September 2020

A new tactical addition to portfolio protection

-

Maya Perone

Maya Perone

Portfolio Manager -

Andrew Kaleel

Andrew Kaleel

Portfolio Manager

Key takeaways

- A challenge for any ‘always on’ protection strategy is the ongoing cost of carry. After the March 2020 sell-off, implied volatility remains elevated, pushing up the cost of the Long Volatility and Trend strategies.

- We have developed a new, in-house tail strategy (’Tail’) that tactically seeks to reflect long (short) exposure to asset classes that are expected to gain (decline) during stressed market regimes.

- We believe Tail provides a compelling addition to a robust suite of ‘protection’ strategies, aimed at maintaining required protection levels in times of high implied volatility, while reducing the cost draft and gap risk associated with Trend.

The COVID-19 related sell-off in March 2020 was a succinct reminder of the sheer ferocity with which markets can decline, and that no two crises follow the same playbook. Markets are always evolving and require a multi-layered approach to portfolio protection.

Of the three distinct portfolio ‘protection’ strategies currently utilised by the Diversified Alternatives team, each offers its own individual characteristics to help construct an overall ‘holistic’ take on protection. Long Volatility provides the most effective protection against gap risk and short-term shock events (2020 crisis). The Trend strategy is a complementary strategy that provides well documented ‘crisis alpha’ when markets exhibit sustained increases (decreases) in asset prices.

The major challenge for both the Long Volatility and Trend strategies is the ongoing ‘carry’. A Long Volatility strategy costs more for the same level of protection during periods of heightened implied volatility, and a Trend-following strategy often has a negative carry in trendless regimes. In the past, we have not necessarily seen correlation between the carry costs of these two strategies and therefore relative weights can be modulated to mitigate the costs of protection. However, periods following market shocks have historically been defined by heightened cross-asset correlation and heightened implied volatility, as has been the case since March 2020. In essence, both strategies are expensive. The increase in implied volatility (and cost) has reduced our risk appetite in the Long Volatility strategy. Similarly, periods of strong trending markets for the Trend strategy are often followed by extended periods of mean reversion during which time Trend struggles.

While a protection strategy is intended to be highly effective and efficient in providing non correlated returns in stressful markets, is there an additional strategy that can quickly, systematically and tactically provide protection when risk (and protection costs) are relatively high?

The Tail Strategy (‘Tail’)

A ‘Tail’ model could be used as an additional element to be deployed as part of a protection strategy in a portfolio. Unlike the Long Volatility and Trend-following strategies, exposure to Tail can be modulated in order to target required levels of portfolio protection, particularly during periods of high cost of carry for Long Volatility and/or Trend.

Tail seeks to tactically reflect long (short) exposure to asset classes that are expected to gain (decline) during stressed market regimes. During periods of low volatility and a lack of tail events, the tactical signal is designed to ‘switch off’ Tail, and therefore does not entail a cost of carry in periods when it is not required.

In order to capture as wide a series of shock events as possible (not just equity market risk), Tail utilises a variety of asset classes to construct the index. Given the unpredictable behaviour of stressed markets, it is important to avoid reliance upon any one particular asset. Will gold continue to behave as it has historically and provide the associated defensive characteristics? Will the US dollar broadly continue to be the currency of choice as investors seek a haven? Will bonds continue to provide the airbag they once did given historically low yields? With a diversified index, we simply require ‘defensive’ assets to outperform ‘risk’ assets for Tail to have the desired impact. The tactical trigger that determines investment in Tail is a high conviction trend mechanism utilised within the existing Trend strategy.

