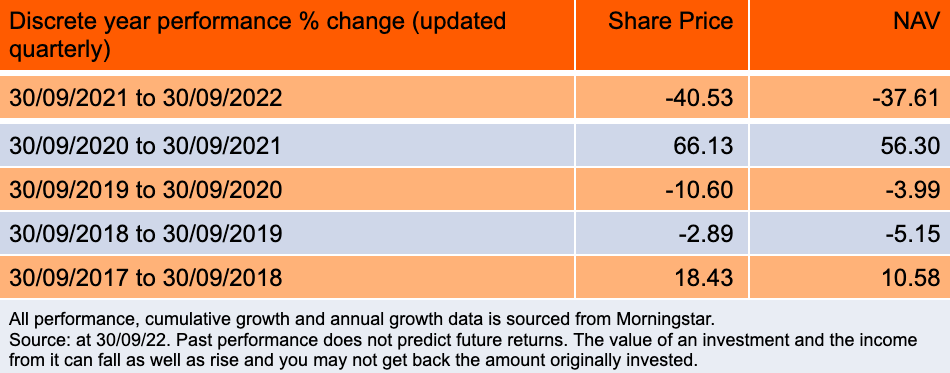

2022 has been a tough year for risk assets, especially UK small and mid-cap markets following a strong run in 2021. With inflation high, interest rates rising and a recession looming over the UK, smaller companies – generally more geared into economic cycles and the domestic economy – have been feeling the brunt of cooling investor sentiment (see table below). This can also be seen within the AIC’s UK Smaller Companies sector: all but one have lost money over a 1-yr basis.1

