Market review

Bond markets tempered the outlook post an outsized US Federal Reserve (Fed) policy easing. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 0.31%.

The global outlook had a strong influence on the movement of yields through the month. Yields took a round trip.

Australia’s three-year government bond yields ended the month 1 basis point (bp) lower at 3.54%, while 10-year government bond yields were unchanged at 3.97%. Against the current cash target rate of 4.35%, three-month bank bills ended 4bps higher at 4.43%. Six-month bank bill yields ended 9bps higher at 4.62%. The Australian yield curve steepened modestly.

The Reserve Bank of Australia (RBA) kept interest rates on hold, at 4.35%, but softened the tone in the fight against inflation. The economy is visibly slowing, and upside inflation risks have diminished. The RBA are not looking to join their global peers in easing rates in the near term, but the path to easing has commenced. They were presented with a softer than expected second quarter GDP outcome, driven by a very weak household sector. Annual GDP growth was a paltry 1% in fiscal year 2023-24. Subsequent household spending indicators suggest that the real wage lift, from tax cuts, lower inflation and higher wages, is being saved rather than spent. This will keep spending subdued. Consumer and business sentiment remains weak, while forward indicators of employment remain skewed to the downside. In a continued anomaly, current employment remains elevated. The monthly CPI, while distorted by energy rebates, showed inflation is moving lower and the headline came back to the RBA’s target band at 2.7%yoy.

The global outlook had a strong influence on the movement of yields through the month, which took a round trip through September. The first half was dominated by the Fed’s first easing for the cycle. Markets were pricing a 40bp move, with the debate between a typical 25bp cut, and a 50bp kickstart to the easing cycle. The Fed chose to move 50bps, noting that they wanted to ensure a smooth landing for the economy. The US economy is softening modestly and inflation moderating, which is a comfort to the Fed. The debate now centres on the Fed’s next moves, and as it became more apparent that they will revert to 25bp cuts, the market has had to reprice, lifting yields through the second half of the month. This was backed up by the Chinese government putting in place a more comprehensive support package for its embattled economy late in the month. This consisted of rate cuts, liquidity for equity purchases and easing of controls for home ownership. These factors contributed to a stronger rebound in risk sentiment, which impacted Australia.

Market outlook

The Australian economy is slowing, and while no recession is forecast, the pressure of higher interest rates is broadening out across sectors of the economy. Inflation is moderating slowly from high levels. The RBA needs to balance these risks along their so-called narrow path. An extended period of policy at restrictive levels will slow growth further, rebalance the labour market and subdue inflation. The global economic backdrop is slowing, and while there remain volatility risks, the policy path is lower.

Our base case is for the RBA to remain on hold at current rates before commencing an easing cycle in Q1 2025. We price a more modest than the historically average easing cycle, of around 175bps, spread over an extended period. We skewed the risks to the downside in early September, as global conditions deteriorated, and local data softened. The low case is for an earlier start, and slightly more easing over the whole cycle. The high case presently has no weight and looks to a later start and less easing over the cycle. The market has built in an RBA easing cycle, with around 125bps priced over 18 months. We believe there is value in targeted parts of the curve which outperform into easing cycles. We continue to hold a long duration position.

Monthly focus – Better days to come: Cautious consumers

The health of the Australian consumer is key for the direction of overall economic growth, and monetary policy. Household consumption makes up to 50% of overall GDP and has been subdued of late, detracting from growth in the second quarter. We estimate that this will pick up only slowly towards year end, as the spend versus save debate continues.

