ESG integration is a central part of the Janus Henderson Australian Fixed Interest Team’s investment process and is something we continue to work to enhance and improve upon. As the market has evolved over the past year, our team has worked hard to evolve with it in our consideration of ESG factors. In this article, we provide an overview of our key accomplishments in 2023 including the launch of our Sustainable Credit Fund, along with our efforts in conducting and reporting of ESG engagements, having our mainstream funds accredited by the Responsible Investment Association Australasia (RIAA), being awarded the top rating by Evergreen Responsible Investment Rating (ERIG), being shortlisted for Best ESG Investment Fund, building on our Holistic framework and our firmwide decarbonisation achievements.

Our team continues to encourage the development of positive impact capital markets. Given the bespoke nature of bonds and complexity in structuring, as active managers we have been engaging directly with CFOs and treasury teams, as well as debt origination desks within banks, to ensure our clients’ interests are appropriately considered while seeking to promote a viable way to grow the local positive impact investing landscape. We have worked hard to ensure that we have a seat at the table when new positive impact bonds are being developed and subsequently issued. These early conversations help grow the market and benefit our clients when we achieve favourable terms and allocations during the syndication process.

At the end of December 2023, we were invested across $1.34 billion of Green, Social, Sustainability and Sustainability-Linked Bonds (GSSSB) on behalf of our clients in our Australian Fixed Interest Funds and mandates.

Launch of the Janus Henderson Sustainable Credit Fund (ASX:GOOD)

In Q1 2023, we launched the Janus Henderson Sustainable Credit Fund – a diversified credit portfolio that invests in debt securities issued by companies that we deem to have robust sustainable practices, and those companies that have the potential to enhance outcomes for society’s wellbeing and protection of the planet. Through our rigorous screening and selection process, we look for investment opportunities that help to address themes such as poverty, gender equality, affordable housing, and disability, as well as planet-related themes including decarbonisation, biodiversity, sustainable buildings and the establishment of a circular economy.

Available as a managed fund and an active ETF trading on the ASX under the ticker ‘GOOD’, this fund is an actively managed portfolio which includes securities such as corporate debt, hybrids, asset backed securities and liquid instruments.

The Janus Henderson Sustainable Credit Fund seeks to achieve a total return before fees that exceeds the total return of the Bloomberg AusBond Composite 0-5yr Index by 0.75% p.a. over rolling three-year periods.

We note the rise in society’s expectations of companies and the impact they have on the planet. This fund has a dual mandate, seeking to deliver on sustainability and return objectives; thereby offering a solution to clients that are wanting to align their values with financial return objectives.

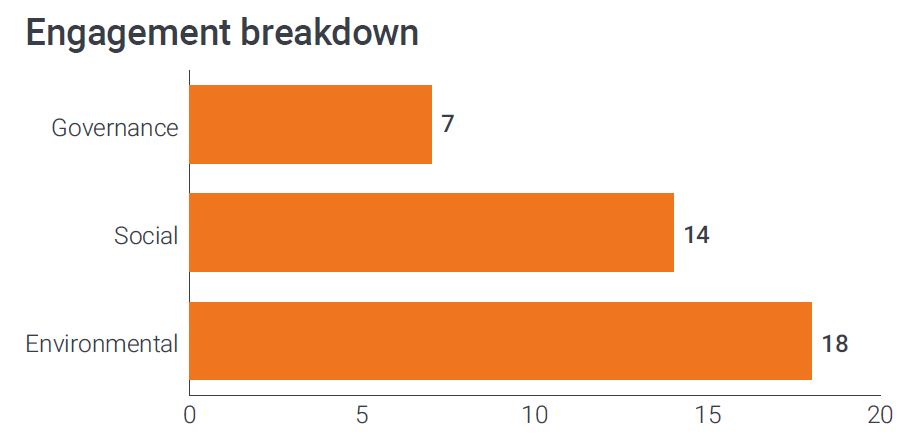

18 company engagements in this calendar year

An integral part of our investment process involves engagement with companies and issuers around emerging ESG issues and themes and a company’s response to them. This may include themes such as modern slavery risks or climate related issues, or more broadly a discussion around an issuers’ sustainability credentials. These ESG engagements are undertaken by the team in addition to regular issuer meetings, in which we would ask ESG-aligned questions, such as during the credit approval process, company reporting and the roadshow of a new bond deal. 2023 was no different, with company engagements remaining core to our credit process. Since 30 June 2020, we have been publishing the findings from these meetings in our quarterly ESG engagement report. Please contact your usual Janus Henderson representative if you would like to receive these each quarter.

Specifically in 2023, the team conducted 18 ESG engagement meetings, including group calls on GSSSB, management one-on-one meetings and site visits. In addition, we have had numerous group and credit calls in which ESG themes and topics were discussed.