Source: Bloomberg as at 28/09/22

Note: Past performance does not predict future returns

A challenging year

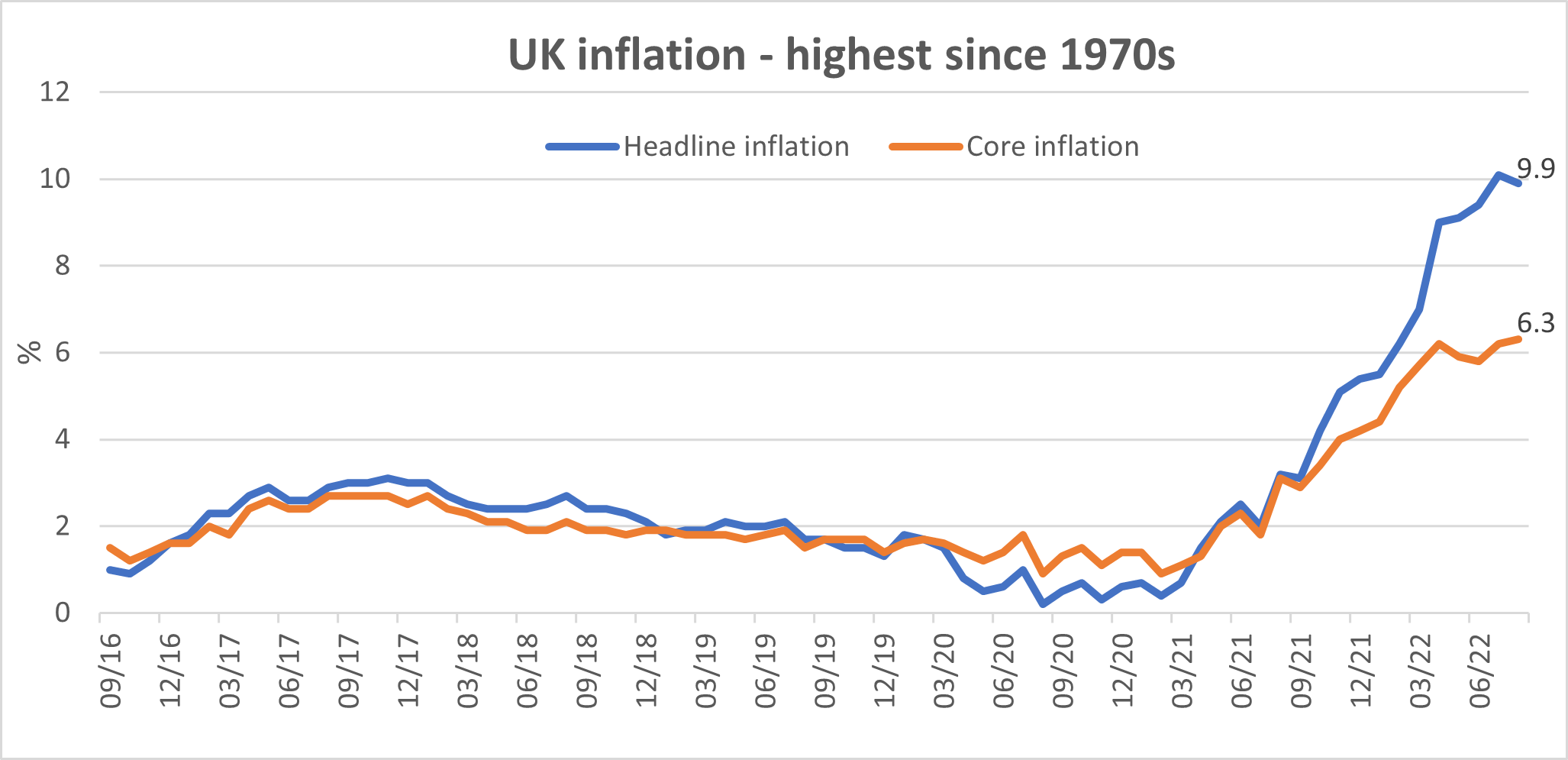

The current economic environment is challenging. Interest rates are rising as central banks respond to the worst inflation since the 1970s. Even the latest reading of core inflation, which removes more volatile food and energy prices, is at a 30-yr high of 6.3%.2 This has been squeezing household budgets and reducing discretionary spend on ‘non-essential’ items such as holidays, clothing, and meals out. As such, businesses operating within these areas have begun to feel the pinch. What is more, a weakening pound is likely to import further inflation as it makes the cost of goods and services that are imported to the UK more expensive. It is why the Bank of England expects a recession to begin this year and last through most of 2023.

Source: Office for National Statistics, as at August 2022

There is no doubt that such an economic environment creates risks for domestically exposed smaller companies, and as the recession plays out, earnings revisions may lead to further price swings. However, as often the case during periods of economic uncertainty, investors have become paralysed by short-term news-flow and market volatility. And yet, for several reasons, the investment case for the UK’s smaller companies remains compelling over the long-term.

