Affordable shelter is one of the key factors that can lead to life changing outcomes for individuals and families, as access to good quality affordable housing is fundamental to wellbeing. It can help reduce poverty as well as enhance equality of opportunity, social inclusion and mobility. The Victorian Government describes ‘affordable housing’ as “housing for people on moderate or lower incomes” which often includes students, artists, childcare workers, nurses, hospitality and service industry staff and other front-line workers.

A report by ‘Homelessness Australia’ found that “On any given night, 122,494 people in Australia are experiencing homelessness” as the current housing crisis deepens. Demand for homelessness services has risen across the country as rent prices soar and vacancy rates are at record lows. Women and children make up 74% of those accessing services.

While there are many contributing factors, the simple economics are that housing demand is outstripping supply (that is, existing homes but more importantly, Australia’s ability to build homes). Population growth, an increase in single occupancy dwelling, prolonged life expectancies, the elderly remaining in their own homes, a shortage of residential land close to cities and natural disasters destroying homes, amongst other structural trends, have increased demand for housing. Housing supply has been further disrupted by global supply issues during the pandemic. Janus Henderson estimates that 2022 and 2023 represent the first years in decades where outright housing demand will outstrip supply in Australia. This trend could extend beyond that timeframe.

What can investors do to help?

The Janus Henderson Australian Fixed Interest team has identified ‘affordable housing’ as one of its ‘People and Planet’ themes within its Sustainable Credit Fund and buys ‘use of proceeds’ bonds and sustainability bonds where capital is directed to affordable housing projects.

To solve the housing affordability crisis, collaborative efforts from a variety of stakeholders will be required. While state and federal governments are likely to do most of the heavy lifting, industry can also play a part. Regardless of which parties are involved, these projects require funding. Investors can play a role by putting their capital towards these worthy projects through investing in funds that invest in this sector.

In addition to investing in the (limited) supply available, Janus Henderson’s Australian Fixed Interest team has a role to play through our active engagement. By having conversations with issuers and offering them support to come to market, we seek to increase the supply of public debt that has proceeds directly linked to alleviating the pressures on affordable housing.

The following gives a sense of the types of affordable housing themed investments available.

Federal Government

The Federal Government has several programmes in place to address housing affordability. This includes shared equity schemes, regional first home buyers grants, encouraging older Australians to downsize their homes and the Defence Home Ownership Assistance Scheme.

When it comes to building more housing, the government has established a $10 billion Housing Australia Future Fund which is to provide 20,000 new social housing dwellings (4,000 of which will be allocated to women and children impacted by family and domestic violence and older women at risk of homelessness) and 10,000 new affordable housing dwellings, over the next 5 years.

Housing Australia (formerly known as the National Housing Finance and Investment Corporation), is a government owned entity who administer the Home Guarantee schemes as well as provide lending to registered commercial enterprises at discounted funding rates to deliver community housing projects. Housing Australia have been given additional responsibilities in delivering the Housing Australia Future Fund and National Housing Accord commitments (discussed in section below on States).

Housing Australia – Intended impacts

- Reduced housing affordability stress

- Reduce homelessness

- New supply of housing stock

- Better community access to social and affordable housing

Housing Australia issue bonds with the proceeds going directly towards these housing projects. They are AAA rated, government guaranteed, publicly offered bonds that our funds can, and do invest in.

Source: Housing Australia, October 2022

State Governments

Like the Federal Government, state governments have responsibilities in place to assist with the affordable housing crisis. This includes supporting the distribution of funding options and grants, undertaking expedited zoning, planning and land release and committing to building a strong and sustainable Community Housing Provider sector.

In addition, the Australian states and territories have agreed to match the Commonwealth Government’s commitment of another 10,000 affordable homes over 5 years (starting in 2024), through the National Housing Accord program. This will take the total national number of houses to 40,000; 20,000 in social houses and 20,000 affordable houses.

For investors, we can gain access to the funding of these state-based projects through Housing Australia (who is taking on the funding task of both the Housing Australia Future Fund and National Housing Accord) and through the state government’s own issuance of sustainability bonds. For example, Treasury Corporation Victoria’s (TCV) and NSW Treasury Corporation (TCorp) have capital directed to affordable housing within their sustainability bond framework (amongst other sustainable investments).

Supranationals/Sovereign agencies

Supranationals advocate for the same themes (i.e., access to shelter), but in developing countries. For example, African Development Bank’s (ADB) charter is to alleviate poverty, generate investment/economic growth and improve equality and living conditions within Africa. To achieve this, they raise capital for a number of projects that seek to achieve positive social outcomes. As an example, ADB has issued ‘use of proceeds bonds’ into the Australian bond market with capital directed towards ‘affordable housing’ projects in Africa combined with other ‘eligible’ programs linked to their social goals.

Banks/Lenders

There are examples of commercial banks and mutuals that are dedicating a proportion of their finance and lending activities toward supporting finance for social housing. We look for those institutions who have a meaningful footprint in the area and have support of the sector embedded in their corporate targets. One such example is Bank Australia.

The bank has dedicated assets classified as impact finance assets. The impact portfolio is currently $1.8 billion (as at June 30 2023) – or around 17% of their assets, with plans to grow this to 20%.

Bank Australia have been investing in affordable housing for 15 years. This includes lending to community housing providers (CHPs) to help them build affordable and social housing. These are secured commercial loans through the CHPs for residential mortgages that originated as part of government sponsored administrated affordable housing programs. In addition, they lend to Women’s Property Initiatives to “support the development of long-term, high-quality housing solutions for women on low incomes (and often their children) to allow them to start again”.

