Knowledge. Shared Blog

September 2020

A 60-Second Primer on the Joe Biden Tax Plan

-

Matt Sommer, CFA, CFP®, CPWA®

Matt Sommer, CFA, CFP®, CPWA®

Sr. Managing Director

While it may be too early to make changes to existing financial plans in anticipation of possible tax law changes, there are actions investors can consider taking now to help improve the tax efficiency of their portfolios. Retirement and wealth strategies expert Matt Sommer outlines the key highlights of Joe Biden’s proposed tax plan and discusses three tax planning strategies that can be incorporated year-round – regardless of the election outcome.

With the 2020 U.S. presidential election in full swing, many investors are wondering how a change in the White House could impact future tax bills. While November is fast approaching, it’s important to remember that, regardless of who wins the election, any proposed changes to tax laws will need to be approved by Congress – a process that can take many months, especially if the proposals face a filibuster by the Senate.

But while it might be too early for investors to make changes to their existing financial plans in anticipation of possible tax law changes, it is still in their best interest to stay informed and understand the facts.

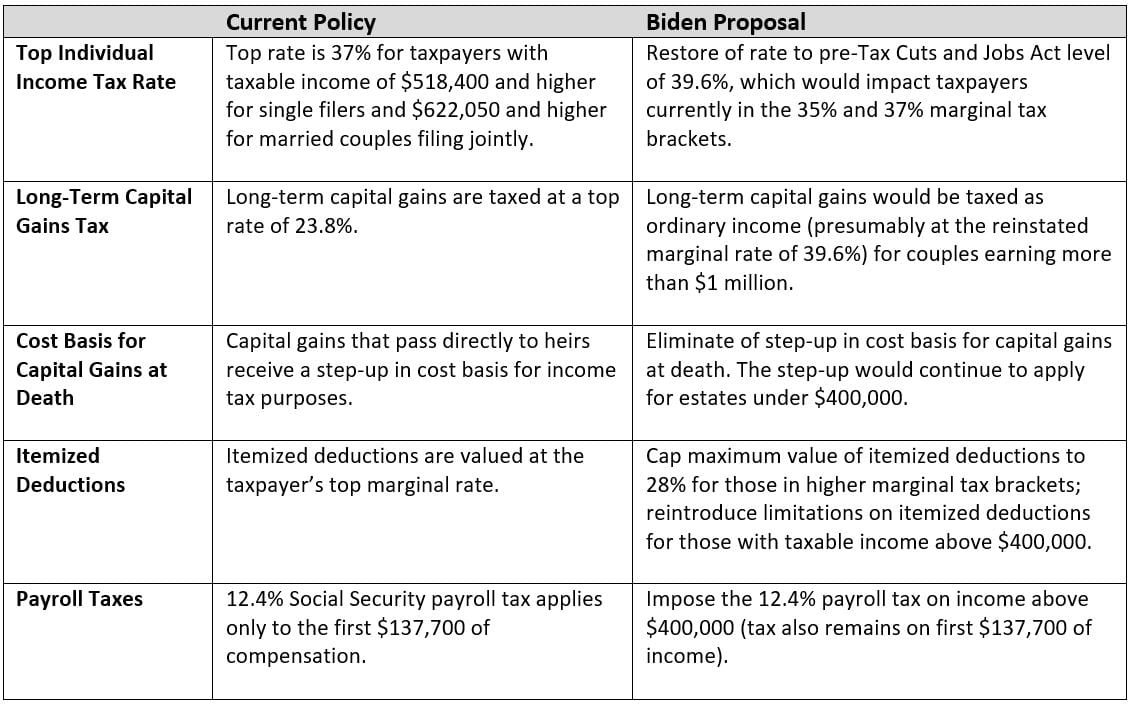

With that in mind, the following primer outlines Joe Biden’s proposed tax plan using information provided by the non-partisan Committee for a Responsible Federal Budget’s July 30, 2020 analysis. According the analysis, the five highlights of the Biden tax plan that impact investors include1:

Using projections provided by the Tax Policy Center, Penn Wharton Budget Model, Tax Foundation, and American Enterprise Institute, the analysis from the Committee for a Responsible Federal Budget found that Biden’s tax plan would increase the effective tax rate for the top one-fifth of earners by 2.3% to 5.7% in 2021. The increase for the top 1% of earners would range from 13% to 18%. For the bottom four-fifths of earners, taxes would increase from 0.2% to 0.6%. (Note that this tax increase is not imposed directly by the Biden plan, but rather the projections account for the indirect effects borne by workers as a result of increasing the corporate tax rate from 21% to 28%.)

Separately, Biden campaign officials have discussed a proposal to “equalize” the tax benefits associated with qualified retirement plan contributions. Details have not yet been released, but the general idea is to replace deductions that are more valuable to higher-income investors with a refundable tax credit that provides all taxpayers the same benefit. In 2012, the Tax Policy Center examined a proposal that would replace the current system with a 30% tax credit. The impact to the federal budget would be neutral; however, tax increases would fall disproportionately on the top 10% of earners.2

Evergreen Tax Planning Strategies

Again, given the uncertainty surrounding the upcoming election, it may be too soon to make wholesale changes to your financial plan. But there are three actions you can take now to “hedge your bets,” so to speak, from a tax planning perspective.

- Consider taking advantage of a Roth 401(k). Roth utilization is still relatively low – likely because people tend to dislike the fact that they don’t receive their deductions up front with a Roth. But many investors do not realize that they can mix and match contributions to a traditional and Roth 401(k) as long as they don’t exceed the 2020 maximum. For investors who already have a substantial amount of assets built up in a pre-tax plan, diverting some of those assets to a Roth will allow the money to grow tax free, helping to provide additional diversification from a tax perspective. Simply put, this strategy gives you more options and greater flexibility – regardless of what happens to tax rates in the future.

- Harvest tax losses to offset capital gains. Tax-loss harvesting is an exercise typically associated with year-end planning, but capital losses can be taken at any time of the year. If you have investments that have lost value, you can sell them and use the capital loss to offset any capital gains. In 30 days, the same security may be repurchased again. And even if you cannot use all of your losses immediately, you can carry them over indefinitely to offset future gains. (As a reminder, to generate a capital loss, a wash sale must be avoided. A wash sale occurs when a security is sold at a loss and the same or a substantially similar security is bought within 30 calendar days before or after the sale.) Bottom line, if tax rates go up, incorporating tax-loss harvesting into your investment plan could be a useful strategy to help minimize your tax liability.

- Focus on tax-efficient investing. When it comes to tax-efficient planning, asset location – how you distribute your investments across savings vehicles – is just as important as asset allocation. The general principle is that you can potentially lower your overall tax liability by strategically placing high-tax investments in tax-deferred or tax-exempt accounts. For example, if you purchase a stock in a brokerage account and hold it for a year, that investment will be subject to long-term capital gains tax. However, if you purchase the same security inside a (tax-deferred) IRA account, the gains will be taxed as ordinary income with no long-term capital gains treatment. The takeaway here is, the greater the disparity between ordinary income and capital gains, the more important it is to pay attention to the tax treatment of your investments.

None of the strategies outlined above are new – they are time-tested approaches to managing the tax implications of your investments and incorporating tax efficiency in your portfolio. Of course, as with any tax-related considerations, be sure to consult with your tax advisor or accountant before making any changes.

1Committee for a Responsible Federal Budget. “Understanding Joe Biden’s 2020 Tax Plan.” July 30, 2020.

2Roll Call. “Biden retirement proposal would upend traditional 401(k) plans.” August 24, 2020.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe