To forecast what we believe is in store for the global economy and equity markets in 2024, we must first revisit our prognostications for 2023. A year ago, we called for a slowdown in earnings growth, but believed the global economy would avoid recession as declining inflation allowed central banks to throttle back on hawkish policy. Such a scenario would not be horrible for riskier assets, in our view, as long as investors focused on quality companies characterized by stable cash flows and conservative balance sheets.

Much of our assessment has come to pass. But 12 months on, we still find ourselves in a late-cycle economy, and many of our expectations have yet to fully play out. Why? One reason is the resilience of the U.S. consumer, long a growth engine for the global economy. This proved fortuitous given the acute headwinds buffeting another important source of growth: China’s increasingly debt-laden real estate sector.

Buoyant consumption – despite aggressive policy tightening – aligns with our view that the U.S. economy is less rate sensitive than in years past. A healthy consumer matters because recessions have rarely occurred without constrained household spending being a central contributor. But we are not out of the woods, especially with the labor market softening. Monthly job gains have cooled, the number of unfilled positions is well off its 2022 peak and the surge in wages has run its course – although pay is finally positive again in inflation-adjusted terms.

Where are we now?

While investors may cheer an end to rate hikes in the U.S. – and likely soon thereafter in other regions – optimism should be tempered with respect to hopes for a dovish pivot. Policy rates, in our view, are likely to remain restrictive until evidence confirms that inflation is continuing its downward path. The extension of this late-cycle period represents a headwind for both the economy and equities. We, however, are not as pessimistic as some peers. Although many indicators, including an inverted U.S. Treasuries curve, point to a downturn, we believe that the Federal Reserve (Fed) has a reasonable shot at nailing the elusive soft landing, although a shallow recession cannot be ruled out.

Other regions may not be as fortunate. Europe and UK will likely flirt with negative growth over the next few quarters, and an unforeseen shock could send them into recession. As referenced earlier, if China is unable to rely upon real estate investment to spur growth, it may have to settle for gross domestic product expanding at a rate far beneath the 6% to 10% range it had become accustomed to.

Fragile but investable

With much hinging on whether policy makers avert recession, equity markets are in a similarly fragile state as the global economy. Exacerbating the situation is the extreme narrowness of markets that has characterized 2023. The U.S. presently accounts for almost half of the MSCI All-Country World IndexTM, and the technology sector comprises over a quarter of the S&P 500® Index. When including the Internet and e-commerce platforms not classified as tech, this share rises considerably.

