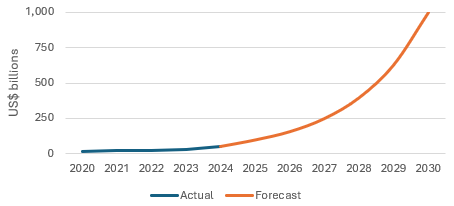

The European exchange traded fund (ETF) market is poised for significant growth in 2025, underpinned by broadening product offerings and a growing appetite for the benefits the ETF wrapper provides. We expect active ETF assets in Europe, which were at US$54 billion at the end of 2024, to surpass US$100 billion in 2025 as increased supply meets growing investor demand for novel solutions to a challenging economic and geopolitical market backdrop. Longer term we predict European domiciled actively managed ETFs will grow to US$1 trillion by 2030, as outlined in US$1 trillion by 2030: the rise of active ETFs in Europe.

Exhibit 1: Actively managed European domiciled ETFs poised for growth

Source: ETF Book (actual) & Janus Henderson (forecast, based on trajectory of the US market, increased product offering from asset managers, strengthening demand from investors in Europe, Asia, Latin America, and the Middle East, diversification away from existing large passive offerings), as at 31 December 2024.

Total flows into all European ETFs (active and passive) in 2024 reached US$260 billion, almost double the flows of 2023, taking the overall European market to US$2.3 trillion. While recognised as a growth segment of the European asset management industry, European ETFs are still in their infancy relative to the more mature US market, where allocations to ETFs have grown to over US$10 trillion. Popular innovations in the US in 2024 included buffered ETFs (targeting downside mitigation), active US securitised bond ETFs (such as AAA CLOs), and active equity ETFs.

Within Europe, environmental, social and governance (ESG) related ETFs have had a sharp slowdown in growth amid a complicated and evolving regulatory environment and valuation concerns. This slowdown, however, should be taken in the context of the multi-year dominance of ESG ETFs in Europe until 2022, while medium to longer-term trend expectations remain positive. In our view, industry led ESG investment frameworks should take the lead and provide clarity to cut through confusion created by changing regulatory and political guidance. As such, investors will become more focused on the credibility of ESG processes and implementation and how these relate back to their ultimate objectives. As some asset managers step away from ESG commitments and products, others will benefit from the opportunity to grow market share.

Investors have also recognised the advantages of the ETF wrapper in structuring unique solutions to investment challenges. These include facilitating time-sensitive trading needs and increasing transparency of holdings. These features have underpinned growth in the US market and are characteristics that have appeal in all regions. Growth in ETF flows has been slower to date in Europe, largely due to fragmented exchange markets and a more conservative investment culture. Cultural adoption of new technologies initially takes time and then accelerates – and we expect a similar pattern for ETF market-share development in Europe.

Investment backdrop

Full year outlooks typically change within a month or two of release due to unforeseen market events. We therefore choose to focus on the market cycle, and the balance of risks for short, medium and long-term scenarios.

The current economic backdrop provides conflicting signals, with stagnating growth in Europe contrasted by a resurgence in US confidence. So called “Trump trades”, predicated on policy-supported reflation of the US economy, are expected to face trade conflict, volatile inflation expectations, bond vigilantes forcing a change in sovereign fiscal policies, and counterbalancing monetary stance from an already-elevated real yield position.

However, the most striking feature to markets as we begin 2025 is euphoric valuations in the US, where animal spirits have driven US equity markets to all-time highs. There have only been two years in the 144-year history of the Schiller CAPE equity valuation dataset when valuations started the year at more expensive levels than they are today. In contrast, valuations in Europe and Japan are far lower. ETF solutions that provide access to these opportunities can strengthen the investor toolkit and help navigate trade-offs between valuations, sentiment, and economic fundamentals.

Exhibit 2: Shiller CAPE ratio at start of year

Source: Janus Henderson Tabular, 31 December 2024. The Shiller Cyclically Adjusted Price-to-Earnings (CAPE) ratio uses real earnings over a 10-year period cyclically adjusted for inflation. It is used by many to determine whether the market is undervalued, fairly valued, or overvalued.

The combination of elevated real yields, a late yet protracted cycle, and overextended valuations lead us to prefer portfolio tilts towards carry, convexity, and increased diversification. ETFs provide a flexible and adaptable platform to express these views. For example, AAA CLO ETFs offer differentiated exposure to credit carry in a portfolio with low duration floating rate note exposure. We anticipate further innovation in 2025 and stand committed to continue to play a critical role in its development.

Bond: A debt security issued by a company or a government, used as a way of raising money. The investor buying the bond is effectively lending money to the issuer of the bond. Bonds offer a return to investors in the form of fixed periodic payments (a ‘coupon’), and the eventual return at maturity of the original amount invested – the par value. Because of their fixed periodic interest payments, they are also often called fixed income instruments.

Carry: The meaning of ‘carry’ is dependent on the context used. For a bond investor, a typical definition would be the benefit or cost of holding an asset, including any interest paid, the cost of financing the investment, and potential gains or losses from currency changes.

Collateralised Loan Obligation (CLO): A bundle of generally lower quality leveraged loans to companies that are grouped together into a single security, which generates income (debt payments) from the underlying loans. The regulated nature of the bonds that CLOs hold means that in the event of default, the investor is near the front of the queue to claim on a borrower’s assets.

Environmental, Social and Governance (ESG) integration is the consideration of financially material ESG risks and opportunities throughout the investment process.

Exchange traded fund (ETF): A security that tracks an index, sector, commodity or pool of assets (such as an index fund). ETFs trade like an equity on a stock exchange and experience price changes as the underlying assets move up and down in price. ETFs typically have higher daily liquidity and lower fees than actively managed funds.

Fiscal/Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal policy is separate from monetary policy, which is typically set by a central bank. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Nominal/real yield: The nominal yield on a bond is the coupon, essentially the interest rate that the bond issuer promises to pay the holder. The real yield is the nominal yield minus the rate of inflation.

Price-to-earnings (P/E) ratio: A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share. It is calculated by dividing the current share price (P) by its earnings per share (E).