Monetary prospects and cycle considerations suggest global economic strength in H2 2025/2026 but a “hard landing” – or at least a scare of one – may be necessary first.Commentary here at mid-year proposed the following baseline scenario:

- A “double dip” in global industrial momentum in H2 2024 with limited recovery in early 2025, reflecting the profile of real narrow money momentum with a roughly one-year lag.

- Pass-through of industrial weakness to the services sector and – crucially – employment, the latter contrasting with experience during the first “dip” in 2022 when labour markets were in excess demand and unaffected.

- A further decline in consumer price inflation rates to below target in H1 2025, echoing a fall in broad money growth to very low levels in H1 2023, assuming a typical two-year lag.

- A rapid response of monetary policymakers to downside labour market and inflation surprises, resulting in official rates falling by more by Spring 2025 than markets expected in mid-2024.

- A consequent strong pick-up in real narrow money momentum by Spring 2025, laying the foundation for an economic boom starting in late 2025, consistent with the cyclical framework suggesting joint strength in the stockbuilding, business investment and housing cycles.

The near-term hard – or hard-ish – landing in this scenario is necessary to elicit policy easing sufficient to drive the later boom. Without it, the global economy could remain stuck in a slow-growth equilibrium into 2026, with policy rates kept above a neutral level despite low inflation.

Incoming news has been consistent with several elements of the baseline scenario but others require confirmation:

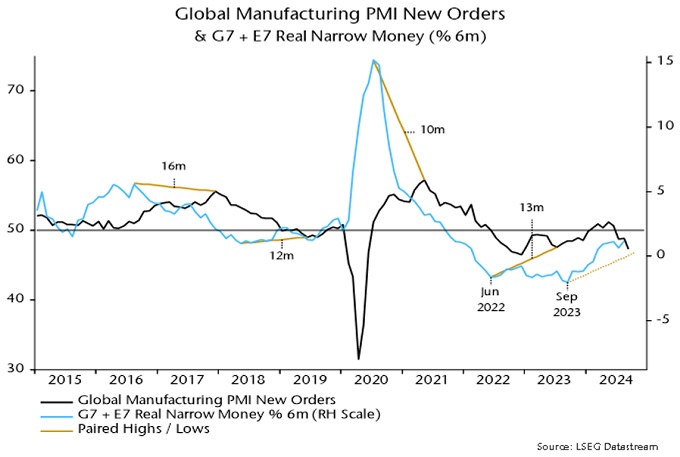

- The global manufacturing PMI new orders index fell to a 21-month low in September. Global six-month real narrow money momentum bottomed in September 2023, signalling a likely PMI trough by end-2024 – see chart 1.

Chart 1

- Real narrow money momentum has been moving sideways since the spring at a low level by historical standards, consistent with industrial momentum remaining weak in early 2025.

- Manufacturing weakness appears to be transferring to services. The global services PMI new business index remained at an expansion-consistent level in September but output expectations fell sharply to a 23-month low – chart 2.

Chart 2

- Employment weakness has yet to crystallise. The global composite PMI employment index is below a low reached during the first dip in 2022 but not yet in contraction territory (50.0 in September). The US economy has continued to add jobs, although payrolls numbers are probably still overstating growth and average weekly hours have fallen.

- Inflation news has been favourable. Six-month headline / core consumer price momentum in the US and Eurozone has moved lower since mid-2024, while global PMI output price indices for consumer goods and services have stabilised close to their 2015-19 averages, when G7 annual core CPI inflation averaged 1.6% – chart 3.

Chart 3

- Monetary authorities have in most cases shifted dovishly since mid-year. A major Chinese policy pivot at quarter-end could lead to a strong rebound in narrow money growth, supporting the expectation of global acceleration.

To summarise, the baseline scenario is still on track but requires confirmation from early further deterioration in labour market news as well as continued inflation progress.

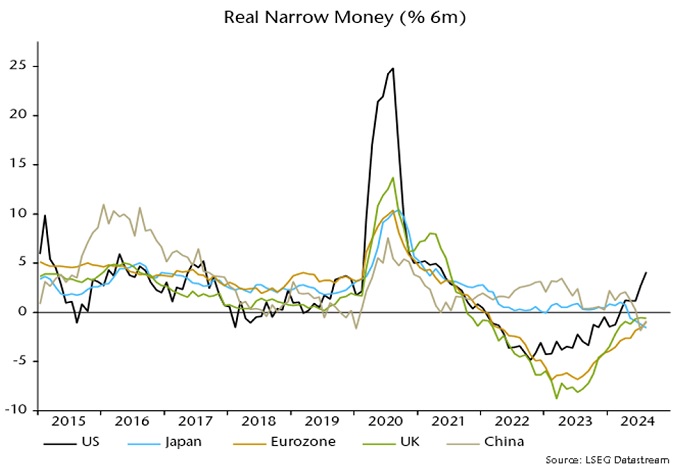

The stabilisation of global six-month real narrow money momentum at a weak level conceals significant geographical dispersion. A strong pick-up in the US has been offset by falls in China and Japan, while a slow recovery in the Eurozone has caught up with a stalling UK – chart 4.

