Consistency is key

Often, when top-performing athletes are asked about the key ingredients to their success, the answer is rarely attributed to one thing, but rather a combination of factors successfully executed with an objective in mind. One attribute that ranks amongst the highest is consistency. Like athletics, music, or art, it is the same in investing. It is the constant grind of pushing yourself towards an objective. It is a slow and arduous process, and you may not see results every day. The only thing keeping you in the game is your belief in the strategy and the end goal.

In an era of instant gratification, consistency lacks the allure of excitement and is often dubbed as boring. As we all know, every dog has its day, but consistency is about turning up day after day, month after month, and decade after decade – that is how household names are made.

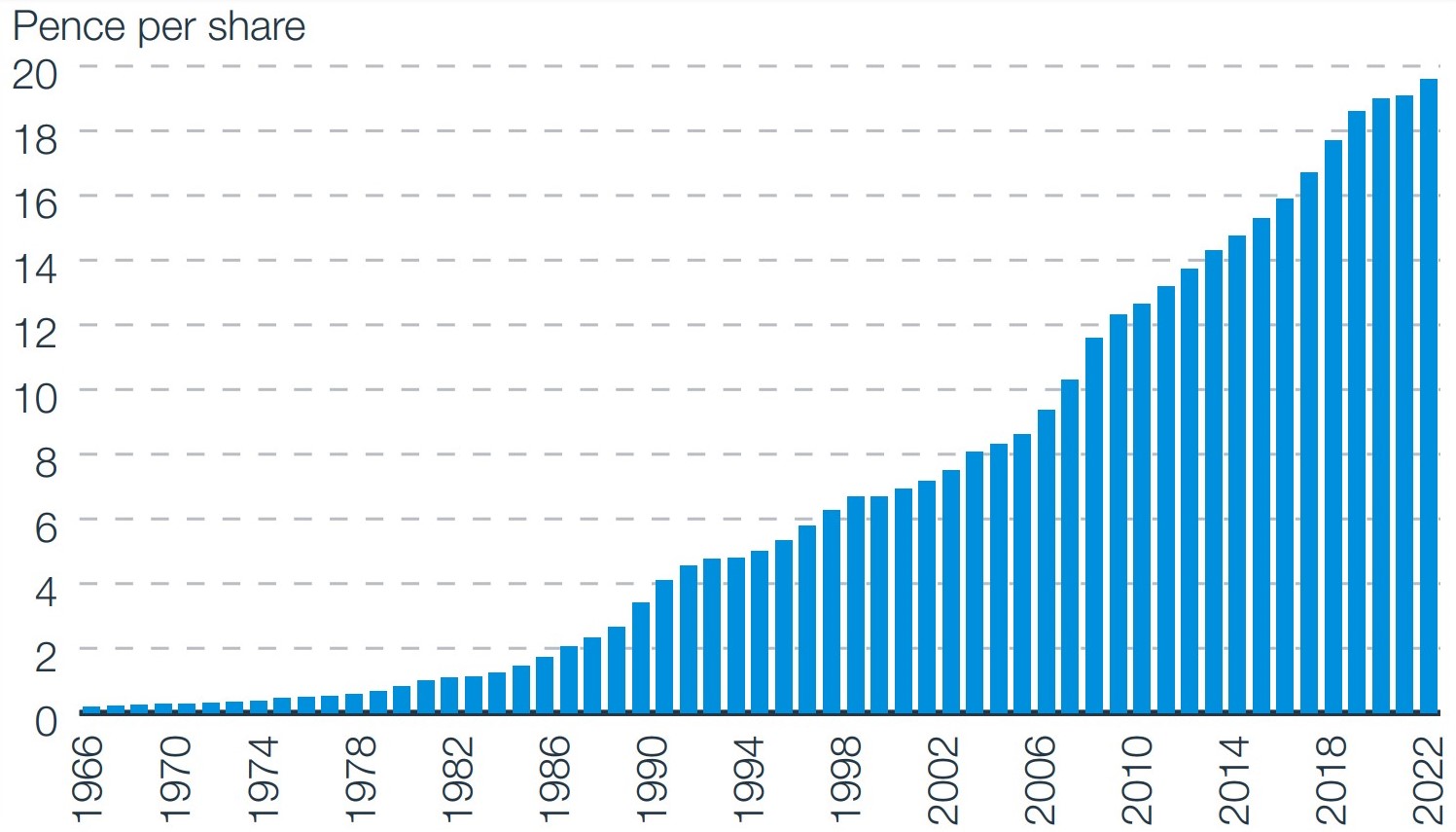

It is a characteristic that comes to mind when one thinks of The City of London Investment Trust, managed by portfolio manager Job Curtis. It has grown its dividend every year since 1966, the last time England won the world cup! This 56-year-old record is the longest of any investment company. While Job has only been at the helm for 31 years, the investment company has not missed a beat in terms of dividends under his tenure. So how has this record been achieved, and as the global economy faces a recession, how is the portfolio positioned for dividend growth going forward?

Source: The City of London Investment Trust, Annual Report 2022

The building blocks

Before we dissect the results, it’s essential to look at some of the building blocks that have led to such an achievement. The first, is the quality of the company. At its core, the City of London seeks to have quality companies that consistently grow their profits and dividends. The aim is to find companies that cover their dividends with cash flow and profits and can squirrel away enough to invest for long-term growth. Of course, different industries and companies have varying investment needs. For example, those in a high-growth phase may need to retain a lot of cash for investment, whilst more mature companies may be able to hand back a more significant proportion of their retained profits to shareholders as dividends. The latter is what City of London focuses on.

However, not all dividends are created equal. Just because two companies yield 5%, it does not mean they have the same valuation. For example, if company A has its dividend covered twice by cashflows, its prospects are very different to company B whose dividend is covered just once. This leads us to the second pillar, strong financials. It’s all very well and good for a business to yield 7%, but is that number going to be the same in 5 years’ time? That is why a solid balance sheet and strong free cash flow are amongst the key characteristics that Job looks for in a business. There is also another layer that rarely gets attention when it comes to dividend payers. Job believes that paying and growing a dividend helps to bring fiscal discipline on corporate management teams. As soon as a company starts paying a dividend, shareholders come to expect it. And knowing that you are expected to send a cheque to your owners every three or six months has a way of focusing the mind.