Asset classes and positioning within the Tail strategy are as follows:

| Long – defensive assets | Shorts – risk assets |

|---|---|

| Global Treasuries | Global stock indices |

| Gold | Hard commodities (ex-gold) |

| VIX | Currencies (relative to $US) |

ALTERNATIVE

PERSPECTIVES Explore more

EXHIBIT 1: A MODELLED TAIL STRATEGY COULD HAVE BENEFITED FROM ITS COMBINATION OF LONG AND SHORT ASSETS

Value of US$100: Tail Index (12% volatility target) vs S&P 500

| Return p.a. | Volatility p.a. | Sharpe ratio | Correlation to world equities | Correlation to global bonds | Correlation to trend index | |

|---|---|---|---|---|---|---|

| Tail Strategy | 9.3% | 11.2% | 0.8 | -0.61 | 0.21 | 0.27 |

Source: Janus Henderson Investors, 31 December 1999 to 31 December 2019. Past performance is not a guide to future performance. The value of your investment may go down as well as up and you may not get back the amount originally invested.

Note: The hypothetical, back-tested performance shown in this model is for illustrative purposes only and does not represent actual performance of any client account. No accounts were managed using the portfolio composition for the periods shown and no representation is made that the hypothetical returns would be similar to actual performance.

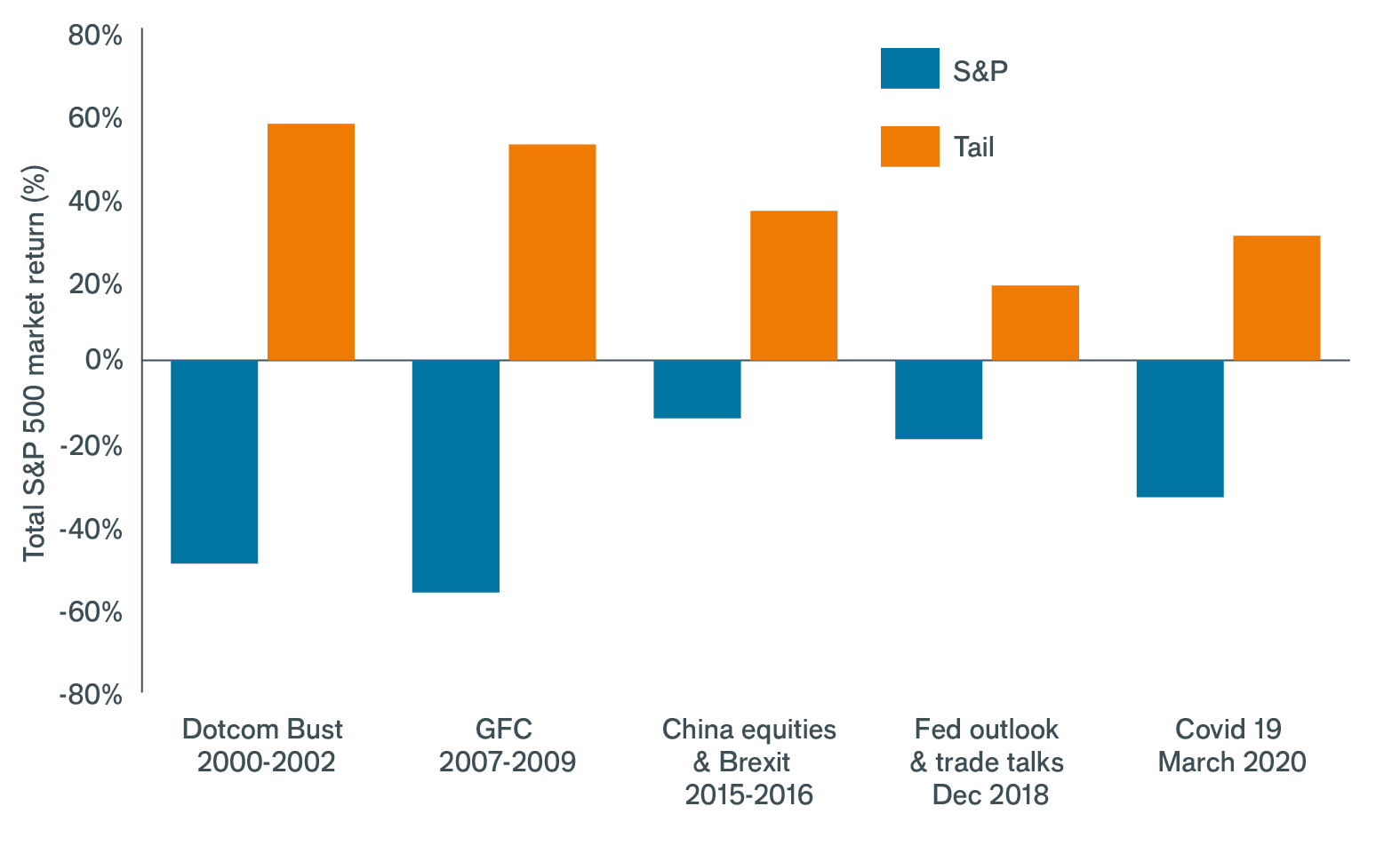

Over the past two decades, there have been several double-digit drawdowns on the S&P 500 Index, each drawdown path unique in terms of its speed and duration. The largest drawdowns were the GFC in 2007–2009 and the Dotcom bust in the early 2000s. While the COVID-19 induced drawdown was not as large, it was much faster. It took only 24 trading days for the S&P 500 Index to decline 33%. By comparison, during the GFC it took the S&P 500 a total of 260 trading days to see a similar decline. Analysis of a modelled Tail strategy across periods of high volatility historically suggests that this element of a protection strategy could offer a potential source of diversification during periods of significant drawdowns (Exhibit 2):

EXHIBIT 2: FIVE BIGGEST DRAWDOWNS FOR THE S&P 500 THIS CENTURY

Note: The hypothetical, back-tested performance shown in this model is for illustrative purposes only and does not represent actual performance of any client account. No accounts were managed using the portfolio composition for the periods shown and no representation is made that the hypothetical returns would be similar to actual performance.

What are the potential shortcomings of the Tail strategy? One factor is that it relies on a tactical trigger to switch on exposure and can therefore be ‘late to the party’. While the strategy has shown the potential to effectively participate in major stress events over the past two decades in modelling, there is no guarantee such a strategy would participate in the initial stages of a market shock. Another potential shortcoming is that Tail also assumes that underlying index constituents will behave as they have historically in market shocks; the next shock may impact past correlations.