Chart 4

The rise in US momentum is puzzling and challenges the expected scenario of economic weakness and labour market deterioration into H1 2025. A near-term stall or reversal would reduce this tension and is plausible, with large monthly rises in March / April about to drop out of the six-month comparison.

Momentum remains negative across Europe but – except in the UK – has continued to recover, with a further acceleration expected as a pattern of rate cuts at successive policy meetings is established. UK-Eurozone monetary convergence is at odds with market themes of UK relative economic resilience and inflation stickiness, and incoming data could force the MPC to shift dovishly soon.

Interpretation of Chinese monetary trends has been clouded recent regulatory changes that have reduced the attractiveness of demand deposits, resulting in a switch into time deposits and money substitutes. The narrow money measure shown in chart 4 incorporates an adjustment but the “true” picture could be stronger or weaker. Previous large stimulus packages have fed rapidly through to monetary acceleration but – even if this occurs – economic momentum is likely to remain weak through Q2 2025, at least.

The cyclical framework used here judges current global economic weakness to reflect mid-cycle corrections in stockbuilding and business investment upswings, rather than new downswings in either cycle. The stockbuilding cycle (3-5 years) bottomed in Q1 2023 but an initial recovery due to an ending of destocking has fizzled as final demand has remained weak. The assumption is that policy easing will generate a second leg up in 2025, with a cycle peak possibly delayed until 2026.

The primary trend in the business investment cycle (7-11 years, last low 2020) is also still up, with the current correction probably attributable to a combination of restrictive interest rates, a profits slowdown and heightened uncertainty. Corporate financial balances (retained earnings minus capex) are in surplus in the US, Japan and Eurozone and a recovery in global economic momentum in 2025 could generate a strong “accelerator” effect on investment as animal spirits revive.

A key assumption is that the long-term housing cycle (average 18 years), which bottomed in 2009, will enjoy a final burst of strength in response to lower rates before peaking, possibly in 2026. One reason for believing that the upswing is incomplete is that peaks were historically associated with mortgage lending booms: annual growth of US residential mortgages reached double-digits before downswings into lows in 1957, 1975, 1991 and 2009. The high so far in the current cycle has been 9% (in 2022), with lower numbers in the Eurozone and UK.

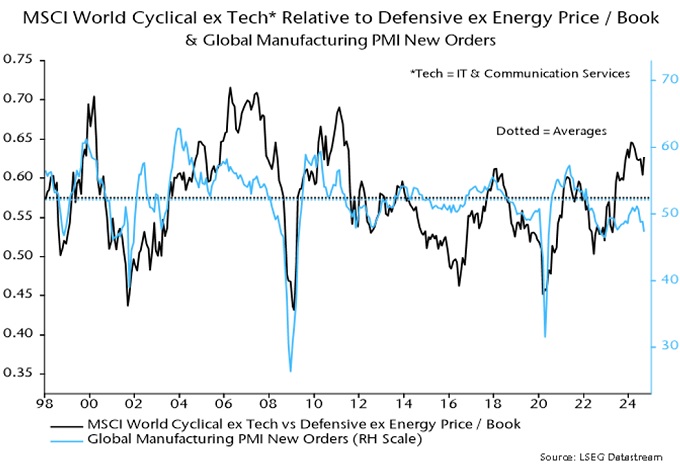

The mid-year commentary suggested that defensive equity market sectors would outperform as a H2 double dip unfolded. They did through early September but cyclical sectors rebounded on hopes of rapid Fed easing and large-scale Chinese stimulus. Even if forthcoming, the economic effects will be delayed and may already be discounted in relative valuations – chart 5.

Chart 5

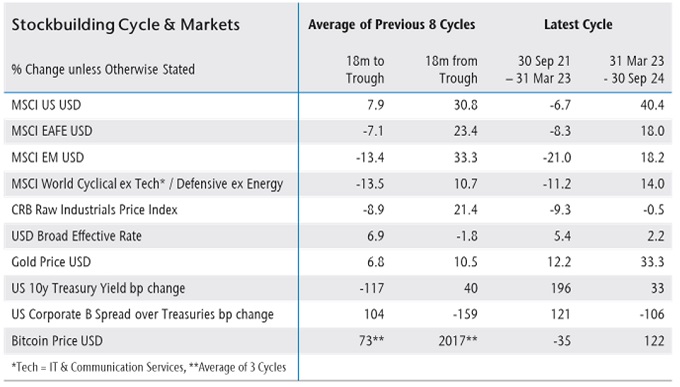

Markets have historically correlated with the stockbuilding cycle, so one approach to assessing investment potential is to compare returns so far in the current cycle with an average of prior upswings. As shown in table 1, US equities, cyclical sectors and gold have performed more strongly than the historical average in the 18 months since the cycle trough in Q1 2023, suggesting limited further upside and possible reversals, even assuming a late cycle peak.

Table 1

Non-US equities – particularly emerging markets – have, by contrast, underperformed relative to history in the current cycle, while commodity prices have been unusually weak. Though also likely to suffer in any near-term hard landing scare, these areas have catch-up potential in the baseline scenario of global economic acceleration through 2025 driven partly by the stockbuilding cycle upswing entering a second phase.