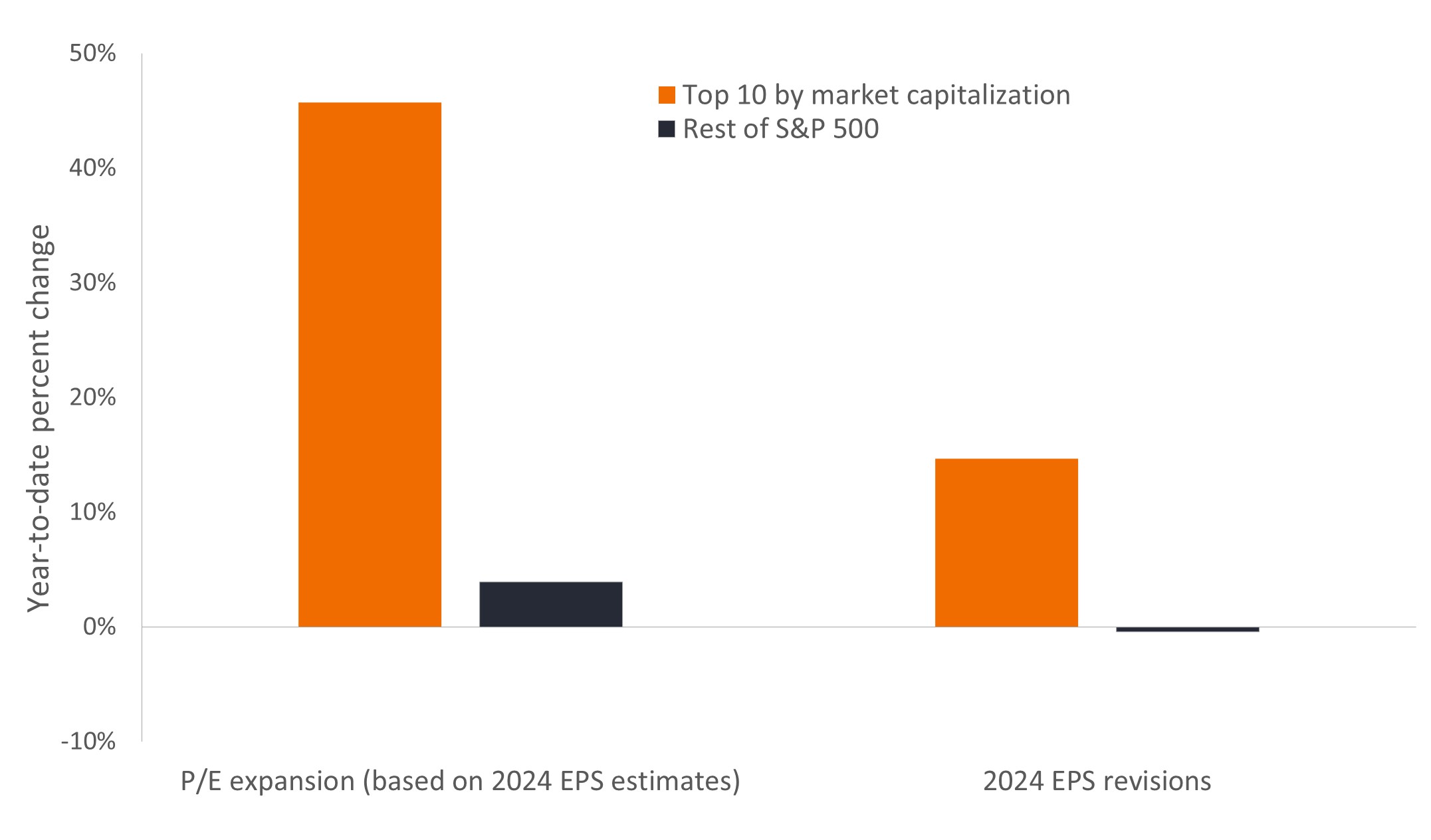

Such concentration in the highest-flying names belies a less sanguine mood than implied by the S&P 500’s year-to-date double-digit gains. The oft cited Magnificent 7 stocks have doubled in 2023. Meanwhile, the equal-weighted S&P 500 is modestly positive. The disparity extends to valuations and earnings. The top ten names in the S&P 500 have seen price-earnings (P/E) multiples – based on full-year 2023 earnings – expand by 40%. Multiples on the remaining members are roughly flat. Similarly, earnings expectations for the top 10 names have been revised upward by 19%. For the rest, again, they are flat. The same holds true for 2024 forecasts. On the aggregate level, we believe 2024 global earnings are at risk of falling short of current expectations.

Figure 1: S&P 500 Index multiple expansion and 2024 earnings revisions

Expanding valuation multiples and rising earnings estimates have been driven by a few mega-cap names, while the rest of the index has barely treaded water.

Source: Bloomberg, Janus Henderson Investors, as of 16 November 2023. EPS = Earnings per share. Past performance does not predict future returns.

Source: Bloomberg, Janus Henderson Investors, as of 16 November 2023. EPS = Earnings per share. Past performance does not predict future returns.

The other 493

The Magnificent 7’s ascendance has been partly driven by these companies’ exposure to the year’s hottest investment theme – artificial intelligence (AI). But another factor is them exhibiting the quality characteristics of consistent cash flows and a judicious use of leverage. Within this context, an allocation to these companies aligns with our preference for staying defensive in what is likely to remain a tepid economy.

One can appreciate the transformative potential of AI while also recognizing that a stock’s price fully reflects its potential. The nature of technology diffusion means that there will likely be many AI beneficiaries outside 2023’s market leaders. Similarly, quality is not limited to a few cash-rich mega caps. Many of the other 493 companies in the S&P 500 – as well as in global indices – possess similar defensive traits.