These are companies that the Australian Fixed Interest team has met with over the last 12 months (a rolling 12 month period). It includes group calls and 1-1 meetings with management at corporates and market update calls from banks. It counts all engagements including multiple meetings with the same company.

Types of topics discussed:

Environmental |

Social |

Governance |

|---|---|---|

| Climate change | Community / charitable initiatives | Audit and accounting |

| Recycling / packaging / plastic | Affordable housing | Business ethics |

| Energy transition | Diversity | Compliance |

| Real estate sustainability | Culture | Board oversight of ESG |

| Food and agriculture | Working conditions | Modern slavery / biodiversity policies |

Evergreen award the highest ESG rating across all the Janus Henderson Australian Fixed Interest funds

In 2023, all our Australian Fixed Interest funds were awarded the highest ESG rating (1st quartile) by Evergreen (ERIG – Evergreen Responsible Investment Rating)

This differentiates our offering and ESG capabilities when compared against 109 other funds rated by Evergreen in Australian Fixed Interest.

ERIG Index

“The ERIG Index was built to assign Responsible Investment (RI) ratings to managed funds, providing Financial Advisers with a tool to build the perfect RI portfolio for your clients.”

RIAA Certification

Over the past year we are delighted to have received RIAA certification for the following funds: Tactical Income Fund & Active ETF (CXA: TACT), Australian Fixed Interest Fund and Australian Fixed Interest Fund – Institutional.

Who is RIAA?

RIAA is the largest and most active network of people and organisations engaged in responsible, ethical and impact investing across Australia and New Zealand. Their Certification Program is the longest running responsible investment program in the world. RIAA is dedicated to ensuring capital is aligned with achieving a healthy society, environment and economy.

Why is certification important?

A certification from RIAA ensures that the fund’s investment intentions and processes are consistent with its responsible investment claims. This provides confidence to our clients that RIAA accredited products offered by Janus Henderson are delivering on their responsible investment promise and meeting the Australian and New Zealand Standard for responsible investing.

RIAA verifies that our products have implemented an investment style and process that systematically takes into account environmental, social, governance or ethical considerations. Our accredited products meet the operational and disclosure practices of Certification Program requirements.

Janus Henderson Sustainable Credit Fund shortlisted for “Best ESG investment fund: Fixed Income”

We are very proud that our newly launched Sustainable Credit Fund, managed by our Australian Fixed Interest Team, has been shortlisted alongside global leaders in sustainability by ESG Investing UK for their 2024 award for “Best ESG investment fund: Fixed Income”. Winners are yet to be announced and we look forward to sharing the outcome with our clients once known.

ESG data gathering as part of our ESG ‘Holistic framework’

Over the last three years we have been collating ESG data on companies (where available) as part of our holistic framework. We use data from research providers MSCI, Sustainalytics and ISS. This analytical tool is currently used to measure a company’s Scope 1 and 2 greenhouse gas emissions, ESG risk rating by Sustainalytics (low, medium, high, severe), ESG controversies, product involvement (including other sectors that we don’t negative screen for, such as alcohol and gambling), gender diversity in senior management, biodiversity and modern slavery statements, and water and waste recycling initiatives amongst other things. We will continue to develop and enhance this tool, which is being used to complement our thorough qualitative analytical work on an issuer.

Janus Henderson firmwide decarbonisation update

- Janus Henderson was an early pioneer of sustainability, becoming carbon neutral in 2007 and maintaining the status each year since. Through this, we ensure that we have a neutral emission footprint across all of our offices, including for energy, waste, water and all business travel emissions.

- Our wide range of carbon offset projects also supports over half of the United Nations Sustainable Development Goals.

- We understand that being carbon neutral on its own is simply not enough to reach the net zero goals, which is why we have set targets to reduce our carbon footprint by 15% per fulltime employee, which we successfully reached in 2021, even excluding the effects of the Covid pandemic.

- In 2022, we set new ambitious, science-based targets on our emissions to reduce our footprint even further. Across our buildings we have also installed energy saving technology such as blinds which keep our buildings cool in the summer and don’t lose heat in the winter, LED lighting which saves on electricity use and electric vehicle charging points.

- In 2024 we will also be transitioning all of our offices to 100% renewable energy.

[jh_content_filter spoke=””]To hear more from our offshore ESG team, please view the following: Climate Week 2023: We Can and We Will invest in a brighter future together – Janus Henderson Investors[/jh_content_filter]

More work to be done:

Looking to 2024, we remain focused on incorporating ESG factors into our investment process and keeping abreast of best practice and regulatory changes. Of priority is making improvements to our ESG reporting for clients. An example of this is constantly looking at ways to provide more in-depth carbon and ESG engagement tracking.