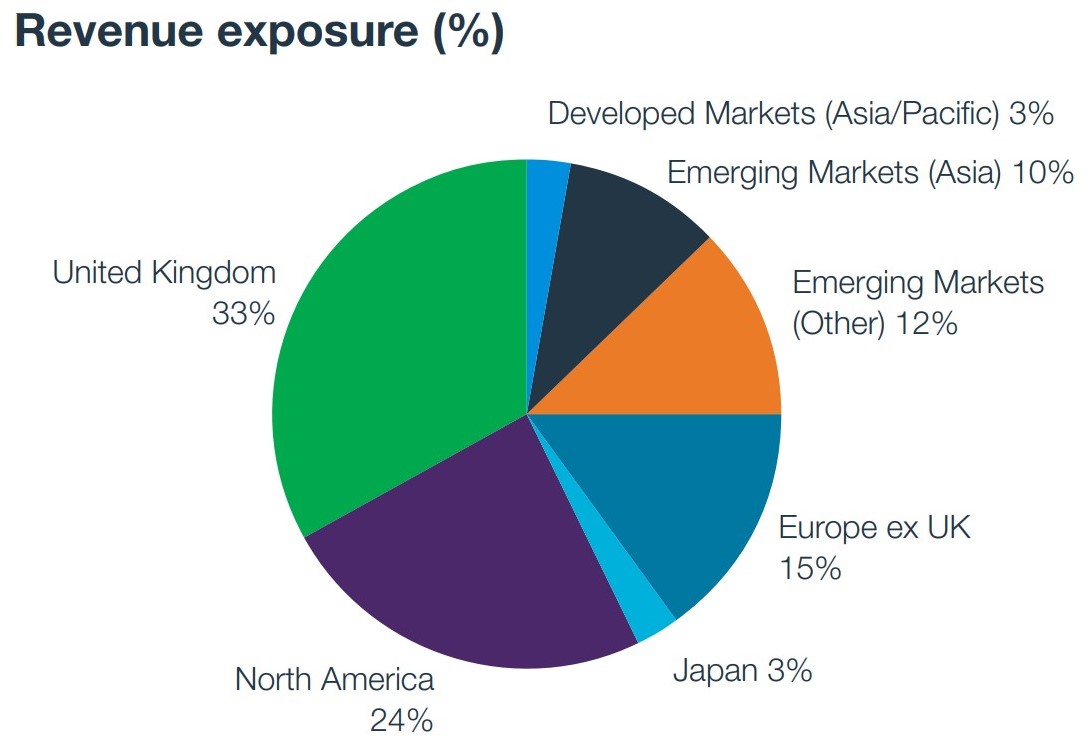

Another key pillar of City of London is diversification. Job believes that diversification across sectors and stocks can help provide consistent dividend growth as well as capital gains. The old adage ‘don’t put your eggs in one basket’ comes to mind. While it might be tempting to have definite biases within a portfolio, too extreme a position can lead to volatile performance – a truism most highly levered growth portfolios can attest to today. As such, the portfolio is always prudently diversified from a sector and stock perspective but with a bias towards larger international companies. Taking it a step further, the underlying revenues of the portfolio also need to be sufficiently diversified to ensure that volatility within one market is offset by revenues from different regions. For example, only 31% of the City of London’s revenues come from the UK, while 69% comes from outside the UK.

Source: The City of London Investment Trust, Annual Report 2022

Lastly, it would be remiss not to mention the investment trust structure. It has been a key advantage in delivering consistent dividend growth. While open ended funds have to distribute all of their income once a year, investment trusts can retain up to 15% which is added to the revenue reserve. The revenue reserve can be drawn down during difficult years for dividends in the equity market enabling an investment trust’s dividend to continue growing. Since Job has managed the City of London, he has used revenue reserves only nine times to keep dividend growing.

Balance is key

So how has this played out in practice, and how is the portfolio positioned going forward?

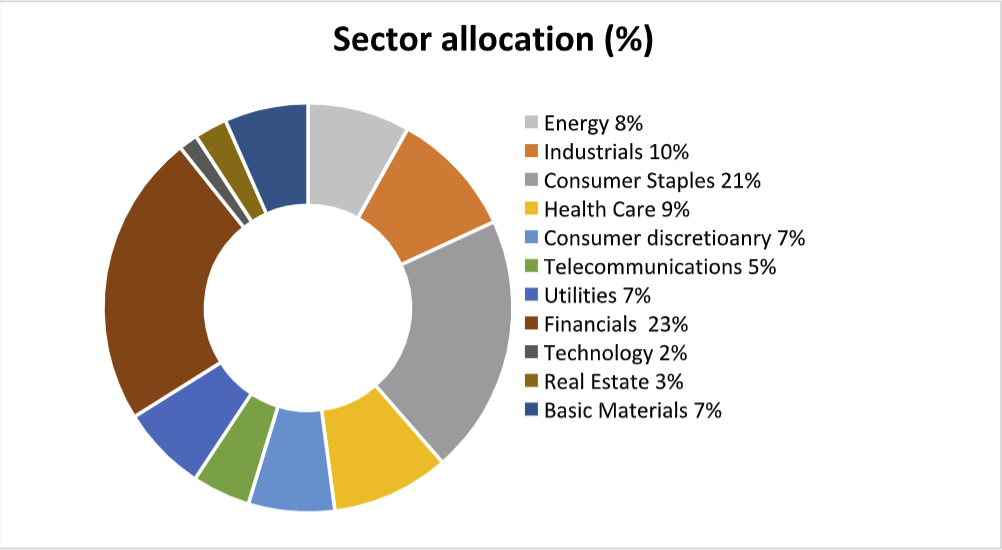

The portfolio has a balance in key areas with the aim of generating long-term income and capital. The first is financials, representing 23% of the portfolio. Companies within this industry group have, in general, performed well as rising interest rates have provided a helpful tailwind. For example, banks find it easier to make their net interest margin with improved rates for deposits. Within the sector, there is a smattering of exposure from more traditional banks (HSBC and Lloyds) to financial services (M&G), life insurance (Phoenix) and private equity (3i). Such exposure to different types of businesses helps Job retain the attractive combination of dividend yield and growth.