We see this as one of the more promising opportunities for equities in 2024. By recognizing that market concentration – often driven by cap-weighted, passive strategies – has left many attractive companies mispriced, investors can access the same durable themes and defensive characteristics that have served them well in 2023, but at more attractive valuations. With our expectation that a deep recession will be avoided, lower-multiple stocks are more likely to experience an upward rerating as the market looks through the nadir of the weakening economy rather than capitulating amid a fierce economic contraction.

Are we there yet?

Until we have greater visibility on the trajectory of the global economy and its impact on earnings, we believe quality companies, often hidden farther down indices’ market caps, represent a reasonable balance between defense and valuation. Policy error is not out of the question, but rather than central banks hiking too much, we believe the larger risk is them pivoting too soon, thus igniting a second wave of inflation. This would inevitably lead to another round of restrictive policy and, thus, a drag on growth.

The cyclical nature of Europe and countries heavily reliant upon exports makes them especially vulnerable to a slowing economy. A worsening geopolitical backdrop and the election cycle in the U.S. could introduce additional risk. The world is also watching how China balances addressing its debt overhang and attempting to reignite growth.

Lastly, investors should understand how the establishment of a new – higher – interest rate regime will impact equities. Companies with challenged business models can no longer rely upon a cheap cost of capital to mask their inability to consistently generate cash. And higher discount rates will remove the boost to future cash flows secular growth companies have been receiving.

This latter point has both stylistic and geographic implications. In this new regime, a cap on growth companies’ multiples could swing the pendulum back toward value names. This could benefit Europe and other deeply discounted regions, especially if a soft landing allows investors to dial up exposure to value and cyclical stocks in anticipation of a recovery. Once the cycle eventually turns, the new rates regime means investors cannot indiscriminately rotate into deep value, but instead should maintain their focus on quality businesses capable of exceeding higher returns thresholds for their invested capital.

Figure 2: Global growth stocks and the cost of capital

The typical relationship between the cost of capital and growth stocks has broken down as a market concentrated in expensive names leaves growth stocks’ valuation multiples above what would be expected when global bonds yield 3.5%.

Source: Bloomberg, Janus Henderson Investors, monthly data as of 31 October 2023. Past performance does not predict future returns.

Source: Bloomberg, Janus Henderson Investors, monthly data as of 31 October 2023. Past performance does not predict future returns.

But growth – and the U.S. companies that dominate the category – should not be lamented. The global economy will have plenty of uses for AI, the cloud and other durable secular themes.

Bloomberg Global Treasury Index tracks fixed-rate, local currency government debt of investment grade countries, including both developed and emerging markets.

Cyclical stocks: Companies that sell discretionary consumer items (such as cars), or industries highly sensitive to changes in the economy (eg. mining).

Earnings per share (EPS): the bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares.

Late cycle: Economic activity often reaches its peak, implying that growth remains positive but slowing.

The Magnificent 7 are a collection of 2023’s market leading stocks, including Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Mega caps: Companies with a market capitalization above US$200 billion.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary tightening/hawkish policy refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money. Monetary stimulus/dovish policy refers to a central bank increasing the supply of money and lowering borrowing costs.

MSCI All-Country World (ACWI) Growth Index reflects the equity market performance of large- and mid-cap securities exhibiting overall growth style across 23 developed markets countries and 24 emerging markets countries.

MSCI All Country World IndexSM reflects the equity market performance of global developed and emerging markets.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Price-to-sales (P/S) ratio: a measure calculated by taking a company’s market capitalization (the number of outstanding shares multiplied by the share price) and dividing it by the company’s total sales or revenue over the past 12 months. Typically the lower the P/S ratio, the more attractive the investment.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields. An inverted yield curve occurs when short-term yields are higher than long-term yields.

Yield-to-worst: The lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe a portfolio, this statistic represents the weighted average across all the underlying bonds held.

IMPORTANT INFORMATION

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Growth and value investing each have their own unique risks and potential for rewards, and may not be suitable for all investors. Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential. Value stocks can continue to be undervalued by the market for long periods of time and may not appreciate to the extent expected.