What Tail ultimately seeks to deliver is a tactically useful and complementary lever within the portfolio protection bucket that addresses some of the challenges faced by other strategies:

- Maintain required protection levels in times of high implied volatility

- Reduce both the cost drag and gap risk associated with Trend

The Tail strategy potentially solves a problem for a particular environment of market stress and, in our view, provides a highly complementary fourth leg to an already robust suite of protection strategies offered by the diversified alternatives team.

Notes:

Hypothetical, back-tested or simulated model performance has many inherent limitations, only some of which are described here. The hypothetical Tail strategy model has been constructed with the benefit of hindsight and does not reflect the impact that certain economic and market factors might have had on the decision making-process. No hypothetical, back-tested or simulated performance can completely account for the impact of financial risk in actual performance. Therefore, it will invariably show optimised rates of return, used solely here for the purpose of illustration. The hypothetical performance results shown may not be realised in the actual management of accounts. No representation or warranty is made as to the assumptions made or that all assumptions used in construction the hypothetical returns have been fully stated. Assumption changes may have a material impact on the returns presented. This material is not representative of any particular client’s experience. Investors should not assume that they will have an investment experience similar to the hypothetical, back-tested or simulated performance shown. There are frequently material differences between hypothetical, back-tested or simulated performance results and actual results subsequently achieved by any investment strategy. Prospective investors are encouraged to contact the investment manager to discuss the methodologies and assumptions used to calculate the hypothetical performance shown.

More Alternative Perspectives

PREVIOUS ARTICLE

Pursuing portfolio protection in a world of radical uncertainty

Should investors always be protected? If so, how can this be implemented? In this article, Portfolio Manager Mark Richardson describes the construction of a multi-faceted ‘strategy designed to mitigate a large range of unforeseeable market risks.

NEXT ARTICLE

The end of the free put

In this short read, Portfolio Managers Aneet Chachra and Steve Cain consider to what extent the offsetting relationship between bonds and equities has held firm in 2020.