An attractive opportunity emerges

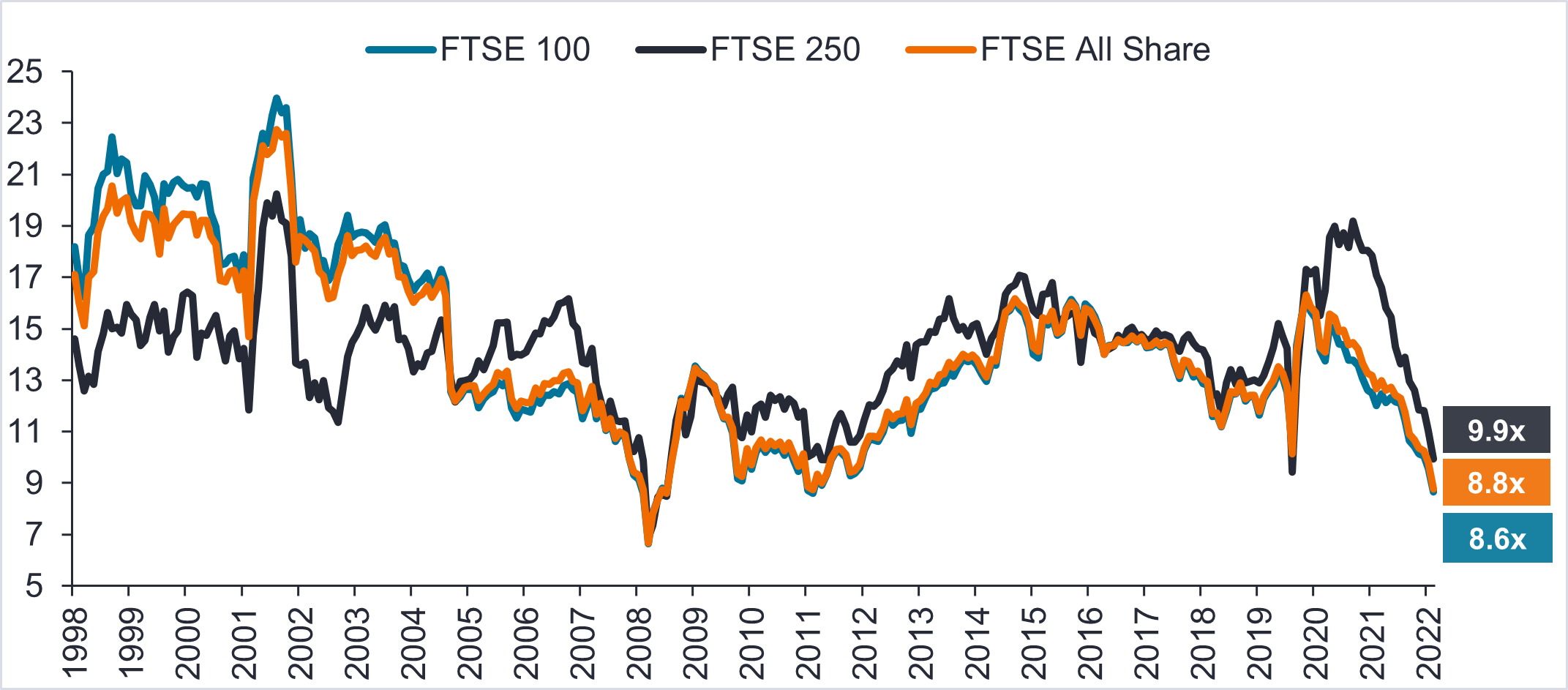

First, valuations. UK equities haven’t been in favour over recent years due to Brexit and a volatile political environment. More recently, the Covid-19 pandemic – though not completely dealt with in some parts of the world – has also been a major headwind to sentiment towards UK equities, especially smaller-and-midcap businesses. This has driven them to trade at a large discount compared to global peers. When we look at the price-to-earnings ratio, for example, we can see that these businesses appear extremely good value relative to history (see chart below). As a result, we have been finding new opportunities and topping-up existing positions at better prices. Recent additions to the portfolio include Harworth, Rathbones, and Workspace.

Small caps trading at a discount

Weighted average 12-month forward P/E by index

Source: Refinitiv Datastream, Janus Henderson Investors Analysis, as at 3 October 2022

To get a better idea of just how cheap the UK small-and-mid cap space is, you can also look at the mergers and acquisitions (M&A) activity. Low valuations make firms attractive takeover targets – an important source of returns of smaller companies. Over the past 18 months, $100 billion3 in transactions have already gone through, with private equity the most important source of capital.

Innovation in the UK

Second, Britain’s innovative firms. The UK’s smaller companies are fast-growing and are where its most innovative and entrepreneurial firms often reside, building disruptive technology and new business models. We look for quality growing businesses with strong entrepreneurial management teams, robust balance sheets, and competitive advantages in niche markets. Using the pandemic as an example; companies had to innovate in order to navigate the crisis. Unsurprisingly, technologies for remote working were the most frequently adopted, either alone or in conjunction with other technologies, including online sales, cloud, data analytics and cyber security.

However, not all innovations were related to the adoption of new technologies. Firms also adjusted their management practices and introduced new products and services to meet demand in the digital sphere. Moreover, while a lot of the adoption of digital technologies and management practices occurred early on, a large share of firms continued to innovate beyond the initial lockdowns. Often, companies with these attributes are better able to navigate periods of economic stress as they can leverage their strengths to deal with factors such as rising costs, whilst further boosting their earnings and gaining market share from struggling competitors. In fact, the corporate fundamentals for our portfolio companies remain in good order because many of them recapitalised and strengthened their balance sheets during the Covid-19 pandemic.