The second, consumer staples (20% of the portfolio), consists mainly of global companies that have strong profitability. These companies sell essential, everyday items. Due to the cost-of-living crisis, a staggering 83% of consumers are said to have changed their purchasing habits, with most cutting spending on non-essential items and switching to cheaper supermarket-branded products. In such an environment, companies that can offer consumers good value have performed well. Among the City of London’s largest holdings are British American Tobacco, Diageo, Tesco, and Unilever. While these companies provide value to consumers, they also have strong pricing power. As a result, they have been better able to cope with higher cost pressures whilst protecting their margins and profitability. Such a characteristic will be key if inflation is to remain elevated for some time.

Source: The City of London, Annual Report, 2022

Other areas are oil (energy) and healthcare, which represent 8% and 9% of the portfolio, respectively. Oil companies have benefitted from elevated oil prices, which Job believes will likely persist over the next two years given the imbalance between demand and supply in the global market. While the volatility in oil prices is very much the short-term play, he also has an eye on the longer-term picture. How these companies perform longer term will depend on how well they execute ambitious plans to achieve “Net Zero”. They will need to cut their fossil fuel exposure while investing in renewable energy (wind and solar) and developing carbon capture.

Looking at healthcare, the City of London has exposure to companies such as AstraZeneca and GlaxoSmithKline. In what has been a volatile market environment, companies within the sector benefitted from their defensive characteristics. Successful companies in this sector have a strong record of bringing to the market medicines and vaccines that improve health, prolong, and save lives. Given its importance and large-scale funding from governments, healthcare spending is relatively resilient in a period of slowing growth.

Navigating an uncertain future

There is no doubt, that the macro-economic outlook is paved with uncertainty. Inflation expectations have increased to levels last seen since the 1980s, the cost-of-living crisis is intensifying as consumers and businesses get to grips with higher energy prices, and the global economy is now headed for a recession. That being said, the building blocks that made City of London what it is today, are still firmly in place. Consistency of approach remains the bedrock on which portfolio manager Job Curtis continues to run the portfolio. And by continuing to look for high quality companies that can pay a sustainable and growing dividend, City of London’s record looks set to continue.

1Source: The City of London Annual Report 2022

Defensive stock – A defensive stock is a stock that provides consistent dividends and stable earnings regardless of the state of the overall stock market. There is a constant demand for their products, so defensive stocks tend to be more stable during the various phases of the business cycle.

Growth stocks – A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market. These stocks generally do not pay dividends. This is because the issuers of growth stocks are usually companies that want to reinvest any earnings, they accrue in order to accelerate growth in the short term.

Leverage – The use of borrowing to increase exposure to an asset/market. This can be done by borrowing cash and using it to buy an asset, or by using financial instruments such as derivatives to simulate the effect of borrowing for further investment in assets.

Levered portfolio – A portfolio that includes at least some securities that were bought with borrowed money. A leveraged portfolio is risky because the securities may result in a loss, which would leave the investor liable to repay the borrowed capital. However, if the securities result in a gain, the investor has essentially made a profit without using his/her own money.

Net zero – net zero means cutting greenhouse gas emissions to as close to zero as possible, with any remaining emissions re-absorbed from the atmosphere, by oceans and forests for instance.

Net interest margin – Net interest margin (NIM) is a measurement comparing the net interest income a financial firm generates from credit products like loans and mortgages, with the outgoing interest it pays holders of savings accounts and certificates of deposit (CDs). Expressed as a percentage, the NIM is a profitability indicator that approximates the likelihood of a bank or investment firm thriving over the long haul.