As we look towards the first half of 2022, we cannot avoid taking a slightly more cautious view than we did at the start of 2021, informed by a combination of factors that we think represent something of a headwind for markets and the economy. Key indicators are pointing to the macroeconomic backdrop deteriorating, inflation is proving problematic, and policymakers have shifted toward a more hawkish stance (particularly in the US). So, despite most major indices retreating from their all-time highs upon the emergence of the latest COVID-19 variant, ‘Omicron’, it does not yet strike us as a good opportunity to turn overly bullish.

The spread of Omicron

It was no surprise to see Omicron disturb the confidence that markets had built around the successful vaccine development and inoculation drive. The heightened virulence of Omicron has fast seen it become the dominant variant across the developed world. In a best-case scenario, it may go the way of some other strains that looked potentially very dangerous, but just disappeared quietly. Indications at this point suggest that heightened transmissibility may have been exchanged for reduced potency. In the worst-case scenario, existing vaccines still seem to provide good levels of protection against severe disease. Given the virus’s continued global circulation and capacity for rapid mutation, however, it is becoming ever clearer we will need to adapt to live with COVID-19, much like we have learned to live with the countless other viruses around us. But there is much that the medical industry can do to help this.

From a purely medical standpoint, we remain very optimistic about how vaccine manufacturers are adapting. BioNTech and Pfizer have been among the first to respond, announcing that they will need a lead time of around three months to adjust their mRNA vaccines to new variants. More and more people are getting access to vaccinations and booster shots. Governments must now do their utmost to secure these gains, helping to support the economy and provide an environment where consumers and businesses can act with confidence.

Muted growth and higher inflation… stagflation?

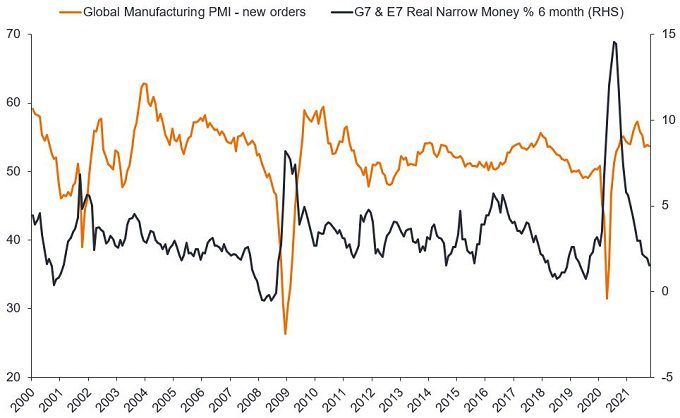

We have seen a sharp decline in the level of real money creation since the summer of 2020 for the G7 nations (US, UK, France, Germany, Italy, Canada, and Japan) – see Exhibit 1. This is ongoing and has contributed to lower expectations for economic growth. We see similar signs of weakness in corporate earnings. Whereas earnings upgrades exceeded downgrades earlier in 2021, implying that companies were doing better than expected as economies began to reopen, we saw this shift towards equilibrium as the year progressed, and we anticipate a further rise in downgrades in the first half of 2022.

Source: Refinitiv Datastream. Janus Henderson Investors analysis, as at 31 October 2021. Narrow money (M1) = currency in circulation + demand / overnight deposits. The Purchasing Managers’ Index (PMI) is an early indicator of the economic health of the manufacturing sector within an economy. The index is based on five indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Anything over 50 suggests the expectation of expansion.

Note: G7 countries = Canada, France, Germany, Italy, Japan, UK and US. E7 countries = Brazil, China, India, Indonesia, Mexico, Russia and Turkey.

Inflation has proved far more persistent than many expected, at higher levels than forecast. This has been exacerbated by the fragility of global supply chains, which has forced many companies to change their behaviour, shifting from ‘just in time’ inventory stocking to ‘just in case’, to ensure business continuity. The rapid spread of the pandemic prompted the shutdown of industries across the globe, while government-mandated lockdowns led to imposed falls in consumer demand. The end of lockdowns, however, saw demand rebound sharply, pushing up the price of products or materials in short supply, with consequences for inflation. This growth in demand was reflected in business optimism, with the manufacturing PMI rebounding sharply from its lows in mid-April 2020.

The risk of a stagflationary environment in 2022 may be exacerbated by the risk of hawkish monetary policy from the US Federal Reserve (Fed), even as we see signs emerging of a broader macroeconomic slowdown. The flattening of sovereign bond yield curves, commonly seen as an indicator of worries over economic growth, should act as a warning sign of potential policy error. The Fed has been clear about its intent to accelerate its tapering of monthly bond purchases in response to rising inflation, to be followed by interest rate increases. If nothing else, a US-led retreat from stimulus measures would seem to suggest that we are past the peak for market liquidity, which could contribute to higher market volatility.

Two steps forward, one step back

While we expect growth to continue, albeit at more muted levels, it seems sensible to consider the risk of further economic setbacks related to the pandemic, and the potential for significant divergence at a stock and sector level. Uncertainty seems likely to become more entrenched, given ongoing supply and demand imbalances related to the pandemic, and the risk of fiscal and monetary policy errors (and inflation). Investors may want to consider a broader set of tools for their portfolio.

It is worth keeping in mind that strategies built around being long equities/long bonds have been a dependable option for investors for many years now. But no market paradigm persists forever, and the environment that we find ourselves in may well prove to be more difficult to navigate. The very factors that have fuelled uncertainty are those that may offer better opportunities for long/short strategies capable of navigating both rising and falling markets.

Inflation: The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Money creation: The process by which the money supply of a country, or of an economic or monetary region, is increased. The majority is created by banks making loans. But the amount created ultimately depends on monetary policy from the central bank, usually via setting interest rates, although the central bank can adjust the amount of money directly through quantitative easing. An increase in the supply of money typically generates more investment and puts more money in the hands of consumers, thereby stimulating growth.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative easing: An unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system, most commonly by purchasing government bonds.

Purchasing Managers’ Indices: The Purchasing Managers’ Index (PMI) is an early indicator of the economic health of the manufacturing sector within an economy. The index is based on five indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Stagflation: A relatively rare situation where rising inflation coincides with anaemic economic growth.

Bond yield curve: A graph that plots the yields of similar quality bonds against their end date (maturities). In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. A yield curve can signal market expectations about a country’s economic direction.

‘Long’ investing: A strategy that involves investing in assets (stocks, bonds, property, etc) in the expectation that they will rise in value over time.

‘Short’ investing: Fund managers use this technique to borrow then sell what they believe are overvalued assets, with the intention of buying them back for less when the price falls. The position profits if the security falls in value.

Long/short investing: A strategy that involves investing in both long and short positions. The intention is to profit from price gains in long positions, and price declines in short positions. This type of investment strategy has the potential to generate returns regardless of moves in the wider market, although returns are not guaranteed.