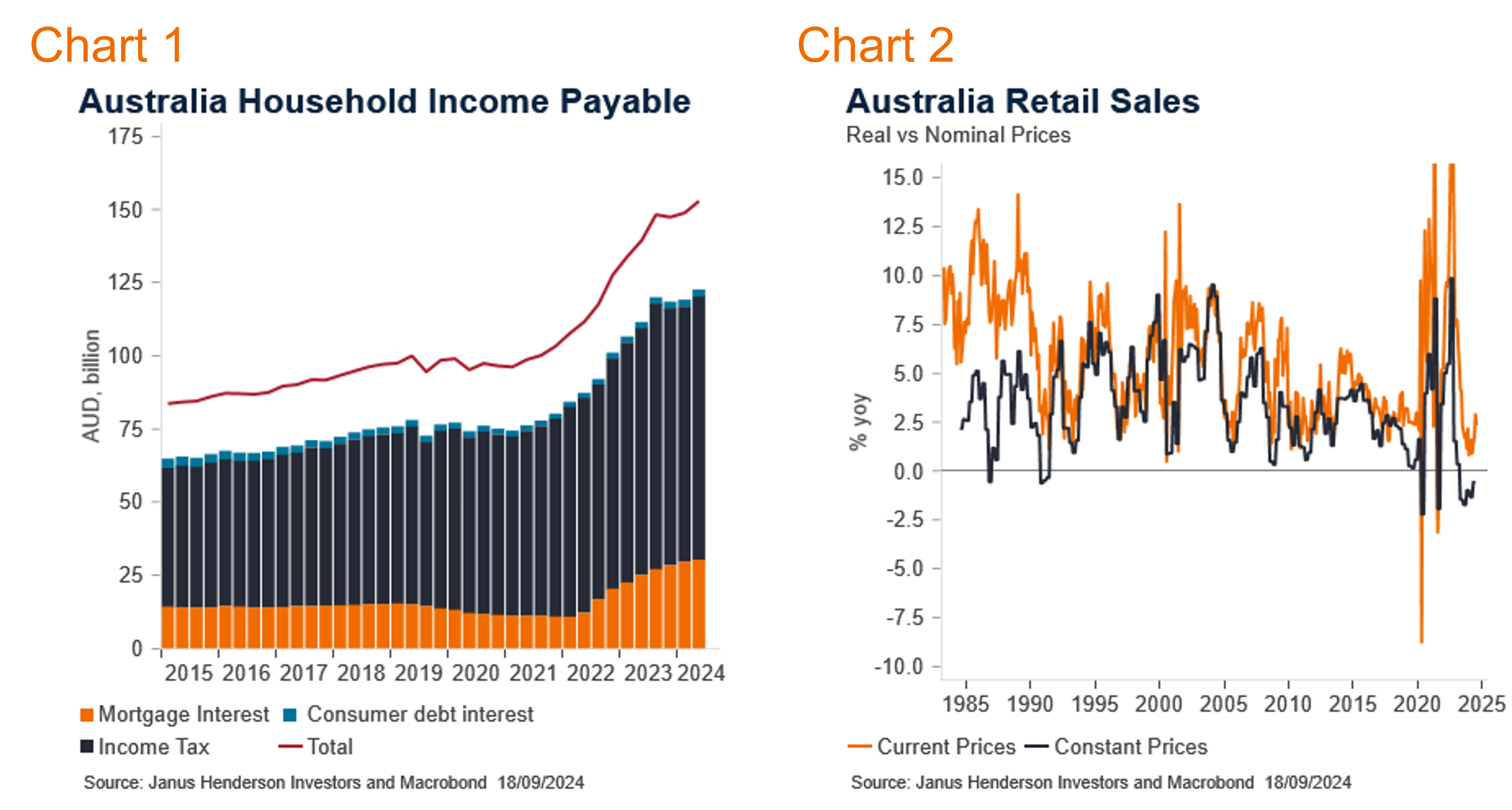

Household spending has been hit by a range of negative forces over the past few years: rising mortgage payments, very high inflation and a higher income tax take. These factors all lower the amount people have to spend. Chart 1 shows the rise in aggregate mortgage payments. However, even more than mortgage interest payments have been the rise in aggregate income tax paid by households, as bracket creep raises the tax burden with rising wages. Furthermore, high inflation erodes spending power, leaving households paying more for less, the so called “cost of living crisis.” Chart 2 shows the impact of inflation via real and nominal retail sales. The real component is without inflation, or volumes; the nominal line shows the total cost of spending. Households have been getting less shopping for more cost. It’s perhaps no wonder that household confidence remains in the doldrums.

The worst is behind us. The tax burden has eased, with the stage three tax cuts, mortgage rates have peaked, and inflation is off its highs and moderating. Employment growth has also been relatively solid. Under these conditions household spending should be bouncing higher in both real and nominal terms. It isn’t.

Early third quarter retail and spending data suggests there has been a positive but slow start to the second half of the year. Official reports on the household spending indicator and retail sales in July were lower than expected, and the large Australian bank’s reports on spending data are pointing to slow September sales. The August data, while a little higher, appears to be boosted by warmer weather and an early Father’s day, all of which is temporal spending, and there is likely payback in following periods.

The key to the slow pickup lies in the savings data, and how it intersects with consumer confidence. Facing a higher cost of living, households turned to their accumulated pandemic savings to get them through. As households remain uncertain about the future, and after a period of drawing down savings, they are likely using the current income relief of tax cuts to rebuild savings rather than spend. With the labour market expected to slow from here, and the RBA less likely to ease until 2025, a robust rebound in spending is unlikely as households bunker down.

The uncertainty surrounding the spending / savings profile was one key factor in the RBA’s outlook. Households could have chosen to spend all of the gains coming through in the second half, making the RBA’s job of containing inflation more difficult. It is increasingly apparent that the middle path, of a bit of saving and a bit of spending is coming through. This should allow the RBA to begin the policy normalisation process in early 2025, earlier if savings trump spending.

Views as at 30 September 2024.