Looking to 2023 and beyond, we see a number of structural forces akin to tectonic plates moving within the global economic landscape. These are worthy of investor attention and will likely determine asset allocation and returns over the coming decade. Getting the ‘big picture’ right will be vital for investors, creating both risks and, more importantly, abundant opportunities.

Big picture themes

Pulling apart inflation into structural and cyclical components is an important step in assessing the future path of monetary policy, term risk premia and risk-free yields. These are crucial factors in the valuation of all asset classes and below we explore these components in more detail:

Structural components:

These forces are each likely to place upward pressure on inflation over the coming.

- The world’s alignment into trading blocs: Countries are increasingly aligning into trading blocs of like-minded partners. While not quite de-globalisation, it certainly requires a re-shuffling of supply chains. The primary drivers of this shift include national resilience through supply certainty, cyber security, healthcare, defence, to aid sovereign stability. A potential bi-product of this trend could be bigger governments resulting from the ownership of nationally critical assets and increasing regulation of certain industries.

- The electrification of the economy: The energy transition to lower emitting and renewable energy will require the re-allocation of capital away from fossil fuel energy generation, along with levels of new investment not seen in decades. This transition will be costly and is likely to manifest in higher consumer energy prices.

- The end of an era of stability: Governments, market participants and businesses have been able to take the geo-political stability of the past 70 years for granted. However, the rise of major powers, each with competing agendas of influence and expansion could see confrontation and conflict erupt. This could result in rapid escalation where military pacts commit nations to support their fellow members. In this uncertain environment, companies and markets will demand higher risk premiums to compensate them for the additional risk on their capital.

Cyclical components:

Cyclical inflation, primarily driven by pandemic-induced supply side shocks, pent up demand and high levels of consumer savings, should peak very shortly and subside in 2023. In our assessment, near-term inflation is likely to be sticky and last longer than markets anticipated, but will normalise nonetheless.

Many of the initial supply issues have been resolved with their prices heading back down. However, second round inflation such as rents, energy and wages will take longer to resolve, especially at ‘above full employment’ labour market conditions.

We expect to see meaningful progress towards the Reserve Bank of Australia’s (RBA) inflation targets next year, even though they may not be fully met until 2024 given the significant monetary policy tightening and fiscal restraint observed this year.

Central banks, cash rates and bond yields

Whilst central banks have had to act swiftly to arrest inflation early, the pace of tightening in most regions has slowed and we expect it to peak in 2023. The lagged impact of the sharp tightening in cash rates, as well as the removal of some unconventional policies, such as the repayment of the Term Funding Facility (TFF) should be observable next year.

Roughly $500 billion+ of residential mortgages will reset from fixed rates that are currently paying around 2-2.5% to circa 6%. The RBA will certainly need to take stock of the cumulative impact of cash rate tightening, its impact on household debt, consumers and (most importantly) unemployment, before determining its next steps.

