article

The first half of 2024 saw strong performance from global equities, as the MSCI AC World Total Return Index rose 12.5% in sterling terms (11.6% in US dollar terms). Receding recession fears were a tailwind, even as pricing of interest rate cuts was pushed out further into the future. Expectations of delays to interest rate cuts led to a rise in government bond yields, hampering returns in investment grade corporate bonds as well. Higher-risk credit, such as high yield, still managed to produce positive returns as starting yields were already elevated coming into 2024. Among commodities, oil, copper and gold all saw strong gains.

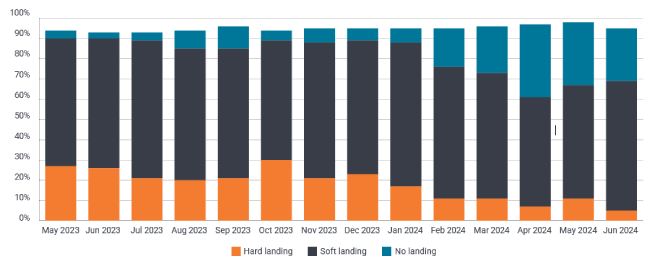

The first half saw recession worries ease substantially. Within the Bank of America Fund Manager Survey the percentage of respondents concerned about a hard landing (sharp contraction in economic growth and rising unemployment) over the next 12 months fell from 23% in December to 5% in June. This change in attitude meant expectations for the number of interest rate cuts from the US Federal Reserve (Fed) in 2024 dropped from over seven to fewer than two over the same period. Expectations for rate cuts were also scaled back at the Bank of England. While the European Central Bank made its first interest rate cut in June, the pace of further moves is now anticipated to be slower than suggested in early 2024.

Despite the shift to a shallower path of interest rate cuts, central banks are still expected to ease the cost of borrowing as inflation continues to decelerate towards target rates, even if some segments remain sticky. Prior rate hikes are still feeding through into economies with a lag, for both corporates and consumers. Borrowers who had termed out their debts continue to roll onto higher costs as they refinance. Central banks are aware that they are likely to need to adjust rates to keep economies on their narrow paths to a soft landing (inflation brought down without causing significant unemployment or economic weakness).

Greater confidence in the economic outlook, expectations for interest rate cuts and robust earnings delivery continued to support equities. While most major regional equity indices rose, the US market and growth stocks more broadly led the advance. Unusually, value stocks did not outperform despite investors becoming more confident in the cyclical outlook for earnings. Small and mid-sized firms also lagged as borrowing costs climbed.

Growth stocks continued their surge, with the global technology sector rising by 25% over the first half.1 Strong interest in Artificial Intelligence continues to be an important theme in markets and across company communications. While earnings growth at those companies seen as at the forefront of utilising the new technology remained very strong, valuations are high. The global technology sector was on a price-to-earnings ratio of 28 times at the end of June. This is some way off the 50 times in the peak of the dot com bubble, but it is very high in comparison to other periods and perhaps leaves the sector sensitive to any disappointment in optimistic earnings forecasts. However, unlike in 2000, earnings have so far been delivered.

Elsewhere, European stocks faced uncertainty after President Macron’s decision to call a snap election in France. With no clear winner, the outcome of the poll prolongs the uncertainty. In contrast, the UK election felt like a done deal well ahead of voting and the result has so far caused little impact. Sentiment towards Chinese equities continues to ebb and flow with news about stimulus measures to resolve some of the structural issues within the economy, but also with headlines about trade conflicts. With November’s US election starting to come into view and China an easy bipartisan target, rhetoric may not settle down any time soon. Polls suggest that the race for the White House remains tight, with a lot of uncertainty about many facets of the campaign and its potential effect on Fed decision-making.

BofA Fund Manager Survey – what is the most likely outcome for the global economy in the next 12 months?

Source: BofA Global Fund Manager Survey, June 2024. No landing is where the economy continues to grow despite central bank efforts to control inflation.

Fixed income assets remain beholden to developments in inflation and central banker commentary, although moves to reduce rates should be supportive. While government bond yields are well below their cycle highs, investors are often receiving a yield above the rate of inflation and are again being paid reasonably well to diversify, compared to much of the last decade. Credit spreads (the additional yield a corporate bond pays over a government bond of similar maturity) remain tight in many areas, but substantial widening is only likely in the event of significant economic deterioration, of which there is currently limited evidence.

Against the historical probabilities, most major economies appear to remain on the narrow paths to soft landings as central banks contemplate when and how quickly to ease policy.

Footnote

1 MSCI World Information Technology Total Return Index.

All index return data is sourced from LSEG Datastream, in total returns in sterling terms, unless indicated otherwise.

Corporate bonds: Bonds issued by companies. These can be rated investment grade by credit rating agencies, which means they are perceived to have a relatively low risk of defaulting (failing to meet repayments to bondholders). Conversely, bonds rated high yield carry a higher risk of the issuer defaulting, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Growth stocks: Companies where earnings growth is expected to be superior to the market average over the long term.

Total return: The return from an investment comprising both income and any capital gain.

Value stocks: Companies that are deemed to be undervalued by the market.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.