While the major Australian banks all talk of their involvement in lending to the build of more affordable housing, NAB and ANZ have made notable contributions and have set new targets. NAB has made a commitment to lend an additional $6 billion by 2029 towards affordable and specialist housing, after already financing more than $3.6 billion over three years from 2019. ANZ has funded or facilitated $4.4 billion for affordable and sustainable homes, for either rent or purchase, and aims for $10 billion by 2030. These new commitments were likely spawned from the round table discussion on this topic held between the banks, super funds and government (hosted by Jim Chalmers) in late 2022.

Separately, ANZ has issued a United Nations Sustainable Development Goals (SDGs) bond which channels funding towards selected United Nations SDGs. One of these is SDG 11 (Sustainable cities and communities) which includes Social and Affordable Housing. As at 30 September 2022, ANZ’s SDG bond impact report states that the capital directed to this theme contributed to the “operation of 448 dwellings in Australia to be used exclusively for the provision of social and affordable housing for a minimum of 25 years.”

Corporates

Something we have been investigating more recently is the push by some corporates into the “build-to-rent” sector. Whilst this sector is still nascent in Australia, our team conducted a site tour of one of Mirvac’s build-to-rent developments. Whilst we had hoped for more, we would not classify this sector yet as “affordable” shelter and look for more progress to be made here.

We have also had discussions with universities regarding their potential to build affordable housing. The universities often have large land available (on campus) and are already in the business of providing student housing. We have been made aware that this is something that has been explored between some state governments and universities. The safety and security of their staff and students is paramount, and this may prove to be a sticking point for the universities to proceed with these types of projects.

For our part, we will continue to have conversations with corporates on what they can do to alleviate the housing affordability pressures during our engagement meetings.

Conclusion

Progress towards alleviating the housing affordability crisis can be helped along by investors willing to allocate capital to this space through:

- Direct ‘use of proceeds’ bonds, channelled specifically to the cause, but with the creditworthiness of high quality investment grade institutions.

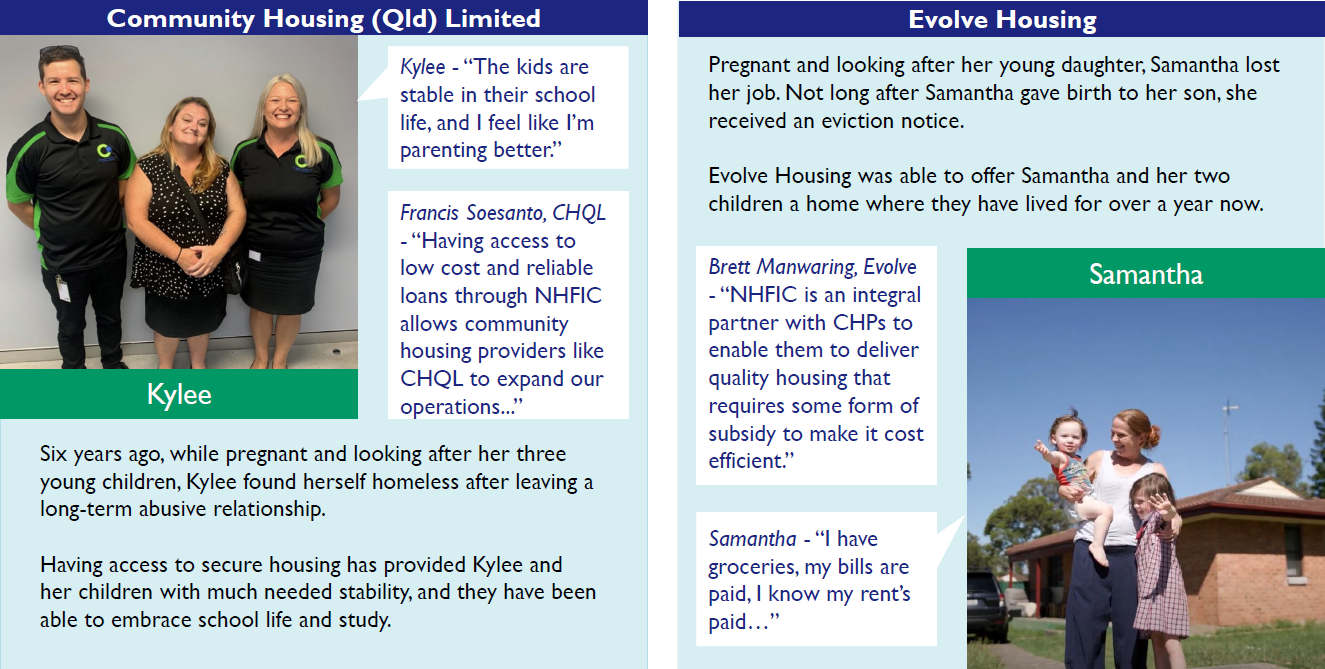

- Accessing competitive financing rates, combined with government funding, provided to CHPs allow projects to go ahead that may otherwise be shelved in a period of increasing costs of construction and interest rates.

- Engagement/stewardship activity undertaken by managers like Janus Henderson with key stakeholders, such as the Australian Office of Financial Management/Federal Government, state issuers, and companies to closer link our client capital with social goals including housing.