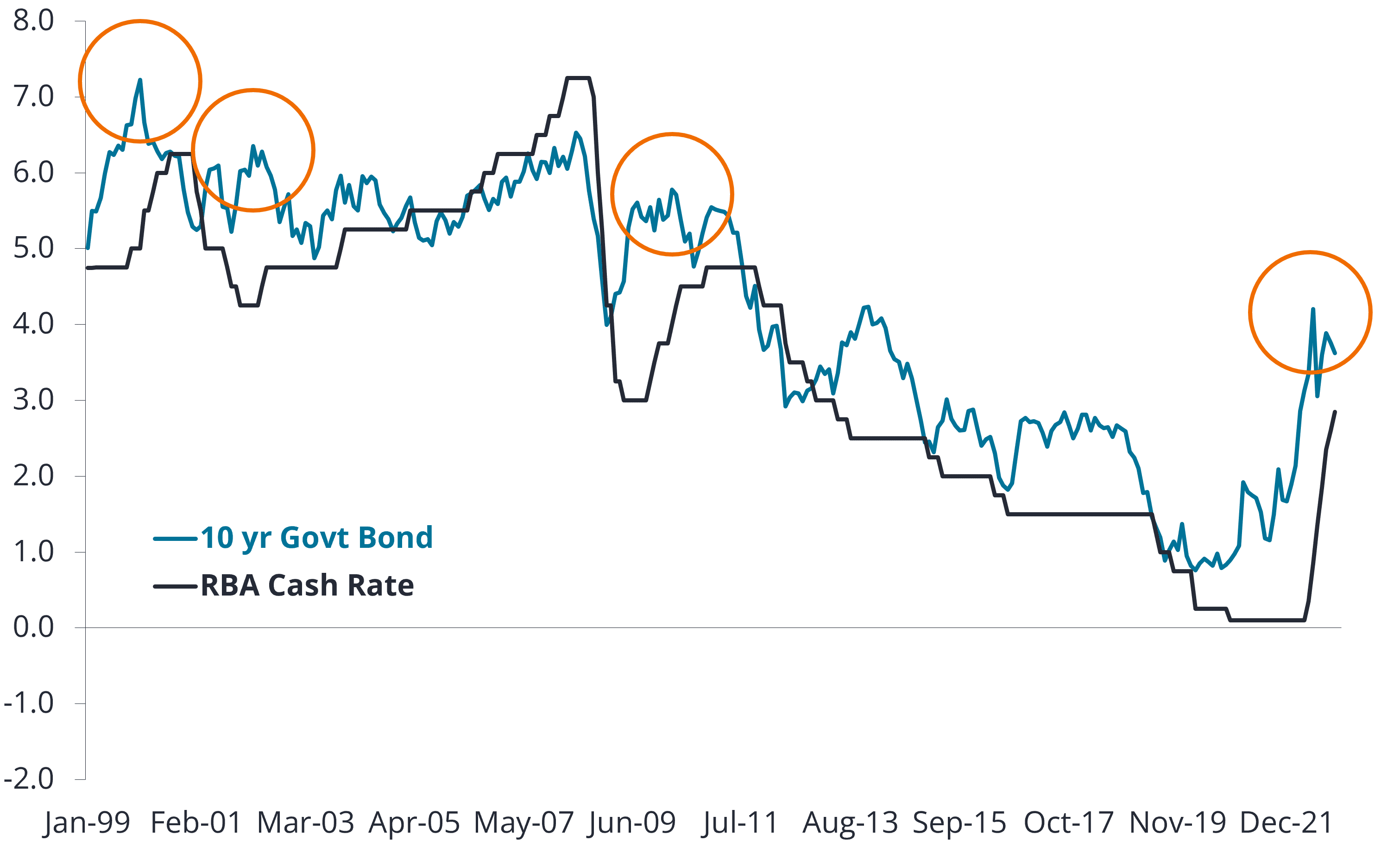

Our observation over previous tightening cycles is that bond yields peak well ahead of the final cash rate tightening and generally this happens early in the tightening cycle. This episode seems no different, with bond yields peaking on 14 June 2022, just after the second monthly cash rate tightening by the RBA. Despite remaining volatile, they have since traded sideways or lower. For this cycle, we think we’ve probably passed peak bond yields, but believe investors must be mindful of the volatility and that fixed interest and interest rate risk (duration) needs to be actively managed.

Chart 1: Australian Government 10-year bond yields and RBA cash rates (%)

Bond markets typically fully priced by the first hikes

Source: Janus Henderson, Bloomberg. Monthly to 17 November 2022.

As one door closes, another one opens

One of the most profound distortions in markets by central bank activity over the past decade has been the influence of ultra-low (and negative) rates on risk assets such as shares, property, infrastructure and corporate debt (both investment grade and high yield).

When history books are written about this period, the experiment of negative interest rates will receive terrible reviews. As we look to 2023 and beyond, all of these risk assets need to re-price and normalise. The good news is the discount rate has done a lot of the heavy lifting already, meaning that the sustainability of corporate earnings will be important going forward.

Central banks tightening into restrictive territory will naturally act as a break on economic growth in 2023. However, the starting point for this backdrop is a multi-decade low in the unemployment rate. Absent of a left field shock, we expect the unemployment rate to lift from circa 3.5% to 4-5%, rather than a more draconian 7%+. As such, whilst corporate earnings will likely be tempered and soften, it is unlikely to fall off a cliff with default rates only lifting modestly.

However, we expect a wide dispersion to this top-down assessment, with various industries struggling (such as construction) and others remaining more resilient (such as universities). Investors will need to navigate both a tightening of policy and a higher inflationary environment in the near-term.

In the table below, we depict our preferred sectors on the left and the sectors likely to struggle against this backdrop on the right.

Navigating policy tightening

XXXXXXX

Source: Janus Henderson Investors, Bloomberg, Standard & Poor’s. As at 20 June 2022. Note: References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Are bonds back?

The good news for investors is that not only have the defensive characteristics of the fixed interest asset class been restored, the cost of this ‘portfolio insurance’ has materially improved, with yields on high quality assets now surpassing that of equities. Chart 2 below shows the yield available across a range of credit securities, each within the sectors we believe are likely to show resilience and growth over the years ahead.

Chart 2: Australian investment grade yield opportunities

XXXXX

Source: Janus Henderson Investors, Bloomberg. As at 21 October 2022. Note: Yield curve based on Australian Government Bond Yield. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe, or purchase the security. Past performance is not a guide to future performance.

Fixed interest investors who consider the impact of the ‘big picture’ themes when evaluating sectors, companies and securities are more likely find opportunities with resilient fundamentals, that can withstand the uncertainties ahead.

After a tough 2022, as we move into 2023 we believe ‘bonds are back’ – once again able to provide the defensive qualities that investors seek within the context of a balanced investment portfolio.

Thank you for your support over 2022. We look forward to working with you in 2023 and wish you a safe and happy festive period and new year.