Structural growth trends

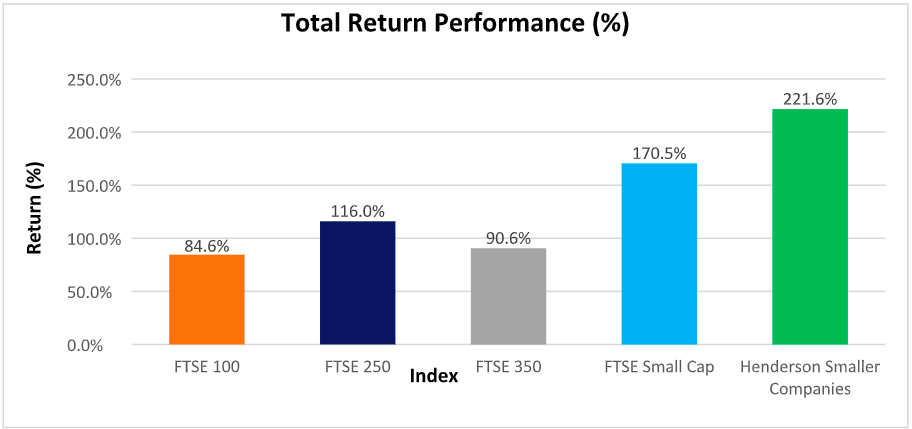

It is in seeking these types of companies that we believe strong returns may be found. As long-term investors, we are focused on performance over three, five and ten years, and as such, see poor performance in the short term as opportune. Our long-term track record is a testament to this (see chart below). While market turmoil may impact sentiment and valuations in the short term, the structural growth drivers for the types of businesses in which we invest remain intact. If the last 18 months alone are anything to go by, its clearer that we need cleaner energy sources, more sustainable methods of transportation and building. Our portfolio consists of companies that are working to deliver some of these goals. This includes SMS plc, Victrex and TI Fluid Systems.

Source: Bloomberg, as at 28/09/2022. Note: Data on a total return basis for the ten years to 28/09/2022.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Historically, small and mid-cap stocks have always bore the brunt of market volatility when investors perceive the macroeconomic climate to be riskier – this time is no different. However, it would serve us well to remember that they also tend to bounce back much harder and faster as economies and stock markets recover – the pandemic being a prime example. Following a tough 2020 on account of the pandemic, 2021 was a strong year for small and mid-caps. Therefore, the recent market volatility needs to be looked at in context to the longer-term trends.

A cautious outlook

We cannot ignore the risks facing equities at the moment. We are in a risk-off environment as investors remain anxious about the war in Ukraine, the prospect of embedded inflation, the ensuing path of monetary tightening and rapidly rising interest rates, and China’s Zero-Covid policy, all of which together are weighing on economic growth. That being said, this is a stock pickers market, and our job is to find high quality, cash generative, fast-growing firms that can weather the storm and flourish out of it. We are looking for growth at a reasonable price for a reason and we will continue to look for opportunities where we believe valuations are attractive and are not accurately priced by the market.

Economic cycle – The term economic cycle refers to the fluctuations of the economy between periods of expansion (growth) and contraction (recession). Factors such as gross domestic product (GDP), interest rates, total employment, and consumer spending, can help to determine the current stage of the economic cycle.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Mid-cap – Mid-cap (or mid-capitalization) is the term that is used to designate companies with a market cap (capitalization)—or market value—between $2 and $10 billion. As the name implies, a mid-cap company falls in the middle between large-cap (or big-cap) and small-cap companies.

Monetary tightening/ Quantitative tightening – Quantitative tightening (QT) refers to monetary policies that contract, or reduce, the Federal Reserve System (Fed) balance sheet. This process is also known as balance sheet normalization. In other words, the Fed (or any central bank) shrinks its monetary reserves by either selling Treasury’s (government bonds) or letting them mature and removing them from its cash balances. This removes liquidity, or money, from financial markets.

Price to earnings (P/E) ratio – A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share.

Small cap – A small-cap stock is a stock from a public company whose total market value, or market capitalization, is about $300 million to $2 billion. The precise figures vary.

Valuation metrics – Metrics used to gauge a company’s performance, financial health, and expectations for future earnings eg, price to earnings (P/E) ratio and return on equity (ROE).

Volatility – The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.